New Mexico Paint Removal And Cleaning Services Contract - Self-Employed

Description

How to fill out Paint Removal And Cleaning Services Contract - Self-Employed?

Are you presently in a scenario where you need documents for either business or personal purposes nearly all the time.

There are numerous legal document templates available online, but finding forms you can trust is challenging.

US Legal Forms provides thousands of form templates, such as the New Mexico Paint Removal And Cleaning Services Contract - Self-Employed, that are designed to meet federal and state requirements.

Select the pricing plan you want, provide the necessary information to process your payment, and complete the transaction using your PayPal or Visa or Mastercard.

Choose a preferred file format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Once logged in, you can download the New Mexico Paint Removal And Cleaning Services Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

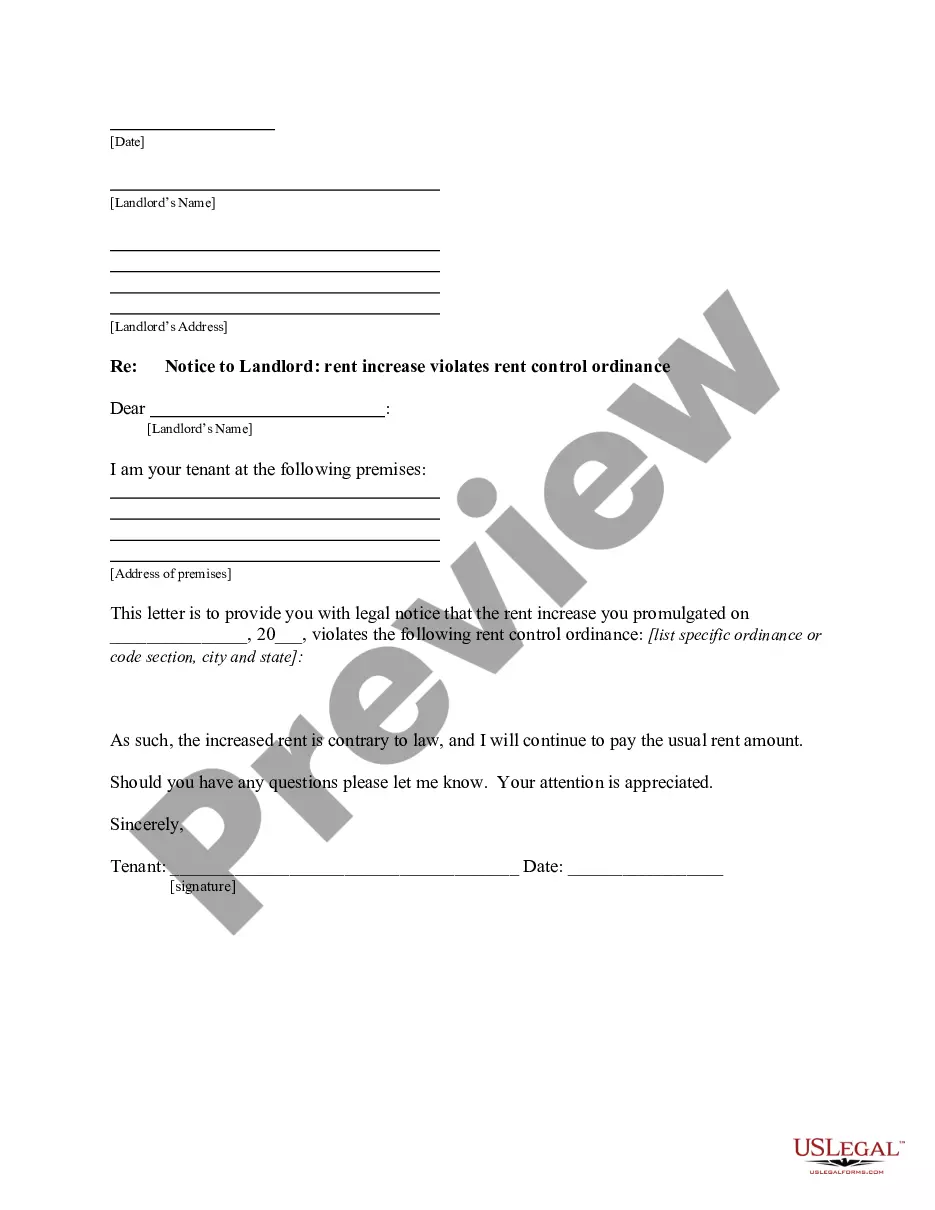

- Use the Review button to examine the form.

- Read the details to confirm that you have chosen the appropriate form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your needs and criteria.

- Once you find the correct form, click on Acquire now.

Form popularity

FAQ

Securing cleaning contracts requires persistence and a strategic approach. You must demonstrate your reliability and quality of service to potential clients. Utilizing a New Mexico Paint Removal And Cleaning Services Contract - Self-Employed not only streamlines your proposal but also establishes a professional standard, making it easier for clients to choose your services.

Acquiring cleaning clients can be challenging, but effective marketing strategies can ease the process. Utilizing online platforms, networking in your community, and building a strong portfolio can significantly improve your visibility. With a solid New Mexico Paint Removal And Cleaning Services Contract - Self-Employed, you can present a professional image that builds trust and attracts clientele.

The 20 minute rule in cleaning suggests focusing on one area for twenty minutes to maintain efficiency and avoid burnout. This approach helps you accomplish tasks without feeling overwhelmed. When running a self-employed cleaning business, implementing this rule can optimize how you manage your time and efforts in line with your New Mexico Paint Removal And Cleaning Services Contract.

The self-employment tax rate is 15.3%, not 30%. This rate comprises both Social Security and Medicare taxes. If you are self-employed and working under a New Mexico Paint Removal And Cleaning Services Contract - Self-Employed, understanding this tax rate will help you plan your finances effectively.

The self-employment tax in New Mexico is a federal tax that applies to self-employed individuals, typically at a rate of 15.3%. This tax is assessed on net earnings from self-employment, including income from a New Mexico Paint Removal And Cleaning Services Contract - Self-Employed. It is important to report your earnings correctly to avoid penalties.

While you cannot fully avoid self-employment tax, you can reduce your taxable income through deductions. Expenses related to your New Mexico Paint Removal And Cleaning Services Contract - Self-Employed, such as tools and materials, may qualify as deductions. Tracking these expenses accurately will help you manage your tax burden effectively.

In New Mexico, the self-employment tax rate is generally 15.3%. This includes 12.4% for Social Security and 2.9% for Medicare. For self-employed individuals, understanding the implications of the New Mexico Paint Removal And Cleaning Services Contract - Self-Employed is essential for proper tax planning.

Yes, a cleaning business is typically considered a contractor in New Mexico, especially when operating under a New Mexico Paint Removal And Cleaning Services Contract - Self-Employed. This classification means that you are responsible for your taxes and business expenses, allowing for greater independence. Understanding this classification helps you make informed decisions regarding your business practices. Legal resources, such as uslegalforms, can provide essential documentation and support for your cleaning business.