New Mexico Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens

Description

How to fill out Assignment Of Overriding Royalty Interest For Multiple Leases - Interest Assigned Is Difference Between Specified Percentage And Existing Leasehold Burdens?

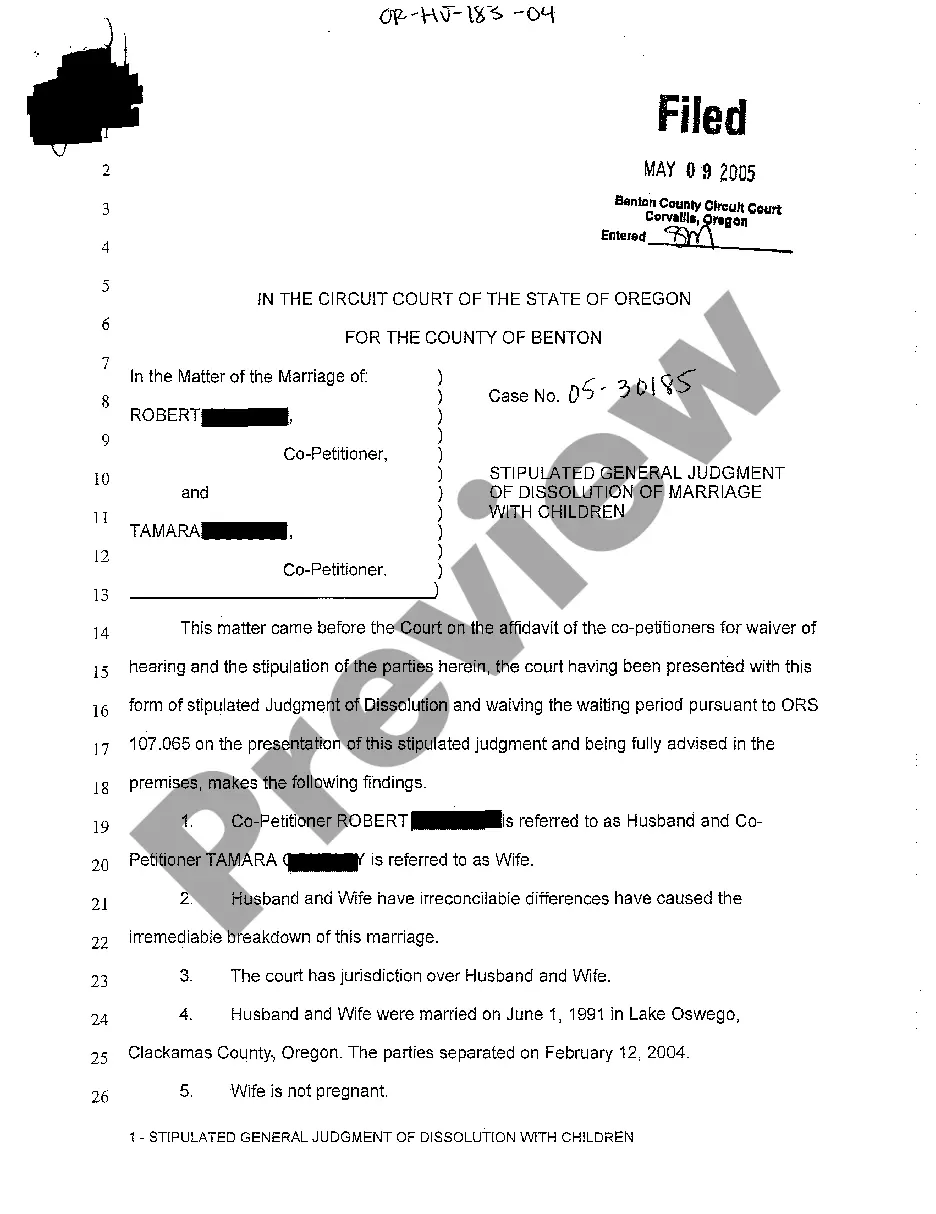

Are you currently within a situation where you will need papers for sometimes enterprise or personal purposes virtually every working day? There are plenty of legitimate papers themes available on the Internet, but getting versions you can rely is not easy. US Legal Forms gives a huge number of type themes, much like the New Mexico Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens, which are published in order to meet federal and state specifications.

If you are previously familiar with US Legal Forms website and possess a merchant account, merely log in. After that, you can down load the New Mexico Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens design.

If you do not have an accounts and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the type you require and ensure it is for the proper city/state.

- Take advantage of the Preview switch to review the shape.

- See the explanation to actually have chosen the correct type.

- When the type is not what you are seeking, take advantage of the Search industry to obtain the type that meets your requirements and specifications.

- Once you obtain the proper type, click on Buy now.

- Opt for the pricing prepare you desire, submit the required information to make your money, and pay money for the order with your PayPal or Visa or Mastercard.

- Choose a hassle-free data file formatting and down load your copy.

