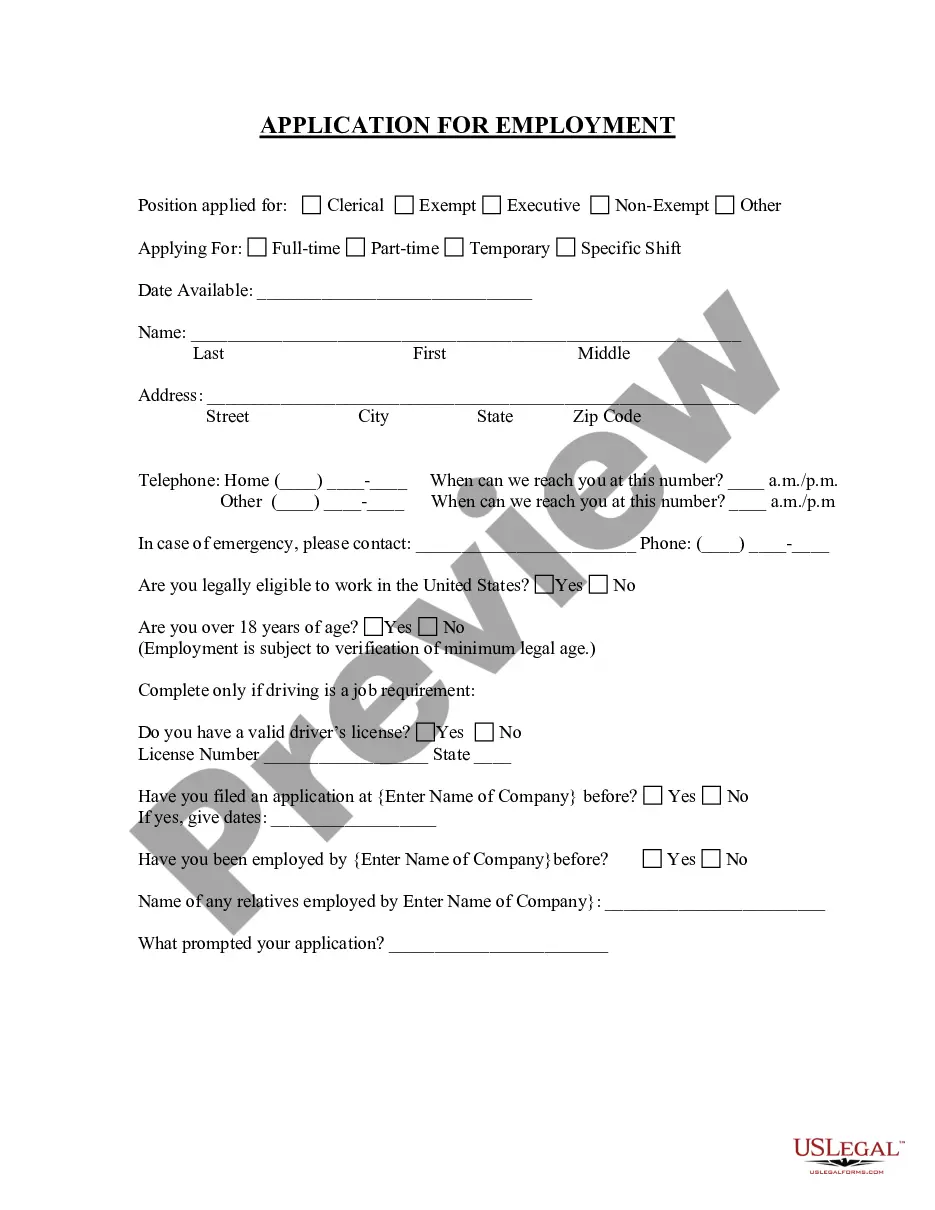

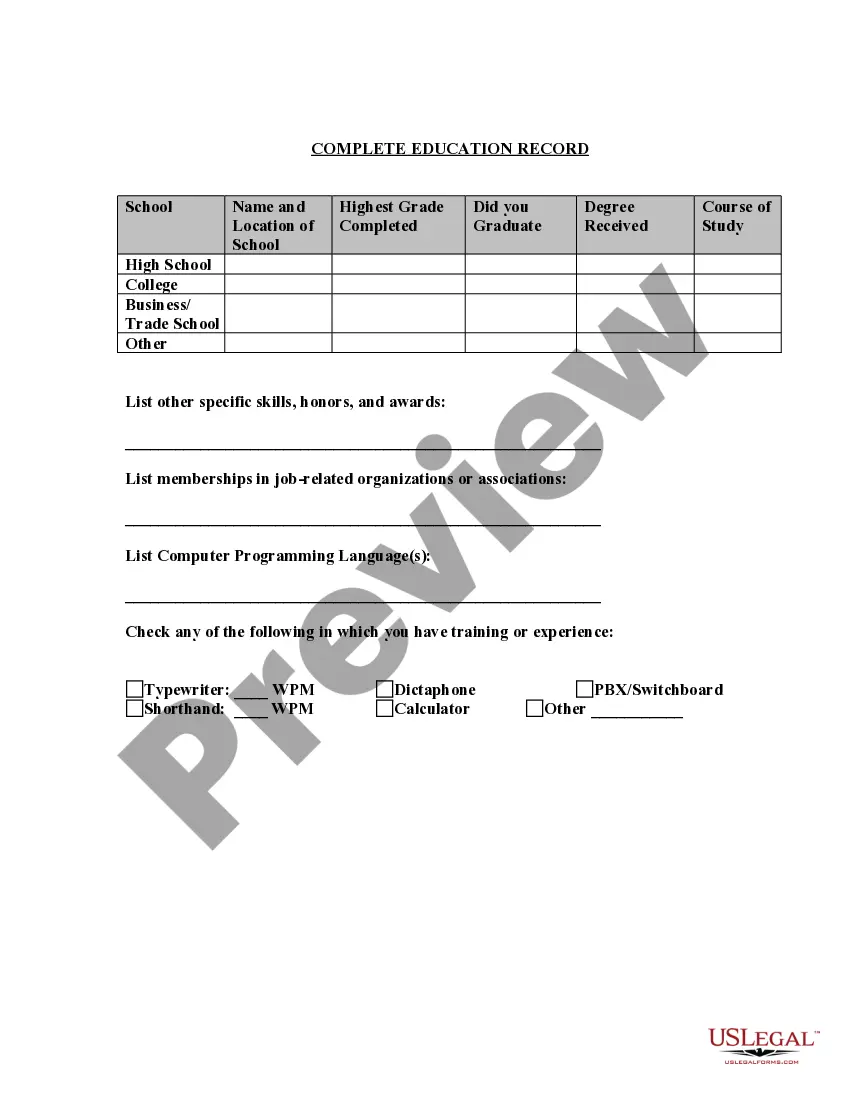

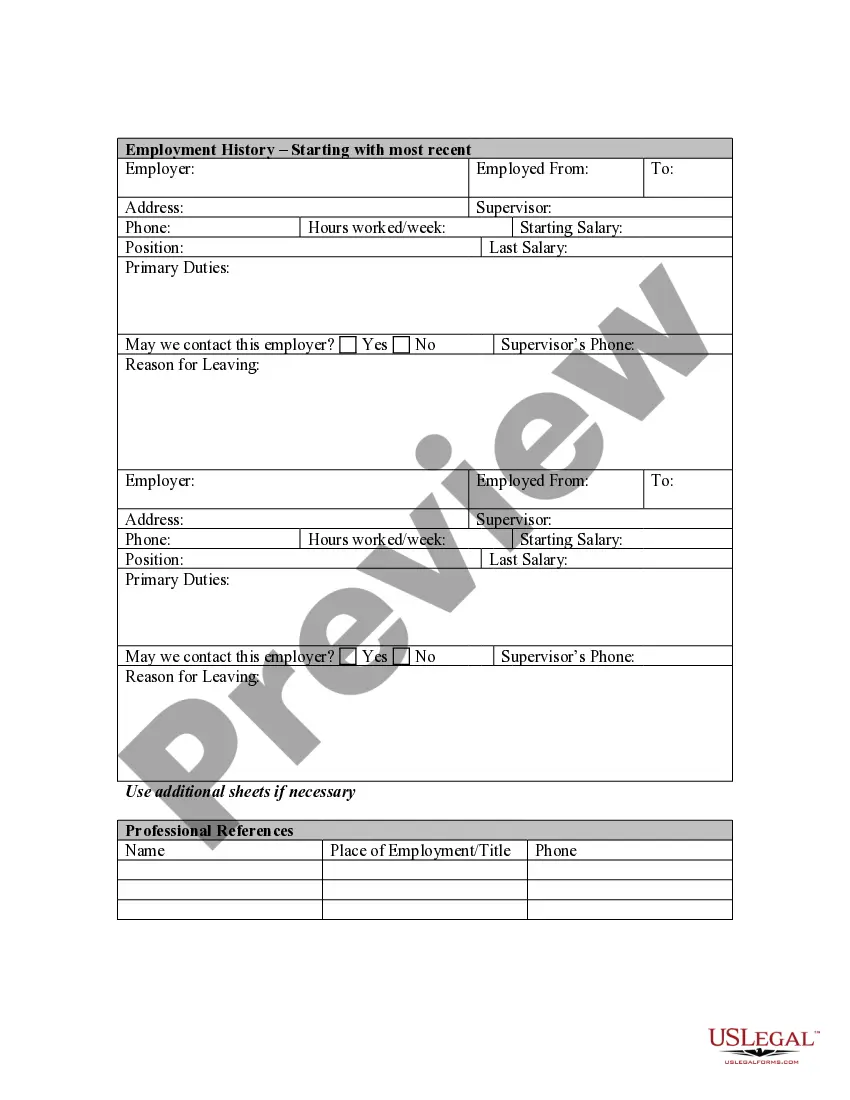

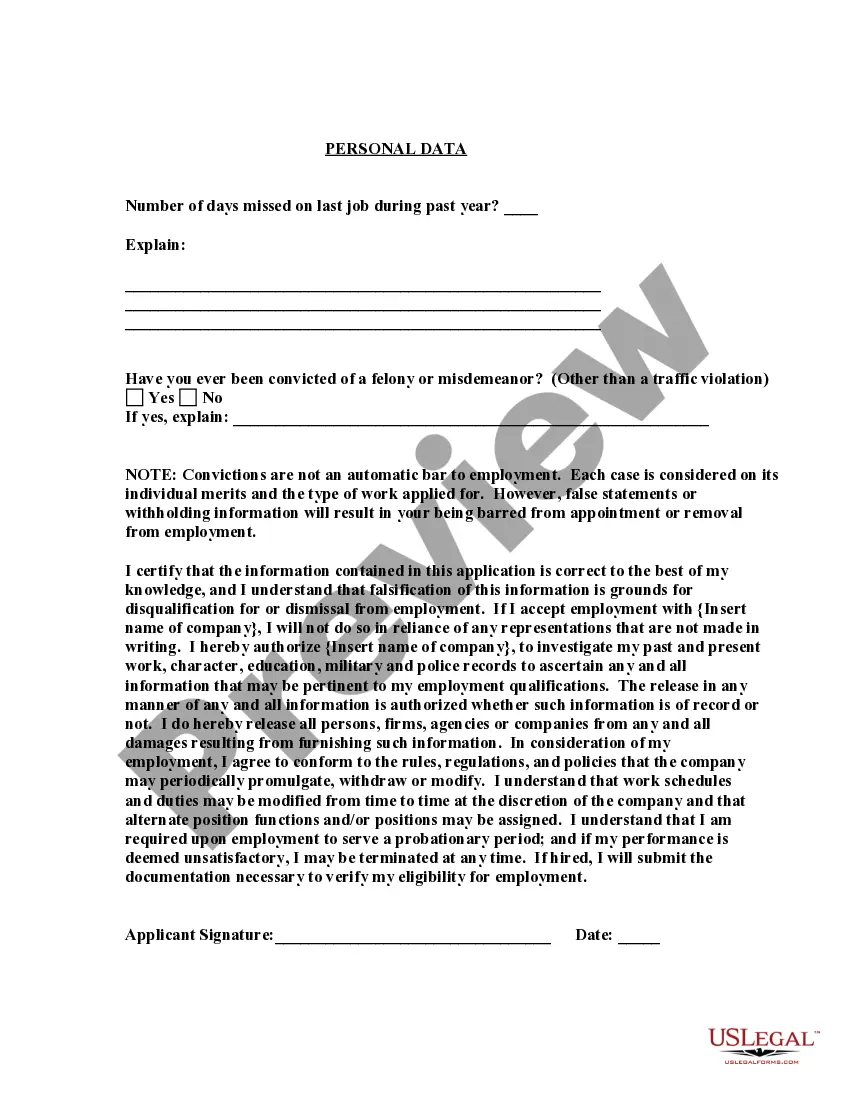

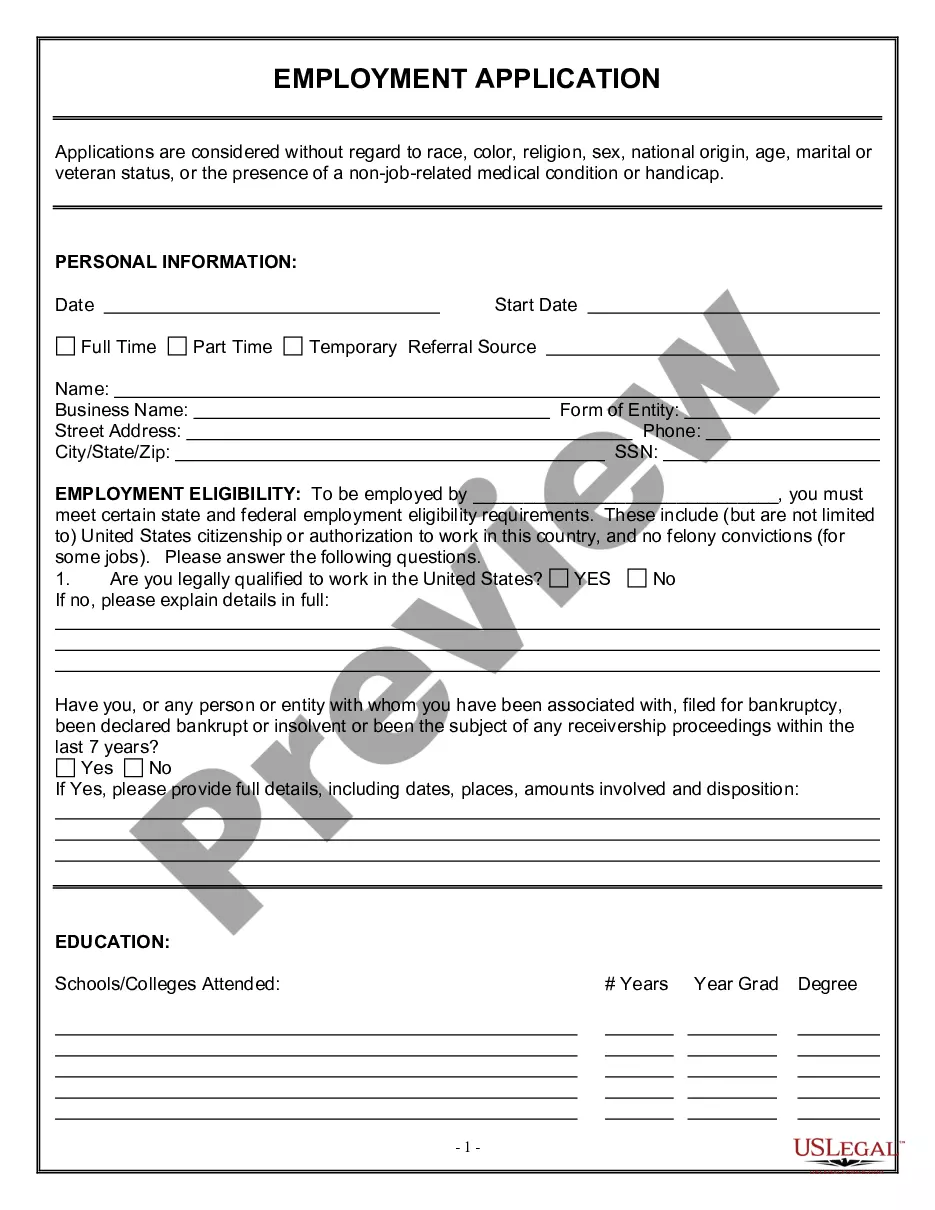

New Mexico Application for Work or Employment - Clerical, Exempt, Executive, or Nonexempt Position

Description

How to fill out Application For Work Or Employment - Clerical, Exempt, Executive, Or Nonexempt Position?

Are you presently in a position where you require documents for potential business or specific applications almost every day.

There is a plethora of legal document templates accessible online, yet finding those you can rely on is not straightforward.

US Legal Forms provides thousands of template forms, such as the New Mexico Application for Work or Employment - Clerical, Exempt, Executive, or Nonexempt Position, which are designed to meet state and federal standards.

