New Mexico Data Entry Employment Contract - Self-Employed Independent Contractor

Description

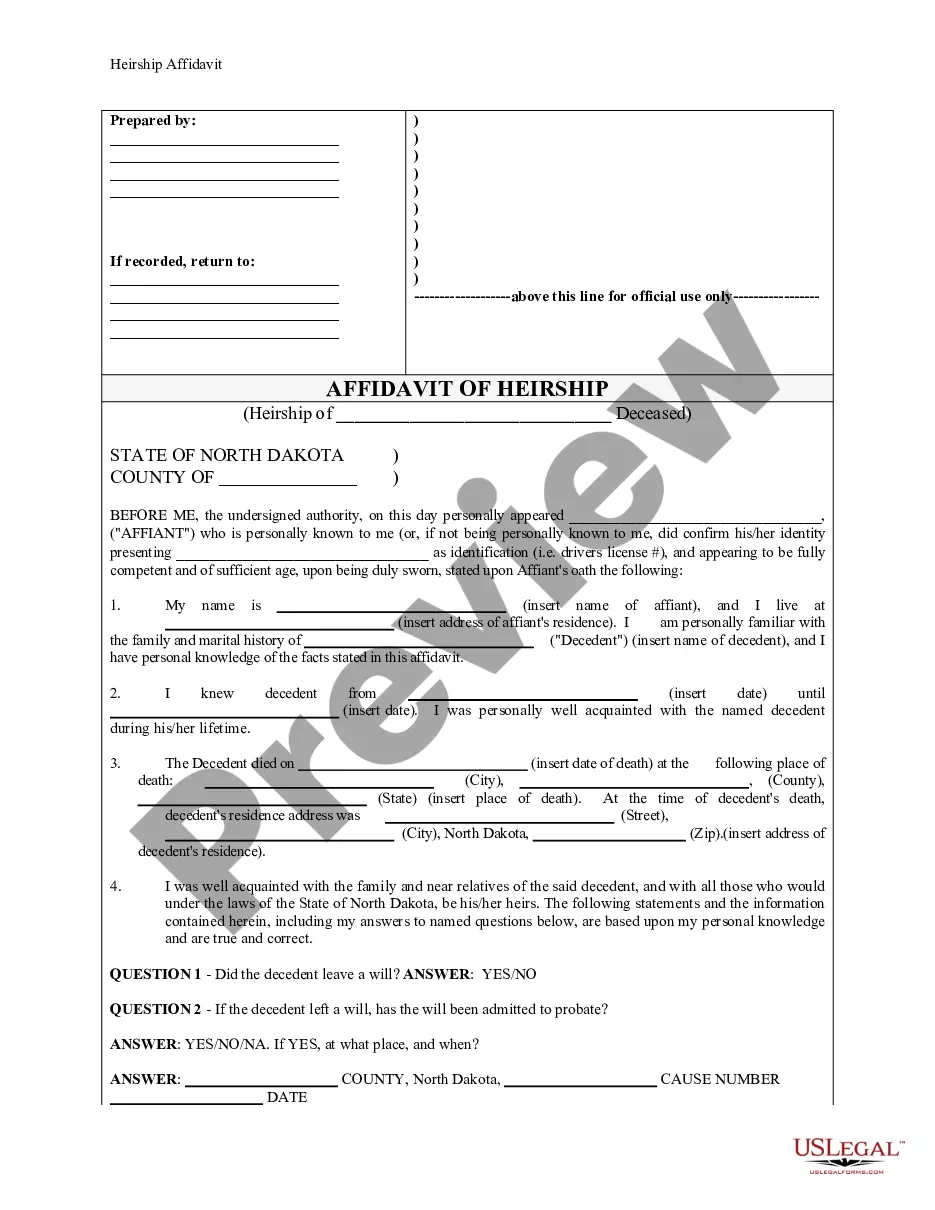

How to fill out Data Entry Employment Contract - Self-Employed Independent Contractor?

You might spend numerous hours online searching for the correct legal document template that complies with the state and federal requirements you seek. US Legal Forms offers a vast array of legal forms that can be reviewed by experts.

