New Mexico Royalty Owner's Statement of Ownership

Description

How to fill out Royalty Owner's Statement Of Ownership?

Are you currently inside a situation that you require paperwork for sometimes organization or person reasons virtually every day time? There are a variety of legitimate file layouts available online, but finding types you can depend on is not easy. US Legal Forms offers a huge number of kind layouts, such as the New Mexico Royalty Owner's Statement of Ownership, which can be composed to satisfy federal and state needs.

In case you are previously acquainted with US Legal Forms website and also have a free account, just log in. Afterward, you may down load the New Mexico Royalty Owner's Statement of Ownership format.

Should you not come with an bank account and wish to begin to use US Legal Forms, abide by these steps:

- Get the kind you will need and ensure it is for that correct area/state.

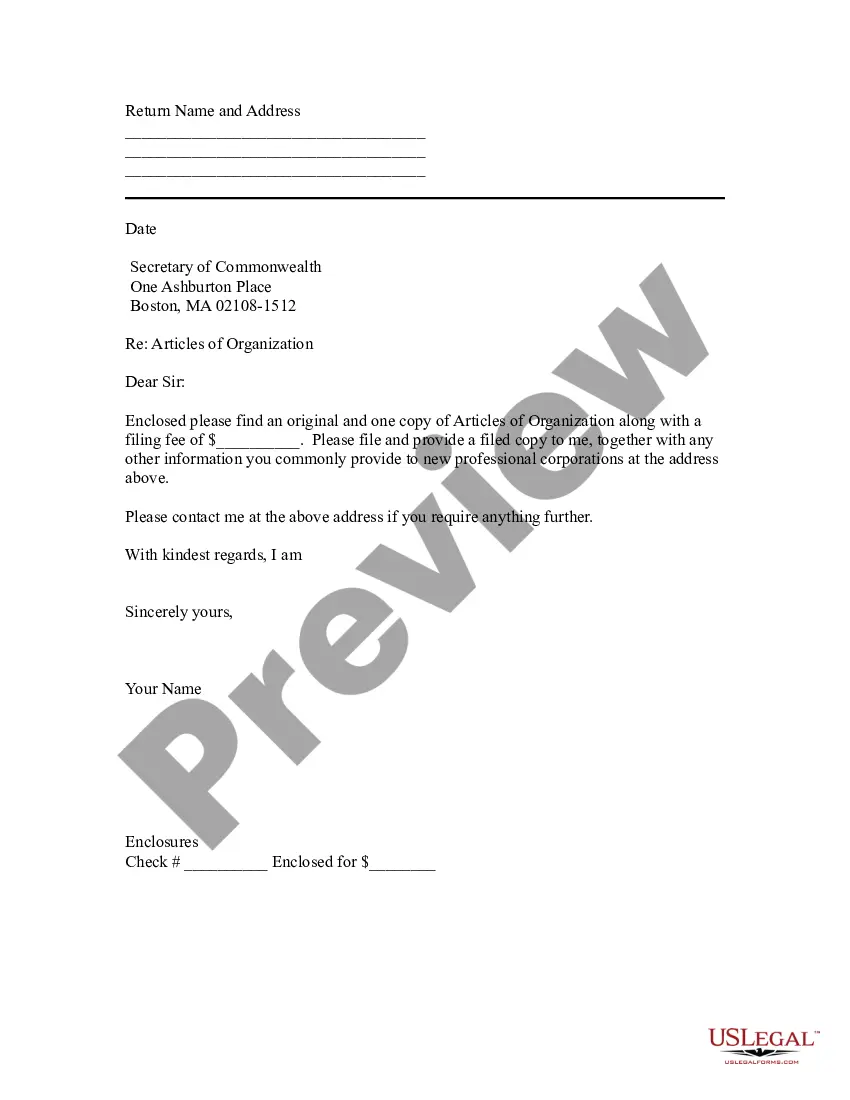

- Utilize the Preview button to analyze the form.

- Read the outline to actually have chosen the right kind.

- In case the kind is not what you`re trying to find, make use of the Lookup area to get the kind that fits your needs and needs.

- Once you get the correct kind, just click Purchase now.

- Select the pricing plan you want, submit the desired information to generate your bank account, and pay for the transaction with your PayPal or Visa or Mastercard.

- Pick a convenient data file formatting and down load your duplicate.

Find each of the file layouts you might have purchased in the My Forms food list. You can aquire a extra duplicate of New Mexico Royalty Owner's Statement of Ownership anytime, if required. Just go through the necessary kind to down load or print the file format.

Use US Legal Forms, the most substantial assortment of legitimate varieties, to conserve time and avoid mistakes. The services offers expertly made legitimate file layouts which you can use for a selection of reasons. Produce a free account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

It is calculated as follows: Volume X Price ? Deductions ? Taxes X Owner Interest = Your Royalty Payment. Whether you are a mineral owner receiving royalty checks or just wanting to know what your minerals are worth, LandGate knows what they are worth and can market your minerals to get you the most money.

Royalty statements are the basic accounting documentation mailed to royalty rights holders, usually on a monthly basis. Royalty statements are often the only connection between a mineral owner and the oil company. The phrase oil company as used in this article can be interchangeable with Operator and Producer.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.

The royalty rate is negotiated between the owner of the mineral rights and the company extracting the oil and gas, and can range from 12.5% to 25% of the production value. Royalties are an important source of income for landowners who have mineral rights.

Generally, the standard royalty rates for authors is under 10% for traditional publishing and up to 70% with self-publishing.

Many owners wonder what's a ?good? oil and gas lease royalty is. It depends on several factors, but in general you should be able to lease your oil and gas mineral rights for between 17% and 25%.

Generally, the standard royalty rates for authors is under 10% for traditional publishing and up to 70% with self-publishing.