New Mexico Cable Disconnect Service Contract - Self-Employed Independent Contractor

Description

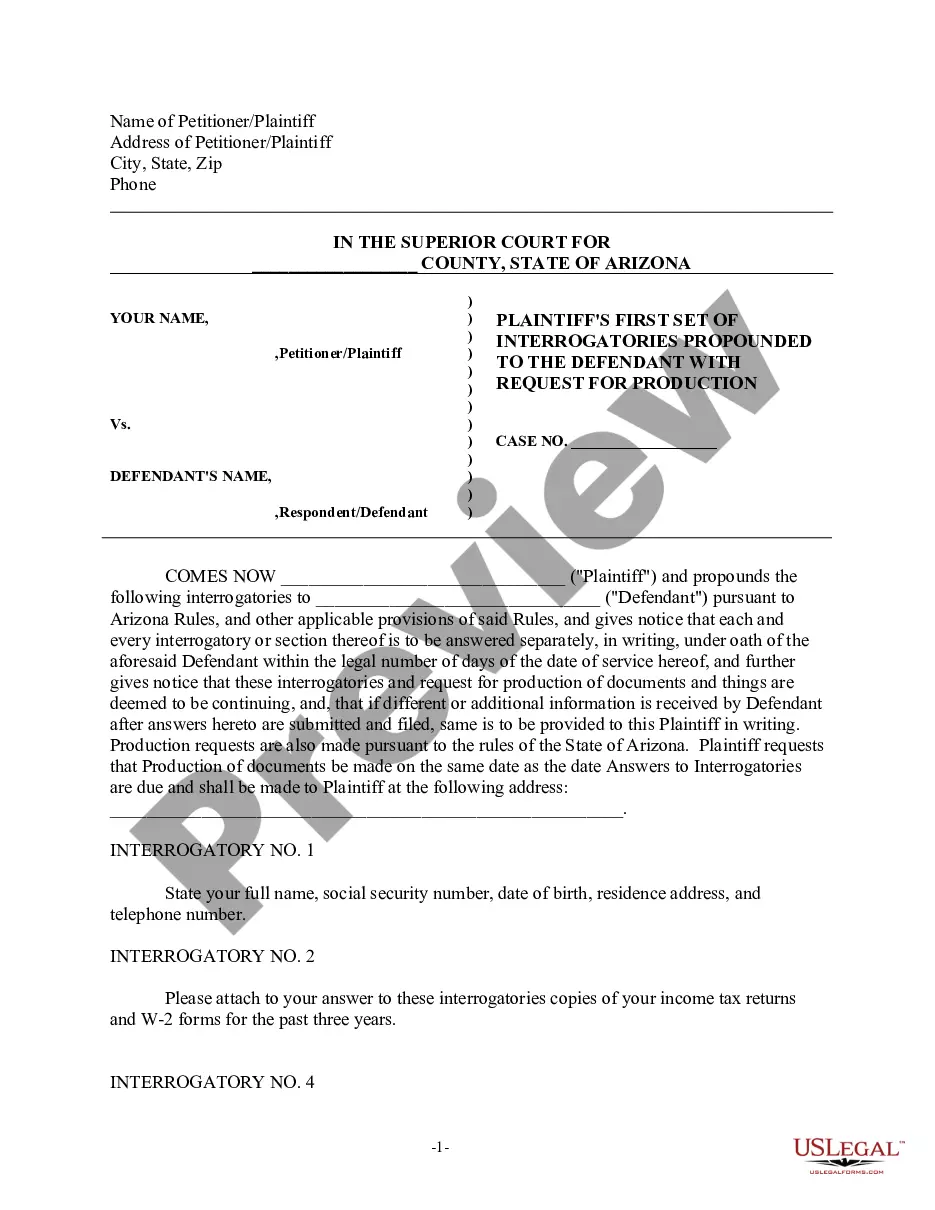

How to fill out Cable Disconnect Service Contract - Self-Employed Independent Contractor?

You can spend countless hours online trying to discover the legal document template that fulfills the federal and state requirements you need.

US Legal Forms provides a vast selection of legal templates that can be reviewed by professionals.

It is easy to download or print the New Mexico Cable Disconnect Service Contract - Self-Employed Independent Contractor from their service.

If available, take advantage of the Preview option to view the document template as well. If you wish to get another version of the form, use the Search field to find the template that suits your needs.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, edit, print, or sign the New Mexico Cable Disconnect Service Contract - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours indefinitely.

- To acquire another copy of any purchased document, go to the My documents tab and click the relevant option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the region/city of your preference.

- Review the form description to confirm you have selected the correct document.

Form popularity

FAQ

Yes, contractors typically need to be licensed in New Mexico to operate legally. This requirement applies to those entering into a New Mexico Cable Disconnect Service Contract - Self-Employed Independent Contractor. Licensing ensures that contractors meet the necessary standards for quality and safety. By obtaining the proper license, you can enhance your credibility and build trust with clients in the state.