Upon locating the correct form, click Get now.

Choose the subscription plan you desire, complete the required information to create your account, and pay for your order using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the New Mexico Application for Work or Employment - Clerical, Exempt, Executive, or Nonexempt Position template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Use the Review button to inspect the document.

- Examine the details to confirm you have selected the appropriate form.

- If the form does not meet your needs, utilize the Lookup field to locate the form that fits your criteria.

Form popularity

FAQ

Who is eligible for overtime pay? To qualify as an exempt employee one who does not receive overtime pay staff members must meet all the requirements under the duties and salary basis tests.

Exempt employees refer to workers in the United States who are not entitled to overtime pay. This simply implies that employers of exempt employees are not bound by law to pay them for any extra hours of work. The federal standard for work hours in the United States is 40 hours per workweek.

Key Takeaways. An exempt employee is an employee who does not receive overtime pay or qualify for minimum wage. Exempt employees are paid a salary rather than by the hour, and their work is executive or professional in nature.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

Executive exemption New Mexico law exempts bona fide executive employees from its minimum wage and overtime requirements. NM Statute 50-4-21(C)(1) However, New Mexico does not define criteria for an employee to be deemed an administrative employee.

Executives, administrators, and other professionals earning at least $455 per week do not have to be paid overtime under Section 13(a)(1) of the Fair Labor Standards Act. External salespeople (who often set their own hours) are also exempted from NM overtime requirements, as are some types of computer-related workers.

The FLSA includes these job categories as exempt: professional, administrative, executive, outside sales, and computer-related. The details vary by state, but if an employee falls in the above categories, is salaried, and earns a minimum of $684 per week or $35,568 annually, then they are considered exempt.

$11.50 per hour effective January 1, 2022 (previously $10.50 per hour effective January 1, 2021)

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.