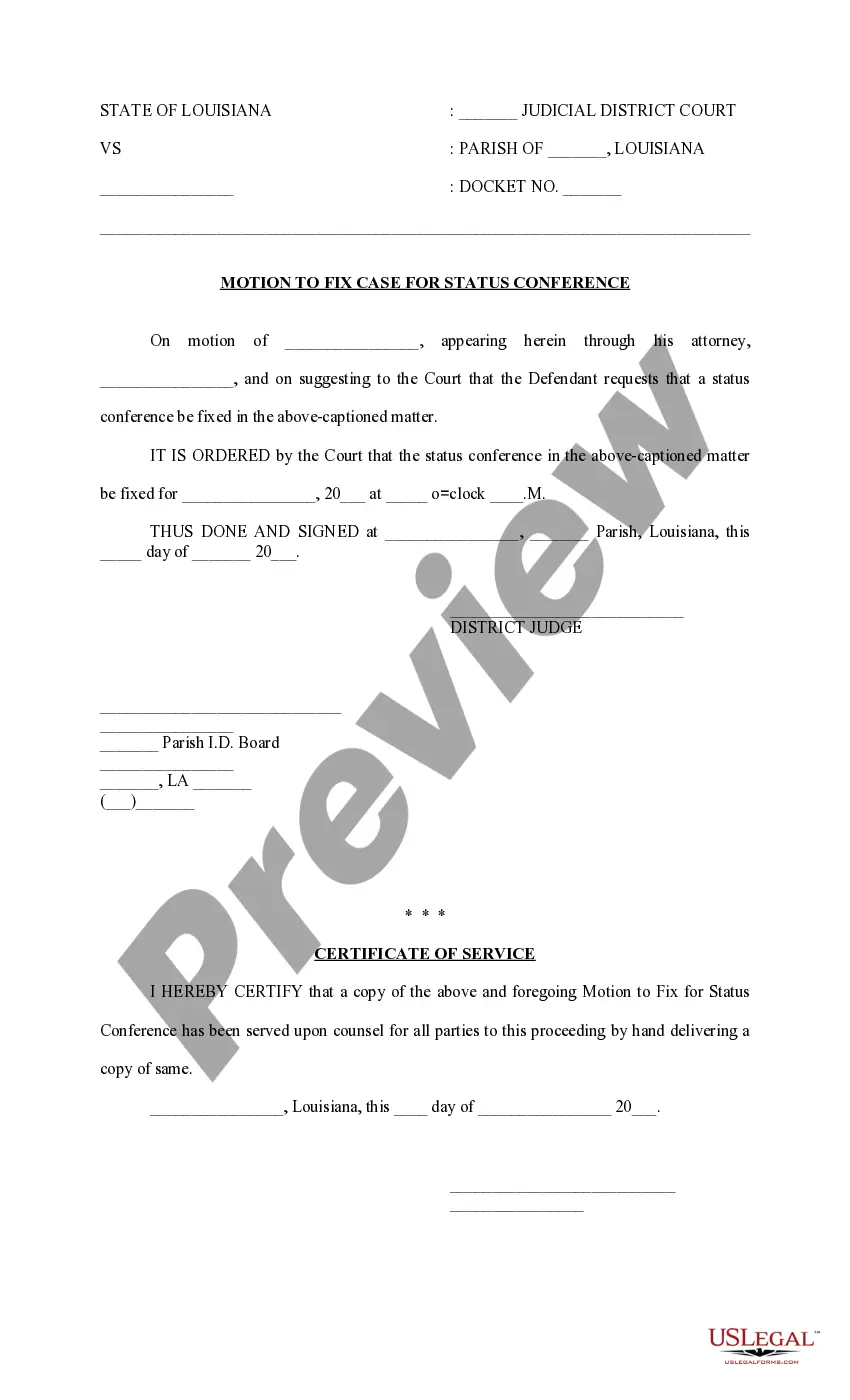

This due diligence form is a workform summarizing the substance of miscellaneous agreements as well as any provisions or requirements that may apply in business transactions.

