New Mexico Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman

Description

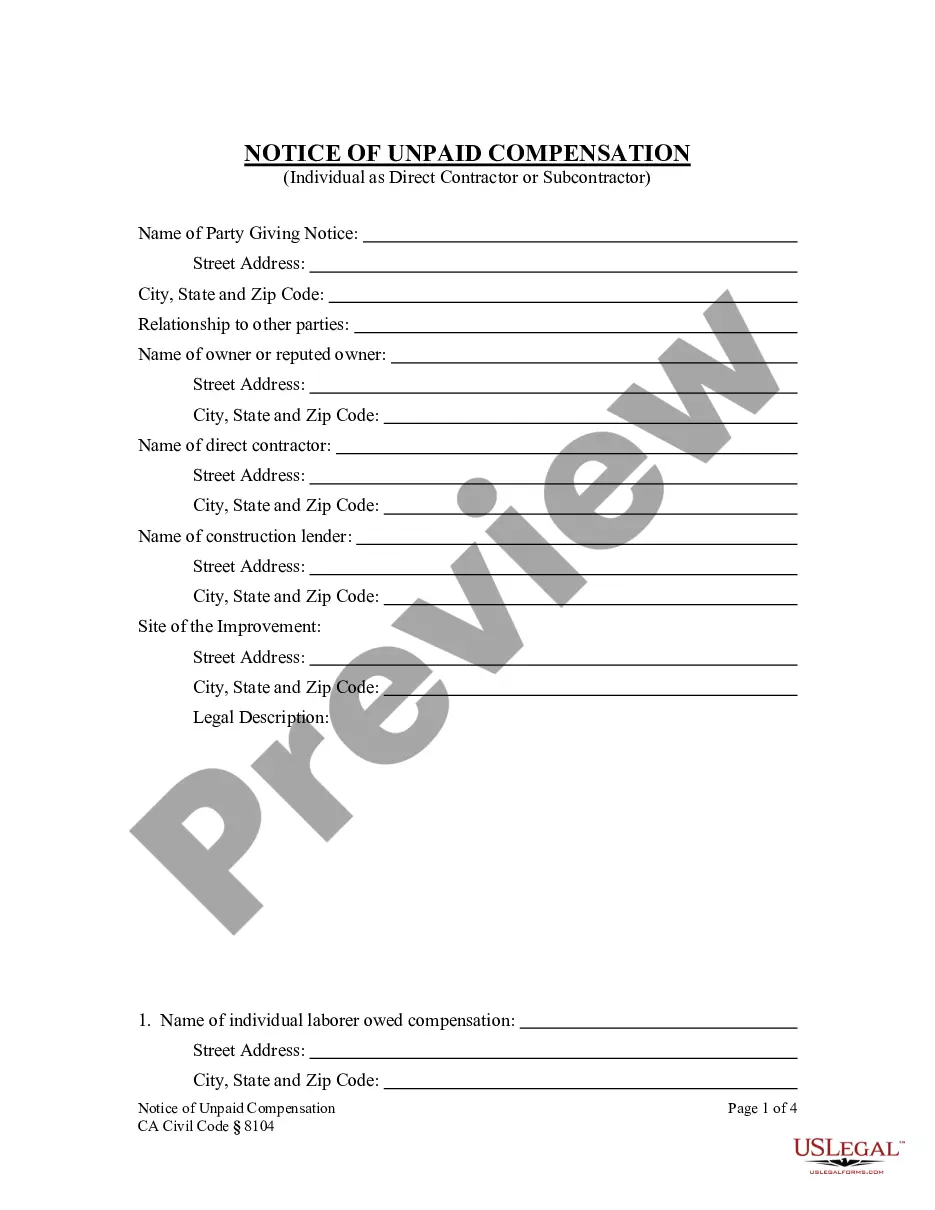

How to fill out Quitclaim Deed Of Life Estate Interest Created Under A Will, To The Remainderman?

Choosing the best authorized papers template could be a battle. Naturally, there are a variety of layouts available on the Internet, but how do you find the authorized kind you need? Take advantage of the US Legal Forms website. The services delivers a huge number of layouts, such as the New Mexico Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman, which can be used for company and private requires. Each of the forms are checked out by pros and satisfy federal and state demands.

If you are already signed up, log in to your accounts and then click the Download switch to obtain the New Mexico Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman. Make use of accounts to search from the authorized forms you might have purchased previously. Go to the My Forms tab of your own accounts and get one more version of the papers you need.

If you are a whole new consumer of US Legal Forms, listed here are straightforward guidelines that you can follow:

- First, ensure you have selected the right kind for your metropolis/area. You can look through the shape utilizing the Preview switch and study the shape explanation to guarantee it will be the right one for you.

- In case the kind will not satisfy your needs, make use of the Seach field to obtain the right kind.

- When you are certain the shape is suitable, click on the Acquire now switch to obtain the kind.

- Opt for the rates prepare you desire and enter in the essential information. Build your accounts and buy the order using your PayPal accounts or bank card.

- Opt for the data file file format and down load the authorized papers template to your device.

- Complete, change and print and signal the acquired New Mexico Quitclaim Deed of Life Estate Interest Created Under A Will, to the Remainderman.

US Legal Forms is the greatest collection of authorized forms in which you can discover different papers layouts. Take advantage of the company to down load appropriately-manufactured documents that follow condition demands.

Form popularity

FAQ

Traditional Life Estates Can Create Problems The life tenant occupies the house and is responsible for paying taxes and general upkeep. While the beneficiary holds future interest in the house, they have no legal standing to ensure that the house is cared for and does not lose value.

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.

A conventional life estate is one created by grant from the owner of the fee simple estate. A legal life estate is one created by statute in some states and depends on the law of the state where the real estate is located. Examples of this type of life estate include curtsey and dower.

Some of the advantages include: Simplicity. Creating a life estate only requires a new deed to be drafted and recorded. Probate avoidance. Ownership automatically transfers to the remainder owner upon the death of the life tenant owner. Protection. ... Tax benefits. ... Long-term care planning.

For the life estate interest, multiply the figure in the life estate column for the individual's age by the equity value of the property. 3. For the remainder interest, multiply the figure in the remainder interest column for the individual's age by the equity value of the property.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.

Recording (N. M. S. A. 1978, § 14-9-1) ? A quit claim deed is required to be filed at the County Clerk's Office where the property is located along with the required recording fee(s). Signing (N. M. S. A. 1978, § 47-1-44) ? In New Mexico, it must be signed with a Notary Public viewing the Grantor(s) signature(s).