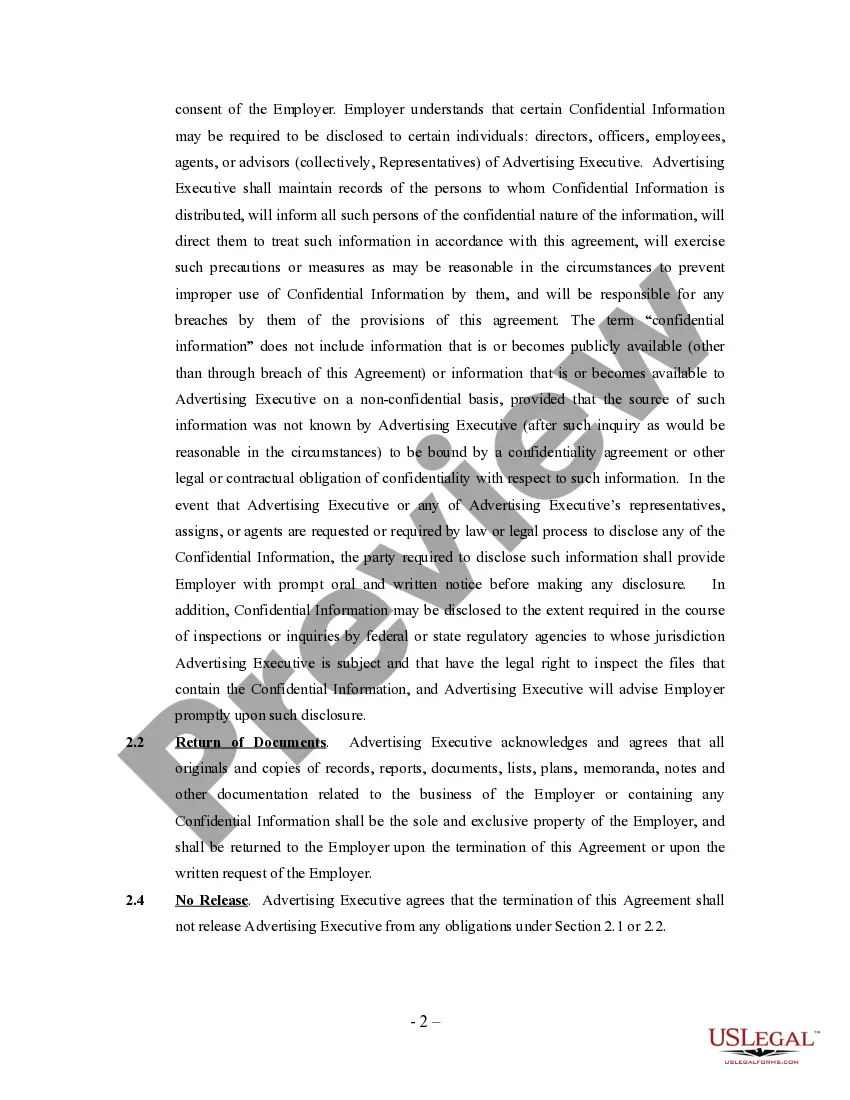

New Mexico Advertising Executive Agreement - Self-Employed Independent Contractor

Description

How to fill out Advertising Executive Agreement - Self-Employed Independent Contractor?

Locating the appropriate authorized document template can be a challenge. Of course, there are numerous templates accessible online, but how can you acquire the authorized form you require? Utilize the US Legal Forms website.

This service provides a vast array of templates, such as the New Mexico Advertising Executive Agreement - Self-Employed Independent Contractor, which you can utilize for both business and personal purposes. All templates are reviewed by professionals and comply with federal and state regulations.

If you are already registered, sign in to your account and click on the Obtain button to locate the New Mexico Advertising Executive Agreement - Self-Employed Independent Contractor. Use your account to browse the authorized templates you may have previously purchased. Proceed to the My documents section of your account and retrieve another copy of the document you require.

Fill out, modify, print, and sign the acquired New Mexico Advertising Executive Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest repository of authorized forms where you can find various document templates. Use the service to obtain professionally crafted documents that adhere to state requirements.

- If you are a new user of US Legal Forms, here are some straightforward instructions for you to follow.

- Firstly, ensure you have selected the appropriate form for your specific area/region. You can view the form using the Preview button and examine the form outline to confirm it is the correct one for you.

- If the form does not meet your requirements, utilize the Search field to find the suitable form.

- Once you are confident the form is correct, click the Acquire now button to obtain the form.

- Select the payment method you prefer and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card.

- Choose the download format and save the authorized document template to your device.

