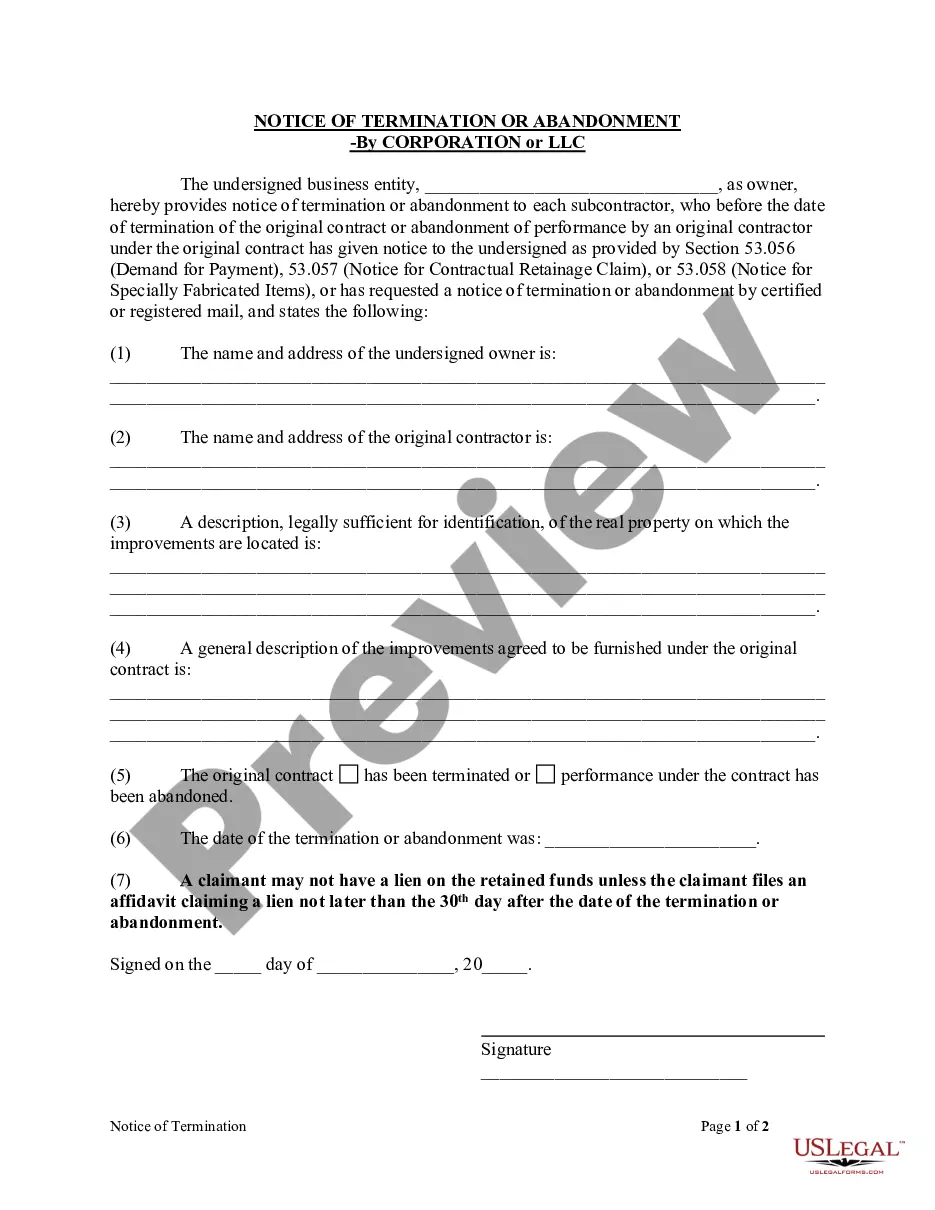

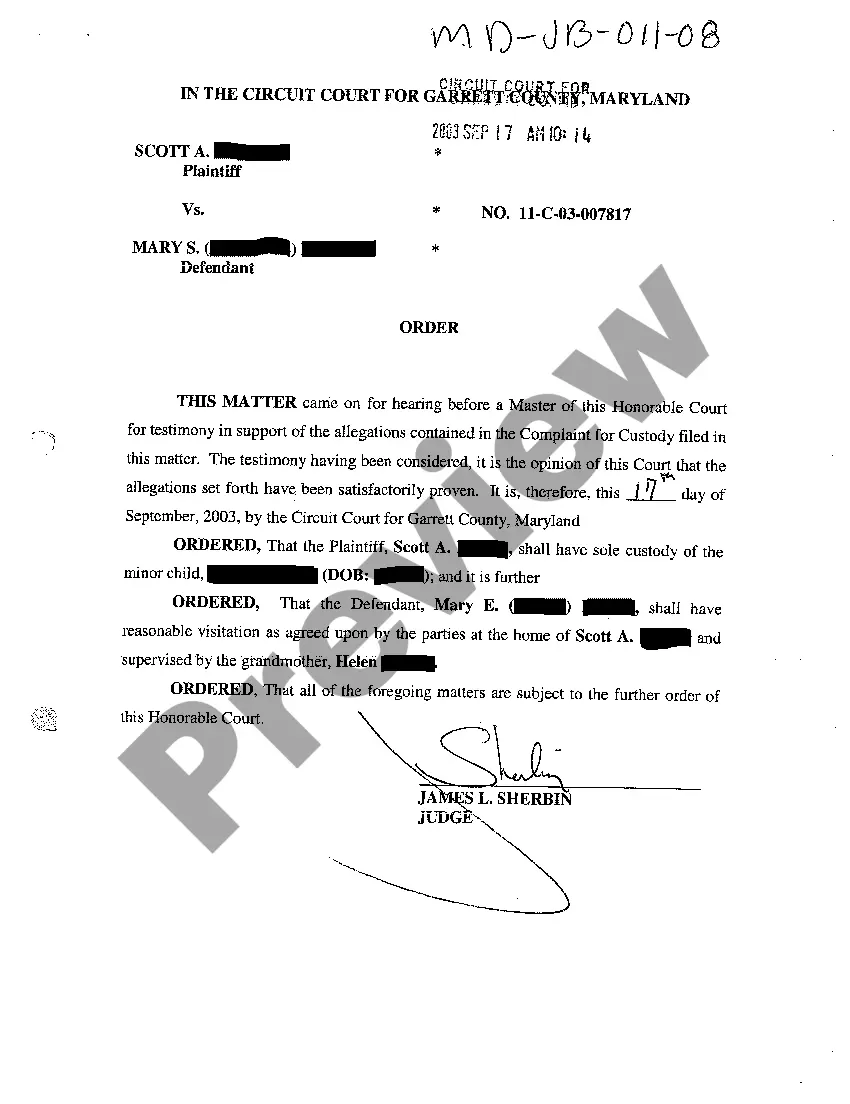

This due diligence form is a workform summarizing the substance of miscellaneous agreements as well as any provisions or requirements that may apply in business transactions.

Montana Miscellaneous Agreement Workform

Description

How to fill out Miscellaneous Agreement Workform?

If you need to fill, download, or print legitimate document templates, utilize US Legal Forms, the largest selection of legitimate forms available online.

Take advantage of the site's simple and user-friendly search to find the documents you require.

Various templates for business and personal purposes are categorized by types and states, or by keywords.

Step 4. Once you have found the form you need, click the Acquire now button. Choose your preferred payment plan and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account for this process. Step 6. Select the format of your legal document and download it to your device. Step 7. Complete, revise, and print or sign the Montana Miscellaneous Agreement Workform. Every legal document template you purchase is your property permanently. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Stay proactive and download and print the Montana Miscellaneous Agreement Workform using US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to obtain the Montana Miscellaneous Agreement Workform with just a few clicks.

- If you are an existing US Legal Forms client, Log In to your account and click the Obtain button to get the Montana Miscellaneous Agreement Workform.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Use the Preview feature to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the document, use the Search section at the top of the screen to find alternative types of your legal document template.

Form popularity

FAQ

To register as an employer in Montana, you will need to file an Employer Registration Form with the Montana Department of Labor and Industry. This process requires basic information about your business, including its legal name, address, and ownership structure. Completing this registration is a crucial step for successfully managing your workforce. The Montana Miscellaneous Agreement Workform can assist you in navigating these requirements smoothly.

To file employer withholding tax in Montana, you must gather all necessary data on employee wages and the taxes withheld. Complete the required state withholding forms and submit them to the Montana Department of Revenue in a timely manner, often on a quarterly basis. Ensuring accurate and timely filings helps you avoid penalties and maintain compliance. For guidance in managing your tax filings, explore the Montana Miscellaneous Agreement Workform for additional clarity.

