New Mexico Storage Services Contract - Self-Employed

Description

How to fill out Storage Services Contract - Self-Employed?

It is feasible to spend several hours online trying to locate the legal document template that fulfills the state and federal requirements you require. US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

You can effortlessly download or create the New Mexico Storage Services Agreement - Self-Employed from our service. If you possess a US Legal Forms account, you can sign in and click the Obtain button. Subsequently, you can complete, modify, print, or sign the New Mexico Storage Services Agreement - Self-Employed.

Every legal document template you acquire is yours indefinitely. To obtain another copy of a purchased form, navigate to the My documents section and click the corresponding button.

Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of your document and download it to your device. Make modifications to your document if necessary. You can complete, edit, sign, and print the New Mexico Storage Services Agreement - Self-Employed. Download and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to manage your business or personal needs.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your preference.

- Review the form description to confirm you have chosen the right document.

- If available, utilize the Preview button to view the document template as well.

- If you want to find another version of your form, use the Search field to find the template that suits your needs and requirements.

- Once you have located the template you require, click Obtain now to proceed.

- Select the payment plan you prefer, enter your details, and register for an account on US Legal Forms.

Form popularity

FAQ

To set up a sole proprietorship in New Mexico, start by choosing a unique business name and checking its availability. Next, obtain any necessary licenses or permits that align with your specific services, such as those related to storage. It's essential to keep track of your earnings and expenses, as you will report them on your personal income tax return. For streamlined documentation, consider using the US Legal Forms platform to create your New Mexico Storage Services Contract - Self-Employed.

While an operating agreement is not legally required for an LLC in New Mexico, it is highly recommended. This document outlines the management structure and operating procedures of your LLC. Having an operating agreement can help prevent future disputes and clarify roles among members. For those establishing services like the New Mexico Storage Services Contract - Self-Employed, an operating agreement keeps your business dealings organized and clear.

Writing a self-employment contract involves outlining the details of your services, payment terms, and duration of the agreement. Be sure to include clauses that cover confidentiality, rights to work results, and termination conditions. A well-defined contract protects both parties and can provide peace of mind. Consider using US Legal Forms to access customizable templates suited for the New Mexico Storage Services Contract - Self-Employed.

To show proof that you are self-employed, collect documents that demonstrate your business activities. This may include income tax returns, invoices, and bank statements related to your business. Additionally, maintain records of any contracts, such as the New Mexico Storage Services Contract - Self-Employed, to validate your status and provide clarity in your professional dealings.

Yes, you can write your own legally binding contract as long as it meets the necessary legal requirements. Make sure to include all essential elements, such as the offer, acceptance, and consideration, to establish a valid agreement. Using a platform like US Legal Forms can provide you with templates that align with the New Mexico Storage Services Contract - Self-Employed, ensuring your contract is both enforceable and tailored to your needs.

To write a contract for a 1099 employee, start by clearly defining the scope of work, including specific duties and responsibilities. Include payment terms, such as hourly rates or project fees, and specify the payment schedule. It's crucial to outline the duration of the contract and include any legal clauses related to confidentiality and termination. For a comprehensive contract, consider using a template from a reliable source like US Legal Forms to ensure compliance with the New Mexico Storage Services Contract - Self-Employed.

Yes, New Mexico requires 1099 filing for independent contractors who earn more than $600 in a calendar year. This requirement also applies to work conducted under a New Mexico Storage Services Contract - Self-Employed. Accurate 1099 forms help both you and your clients maintain clear financial records. Always ensure that you file your forms on time to meet state and federal requirements.

The self employment tax in New Mexico consists of both Social Security and Medicare taxes. This tax applies to your net earnings from self-employment, including any income derived from a New Mexico Storage Services Contract - Self-Employed. As of now, the self employment tax rate is 15.3%. It is essential to keep track of your earnings and report them accurately to avoid potential penalties.

