New Mexico Form of Note

Description

How to fill out Form Of Note?

It is possible to spend several hours online attempting to find the legal document template which fits the federal and state demands you will need. US Legal Forms supplies a huge number of legal kinds that are evaluated by experts. You can easily acquire or print the New Mexico Form of Note from my service.

If you already possess a US Legal Forms accounts, you may log in and click the Download key. Afterward, you may full, revise, print, or signal the New Mexico Form of Note. Every legal document template you purchase is your own property eternally. To get yet another version of any obtained develop, visit the My Forms tab and click the corresponding key.

If you use the US Legal Forms internet site the first time, stick to the simple directions below:

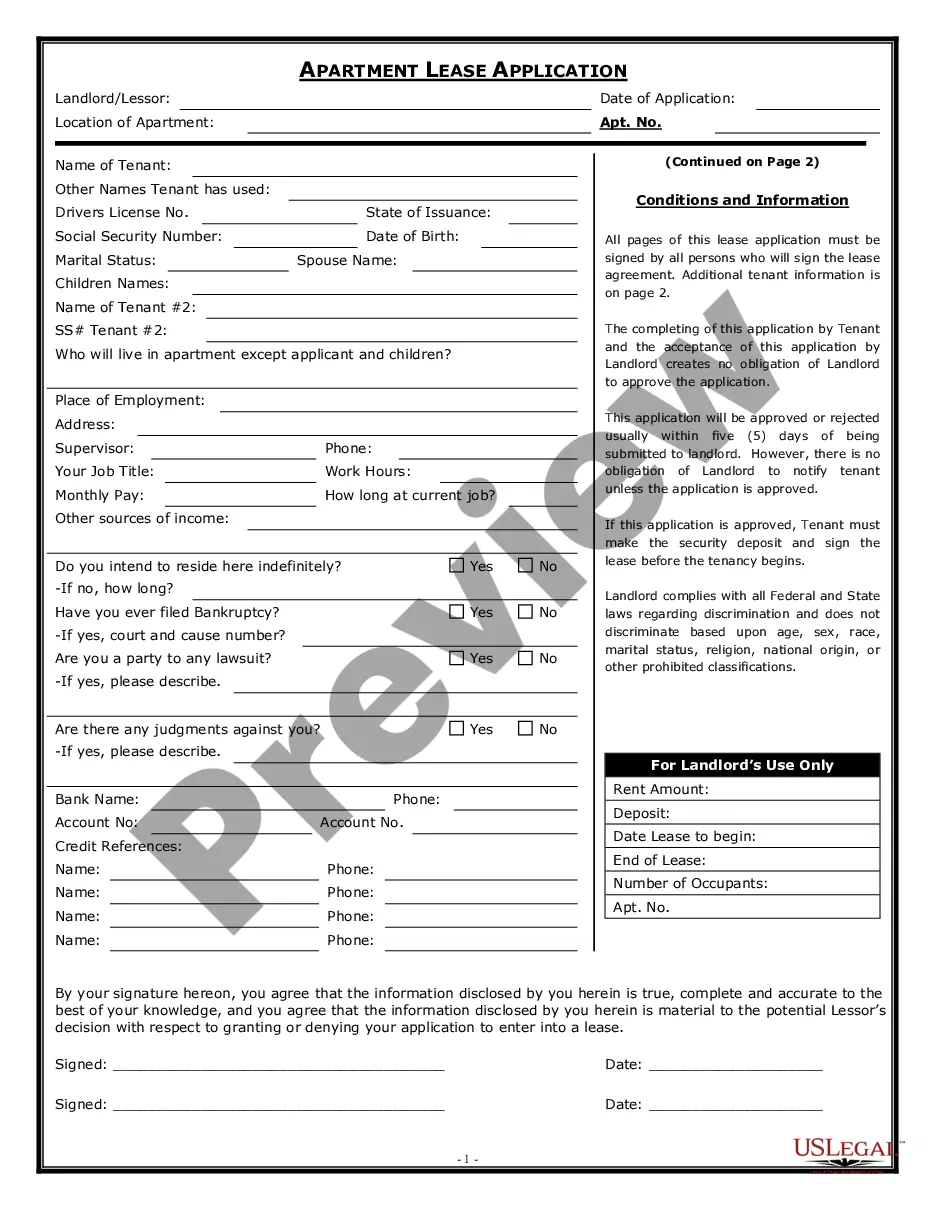

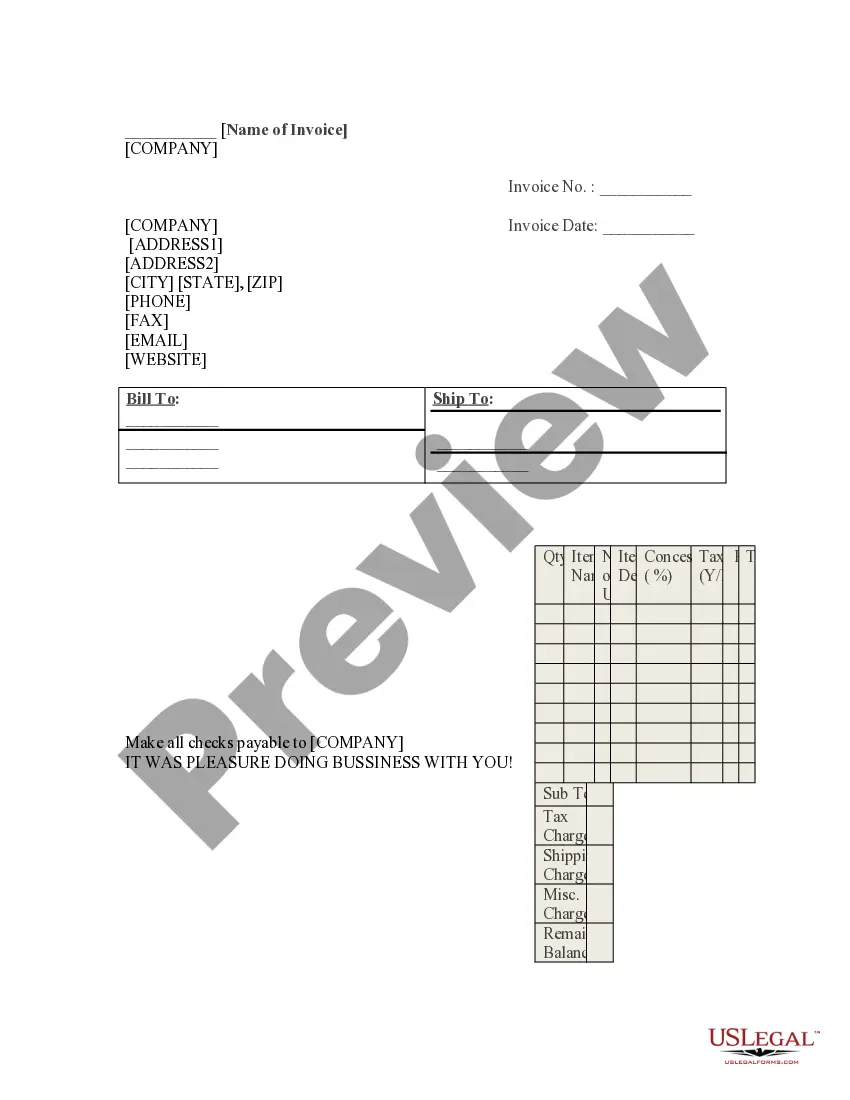

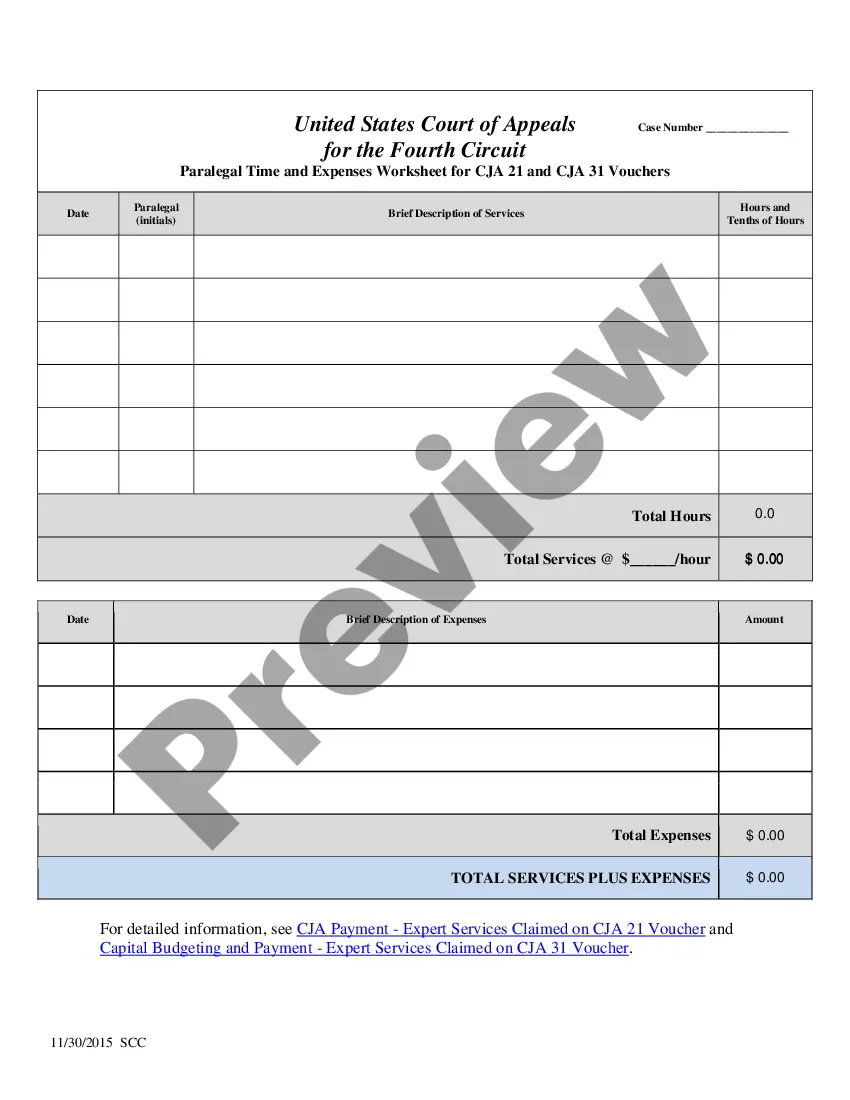

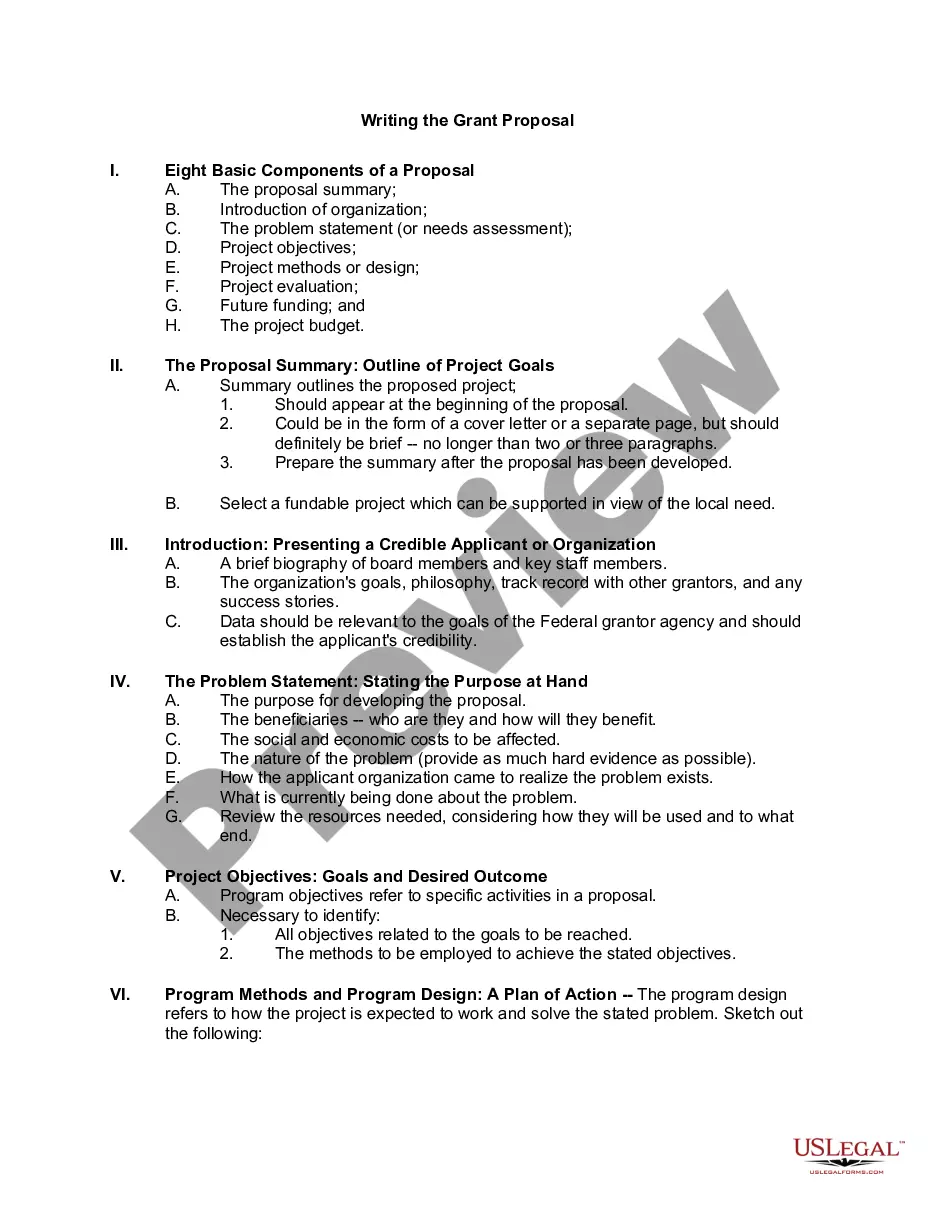

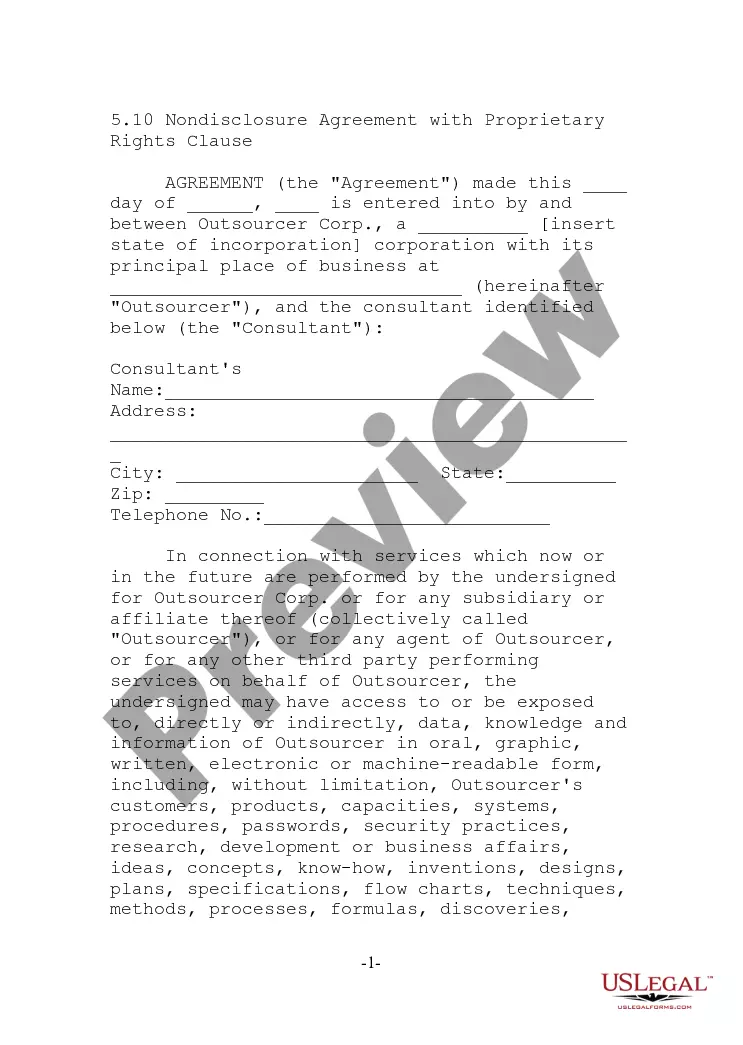

- First, ensure that you have chosen the proper document template for the region/area of your choice. Look at the develop description to ensure you have selected the proper develop. If readily available, utilize the Review key to look with the document template as well.

- In order to discover yet another version of your develop, utilize the Lookup field to find the template that suits you and demands.

- After you have located the template you would like, just click Purchase now to proceed.

- Choose the costs program you would like, enter your qualifications, and register for your account on US Legal Forms.

