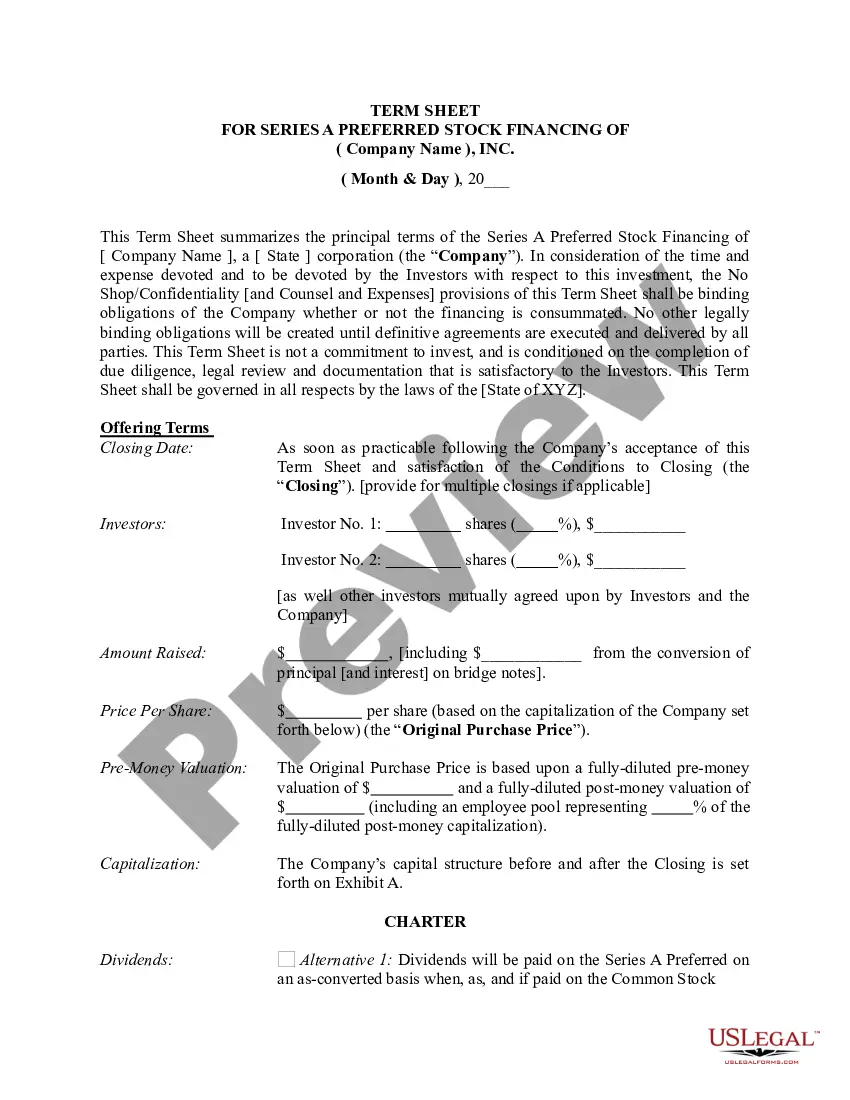

New Mexico Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

Have you been in the placement the place you require documents for either organization or person uses nearly every working day? There are a variety of legal file layouts available on the Internet, but locating types you can depend on isn`t easy. US Legal Forms offers a large number of type layouts, much like the New Mexico Term Sheet - Series A Preferred Stock Financing of a Company, which can be created in order to meet state and federal requirements.

If you are currently informed about US Legal Forms internet site and get your account, simply log in. Afterward, you may down load the New Mexico Term Sheet - Series A Preferred Stock Financing of a Company design.

Should you not provide an account and need to start using US Legal Forms, abide by these steps:

- Get the type you require and ensure it is to the proper town/state.

- Utilize the Preview button to check the form.

- See the information to actually have selected the right type.

- If the type isn`t what you are seeking, take advantage of the Lookup area to discover the type that fits your needs and requirements.