Find each of the papers themes you possess purchased in the My Forms food list. You can get a additional copy of New Mexico Assignment of Overriding Royalty Interest for Multiple Leases - Interest Assigned Is Difference Between Specified Percentage and Existing Leasehold Burdens any time, if necessary. Just select the necessary type to down load or print out the papers design.

Use US Legal Forms, by far the most substantial collection of legitimate types, to save lots of efforts and avoid mistakes. The service gives skillfully made legitimate papers themes that you can use for a selection of purposes. Generate a merchant account on US Legal Forms and start creating your lifestyle a little easier.

Form popularity

FAQ

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

However, unlike royalty and working interests, an overriding royalty interest cannot be fractionalized unlike royalty and working interests. The ORRI is a non-possessory, undivided right to a share of the oil and gas production, but it excludes the production costs of the mineral lease.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

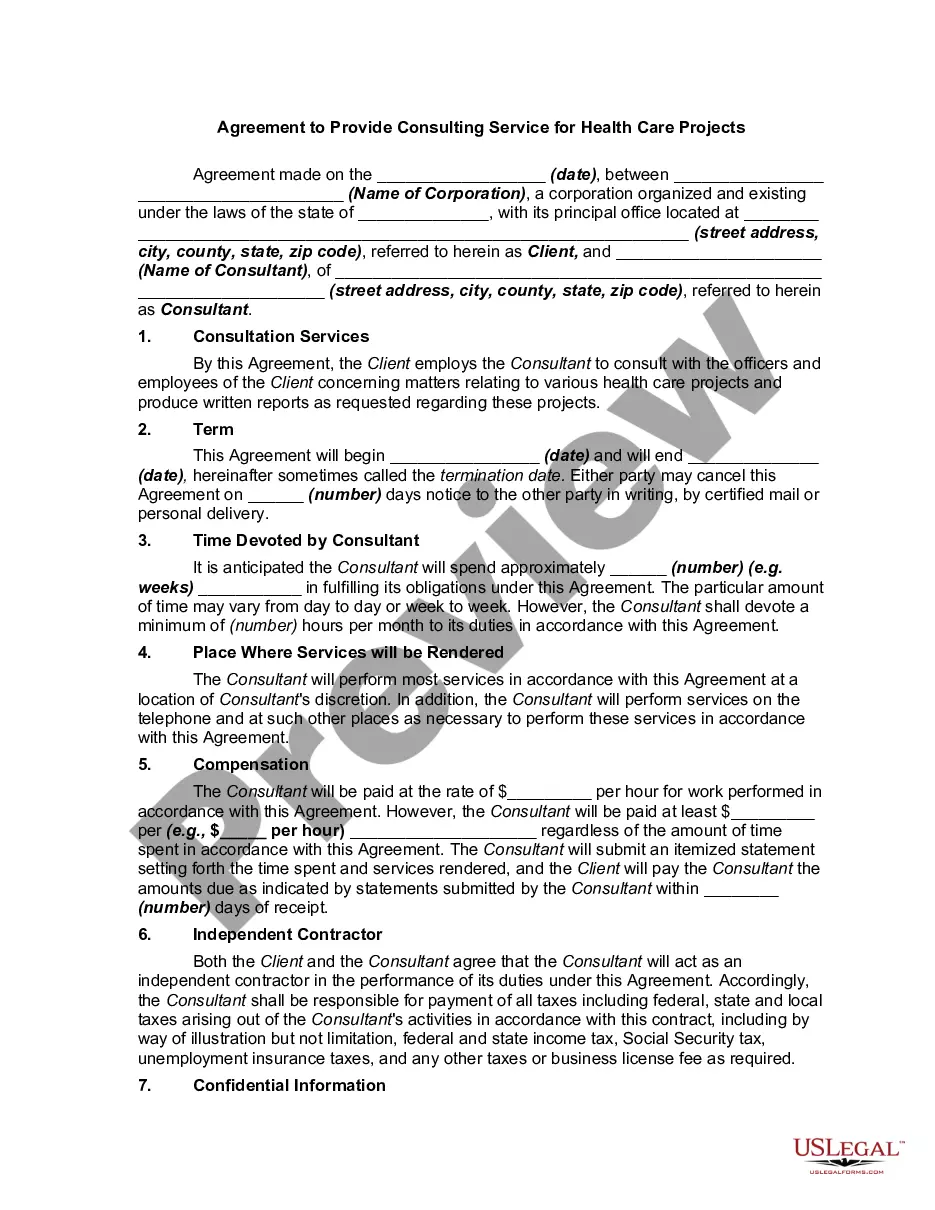

If at any time Assignee desires to transfer or dispose of all or any portion of the Overriding Royalty Interest, Assignee must first give to Assignor written notice thereof stating: (a) the amount of the Overriding Royalty Interest offered by Assignee; (b) the form of consideration (which shall be either cash or a ...