Form popularity

FAQ

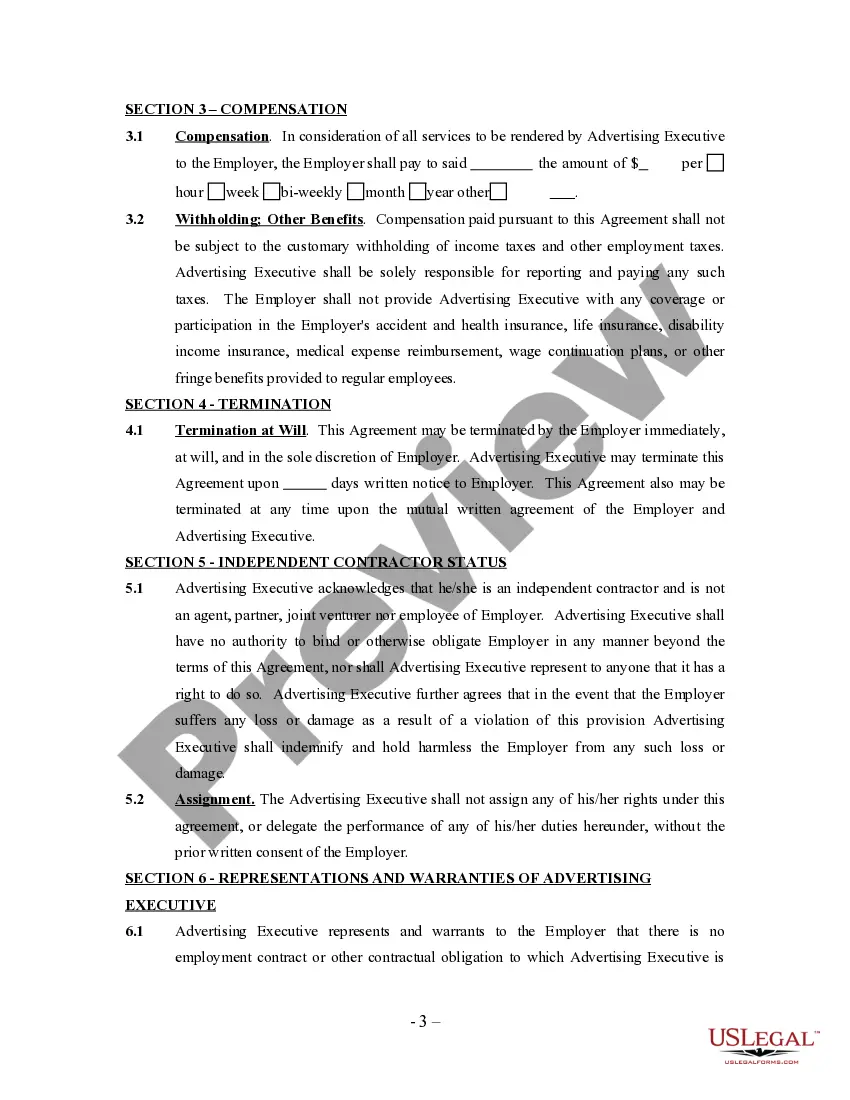

An independent contractor typically fills out several key documents, including a W-9 form for tax purposes and the independent contractor agreement itself. Depending on the nature of the work, they may also need client-specific forms or permits. For those partners using the New Mexico Advertising Executive Agreement - Self-Employed Independent Contractor from US Legal Forms, the paperwork process becomes more efficient and organized.

Filling out an independent contractor agreement requires careful attention to detail. You should begin by inserting the contractor's name, contact information, and the services they will deliver. Don’t forget to specify the payment method and schedule; using the New Mexico Advertising Executive Agreement - Self-Employed Independent Contractor can streamline this process and reinforce compliance with local regulations.

To write an independent contractor agreement, begin by outlining the specific services the contractor will provide. Include essential details such as payment terms, duration of the agreement, and any confidentiality clauses. Remember to leverage the New Mexico Advertising Executive Agreement - Self-Employed Independent Contractor template available on US Legal Forms for comprehensive guidance, ensuring your agreement aligns with state laws.

Indeed, an independent contractor falls under the self-employed category. This designation highlights your role in managing projects as specified in a New Mexico Advertising Executive Agreement - Self-Employed Independent Contractor. Being self-employed provides you with the freedom to choose your clients and set your own hours, which can be rewarding.

Yes, an independent contractor is considered self-employed. This classification signifies that you operate independently, often under terms outlined in a New Mexico Advertising Executive Agreement - Self-Employed Independent Contractor. As a contractor, you manage your own business activities and handle your taxes directly.