- Whenever you find the proper type, simply click Buy now.

- Pick the prices program you desire, submit the desired information and facts to produce your money, and purchase the order with your PayPal or Visa or Mastercard.

- Pick a practical file format and down load your copy.

Locate all the file layouts you might have bought in the My Forms food selection. You can obtain a further copy of New Mexico Term Sheet - Series A Preferred Stock Financing of a Company anytime, if needed. Just click on the needed type to down load or print the file design.

Use US Legal Forms, probably the most extensive collection of legal kinds, in order to save time as well as prevent mistakes. The support offers expertly manufactured legal file layouts that you can use for a range of uses. Make your account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

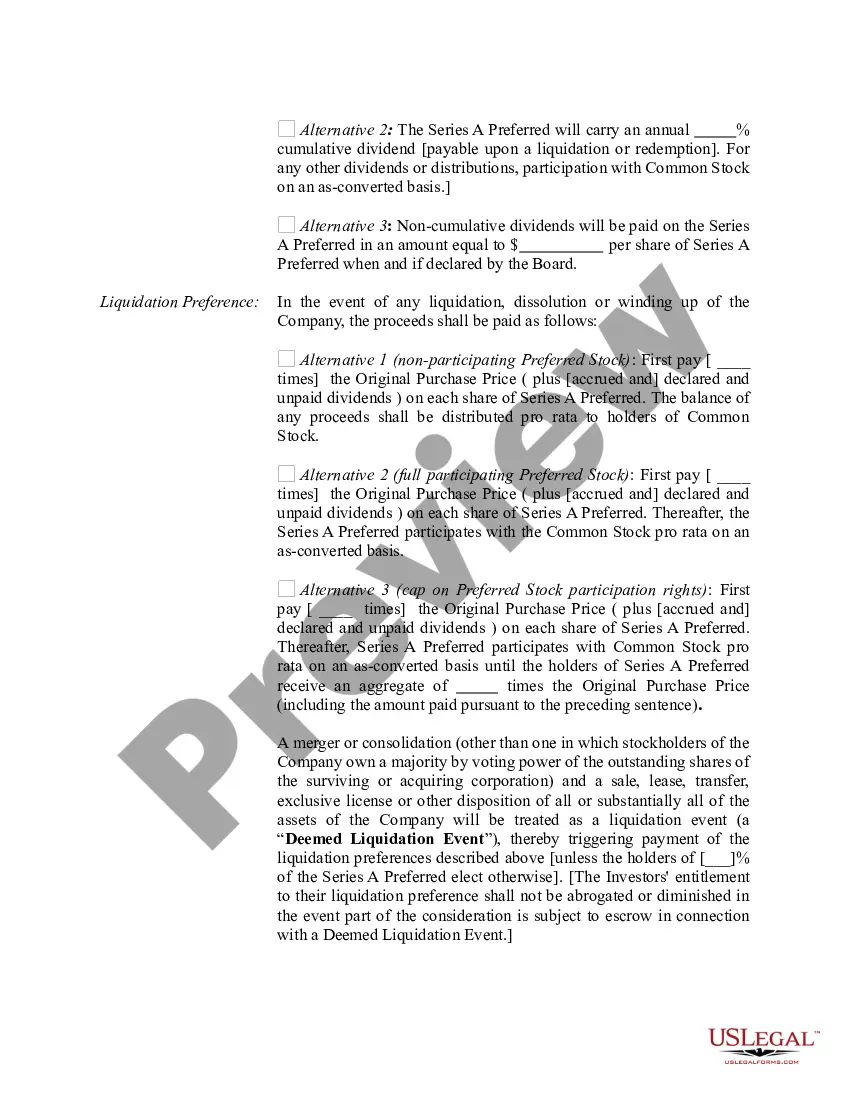

Series 1 Preferred Stock means the 10% Senior Series 1 Cumulative Redeemable Preferred Stock, $. 01 par value per share, issued or to be issued by the Corporation.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