- Comprehensive the deal. You may use your credit card or PayPal accounts to fund the legal develop.

- Choose the format of your document and acquire it for your gadget.

- Make adjustments for your document if required. It is possible to full, revise and signal and print New Mexico Form of Note.

Download and print a huge number of document web templates while using US Legal Forms site, that offers the most important selection of legal kinds. Use expert and condition-distinct web templates to deal with your company or individual requires.

Form popularity

FAQ

Form RPD-41083 is to be used to claim a refund of New Mexico tax on behalf of a deceased taxpayer.

New Mexico has a 5.0 percent state sales tax rate, a max local sales tax rate of 3.813 percent, and an average combined state and local sales tax rate of 7.72 percent.

Complete form RPD-41071, Application for Tax Refund to request a refund. If it appears that the notice is not correct and an overpayment has not been made, or the amount of the overpayment in the notice is not correct, you should follow the instructions on the notice to make the correction.

New Mexico residents may use a form RPD-41071 to apply for a refund on overpaid taxes by filing a form RPD-41071. Note that you may also do so using a letter of your own as long as it contains all the same information on this form.

Annual statements of withholding should not be submitted to the Department, but must be submitted to the taxpayer using form RPD-41359, Annual Statement of Pass-Through Entity Withholding, or 1099-Misc.

Everyone who is required to file a New Mexico personal income tax return must complete and file a form PIT-1, New Mexico Personal Income Tax Return. Depending upon your residency status and your own personal situation, you may need other forms and schedules.

Complete form RPD-41071, Application for Tax Refund to request a refund. If it appears that the notice is not correct and an overpayment has not been made, or the amount of the overpayment in the notice is not correct, you should follow the instructions on the notice to make the correction.

The PTE passes the tax withheld by issuing an annual withholding statement, Form RPD-41359, Annual Statement of Pass-Through Entity Withholding to its owners, members, partners, or beneficiaries. The recipients may then claim the withholding on their income tax returns.