Nevada Motion To Determine The Issue of Exemption is a legal motion filed in Nevada state court to determine the issue of exemption. This motion is used by a debtor to ask the court to determine whether any of the debtor's property is exempt from the claims of creditors. The motion is typically filed after a creditor has obtained a judgment against the debtor. There are two types of Nevada Motion to Determine the Issue of Exemption: (1) Motion to Determine Exempt Property and (2) Motion to Determine Non-Exempt Property. The first motion is used to determine which property of the debtor is exempt from the claims of the creditors and the second motion is used to determine which property of the debtor is not exempt from the claims of the creditors.

Nevada Motion To Determine The Issue of Exemption

Description

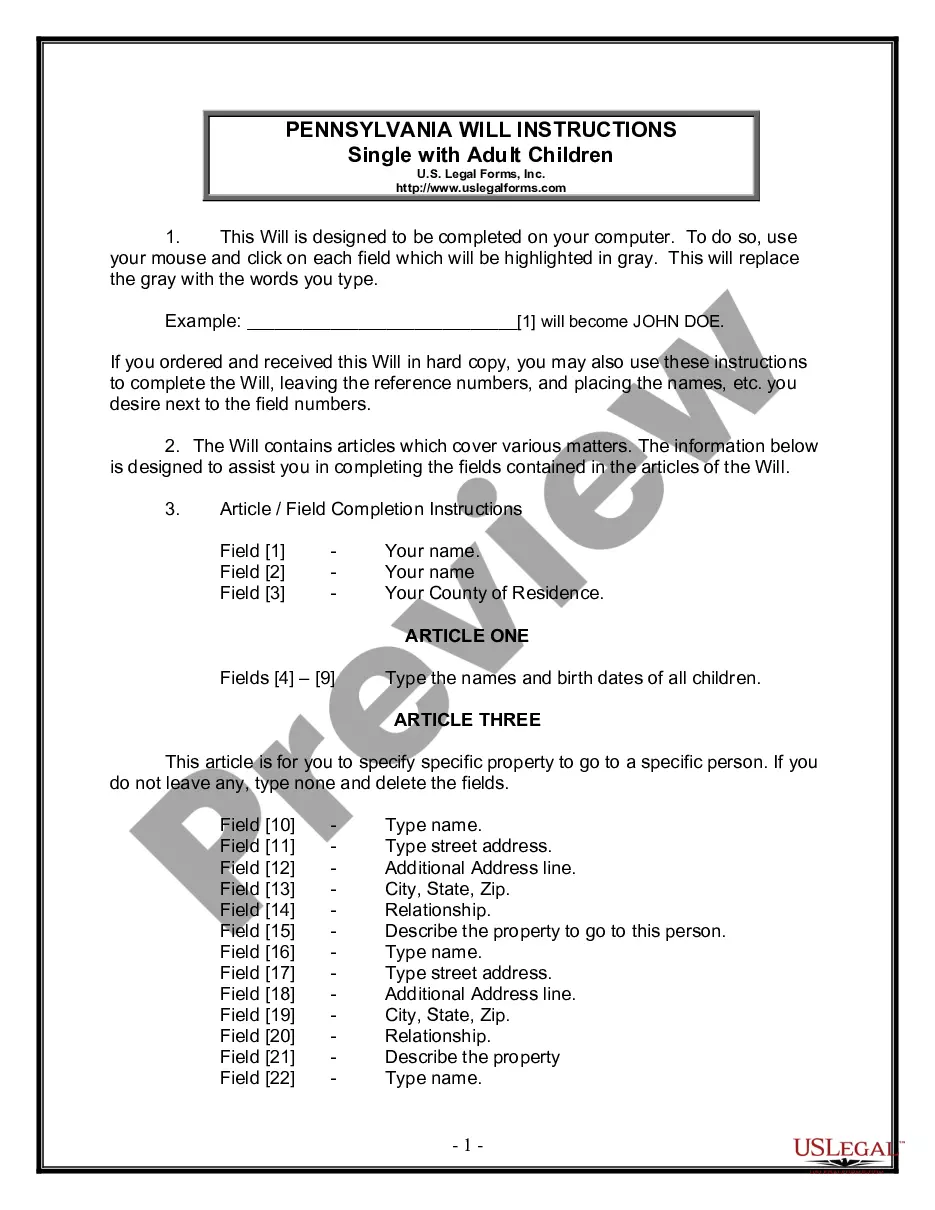

How to fill out Nevada Motion To Determine The Issue Of Exemption?

Handling official documentation requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Nevada Motion To Determine The Issue of Exemption template from our library, you can be sure it complies with federal and state regulations.

Dealing with our service is easy and quick. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to find your Nevada Motion To Determine The Issue of Exemption within minutes:

- Remember to carefully look through the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for another official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Nevada Motion To Determine The Issue of Exemption in the format you prefer. If it’s your first experience with our service, click Buy now to proceed.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the Nevada Motion To Determine The Issue of Exemption you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

(B) The court must dismiss an action for want of prosecution if a plaintiff fails to bring the action to trial within 5 years after the action was filed.

A motion requesting a rehearing or reconsideration may be based only on one of the following grounds: (a) Newly discovered or available evidence. (b) Error in the hearing or in the findings and recommendations or the decision that would be grounds for reversal of the findings and recommendations or the decision.

Types of Exemptions Under Nevada Laws Necessary household goods, furnishings, electronics, clothes, yard equipment, and other personal effects up to $12,000 in value. 5% of your disposable earnings or 50 times the minimum wage (currently $362.50 per week), whichever is higher.

2.47. Unless otherwise provided for in an order of the court, all motions in limine to exclude or admit evidence must be in writing and filed not less than 45 days prior to the date set for trial and must be heard not less than 14 days prior to trial.

Under Nevada law, some of the types of income and property that a creditor cannot take to pay a judgment include: Money or payments received pursuant to the federal Social Security Act, including retirement, disability, survivors' benefits, and SSI. (NRS 21.090(1)(y) and 42 U.S.C. § 407(a).)

2.47. Unless otherwise provided for in an order of the court, all motions in limine to exclude or admit evidence must be in writing and filed not less than 45 days prior to the date set for trial and must be heard not less than 14 days prior to trial.

Rule 11 - Signing Pleadings, Motions, and Other Papers; Representations to the Court; Sanctions (a) Signature. Every pleading, written motion, and other paper must be signed by at least one attorney of record in the attorney's name-or by a party personally if the party is unrepresented.

Rule 35 - Physical and Mental Examinations (a)Order for Examination (1)In General. The court where the action is pending may order a party whose mental or physical condition-including blood group-is in controversy to submit to a physical or mental examination by a suitably licensed or certified examiner.