New Mexico Authorization of Consumer Report

Description

How to fill out Authorization Of Consumer Report?

Have you ever been in a situation where you require documents for both business or personal reasons almost every day.

There are numerous legitimate document templates available online, but finding ones you can rely on is not easy.

US Legal Forms offers a wide array of form templates, including the New Mexico Authorization of Consumer Report, designed to comply with federal and state regulations.

Once you find the appropriate form, click Purchase now.

Choose the pricing plan you prefer, provide the necessary details to set up your account, and make the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the New Mexico Authorization of Consumer Report template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

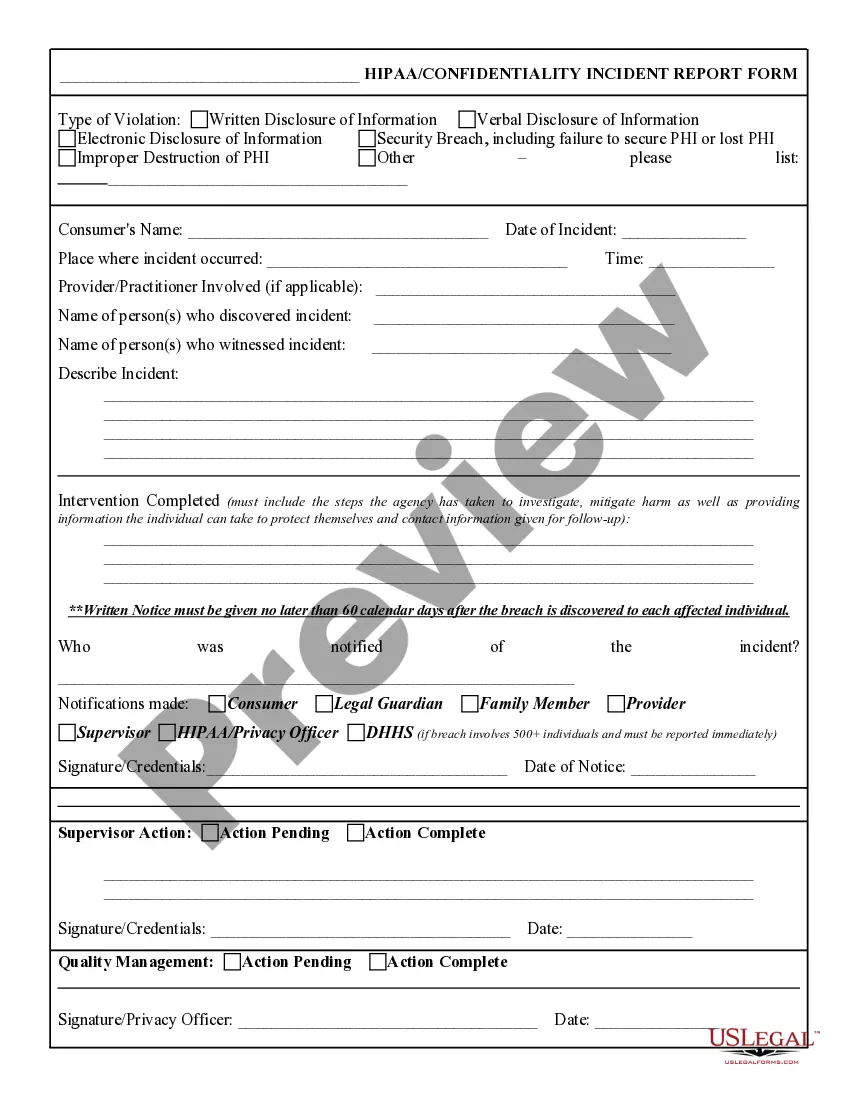

- Use the Review button to examine the form.

- Check the details to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

The FCRA requires any prospective user of a consumer report, for example, a lender, insurer, landlord, or employer, among others, to have a legally permissible purpose to obtain a report. Legally Permissible Purposes.

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and. privacy of information in the files of consumer reporting agencies.

The Fair Credit Reporting Act (FCRA) is a federal law that requires you to make a disclosure to employees or applicants informing them that you will obtain a consumer report about them for employment consideration purposes. The form of the disclosure must meet very specific criteria set forth in the statute.

By signing this form, you are giving consent to have your consumer/credit reports furnished by consumer reporting agencies as part of an investigation to determine your suitability or fitness for federal employment or fitness to perform work under a contract.

A compliant FCRA authorization form is an acknowledgement that a pre-employment background check will be conducted. It can be presented as a self-contained document or jointly with an FCRA disclosure form.

The FCRA requires agencies to remove most negative credit information after seven years and bankruptcies after seven to 10 years, depending on the kind of bankruptcy. Restrictions around who can access your reports.

You must: Tell the applicant or employee that you might use information in their consumer report for decisions related to their employment....You must certify that you:notified the applicant or employee and got their permission to get a consumer report;complied with all of the FCRA requirements; and.More items...

A statement indicating that the account "meets FCRA requirements" may be added if a consumer disputes information on their credit report, but the credit bureau determines that the information is accurate. Additionally, it can be concluded that all information is accurate and under federal regulations.

The Fair Credit Reporting Act (FCRA) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. The law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your consumer reports.

The FCRA requires agencies to remove most negative credit information after seven years and bankruptcies after seven to 10 years, depending on the kind of bankruptcy. Restrictions around who can access your reports.