New Mexico New Client Questionnaire

Description

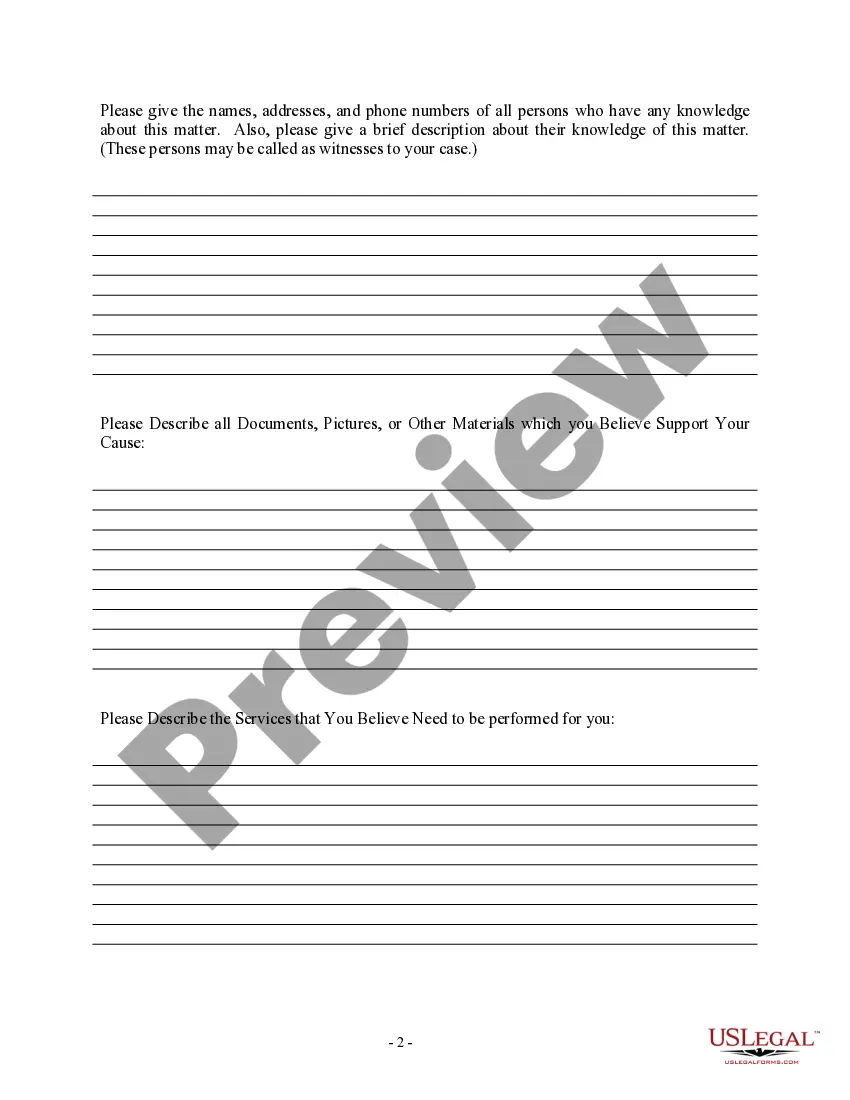

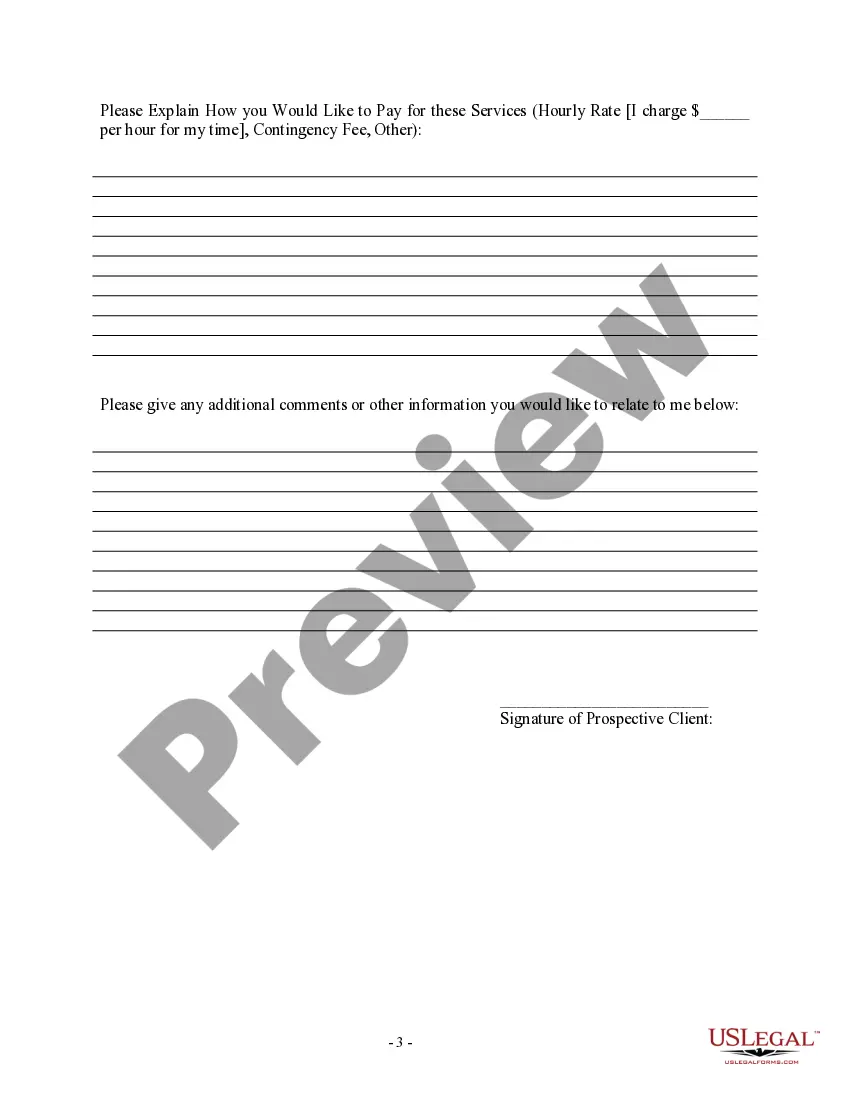

How to fill out New Client Questionnaire?

Finding the right legal record template could be a struggle. Obviously, there are a lot of web templates available on the Internet, but how can you discover the legal form you need? Take advantage of the US Legal Forms internet site. The assistance provides a huge number of web templates, for example the New Mexico New Client Questionnaire, which you can use for enterprise and private requirements. All of the kinds are checked by pros and fulfill federal and state demands.

If you are previously registered, log in to your accounts and click on the Obtain key to find the New Mexico New Client Questionnaire. Make use of accounts to appear from the legal kinds you possess ordered formerly. Check out the My Forms tab of your accounts and acquire an additional copy of the record you need.

If you are a fresh consumer of US Legal Forms, listed here are basic directions that you should follow:

- Initially, make sure you have selected the correct form to your metropolis/county. You may check out the shape utilizing the Review key and browse the shape outline to make sure it is the right one for you.

- In the event the form is not going to fulfill your needs, make use of the Seach industry to obtain the correct form.

- When you are sure that the shape is acceptable, click the Get now key to find the form.

- Select the pricing strategy you want and enter in the essential details. Make your accounts and pay for the transaction with your PayPal accounts or credit card.

- Opt for the file format and down load the legal record template to your gadget.

- Total, modify and printing and signal the received New Mexico New Client Questionnaire.

US Legal Forms will be the most significant catalogue of legal kinds in which you can find a variety of record web templates. Take advantage of the company to down load expertly-manufactured documents that follow condition demands.

