New Mexico Cosmetologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Cosmetologist Agreement - Self-Employed Independent Contractor?

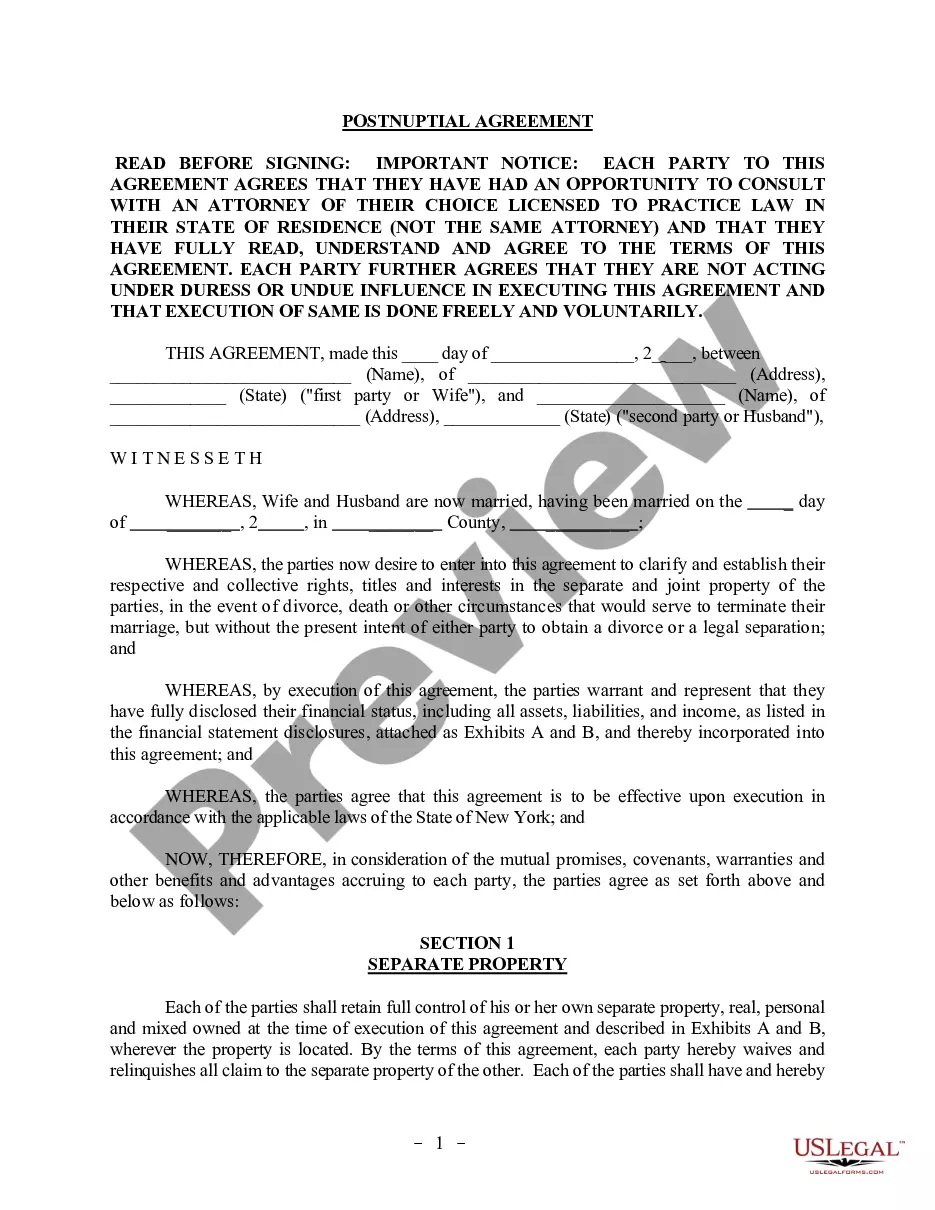

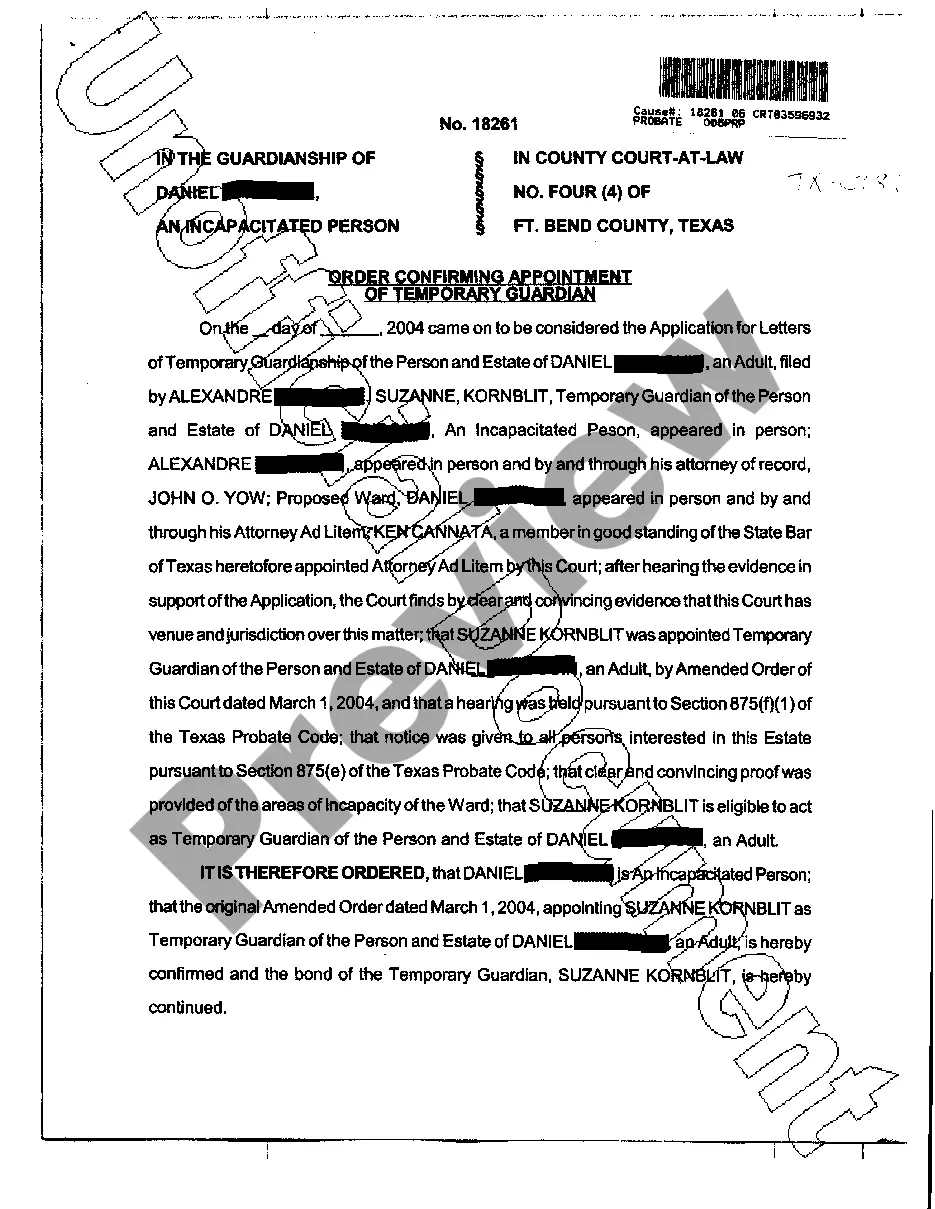

US Legal Forms - one of the most substantial collections of legal forms in the United States - offers a broad selection of legal document templates you can download or print.

Using the website, you can discover thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can access the latest versions of forms such as the New Mexico Cosmetologist Agreement - Self-Employed Independent Contractor in just minutes.

