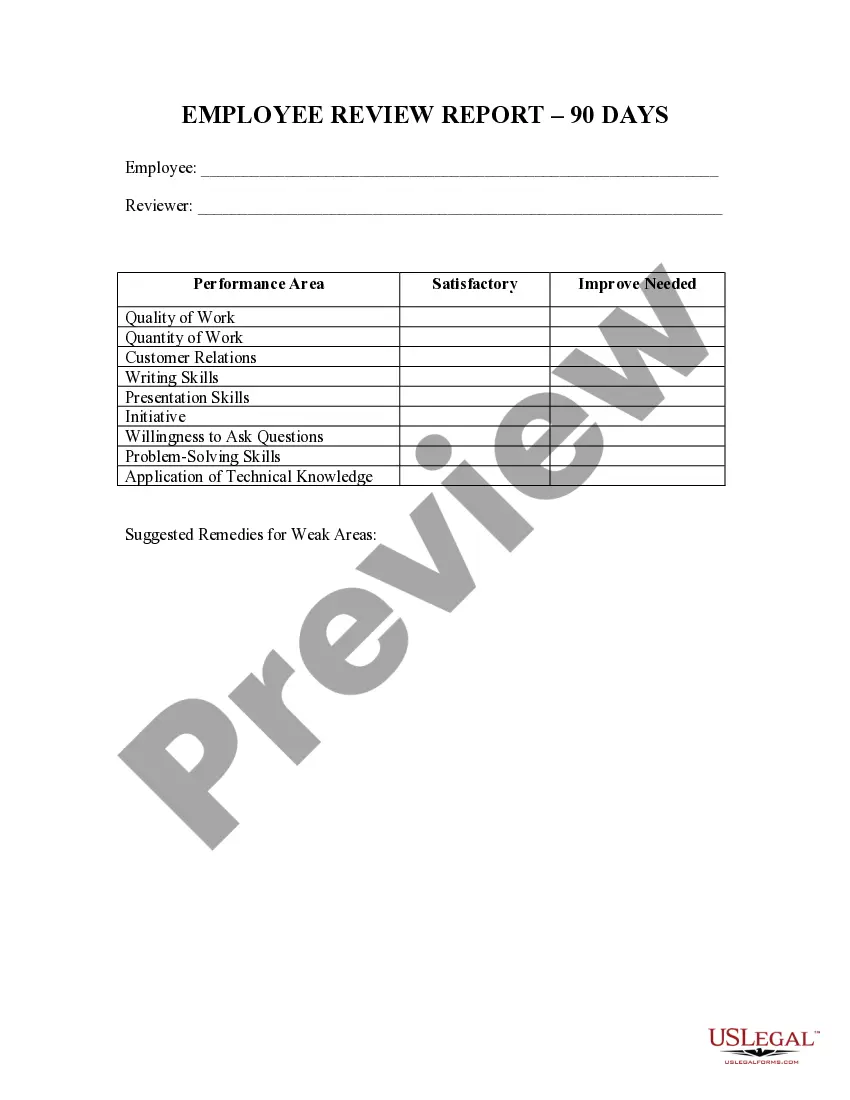

New Mexico Employee 90 day Review Report

Description

How to fill out Employee 90 Day Review Report?

You can dedicate numerous hours on the internet searching for the authorized document template that meets the federal and state requirements you need.

US Legal Forms offers an extensive range of legal forms that can be reviewed by professionals.

You can actually download or print the New Mexico Employee 90-day Review Report from the services.