Form popularity

FAQ

California has four state payroll taxes: Unemployment Insurance (UI) and Employment Training Tax (ETT) are employer contributions. State Disability Insurance (SDI) and Personal Income Tax (PIT) are withheld from employees' wages.

Forms Also Available Online Claimants who have additional questions about their forms can call the 1099 Information and Message Line at (505) 841-8069. UI claimants may also view and print their IRS 1099-G form online from the department website, .dws.state.nm.us, by clicking on "View My 1099."

For a tax year beginning on or after January 1, 2022, but not after December 31, 2022, file your amended return on the 2022 PIT-X form. For tax years beginning on or after January 1, 2005, use the PIT-X form for the tax year you are amending.

Personal income tax (PIT) rates.

Everyone who is required to file a New Mexico personal income tax return must complete and file a form PIT-1, New Mexico Personal Income Tax Return. Depending upon your residency status and your own personal situation, you may need other forms and schedules.

Schedule PIT-B provides a credit against New Mexico tax equal to the New Mexico source income divided by total income everywhere. NOTE: Qualifying residents may be eligible to claim credit for taxes paid to another state.

Required Employer Information: Employer's Federal Employer Identification Number (FEIN). If you have more than one FEIN, please make certain you use the same FEIN you use to report your quarterly wage information when reporting new hires. Employer's Name. Employer's Payroll Processing Address.

The personal income tax is filed using Form PIT-1, Personal Income Tax Return. If you are a New Mexico resident, you must file if you meet any of the following conditions: You file a federal return; You want to claim a refund of any New Mexico state income tax withheld from your pay, or.