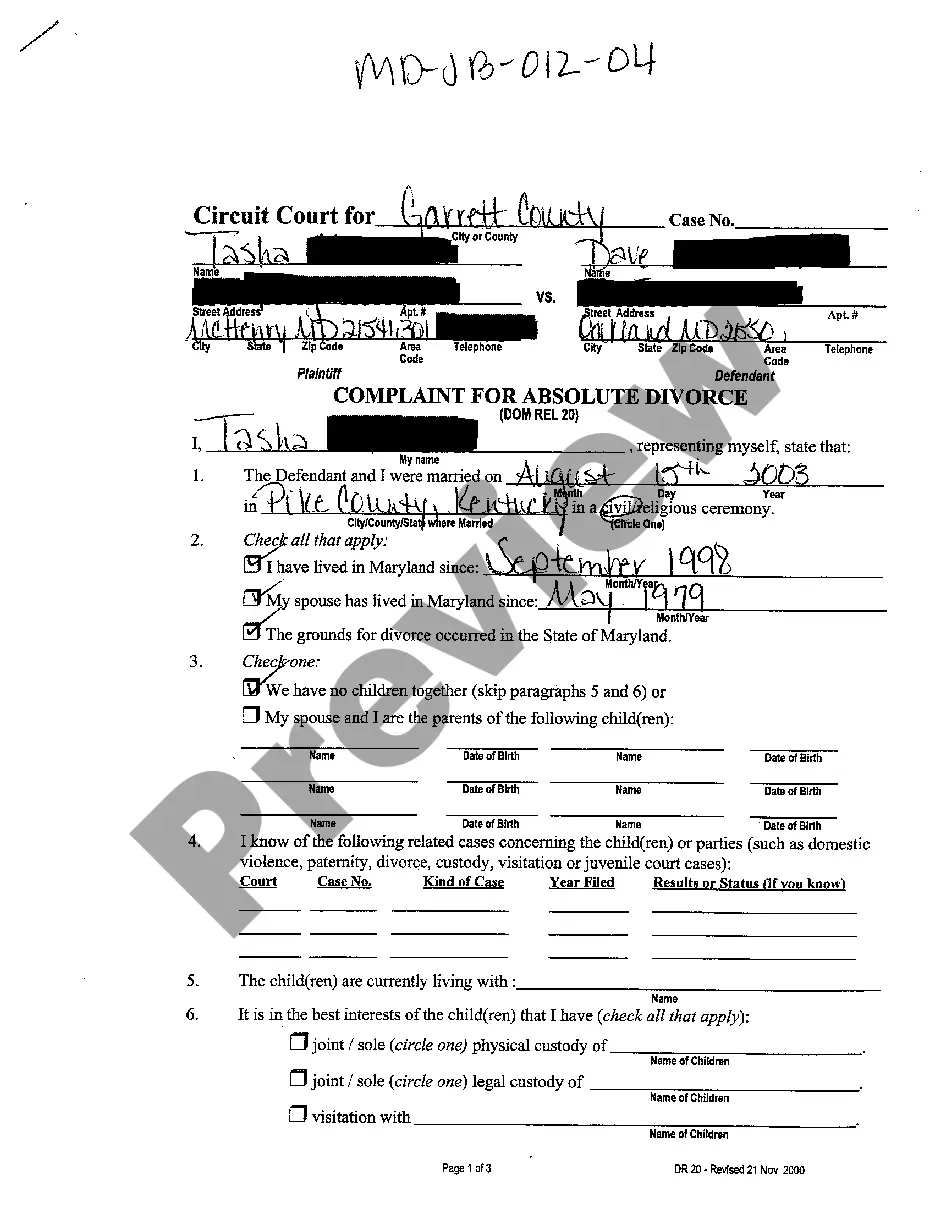

To write an independent contractor agreement for the New Mexico Cable Disconnect Service Contract - Self-Employed Independent Contractor, start by drafting an introduction that states the parties involved and the purpose of the agreement. Next, include sections that define the services, payment details, and project timeline for clarity. It is also wise to incorporate termination clauses and dispute resolution methods to safeguard your agreement and protect your rights.

When filling out an independent contractor agreement for the New Mexico Cable Disconnect Service Contract - Self-Employed Independent Contractor, begin with your name and the client’s details as a foundation. Clearly outline the scope of work, including deadlines and deliverables, to set mutual expectations. Don't forget to address payment terms and confidentiality to protect both parties' interests.

To complete the independent contractor form for the New Mexico Cable Disconnect Service Contract - Self-Employed Independent Contractor, start by entering your personal details such as name, address, and contact information. Next, provide the specific services you will offer, including a detailed description of tasks. Finally, make sure to include the payment terms and any deadlines for service completion to ensure clarity for both parties.

The new federal rule for independent contractors clarifies the classification of workers and outlines criteria that determine if someone is an independent contractor or an employee. This upcoming legislation could impact how businesses engage independent contractors across different states, including New Mexico. Staying informed about these changes is essential for compliance. Platforms such as USLegalForms can provide up-to-date information.

Legal requirements for independent contractors vary by state but generally include tax obligations and proper licensing. In New Mexico, for example, self-employed independent contractors must comply with state regulations for their specific industry. It is important to maintain accurate records and fulfill tax responsibilities. For detailed guidance, consider exploring resources like USLegalForms.

No, it is not illegal to terminate a 1099 contract. As a party to the agreement, you retain the right to end the relationship, provided you follow any relevant terms outlined in your contract. However, note that abrupt terminations could lead to disputes, so approaching the situation thoughtfully can save you from headaches. Always handle it professionally.

To terminate a contract with an independent contractor, review your contract for termination provisions. Deliver a written notice, specifying the reasons for termination and setting a final date. It's helpful to have a conversation to explain your decision, thereby clarifying any concerns and promoting a smoother transition. This method aligns well with best practices.

While it is not legally required to give two weeks' notice as an independent contractor, it is a professional practice. Providing notice can enhance your reputation and leave the door open for future opportunities. Your agreement may specify notification periods, so check those details. Ultimately, it’s about good professional courtesy.

To terminate a contract with an independent contractor, refer to the terms outlined in your agreement. Provide written notice, ensuring you include any necessary details such as the effective date of termination. Additionally, it's considerate to discuss your decision verbally before sending the official notice. This ensures clear communication while maintaining a positive relationship.