Whether contractors need a license in New Mexico depends on their specific trade or services. Some professions require licensing, while others do not. If you are entering a New Mexico Advertising Executive Agreement - Self-Employed Independent Contractor in a regulated field, make sure to check local regulations to ensure compliance before starting your business.

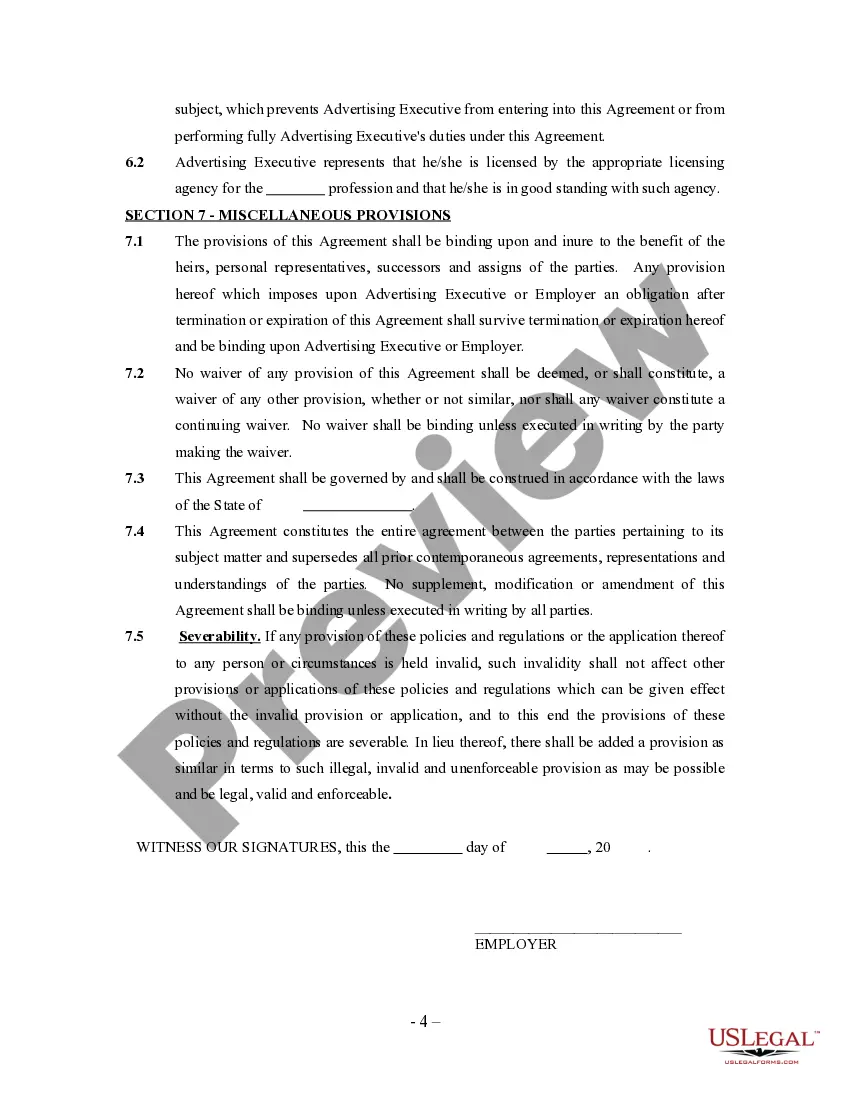

Having a contract as an independent contractor is highly advisable. A contract, such as the New Mexico Advertising Executive Agreement - Self-Employed Independent Contractor, outlines the terms of your working relationship, ensuring clarity and protection for both parties. This legal document helps to prevent disputes and establishes expectations for the work to be completed.

To qualify as self-employed, an individual must operate their own business or work as an independent contractor, earning income directly from clients or customers. Under the New Mexico Advertising Executive Agreement - Self-Employed Independent Contractor, this means you should have control over your work schedule and business operations. Additionally, you accept responsibility for your taxes and expenses.

The new federal rule clarifies the classification of independent contractors, aiming to prevent misclassification. It emphasizes the importance of evaluating the working relationship, whether through the New Mexico Advertising Executive Agreement - Self-Employed Independent Contractor or other arrangements. Understanding these changes can help you maintain compliance and protect your rights as a contractor.

While both terms are often used interchangeably, self-employed typically refers to individuals who run their own business, whereas independent contractors work on specific projects or assignments. In the context of the New Mexico Advertising Executive Agreement - Self-Employed Independent Contractor, using the term independent contractor emphasizes your flexibility in work arrangements. Ultimately, choose the term that best represents your situation.