Missouri Miscellaneous Agreement Workform

Description

How to fill out Miscellaneous Agreement Workform?

Finding the correct legal document template can be challenging.

Of course, there are numerous templates accessible online, but how can you determine which legal form you need.

Utilize the US Legal Forms website. The service offers a vast selection of templates, including the Missouri Miscellaneous Agreement Form, suitable for both business and personal purposes.

If the form does not fulfill your requirements, utilize the Search feature to find the appropriate form. Once you are confident the form is suitable, select the Purchase now option to obtain the form. Choose your desired pricing plan and enter the necessary information. Create your account and place an order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Missouri Miscellaneous Agreement Form. US Legal Forms is the largest repository of legal documents where you can discover a multitude of paper templates. Use the service to download professionally crafted documents that meet state requirements.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to access the Missouri Miscellaneous Agreement Form.

- Use your account to review the legal forms you have previously acquired.

- Navigate to the My documents section of your account to download additional copies of the documents you require.

- If you are a new user of US Legal Forms, below are simple instructions to follow.

- First, ensure you have selected the correct form for your area/county. You can review the form using the Review option and read the form description to confirm it's suitable for you.

Form popularity

FAQ

Choosing between 0 or 1 on your W-4 depends on your financial situation. Putting 0 means more tax will be withheld from your paycheck, potentially leading to a larger refund, while 1 may result in less withholding and a smaller refund or balance owed. The Missouri Miscellaneous Agreement Workform can provide guidance on making this decision clear based on your needs. Ultimately, consider your overall tax strategy when making this selection.

The amount you should withhold for Missouri state taxes varies based on your income and personal exemptions. Typically, you can refer to the state’s withholding tables and your completed Missouri Miscellaneous Agreement Workform for guidance. It is essential to reassess your withholding annually or with any significant life changes to align with your financial goals. Using online tools or platforms like US Legal Forms can help make this process easier.

Filling out a Missouri W-4 form involves providing your name, address, and social security number. Then, adjust your allowances based on your personal circumstances, keeping in mind your expected income and tax situation for the year. Utilizing the Missouri Miscellaneous Agreement Workform can help clarify these adjustments. Ensuring accurate completion will help prevent any surprises during tax time.

Yes, 1099-MISCs can be filed electronically, which simplifies the process for many users. When using the Missouri Miscellaneous Agreement Workform, electronic filing helps you ensure accuracy and meet deadlines effectively. This method also allows for quicker processing by the IRS and state agencies. Using platforms like US Legal Forms can assist you in navigating these requirements easily.

When submitting your Missouri tax return, you should attach forms that substantiate your income, deductions, and any tax credits claimed. This typically includes W-2s, 1099s, and relevant schedules, as well as the Missouri Miscellaneous Agreement Workform if you declare miscellaneous income. Proper documentation ensures accurate processing and minimizes the likelihood of inquiries.

The 183-day rule in Missouri determines whether you qualify as a resident for tax purposes. If you spend more than 183 days in the state in a year, you may be considered a resident, which affects your tax obligations. Understanding this rule is essential, especially if you have miscellaneous income to report using the Missouri Miscellaneous Agreement Workform.

You do not need to attach a copy of your federal tax return to your Missouri state return. However, if there are complexities or discrepancies, referring to your federal return may help clarify your Missouri tax situation. In cases of miscellaneous income, utilizing the Missouri Miscellaneous Agreement Workform can enhance understanding and accuracy during filing.

