New Mexico Priority of Proposed Operations

Description

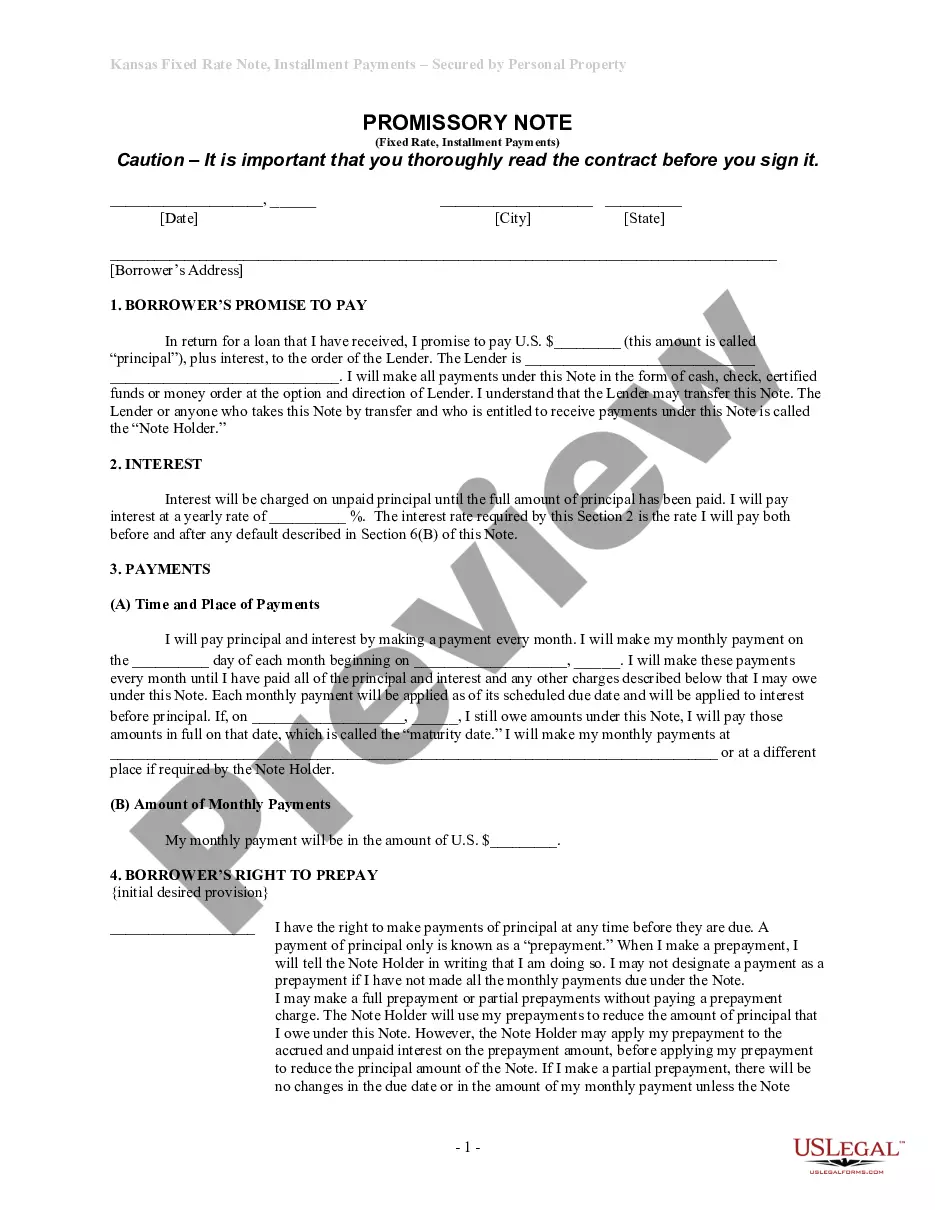

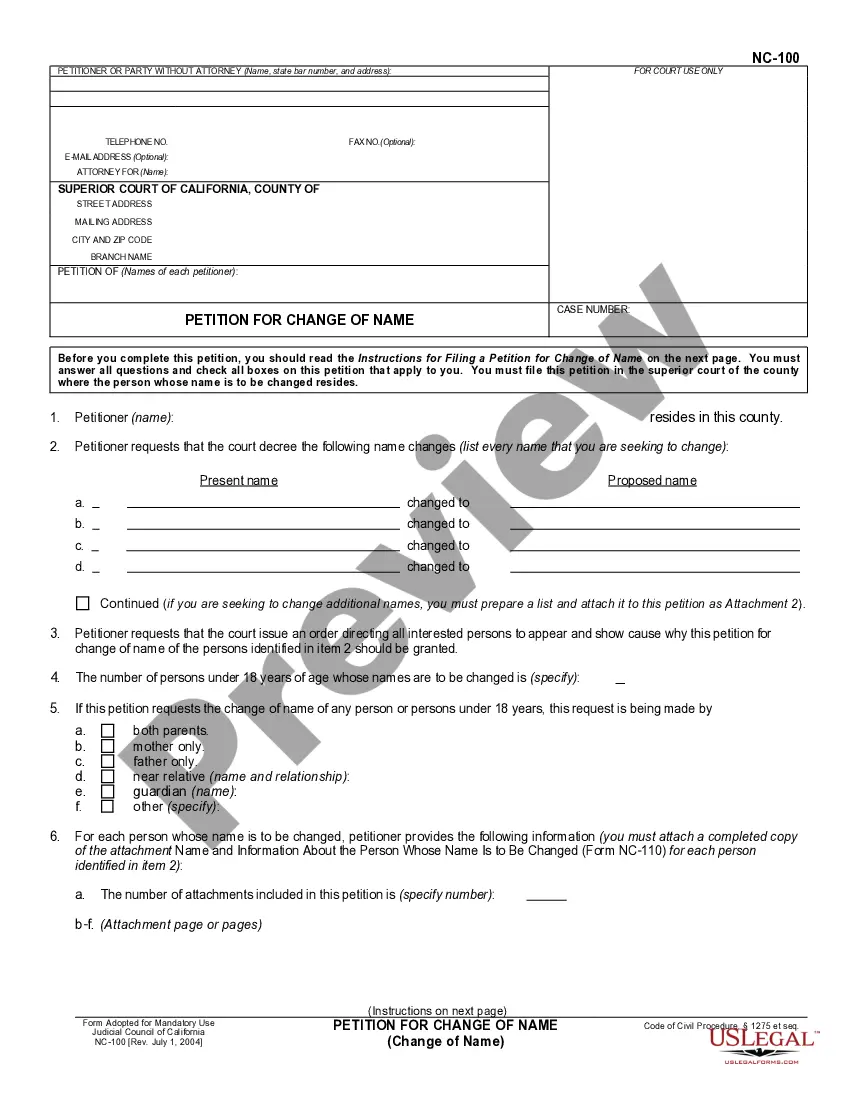

How to fill out Priority Of Proposed Operations?

If you have to total, acquire, or print out authorized record templates, use US Legal Forms, the most important assortment of authorized varieties, that can be found on-line. Utilize the site`s simple and easy handy search to find the paperwork you need. Different templates for company and person reasons are categorized by classes and says, or key phrases. Use US Legal Forms to find the New Mexico Priority of Proposed Operations in just a few mouse clicks.

Should you be previously a US Legal Forms buyer, log in to the accounts and then click the Down load button to obtain the New Mexico Priority of Proposed Operations. You can even accessibility varieties you earlier acquired within the My Forms tab of your respective accounts.

If you are using US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have chosen the shape for the correct area/country.

- Step 2. Take advantage of the Review option to look over the form`s content material. Never neglect to learn the explanation.

- Step 3. Should you be not satisfied together with the type, make use of the Lookup field at the top of the screen to discover other models of your authorized type web template.

- Step 4. When you have located the shape you need, go through the Get now button. Select the costs prepare you like and add your references to sign up to have an accounts.

- Step 5. Method the purchase. You should use your Мisa or Ьastercard or PayPal accounts to complete the purchase.

- Step 6. Find the formatting of your authorized type and acquire it in your product.

- Step 7. Complete, edit and print out or signal the New Mexico Priority of Proposed Operations.

Every authorized record web template you acquire is the one you have eternally. You may have acces to each type you acquired inside your acccount. Select the My Forms area and decide on a type to print out or acquire once more.