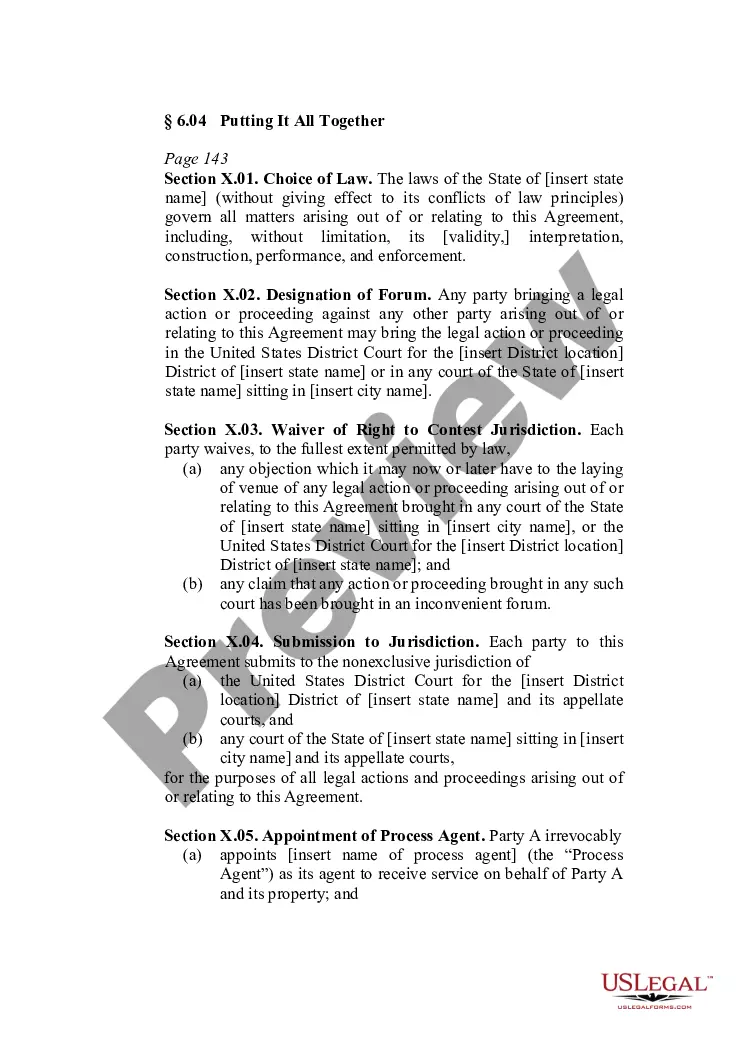

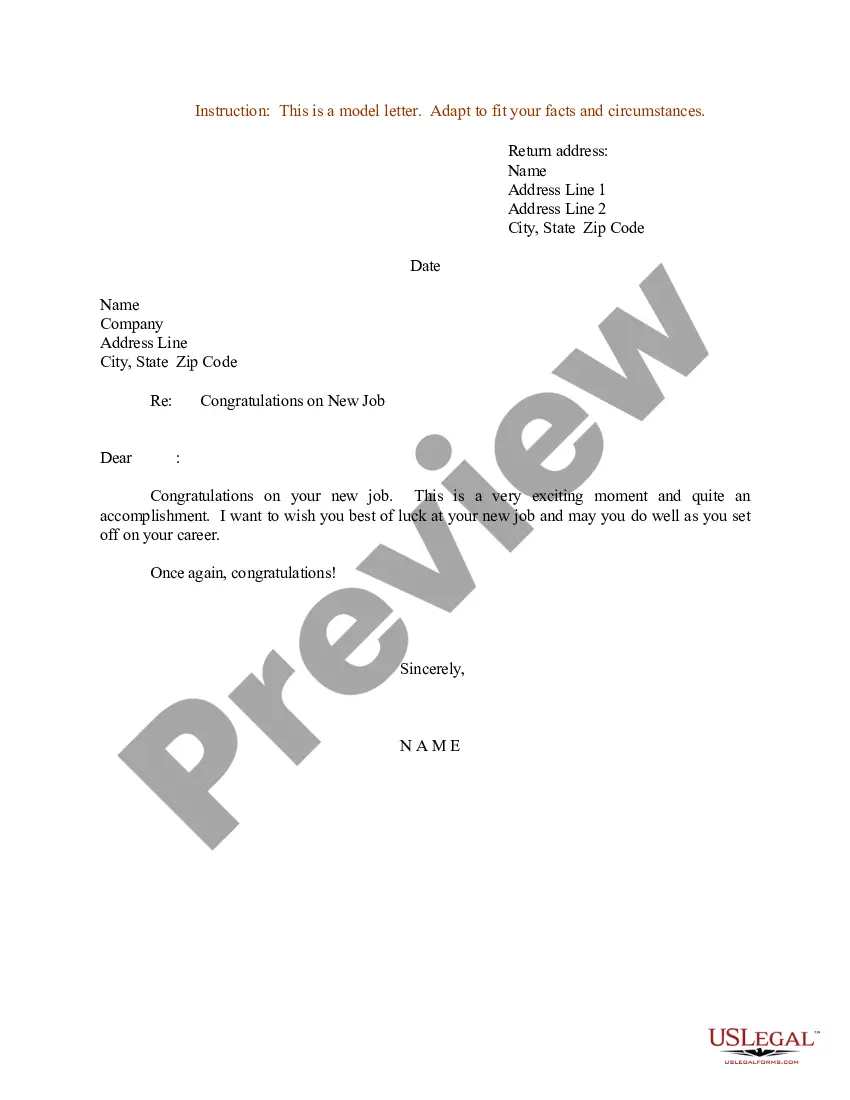

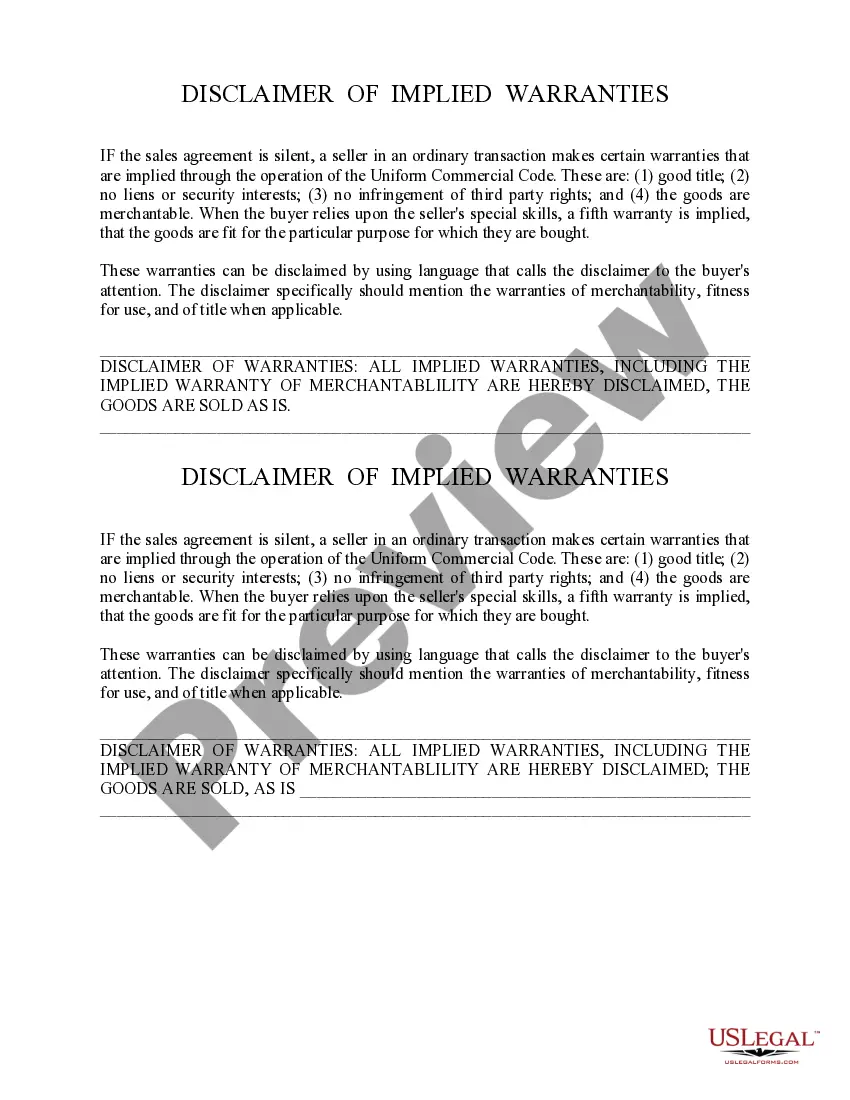

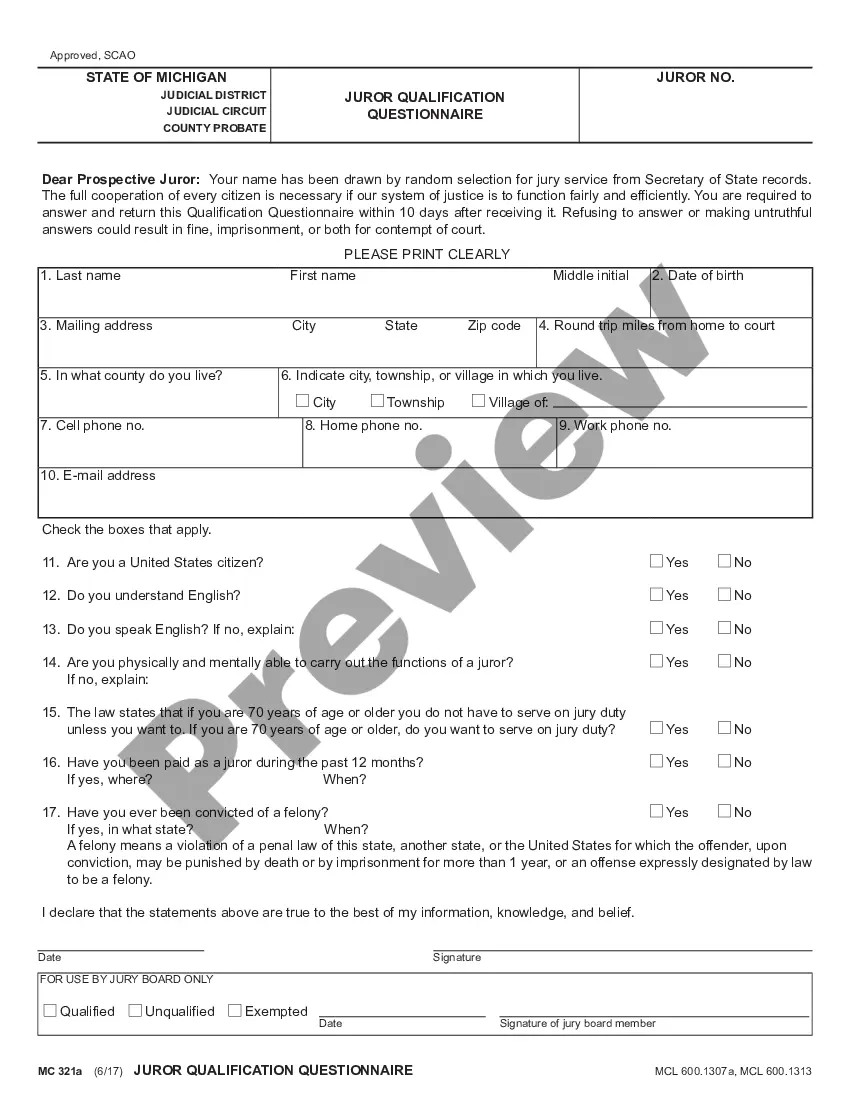

If available, use the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you may Log In and press the Download button.

- Subsequently, you can complete, modify, print, or sign the New Mexico Employee 90-day Review Report.

- Each legal document template you obtain belongs to you permanently.

- To acquire an additional copy of a purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/town of your preference.

- Review the form outline to confirm you have chosen the correct one.