If you already have an account, Log In and retrieve the New Mexico Cosmetologist Agreement - Self-Employed Independent Contractor from the US Legal Forms catalog. The Download button will appear on every form you view. You can access all previously saved forms in the My documents tab of your account.

Select the format and download the form to your device.

Make adjustments. Fill out, modify, print, and sign the saved New Mexico Cosmetologist Agreement - Self-Employed Independent Contractor. Every template added to your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the New Mexico Cosmetologist Agreement - Self-Employed Independent Contractor with US Legal Forms, the most comprehensive catalog of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/region. Click the Preview button to review the form's content.

- Check the form description to confirm you have chosen the right form.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose the pricing plan you prefer and provide your credentials to register for an account.

- Process the payment. Use a credit card or PayPal account to complete the transaction.

Form popularity

FAQ

To become an authorized independent contractor, you must obtain the necessary licenses and certifications specific to your field. Research the regulations in New Mexico to ensure compliance. Additionally, you’ll often need to establish a legal business entity and might benefit from drafting a New Mexico Cosmetologist Agreement - Self-Employed Independent Contractor. This formalizes your status and protects your rights as a self-employed professional.

To create an independent contractor agreement, begin by gathering essential information about both parties, including names, addresses, and roles. Next, outline terms such as payment rates, work expectations, and deadlines. You can also access tools like US Legal Forms, which provides customizable templates for a New Mexico Cosmetologist Agreement - Self-Employed Independent Contractor. This approach streamlines the process and ensures all necessary elements are included.

Typically, an independent contractor agreement can be drafted by either the cosmetologist or a legal professional. It is crucial to define the terms clearly to protect both parties involved. You can use templates or services like US Legal Forms to create a New Mexico Cosmetologist Agreement - Self-Employed Independent Contractor that meets your needs. Ensure that the document outlines critical details like payment terms, responsibilities, and duration.

To fill out an independent contractor agreement, begin by entering the names and addresses of both the contractor and the client. Next, specify the services provided under the New Mexico Cosmetologist Agreement - Self-Employed Independent Contractor, along with payment terms. Include any additional clauses that clarify responsibilities and expectations. Finally, have both parties sign the agreement to make it legally binding.

Writing an independent contractor agreement starts with clearly identifying both parties involved. Specify the terms, conditions, and expectations associated with the New Mexico Cosmetologist Agreement - Self-Employed Independent Contractor. Include payment details, the scope of work, and duration of the contract. This agreement protects both parties and fosters a clear understanding of their responsibilities.

Filling out an independent contractor form involves providing your name, contact information, and business structure. It's essential to outline your services in relation to the New Mexico Cosmetologist Agreement - Self-Employed Independent Contractor. Indicate your payment method and other relevant conditions. Make sure to review the completed form for accuracy and compliance.

An independent contractor in cosmetology operates their own business while offering services to clients. They work under a New Mexico Cosmetologist Agreement - Self-Employed Independent Contractor, allowing them more flexibility than traditional employees. This structure usually involves managing their schedules, setting their rates, and providing their tools and products. Understanding these aspects helps beauticians thrive in their careers.

To fill out a declaration of independent contractor status form, start by providing your personal information, including your name, address, and contact details. Next, describe the nature of your work as a New Mexico Cosmetologist Agreement - Self-Employed Independent Contractor. Include relevant details regarding your payment structure and how you manage your work schedule. To ensure accuracy, review the completed form before submission.

Filing taxes as an independent contractor can be complex, but it is manageable with proper organization and understanding of the process. Keeping meticulous records and being aware of relevant deductions can simplify the task significantly. Utilizing resources like the New Mexico Cosmetologist Agreement - Self-Employed Independent Contractor can also aid hairstylists in navigating the tax landscape, providing clarity and confidence in their tax filing efforts.

To file taxes as a hairstylist, begin by gathering all income and expense records for the year. Complete IRS Form 1040 and attach Schedule C, which outlines your business activity related to the New Mexico Cosmetologist Agreement - Self-Employed Independent Contractor. Consider consulting a tax professional or using accounting software for accurate reporting and deductions, which may lead to potential tax savings.