The 1% Gross Receipts Tax (GRT) in Montana is applied to certain businesses based on their gross revenue from sales. This tax is particularly relevant for businesses earning above a specific threshold and is typically collected at the state level. Understanding this tax is vital for business owners in Montana to ensure proper compliance. The Montana Miscellaneous Agreement Workform offers insights into tax structures and can assist you in calculating your obligations.

To register for Montana withholding tax, you need to fill out a registration form provided by the Montana Department of Revenue. This registration helps establish your business for tax purposes, enabling you to withhold the correct amounts from employee wages. Completing this step is essential to maintaining compliance with state tax laws. The Montana Miscellaneous Agreement Workform can provide an understanding of tax obligations as you embark on this process.

To register as a Montana state withholding employer, you must complete the appropriate registration form with the Montana Department of Revenue. This process usually requires details about your business, such as its legal structure and federal employer identification number. Once registered, you can start withholding taxes from employee paychecks efficiently. For clarity on the process, the Montana Miscellaneous Agreement Workform can serve as a valuable resource.

Montana does have a state withholding form that employers must use for reporting withheld employee income tax. This form is vital for ensuring that the state receives the correct tax amounts based on employee earnings. Each employer needs to submit this form regularly to stay compliant with state tax obligations. The Montana Miscellaneous Agreement Workform can guide you in understanding your responsibilities regarding withholding.

Yes, Montana has a state W-4 form, which is essential for employees to indicate their tax withholding preferences. This form helps employers calculate the correct amount of state income tax to withhold from their employees’ paychecks. Using this form ensures compliance with Montana tax laws and simplifies the process for both employers and employees. For further assistance, consider the Montana Miscellaneous Agreement Workform to understand any additional requirements.

Finding your geocode in Montana is straightforward and can typically be done through local government websites or online mapping services. Geocodes are essential for various property and legal transactions, including those that relate to the Montana Miscellaneous Agreement Workform. To ensure accuracy, verify your geocode with official sources or utilize platforms like uslegalforms to access relevant documentation and support for your specific needs.

Yes, homesteading is still legal in Montana. However, it's crucial to understand the requirements and processes involved, which can vary based on individual situations. Utilizing the Montana Miscellaneous Agreement Workform can help you navigate these regulations more effectively. This workform provides a structured approach to ensure that your homesteading plans comply with state laws.