New Mexico Qualified Written RESPA Request to Dispute or Validate Debt

Description

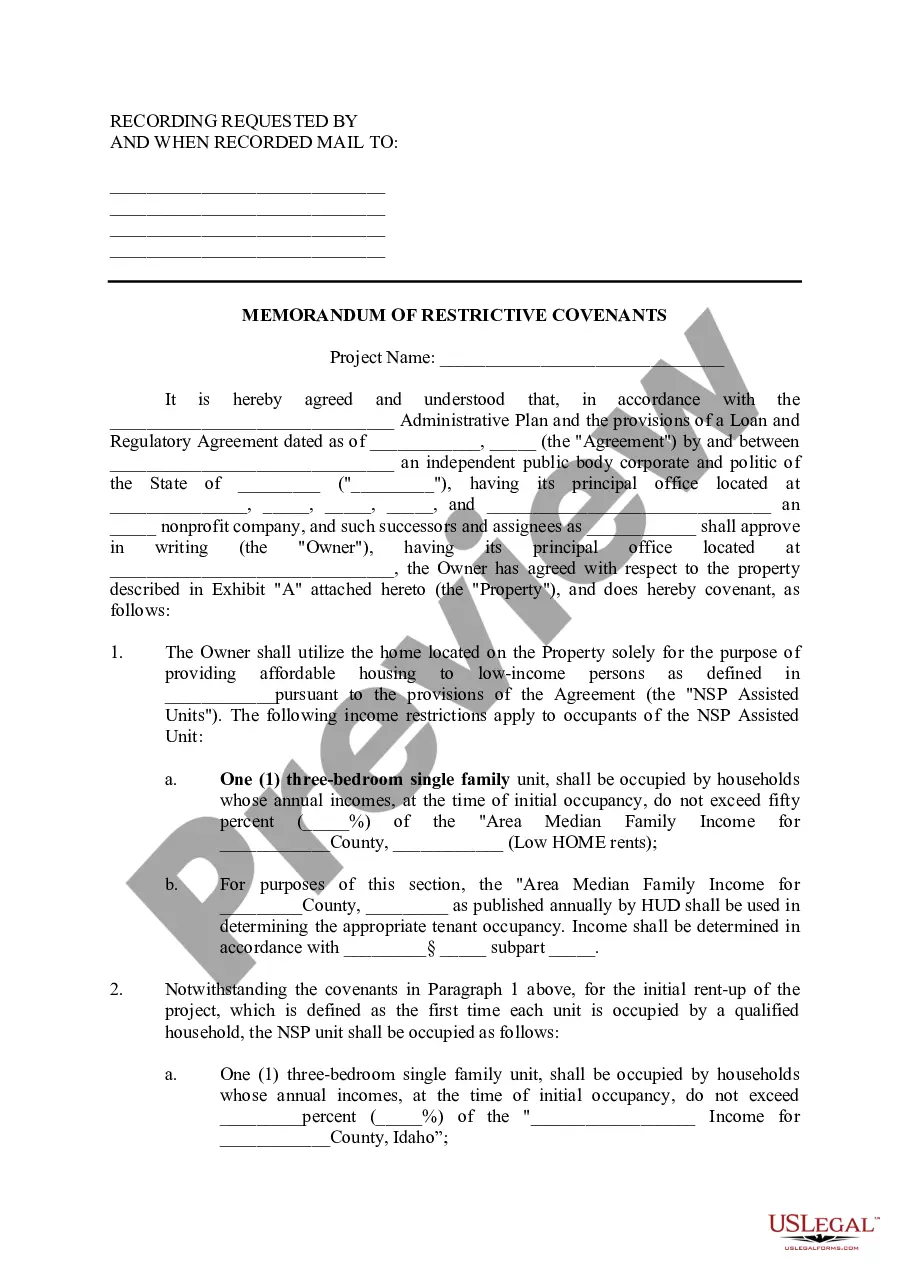

How to fill out Qualified Written RESPA Request To Dispute Or Validate Debt?

Are you in a situation that requires documents for either commercial or personal purposes almost every time.

There are numerous authentic document templates accessible online, but finding ones you can trust is not straightforward.

US Legal Forms offers a vast array of form templates, including the New Mexico Qualified Written RESPA Request to Dispute or Validate Debt, designed to meet state and federal requirements.

Select the pricing plan you want, fill in the required information for payment, and finalize your order using your PayPal or credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- Once logged in, you can download the New Mexico Qualified Written RESPA Request to Dispute or Validate Debt template.

- If you do not have an account and wish to start using US Legal Forms, adhere to these instructions.

- Obtain the form you need and verify it is for your correct city/state.

- Utilize the Review button to examine the form.

- Read the description to confirm that you have chosen the appropriate form.

- If the form is not what you seek, use the Search field to find the form that meets your needs and requirements.

- When you locate the right form, click Purchase now.

Form popularity

FAQ

RESPA prohibits certain practices that can undermine fair treatment for borrowers. First, it prohibits kickbacks, which are payments made for referrals of settlement services that could increase costs for borrowers. Second, RESPA bans the practice of requiring borrowers to use a specific title insurance company, ensuring that consumers can make their own choices. By understanding these prohibitions, you can strengthen your position when submitting a New Mexico Qualified Written RESPA Request to Dispute or Validate Debt.

Generally, a debt validation letter does not require notarization to hold value or be considered valid. The focus should be on the content, including your request for validation and the details of the debt in question. To support your efforts, using a platform like uslegalforms can guide you in preparing your New Mexico Qualified Written RESPA Request to Dispute or Validate Debt efficiently, ensuring you meet all necessary requirements.

In most cases, you do not need to notarize a debt validation letter for it to be effective. However, it's vital to ensure that the letter clearly states your dispute and provides the necessary information. When you're utilizing a New Mexico Qualified Written RESPA Request to Dispute or Validate Debt, keeping it straightforward and concise can help expedite the process, making your communication with creditors smoother.

A debt validation letter must include essential information to confirm the legitimacy of the debt. This typically involves details such as the amount owed, the name of the original creditor, and a breakdown of any fees or interests. When you submit a New Mexico Qualified Written RESPA Request to Dispute or Validate Debt, you should receive this letter to better understand your obligations and assess if the debt is accurate. Gathering this information can empower you in your financial journey.

In New Mexico, debt collectors can pursue old debt for a period of six years from the date of the last payment or transaction. This time frame falls under state law, which governs how collection efforts should proceed. If you've received a New Mexico Qualified Written RESPA Request to Dispute or Validate Debt, it's crucial to understand your rights and options regarding any old debt. Knowing this can help you take necessary steps to protect yourself.

In New Mexico, a debt typically becomes uncollectible after six years from the last payment date or from the date the debt became due. Creditors can no longer take legal action to collect the debt after this period. However, it is important to note that the debt may still appear on your credit report for an additional time. If you're dealing with old debts, consider writing a New Mexico Qualified Written RESPA Request to Dispute or Validate Debt to better understand your rights.

To write a New Mexico Qualified Written RESPA Request to Dispute or Validate Debt, begin by clearly identifying yourself and providing relevant account information. Include a detailed explanation of the issues you're experiencing with the debt. Make sure to request specific information, such as copies of documents that support your dispute. Finally, send your request via certified mail to ensure you have proof of delivery.

Lenders are required to provide specific RESPA information to buyers within a certain timeline, typically within five days of receiving a Qualified Written Request. This information is crucial for buyers looking to ensure their mortgage terms are clear and justified. If you are navigating the complexities of a mortgage, knowing your rights under the New Mexico Qualified Written RESPA Request to Dispute or Validate Debt can help you hold the lender accountable. Always consider using resources like uslegalforms to simplify this process.