Nevada Exchange Addendum to Contract - Tax Free Exchange Section 1031

Description

How to fill out Exchange Addendum To Contract - Tax Free Exchange Section 1031?

If you wish to finalize, retrieve, or generate sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's simple and user-friendly search to find the documents you need. Various templates for commercial and personal purposes are categorized by groups, states, or keywords.

Use US Legal Forms to obtain the Nevada Exchange Addendum to Contract - Tax Free Exchange Section 1031 with just a few clicks.

Every legal document template you acquire is yours permanently. You will have access to every document you downloaded in your account.

Choose the My documents section and select a document to print or download again. Stay ahead and download, and print the Nevada Exchange Addendum to Contract - Tax Free Exchange Section 1031 with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click on the Acquire button to get the Nevada Exchange Addendum to Contract - Tax Free Exchange Section 1031.

- You can also access forms you previously downloaded in the My documents tab of the account.

- If you are using US Legal Forms for the first time, refer to the guidelines below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review option to examine the content of the form. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the purchase. You can use your Visa, Mastercard, or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Nevada Exchange Addendum to Contract - Tax Free Exchange Section 1031.

Form popularity

FAQ

While you can't do a 1031 exchange directly into a personal residence -- exchanges are limited to real property that is held strictly for investment or business purposes -- you can convert an investment property into personal property so long as you follow the IRS' rules to the letter.

Tom: The short answer is yes. Section 1031 is a federal tax code, so it is recognized in all states, so you can exchange from state to state. We regularly are dealing with transactions from our home state of Oregon and into California, Washington, and vice versa.

The short answer to this is yes. Because Section 1031 is a federal tax code, it is technically recognized in all states. Going one step further, swapping a relinquished property in one state into a replacement property in another is known, appropriately enough, as a state-to-state 1031 exchange.

The motivation to use a 1031 exchange can be substantial. This is because investor capital that otherwise would be paid as capital gains tax is rolled over as part of the down payment into a replacement property. This provides greater investment benefits than the sold property.

The main requirements for a 1031 exchange are: (1) must purchase another like-kind investment property; (2) replacement property must be of equal or greater value; (3) must invest all of the proceeds from the sale (cannot receive any boot); (4) must be the same title holder and taxpayer; (5) must identify new

The 1031 Exchange rule allows the investors 45 days to identify the replacement property after closing of relinquished property and close on replacement property in 180 days. Time is of the essence. Qualified Intermediary (QI): A Qualified Intermediary is essential to the completion of a successful 1031 exchange.

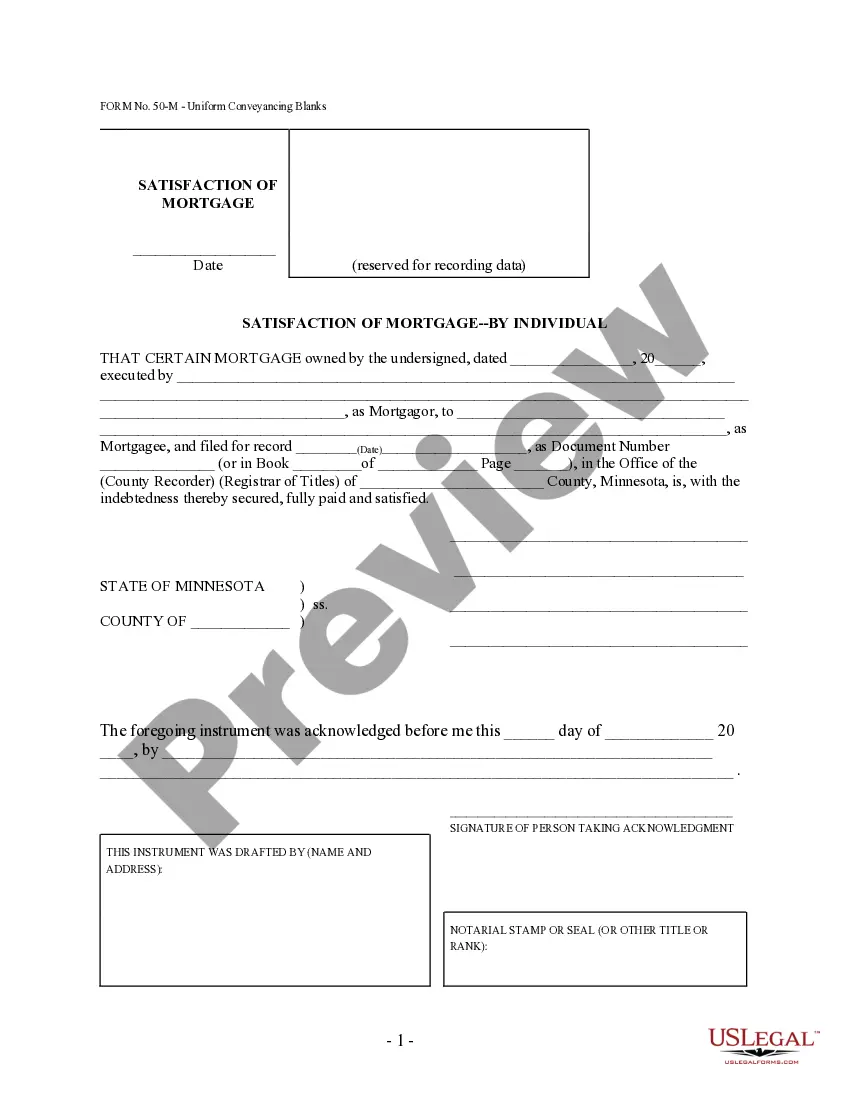

A 1031 addendum will normally clearly show intent to do a 1031 exchange, permit assignment, and advise the other party there will be no expense or liability as a result of the exchange. Sometimes there is cooperation language asserting that both parties to the contract will cooperate with a 1031 exchange.

Under Internal Revenue Code Section 1031, real estate located in one U.S. state is like kind to real estate located in any other state, and you can trade from one state to another. In most cases you are able to defer both federal and state tax, assuming the state has an income tax.

Notes and the 1031 ExchangeThough a contract sale can be incorporated in an exchange, it may not be possible to accomplish this goal all the time. In order for a note to be used in an exchange, you, the Exchangor, must not have actual or constructive receipt of the note.

What is a 1031 Exchange? The sale of a business or investment asset can create a large tax liability. A properly structured tax deferred exchange under Internal Revenue Code §1031 allows businesses and individuals to defer the recognition of capital gains and other taxes associated with the sale.