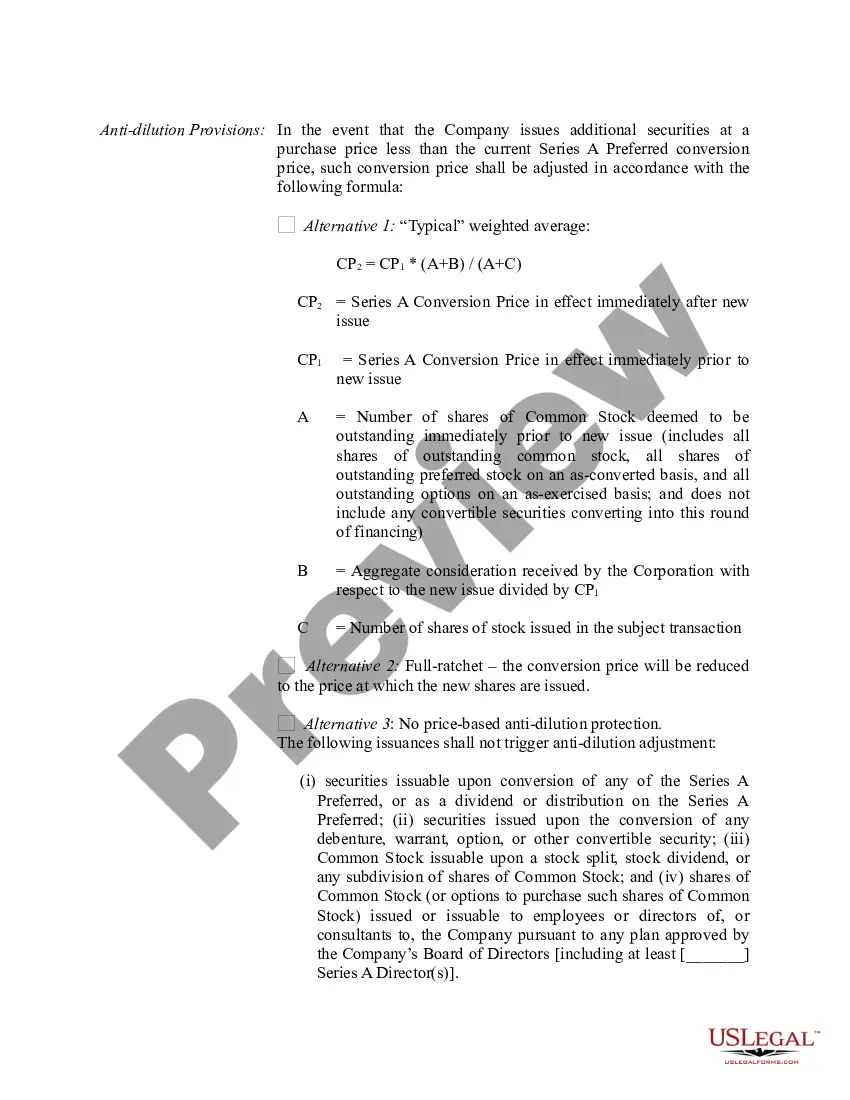

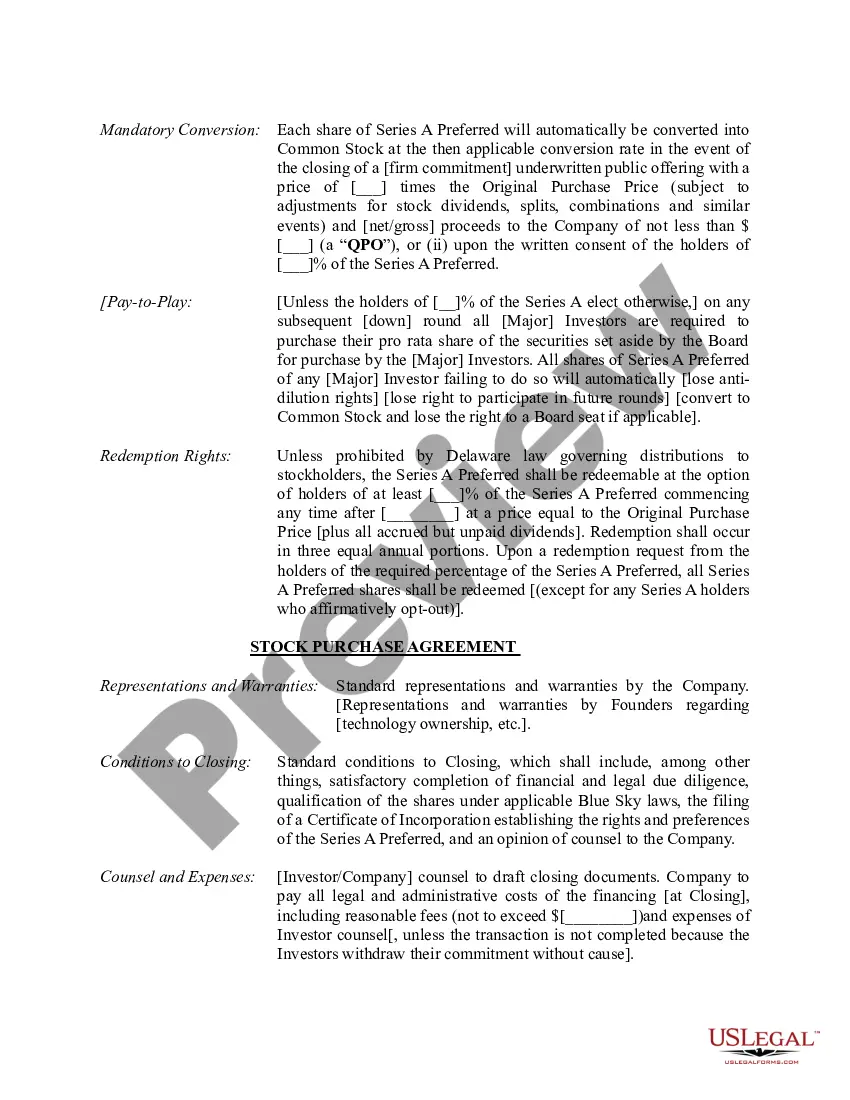

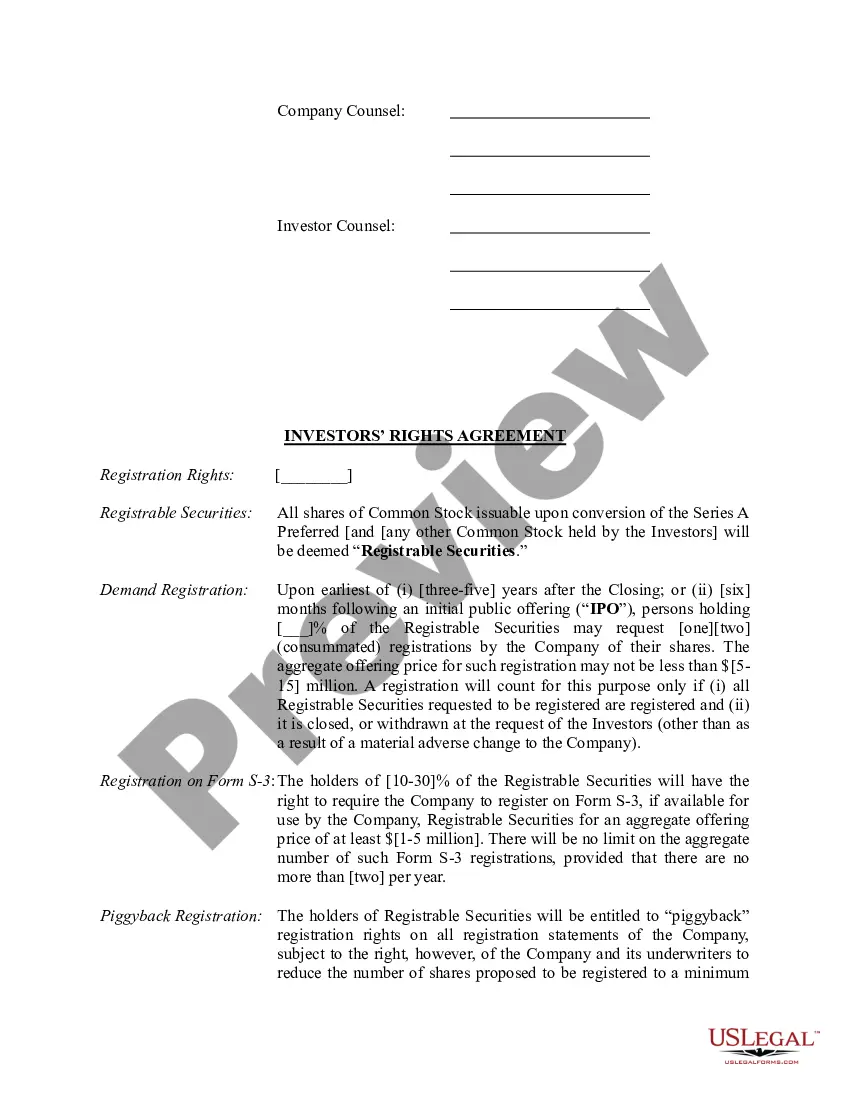

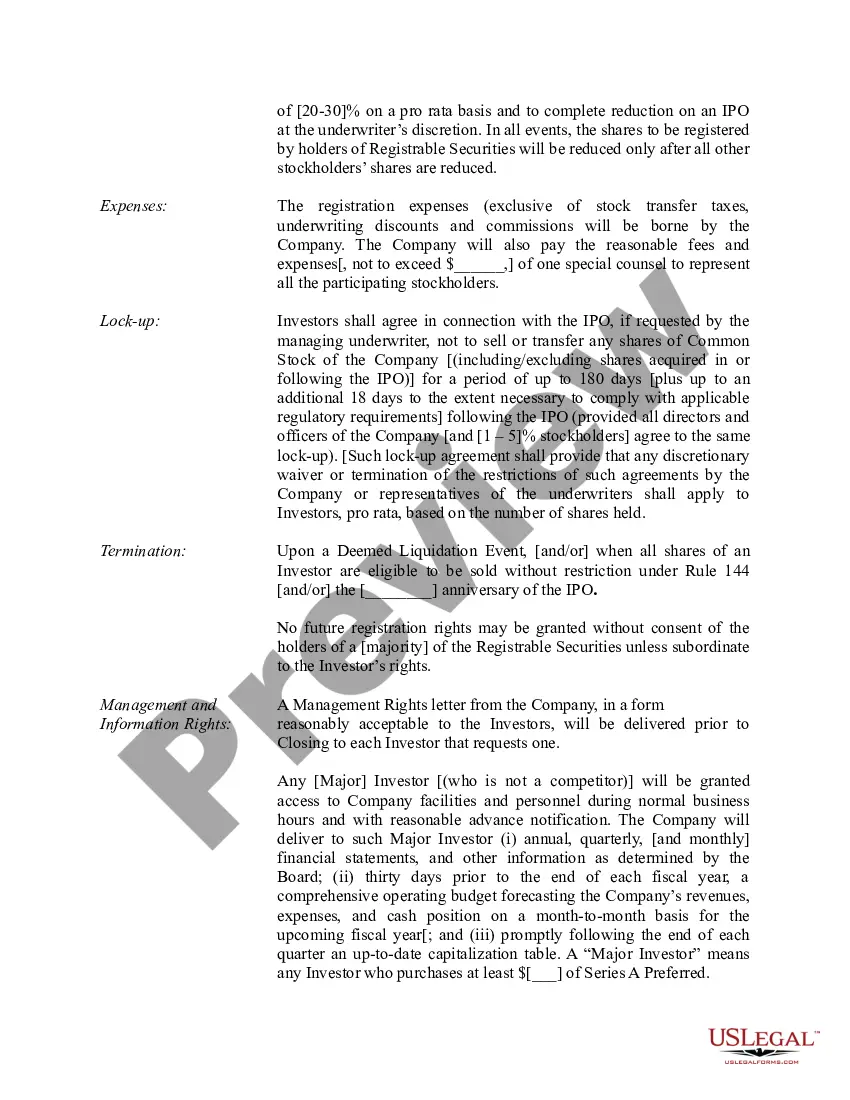

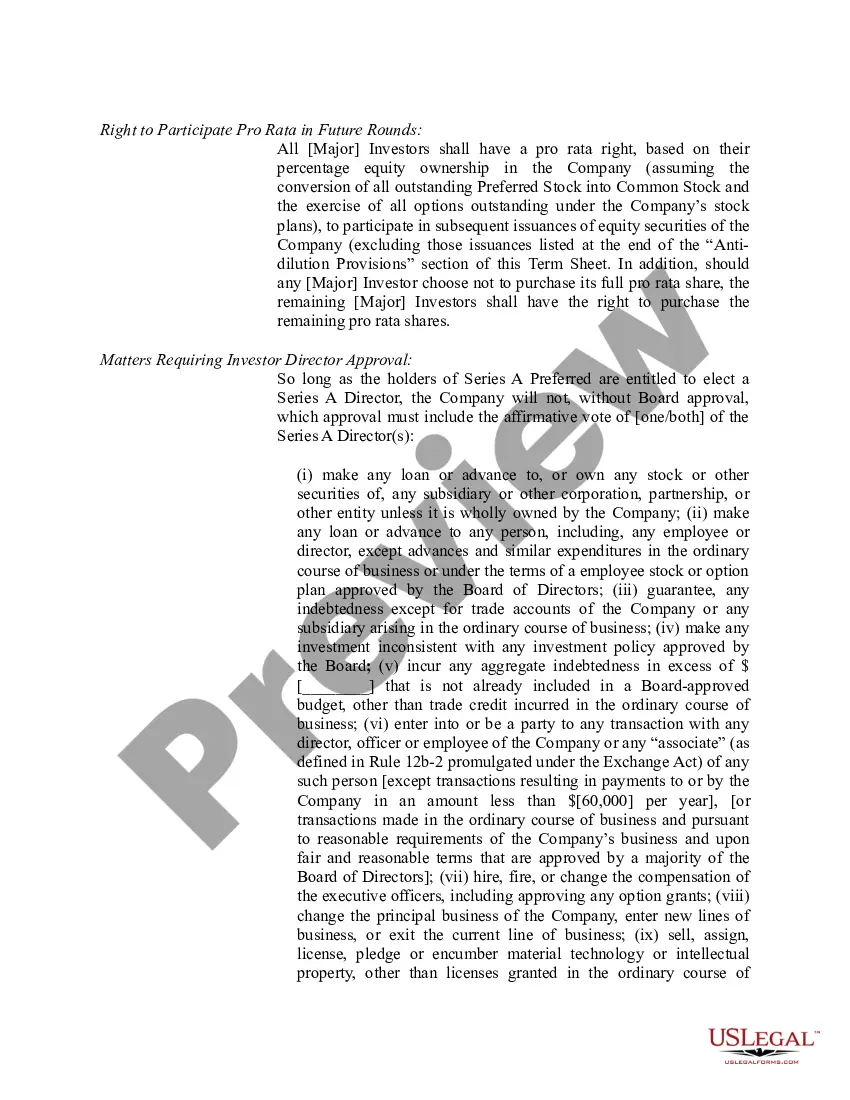

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

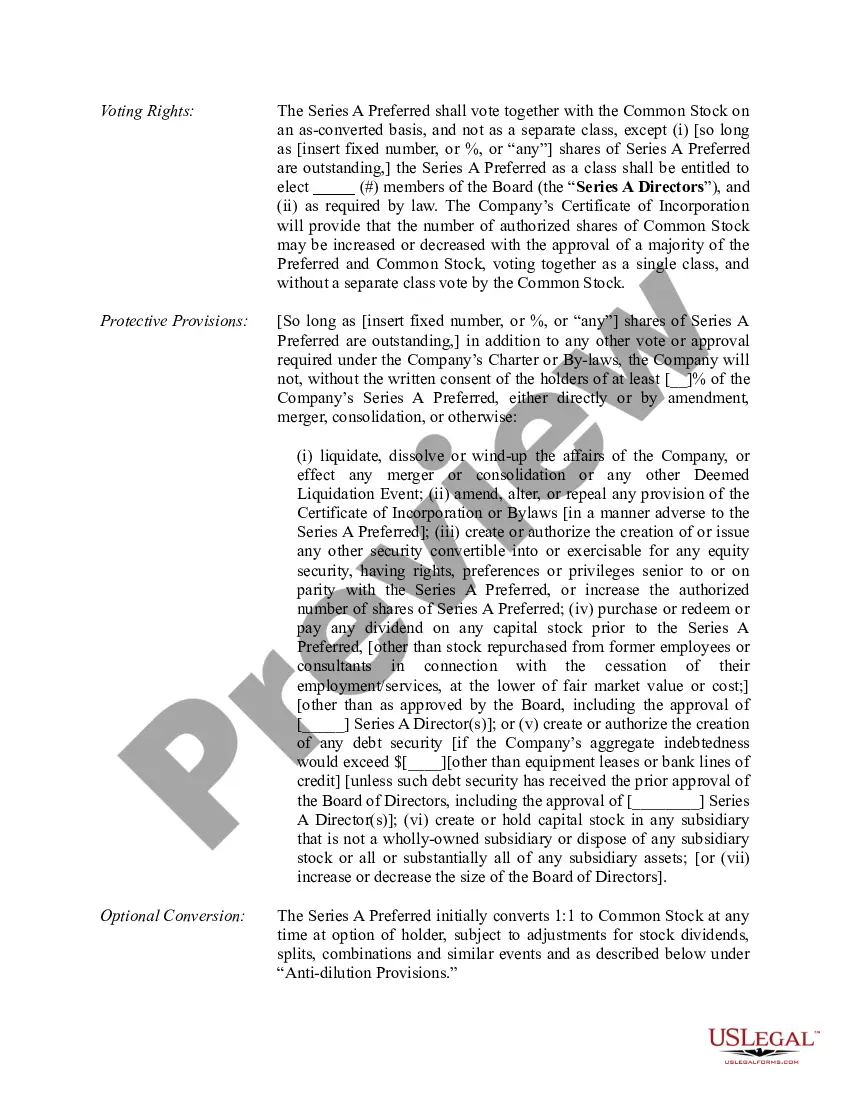

In finance, a class A share refers to a share classification of common or preferred stock that typically has enhanced benefits with respect to dividends, asset sales, or voting rights compared to Class B or Class C shares.

The Series A Preferred Stock, voting separately as a class at each annual meeting, shall be entitled to nominate and elect a number of directors equal to one-third of the total number of directorships (each director entitled to be elected by the Series A Preferred Stock, a ?Series A Director?).

The first round of stock offered during the seed or early stage round by a portfolio company to the venture investor or fund. This stock is convertible into common stock in certain cases such as an IPO or the sale of the company.

The first round of stock made available to the public by a startup is referred to as Series A preferred stock. This type of stock is generally offered for purchase during the seed stage of a new startup and can be converted into common stock in the event of an initial public offering or sale of the company.

Key Takeaways. The main difference between preferred and common stock is that preferred stock gives no voting rights to shareholders while common stock does. Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders.