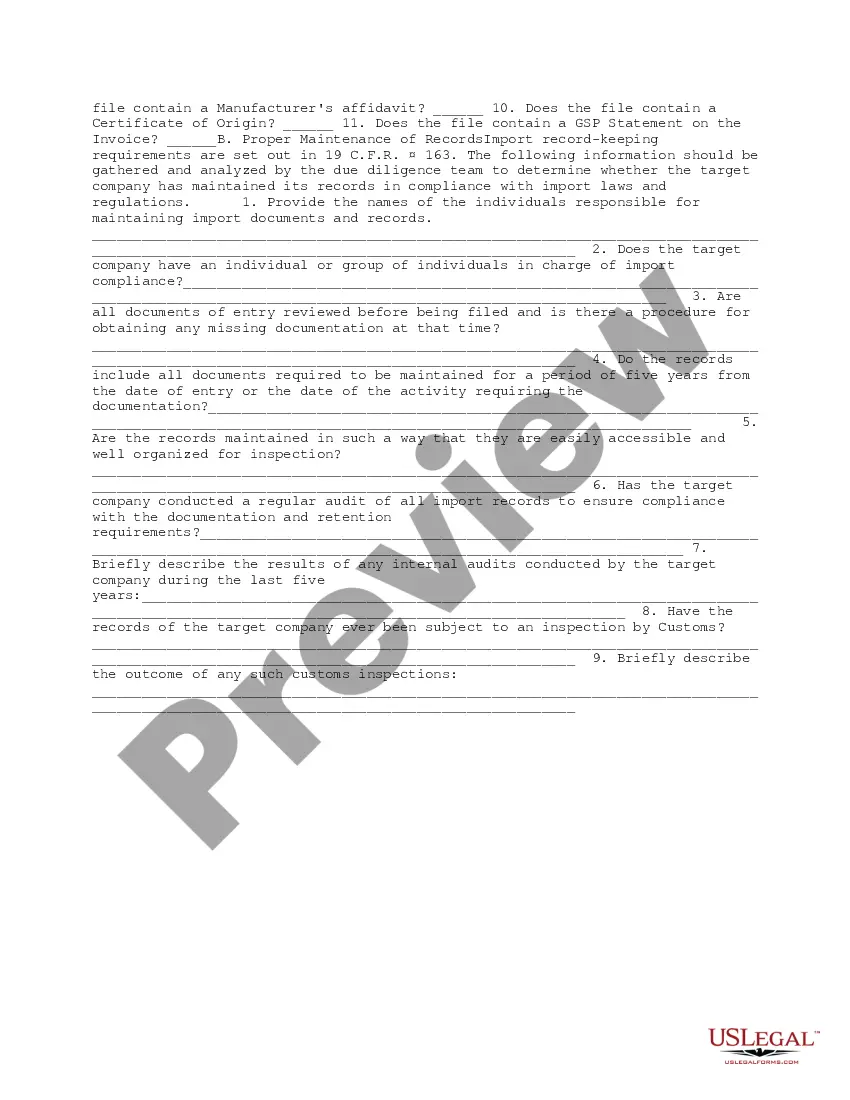

This form provides possible inquiries to be utilized by the due diligence team in determining the risk of exposure to liability for import violations committed by a company.

New Mexico Import Compliance and Records Review Due Diligence

Description

How to fill out Import Compliance And Records Review Due Diligence?

US Legal Forms - one of the largest libraries of legal documents in the United States - provides an extensive selection of legal form templates that you can obtain or print.

By utilizing the website, you can access numerous forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest editions of forms such as the New Mexico Import Compliance and Records Review Due Diligence within minutes.

If the form doesn't suit your needs, use the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you prefer and provide your credentials to sign up for an account.

- If you already have a subscription, Log In to download the New Mexico Import Compliance and Records Review Due Diligence from the US Legal Forms collection.

- The Download button will appear on every document you view.

- You can access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are some basic instructions to help you get started.

- Ensure you have selected the correct form for your city/county.

- Click the Review button to check the form's details.

Form popularity

FAQ

Rule 8 in Mexico refers to specific regulations governing the customs process, particularly related to importations. This rule emphasizes the importance of having complete and accurate documentation when bringing products into Mexico. Understanding the implications of New Mexico Import Compliance and Records Review Due Diligence is vital here, as this knowledge helps avoid potential fines or delays. Consulting with uslegalforms can provide additional insights and tools to ensure compliance with Rule 8 and all applicable regulations.

Starting an import/export businessGet your business basics in order.Pick a product to import or export.Source your suppliers.Price your product.Find your customers.Get the logistics down.

Four Documents You Need to Clear Imports into the United StatesCOMMERCIAL INVOICE. Country of Origin should be included on every commercial invoice.PACKING LIST. The packing list is provided by the freight forwarder or shipper.BILL OF LADING (BOL) The Bill of Lading is a critical piece of documentation.ARRIVAL NOTICE.

(1) To convert a file into the format required by the application being used.

What Does an Importer of Record Do? The importer of record is responsible for ensuring all the legal requirements are met before goods can be cleared through customs. During this process, the IOR must ensure that the product classification is accurate, making sure that imported goods have been appropriately valued.

List of Documents required for Imports Customs ClearanceBill of Entry.Commercial Invoice.Bill of Lading or Airway Bill.Import License.Certificate of Insurance.Letter of Credit or LC.Technical Write-up or Literature (Only required for specific goods)Industrial License (for specific goods)More items...?

Import proceduresObtain IEC.Ensure legal compliance under different trade laws.Procure import licenses.File Bill of Entry and other documents to complete customs clearing formalities.Determine import duty rate for clearance of goods.

The Export.gov website is an amazing resource for finding people who can help you with import country requirements.

There are four basic import documents you need in order to clear customs quickly and easily.Commercial Invoice. This document is used for foreign trade.Packing List. Provided by the shipper or freight forwarder, the packing list may be used by customs to check the cargo.Bill of Lading (BOL)Arrival Notice.

The Canadian Food Inspection Agency (CFIA) is responsible for verifying that imported food, plants and animals meet Canadian requirements.