Form popularity

FAQ

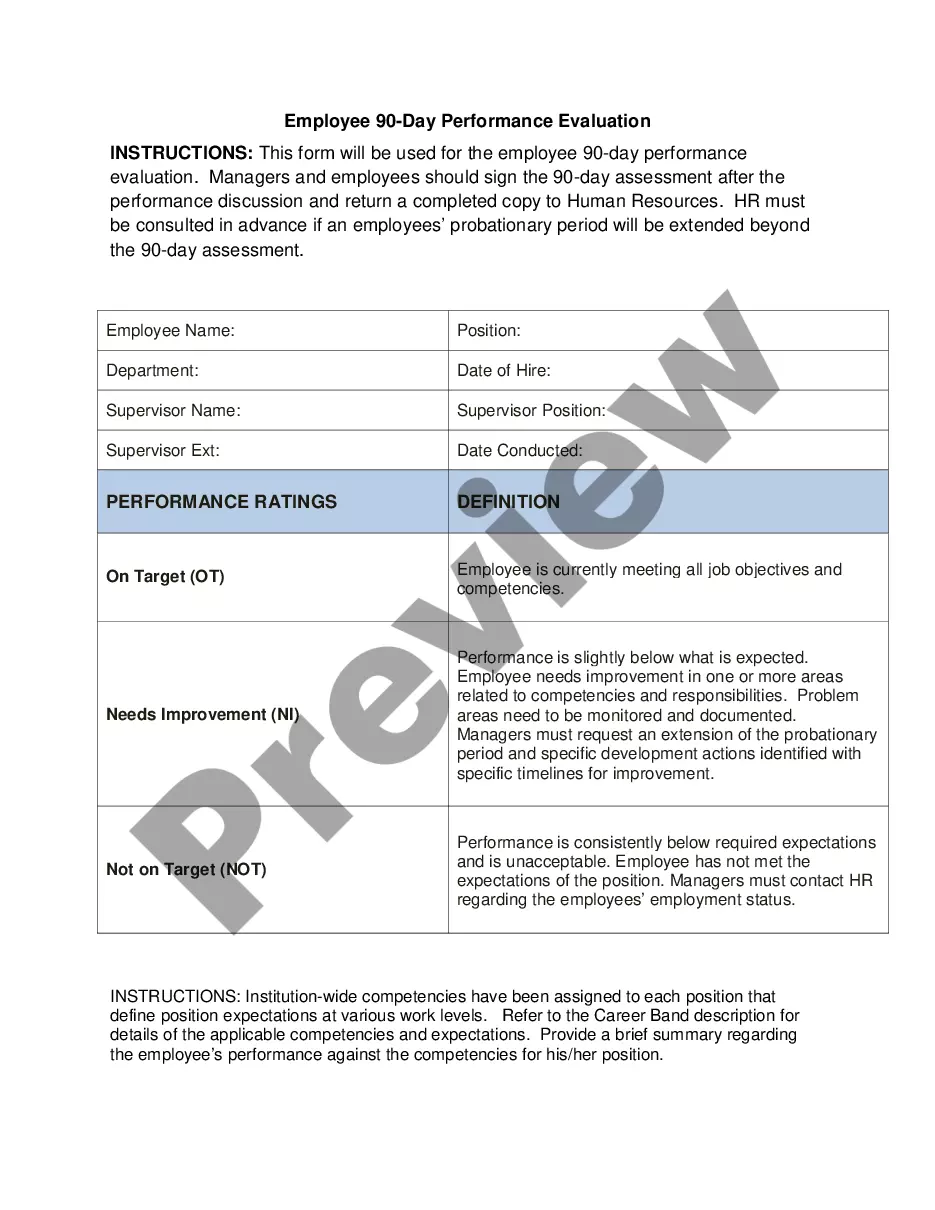

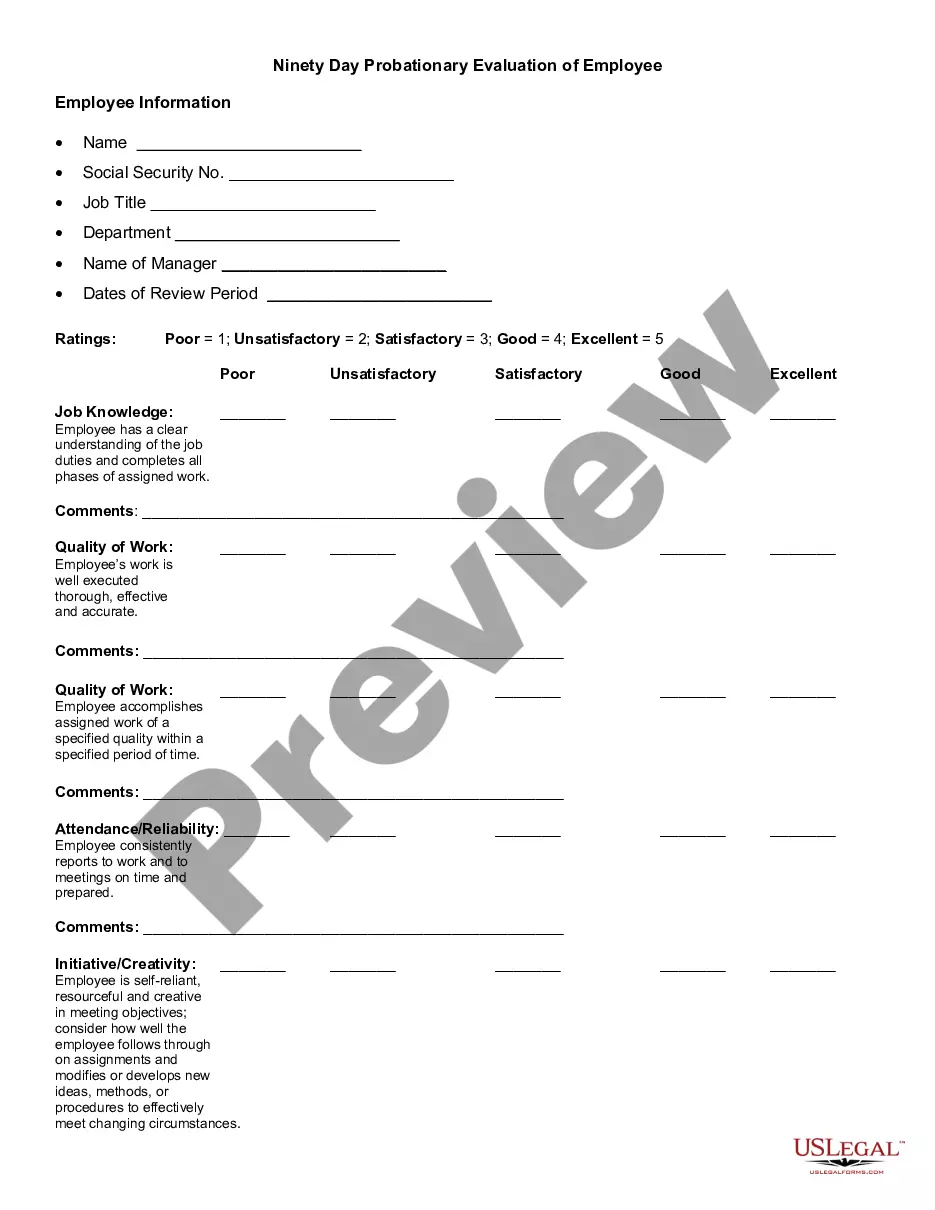

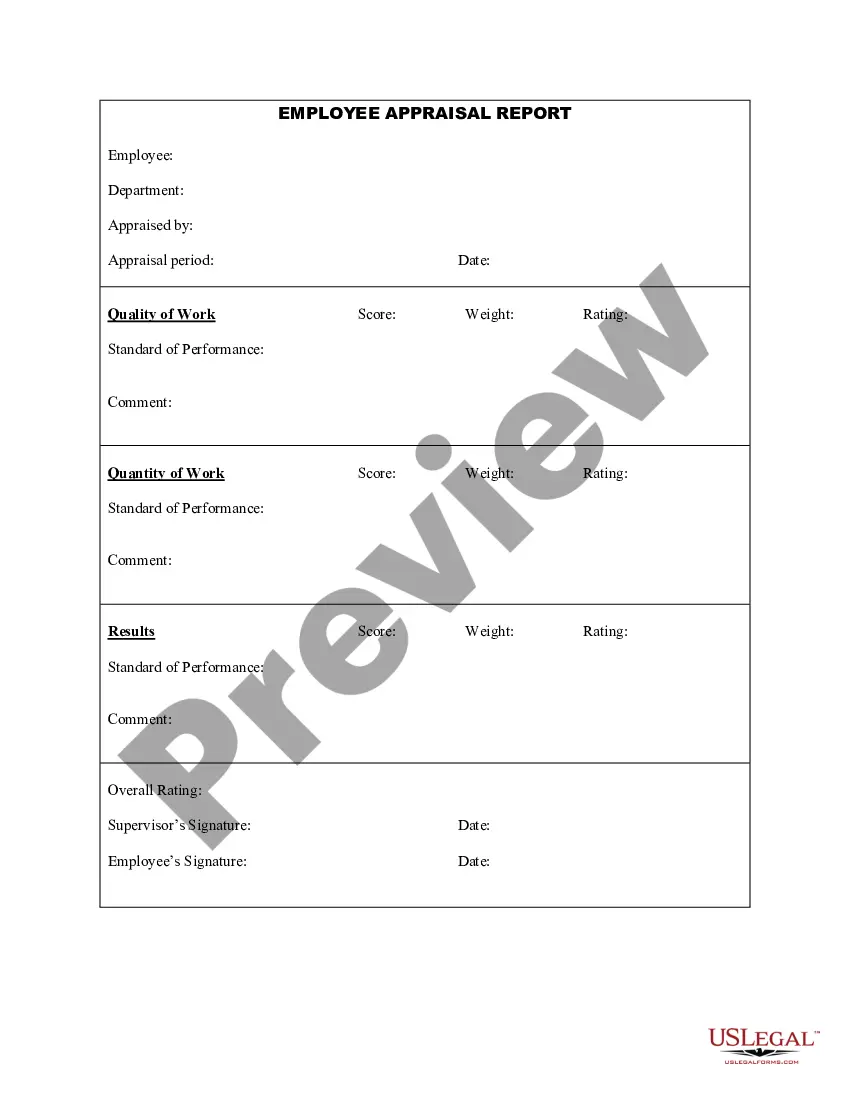

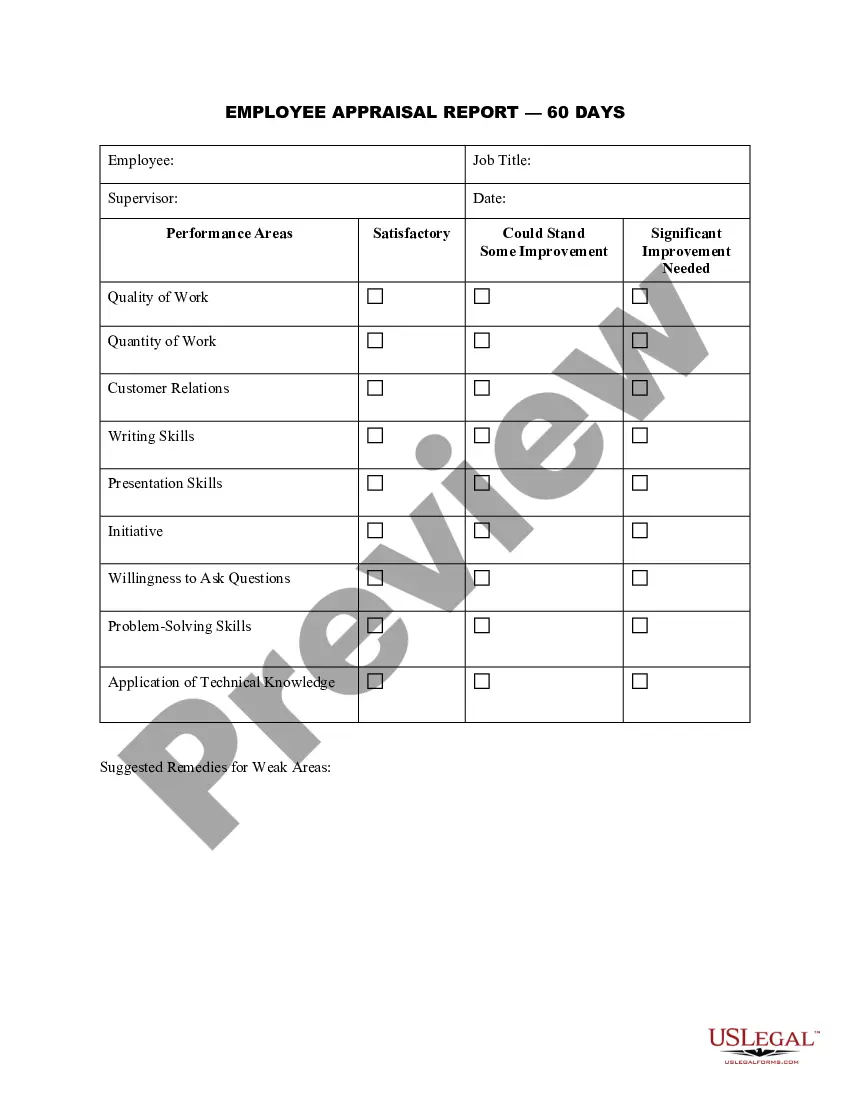

A 90-day new employee evaluation is a structured review process that assesses your performance and integration into the company during your initial three months. It typically involves feedback on your work ethics, contributions, and areas for development. This evaluation is vital for both the employee and employer to ensure alignment and growth, making the New Mexico Employee 90 day Review Report an essential tool for professional advancement.

To request your 90-day review, schedule a meeting with your supervisor or HR representative. Prepare specific questions to discuss your performance and any areas where you