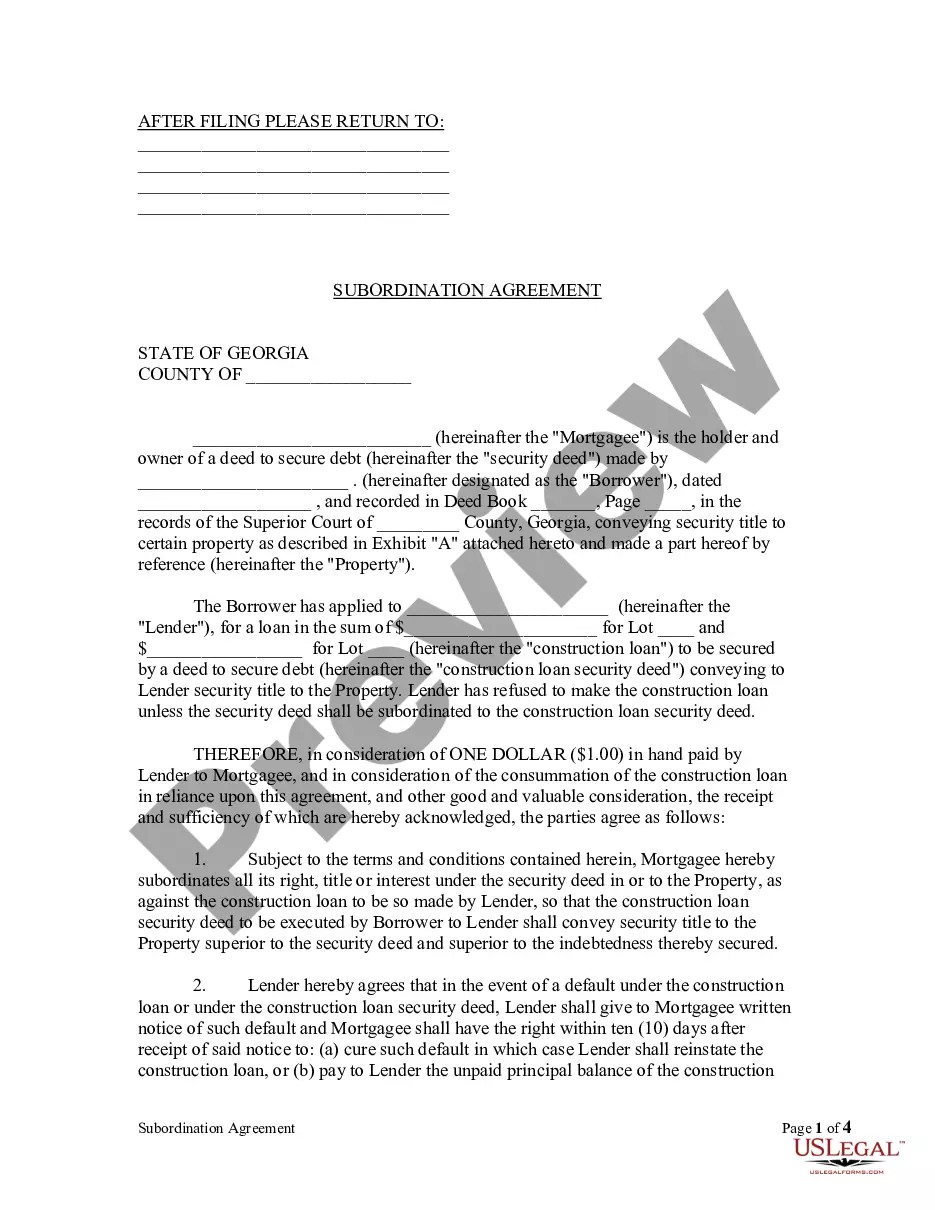

While Missouri does not legally require LLCs to have an operating agreement, it is highly recommended to define the business structure and member roles clearly. An operating agreement can prevent misunderstandings and disputes among members. Utilizing resources such as the Missouri Miscellaneous Agreement Workform can also assist in documenting various agreements.

When mailing your Missouri state tax return, include your completed Form MO-1040, any schedules, and the Missouri Miscellaneous Agreement Workform if you have miscellaneous income to report. Additionally, attach any W-2s or 1099s that verify your income sources. It's vital to ensure you enclose all necessary documentation.

A Missouri tax return should include your personal identification information, income details, and any deductions or credits for which you qualify. For miscellaneous income, the Missouri Miscellaneous Agreement Workform provides a structured way to present this information. Be thorough to prevent any delays in processing your return.