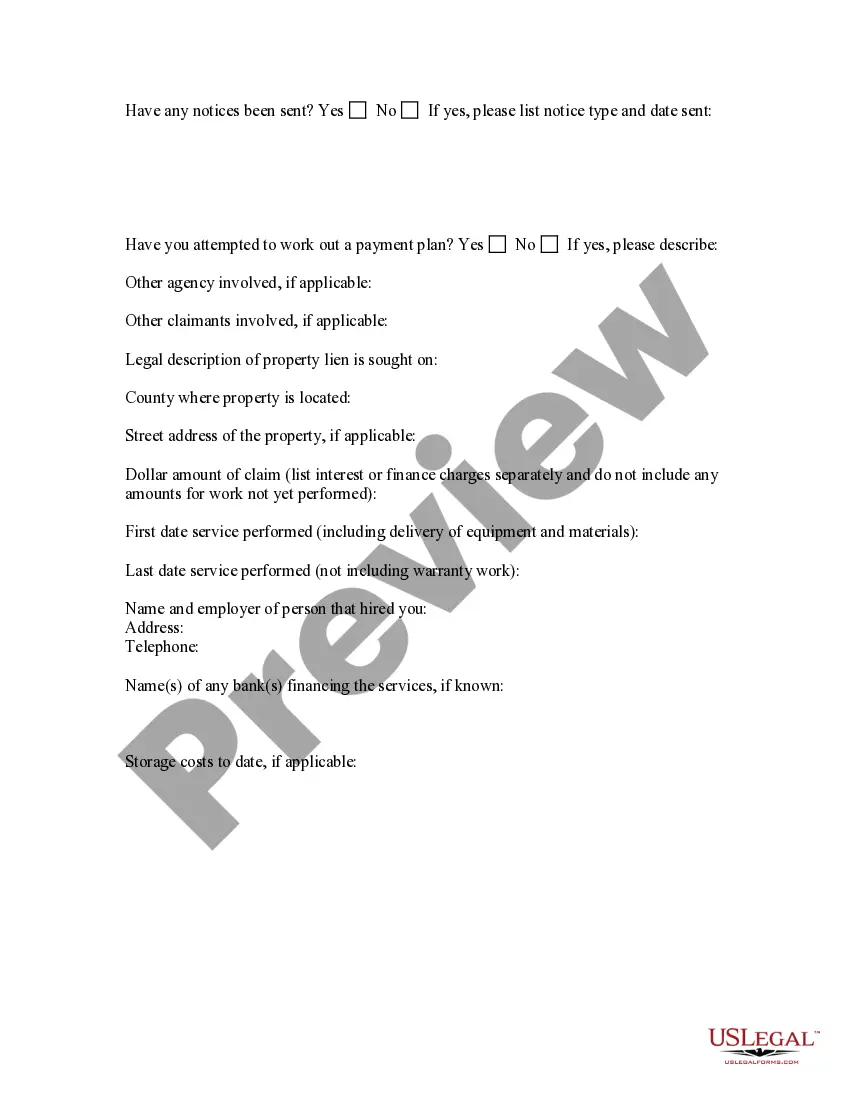

New Mexico General Liens Questionnaire

Description

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client's needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

How to fill out General Liens Questionnaire?

Finding the right legal file format can be a battle. Needless to say, there are tons of layouts available on the Internet, but how would you discover the legal type you will need? Make use of the US Legal Forms internet site. The service offers thousands of layouts, including the New Mexico General Liens Questionnaire, which can be used for company and personal requirements. All of the forms are inspected by experts and meet up with state and federal needs.

In case you are presently authorized, log in for your account and then click the Down load switch to find the New Mexico General Liens Questionnaire. Use your account to look from the legal forms you possess acquired previously. Proceed to the My Forms tab of the account and get yet another version from the file you will need.

In case you are a whole new customer of US Legal Forms, listed below are basic instructions for you to stick to:

- Very first, be sure you have selected the proper type for your personal city/state. You can look through the form while using Review switch and browse the form description to guarantee it will be the best for you.

- In case the type fails to meet up with your needs, utilize the Seach field to get the appropriate type.

- When you are certain that the form would work, select the Buy now switch to find the type.

- Pick the pricing program you would like and enter in the necessary information and facts. Design your account and pay money for the order utilizing your PayPal account or Visa or Mastercard.

- Choose the file format and acquire the legal file format for your system.

- Total, change and print and indicator the received New Mexico General Liens Questionnaire.

US Legal Forms is definitely the biggest library of legal forms for which you will find numerous file layouts. Make use of the service to acquire professionally-made files that stick to state needs.

Form popularity

FAQ

One way to collect upon a judgment in New Mexico is to obtain a judgment lien A judgment lien gives the creditor the right to be paid a certain amount of money from proceeds from the sale of the debtor's property. The judgment creditor will need to identify where the defendant (now the judgment debtor) has property.

The State of New Mexico, including all counties, does not conduct tax deed, tax certificate and tax lien sales. The only property sales conducted by the State are public auctions due to two or more years of delinquent property taxes.

The purpose of the Lien Protection Efficiency Act is to provide for the efficient filing and recording of documents and the protection of public officials and employees and the citizens of the state against nonconsensual common law liens by imposing limitations on the circumstances in which nonconsensual common law ...

To properly attach the lien, the creditor files the judgment with the county clerk in any New Mexico county where the debtor owns property now or may own property in the future.

Lien. When any person neglects or refuses to pay taxes after assessment and demand for payment has been made, a lien automatically exists, and we may file a notice of the lien in favor of the state on all taxpayer property under Section 7-1-37 NMSA 1978.

A judgment obtained through a common law action on a prior judgment or through any other means of revival of a prior judgment shall not be enforceable after fourteen years from the date of the original judgment upon which it is founded.

NEW MEXICO A judgment is a lien on the real estate of the judgment debtor and expires after fourteen years. N.M. Stat. § 39-1-6.

After you file your lien and serve it on the owner, your lien is valid for 2 years in New Mexico. That means you have 2 years to enforce your lien claim unless it's extended.

In all cases when a notice of lien for taxes, penalties and interest has been filed under Section 7-1-38 NMSA 1978 and a period of ten years has passed from the date the lien was filed, as shown on the notice of lien, the taxes, penalties and interest for which the lien is claimed shall be conclusively presumed to have ...