Compete and acquire, and print out the New Mexico Priority of Proposed Operations with US Legal Forms. There are thousands of skilled and condition-distinct varieties you may use for your company or person requires.

Form popularity

FAQ

General Fund Revenue Sources. Gross Receipts Taxes ? Taxes collected on the gross receipts (total money taken in) of a business or service provider. It is usually passed along to the consumer. Compensating Tax ? A tax on goods that are bought out-of-state for use in New Mexico. A Guide to New Mexico's Tax System nmvoices.org ? archives nmvoices.org ? archives

What is New Mexico's Gross Domestic Product (GDP)? In 2023, New Mexico's GDP reached $96.5b, representing an increase of 15.6k% from 2022. New Mexico's GDP has grown at an annualized rate of 1.8% over the five years to 2023. New Mexico Economic Trends, Stats & Rankings | IBISWorld ibisworld.com ? economic-profiles ? new-m... ibisworld.com ? economic-profiles ? new-m...

New Mexico's largest spending areas per capita were public welfare ($3,953) and elementary and secondary education ($1,947). The Census Bureau includes most Medicaid spending in public welfare but also allocates some of it to public hospitals.

It does not have inheritance tax, estate tax or franchise taxes. While New Mexico does not have a state sales tax it does have a statewide "gross receipts tax", which is commonly passed on to the consumer by businesses just like a normal sales tax. Its state income tax ranges from 1.7% to a maximum of 4.9%. Taxation in New Mexico - Wikipedia wikipedia.org ? wiki ? Taxation_in_New_Mexi... wikipedia.org ? wiki ? Taxation_in_New_Mexi...

In April, New Mexico Governor Michelle Lujan Grisham signed the state budget for fiscal 2024. The budget totals $9.57 billion in recurring general fund spending, a 14 percent increase over fiscal 2023 levels. New Mexico - Nasbo Nasbo ? resources ? newmexico-budget Nasbo ? resources ? newmexico-budget

Unlike most other states, New Mexico currently does not require sole proprietorships to register their DBAs with the state. There is no registration process or requirements on either a state or local level.