In New Mexico, a lease agreement does not need to be notarized. However, notarization can provide an additional layer of security and proof of validity. If you are working with a New Mexico Storage Services Contract - Self-Employed, it's wise to have all parties sign the agreement. This can help avoid any disputes down the line.

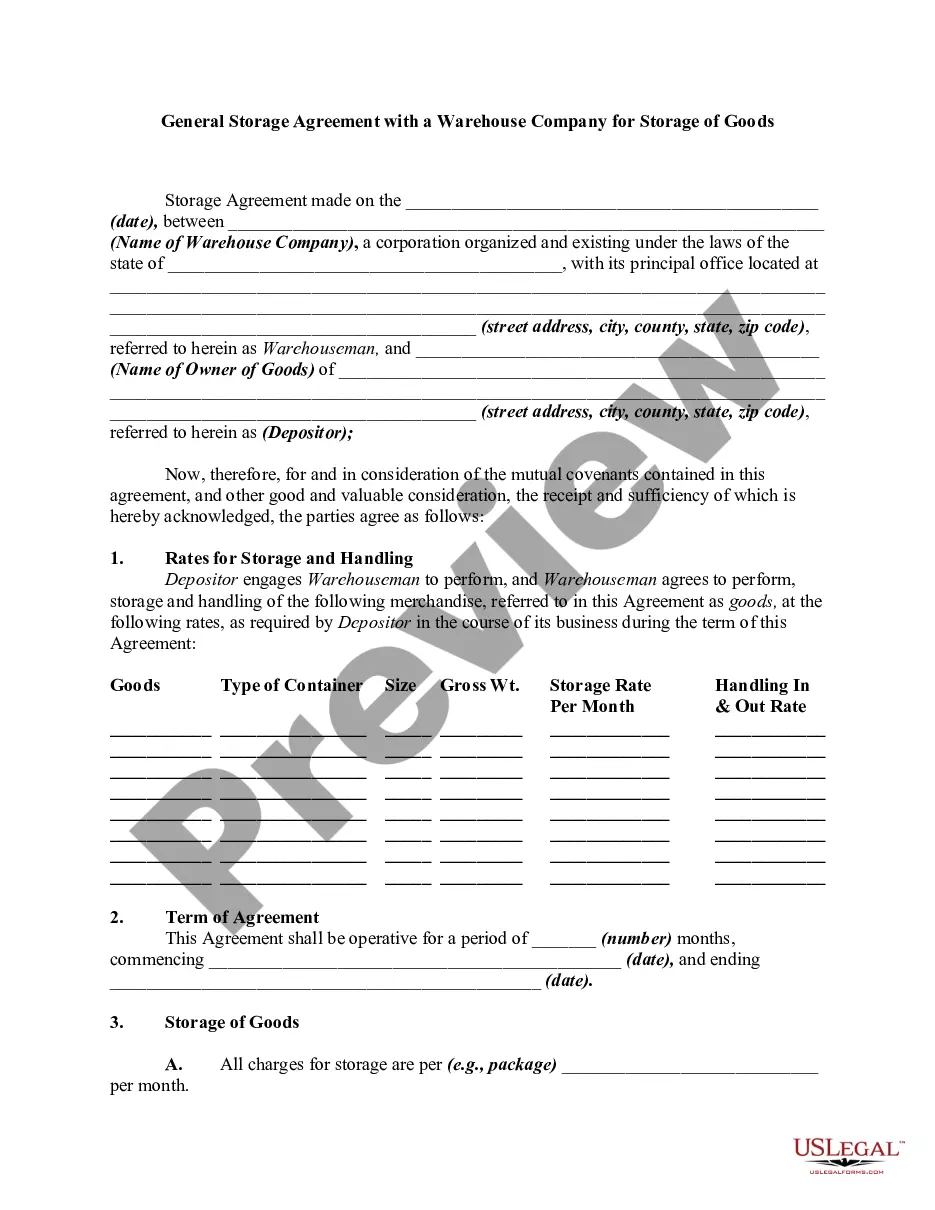

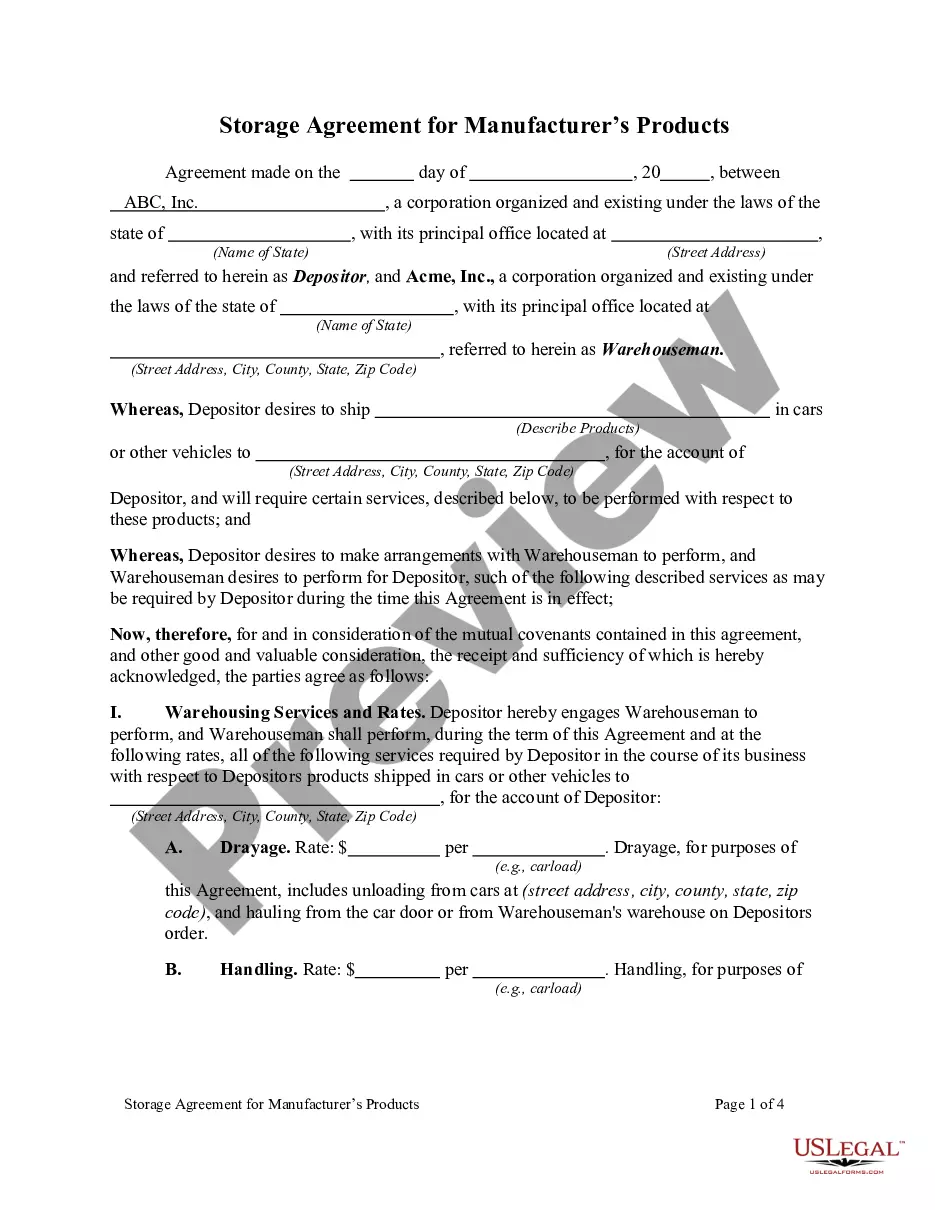

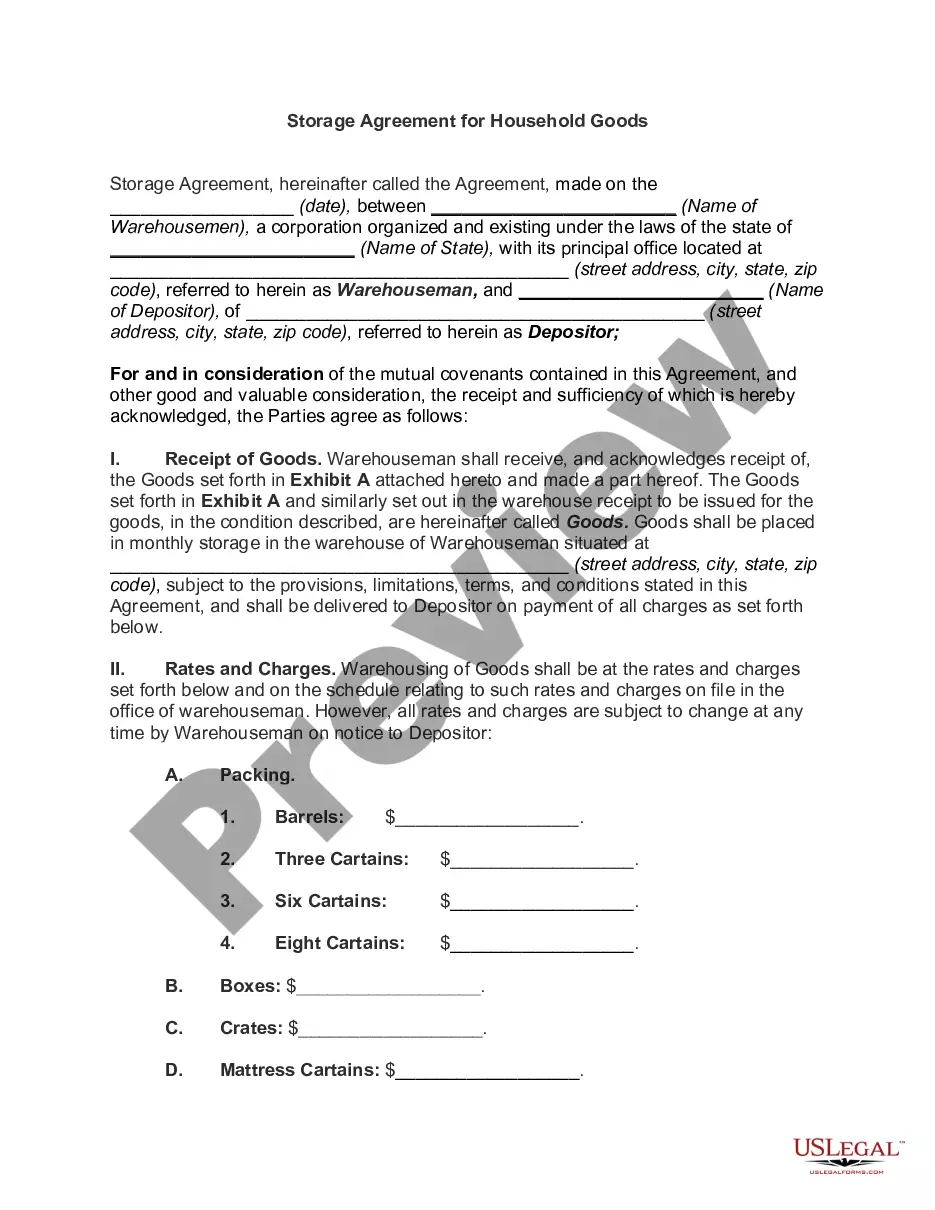

A storage contract is a legal agreement between the provider and the user of storage services. It outlines the terms and conditions of storage, including the duration, fees, and responsibilities of each party. If you are looking for a New Mexico Storage Services Contract - Self-Employed, exploring templates and resources on platforms like USLegalForms can help you craft a comprehensive and clear agreement.