You can download or print the New Mexico Data Entry Employment Contract - Self-Employed Independent Contractor from our service.

If you already possess a US Legal Forms account, you may Log In and click the Acquire button. Subsequently, you can complete, modify, print, or sign the New Mexico Data Entry Employment Contract - Self-Employed Independent Contractor. Each legal document template you purchase is yours permanently. To obtain another copy of a bought form, navigate to the My documents section and click the corresponding button.

Choose the document format and download it to your device. Make any necessary modifications to your document. You can complete, edit, and sign, and print the New Mexico Data Entry Employment Contract - Self-Employed Independent Contractor. Acquire and print a multitude of document templates using the US Legal Forms site, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the appropriate document format for the area/city of your choice. Check the form details to confirm you have chosen the correct document.

- If available, use the Review button to go through the document format as well.

- If you wish to obtain another version of the document, use the Research field to find the format that meets your requirements and criteria.

- Once you have located the format you need, simply click Acquire now to proceed.

- Choose the pricing plan you want, enter your details, and register for a free account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal document.

Form popularity

FAQ

Yes, independent contractors need to ensure they have the appropriate work authorization for their services. This requirement varies depending on the type of work and the client's needs. If you are working under a New Mexico Data Entry Employment Contract - Self-Employed Independent Contractor, it's beneficial to verify your eligibility and compliance to avoid any legal complications.

You can provide proof of employment as an independent contractor through various means. This includes sharing your 1099 forms, invoices submitted to clients, and a New Mexico Data Entry Employment Contract - Self-Employed Independent Contractor outlining your work details. These documents collectively demonstrate your professional engagement and can be essential for banks or other institutions.

To show proof of self-employment, you can present your business licenses, tax returns, and any relevant contracts like the New Mexico Data Entry Employment Contract - Self-Employed Independent Contractor. These documents not only validate your self-employed status but also provide evidence of your earnings and business activity. If you need help creating contracts or tracking income, consider using the services at uslegalforms.

An independent contractor can show proof of employment through a variety of documents, including contracts, correspondence, or invoices issued to clients. A well-documented New Mexico Data Entry Employment Contract - Self-Employed Independent Contractor can serve as a key piece of evidence of the contractor’s work engagements. This clarity can be beneficial when seeking loans or other opportunities.

Independent contractors must earn $600 or more from a single client in a tax year to receive a 1099 form from that client. However, it is crucial to report all income, regardless of the amount, to the IRS. Therefore, if you are working under a New Mexico Data Entry Employment Contract - Self-Employed Independent Contractor, it’s essential to keep accurate records of your income.

Yes, self-employed individuals can absolutely have contracts. In fact, having a contract, like a New Mexico Data Entry Employment Contract - Self-Employed Independent Contractor, defines the working relationship and expectations between a contractor and a client. It provides clarity on services rendered, payment terms, and other vital details.

To show proof of income as a 1099 contractor, you can utilize your 1099 forms that reflect the payments received from your clients. Additionally, bank statements that show deposits can serve as evidence of your earnings. If you have a New Mexico Data Entry Employment Contract - Self-Employed Independent Contractor, it can help clarify your work history and income sources.

To fill out an independent contractor agreement, begin by identifying both parties and outlining the work to be performed. Include sections for payment details, project deadlines, and any special terms relevant to your project. For accuracy and comprehensiveness, consider using a platform that offers the New Mexico Data Entry Employment Contract - Self-Employed Independent Contractor as a valuable template.

Filling out an independent contractor form involves providing personal information, such as your name, address, and Taxpayer Identification Number. You will also need to describe the services you will provide, ensuring clarity for both you and your client. Utilizing a structured approach offered by platforms like uslegalforms can simplify this process.

Yes, self-employed individuals can and should have a contract in place. A well-crafted contract, like the New Mexico Data Entry Employment Contract - Self-Employed Independent Contractor, helps define the scope of work and protects both parties involved. It clarifies expectations and responsibilities, ensuring a smoother working relationship.