seek improvement. Articulating your desire for feedback not only prepares you for the review but also enhances the content of your New Mexico Employee 90 day Review Report. This approach can also lead to a constructive conversation about your career path.

How to Conduct a 90-Day ReviewKnow What You Want to Accomplish.Schedule a Specific Time to Conduct the Review.Write a One-Page Performance Review.Go Over the Performance Review and Ask Questions.Follow Up.

How should I prepare for my end of probation review?Read the job description.Discuss what you've learned.State whether the job has met your expectations.Ensure you receive appropriate feedback.Inform your manager of any areas you're struggling with.Clarify how you see yourself progressing within the company.

How to process payroll yourselfStep 1: Have all employees complete a W-4 form.Step 2: Find or sign up for Employer Identification Numbers.Step 3: Choose your payroll schedule.Step 4: Calculate and withhold income taxes.Step 5: Pay payroll taxes.Step 6: File tax forms & employee W-2s.12-Jan-2021

Running Payroll in New Mexico: Step-by-Step InstructionsStep 1: Set up your business as an employer.Step 2: Register with New Mexico state.Step 3: Set up your payroll.Step 4: Collect employee payroll forms.Step 5: Collect, review, and approve time sheets.Step 6: Calculate payroll and pay employees.More items...?

If you don't have extra funds to spend on a payroll service, the DIY approach can save you some cash. Doing manual payroll isn't the most straightforward task, but armed with the right knowledge, time, and a sturdy calculator, you can do payroll for your small business yourself.

Current FICA tax rates The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Combined, the FICA tax rate is 15.3% of the employee's wages.

How to manually calculate payroll for your small businessStep 1: Prepare your business to process payroll.Step 2: Calculate gross wages.Step 3: Subtract pre-tax deductions.Step 4: Calculate employee payroll taxes.Step 5: Subtract post-tax deductions and calculate net pay.Step 6: Calculate employer payroll taxes.More items...?07-Feb-2021

New New Mexico Employer: Register with the New Mexico Department of Workforce Solutions - (877)-664-6984Register your business with the New Mexico Department of Workforce Solutions.You should receive your Employer Account Number and tax rate instantly after registering.More items...