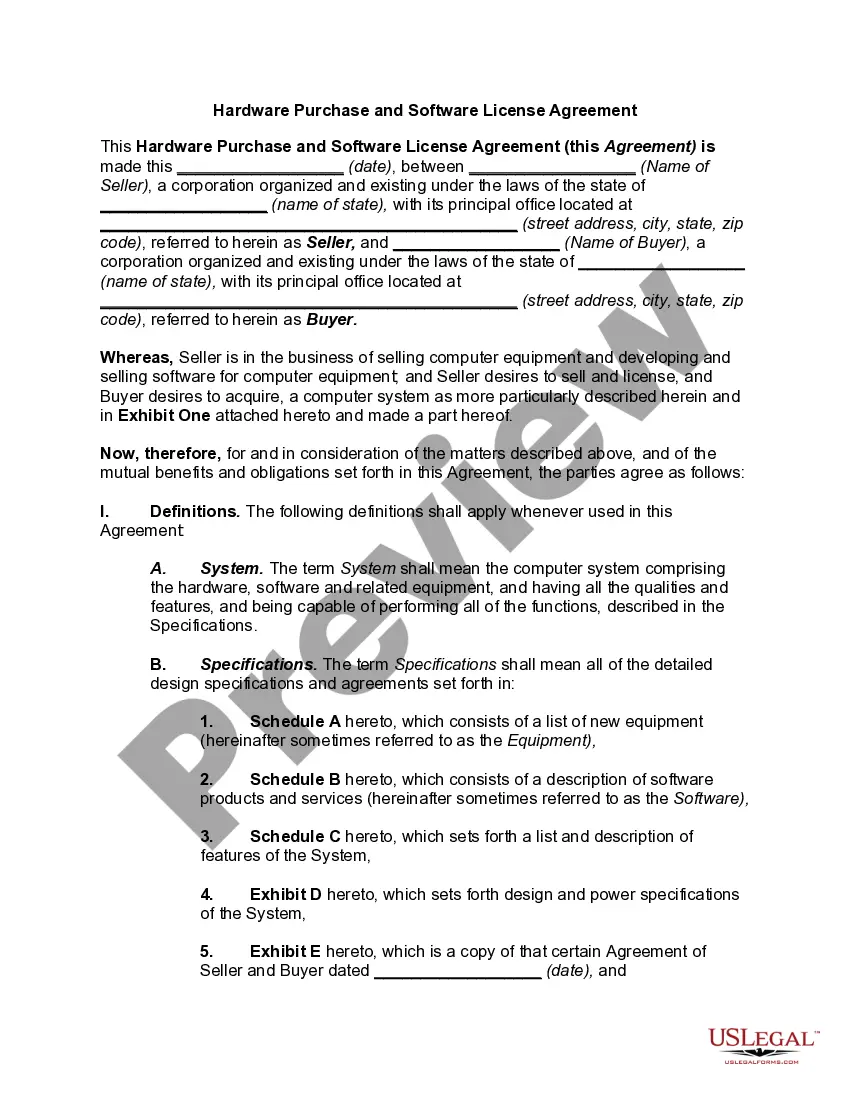

New Mexico Software Sales Agreement

Description

How to fill out Software Sales Agreement?

US Legal Forms - one of several largest libraries of legitimate types in America - provides a variety of legitimate document templates you are able to obtain or produce. Utilizing the internet site, you can find a huge number of types for business and personal purposes, categorized by classes, says, or keywords and phrases.You will find the most up-to-date models of types much like the New Mexico Software Sales Agreement within minutes.

If you already possess a membership, log in and obtain New Mexico Software Sales Agreement through the US Legal Forms local library. The Obtain option will appear on every type you look at. You have accessibility to all earlier acquired types inside the My Forms tab of your own profile.

If you wish to use US Legal Forms the first time, listed here are basic recommendations to get you started:

- Make sure you have picked out the right type for the town/county. Go through the Preview option to analyze the form`s information. Read the type description to actually have chosen the proper type.

- If the type doesn`t fit your demands, make use of the Lookup area near the top of the display screen to find the one that does.

- In case you are pleased with the form, affirm your decision by visiting the Get now option. Then, select the rates program you like and give your qualifications to register for the profile.

- Approach the transaction. Use your credit card or PayPal profile to complete the transaction.

- Choose the structure and obtain the form on your own product.

- Make modifications. Complete, edit and produce and indication the acquired New Mexico Software Sales Agreement.

Each and every design you included in your money lacks an expiration day and is also your own eternally. So, if you wish to obtain or produce yet another duplicate, just check out the My Forms segment and then click on the type you will need.

Obtain access to the New Mexico Software Sales Agreement with US Legal Forms, one of the most extensive local library of legitimate document templates. Use a huge number of skilled and state-specific templates that meet your business or personal needs and demands.

Form popularity

FAQ

These tax-exempt goods include gasoline, groceries, durable medical equipment, prescription medications, and certain medical services. Additionally, there are certain customers that are exempt from the gross receipts tax, such as nonprofits, government agencies, and merchants buying goods for resale.

New Mexico does not have a statute which explicitly defines Software-as-a-Service, however both canned and custom software is considered taxable, and professional services to create software are taxable in New Mexico. Therefore, Software-as-a-Service is subject to gross receipts tax in New Mexico.

Collecting Sales Tax As of 7/1/21, New Mexico is considered a destination-based sales tax state.

File your Form(s) CRS-1 in ance with your filing status: i.e., monthly, quarterly, semi-annually. If you do not know your filing status, please contact your local district office. To e-file, visit the TRD web page at . You can register for online filing by clicking the "sign up now" link.

Examples of deductions are sales for subsequent resale, sales to customers located outside of NM, sales to manufacturers, sales of groceries, sales of construction materials and services to persons engaged in construction business, sales of tangibles to government agencies and non-profits ((501(c)(3) organizations), ...

California imposes a 7.25% state sales and use tax on all taxable SaaS and tangible software. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller. Those district tax rates range from 0.10% to 1.00%. Some areas may have more than one district tax in effect.

EFFECTIVE July 1, 2023 The state portion of the gross receipts tax rate has been lowered from 5.000% to 4.875%, due to HB-163 from the 2022 legislative session. This change impacts all location codes across the state.

The state-wide sales tax in New Mexico is 5.125%.