New Mexico FCRA Certification Letter to Consumer Reporting Agency

Description

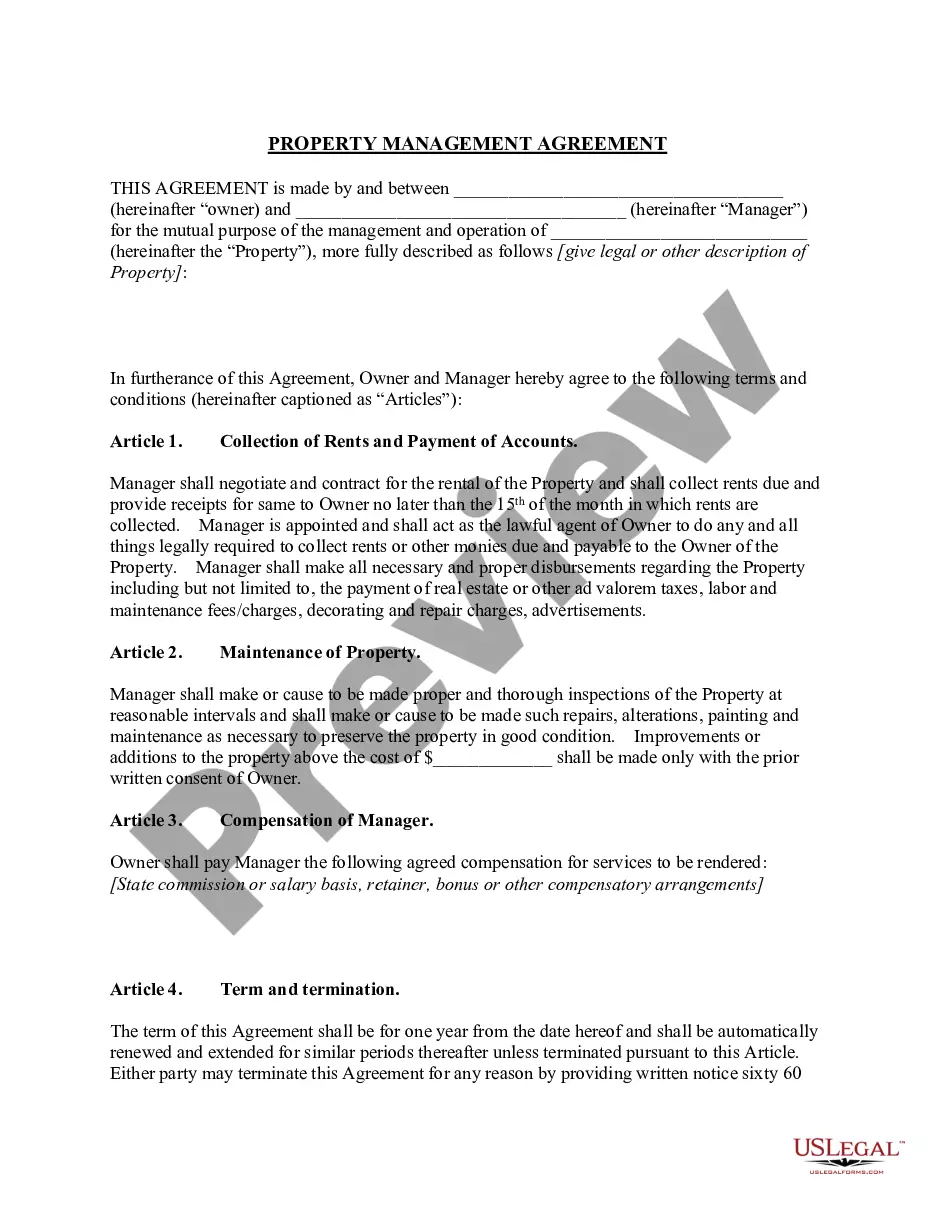

How to fill out FCRA Certification Letter To Consumer Reporting Agency?

You have the capability to spend hours online searching for the legal document template that meets the federal and state criteria you require.

US Legal Forms offers a vast array of legal documents that can be reviewed by experts.

It's easy to download or print the New Mexico FCRA Certification Letter to Consumer Reporting Agency from our service.

If available, use the Review button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, modify, print, or sign the New Mexico FCRA Certification Letter to Consumer Reporting Agency.

- Every legal document template you purchase is yours forever.

- To get another copy of a purchased form, go to the My documents section and click the relevant button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city you choose.

- Read the form description to confirm you have chosen the right form.

Form popularity

FAQ

To obtain a background check in New Mexico, you can request a copy through the New Mexico Department of Public Safety. You will need to provide some personal information and may be required to submit fingerprints. Additionally, for those seeking compliance with regulations, obtaining a New Mexico FCRA Certification Letter to Consumer Reporting Agency can be an essential step.

FAIR CREDIT REPORTING ACT/REGULATION V. Section 623 of the FCRA and Regulation V generally provide that a furnisher must not furnish inaccurate consumer information to a CRA, and that furnishers must investigate a consumer's dispute that the furnished information is inaccurate or incomplete.

Once notified by a CRA of a consumer dispute, the furnisher of the disputed information must do its own reasonable investigation. A reasonable investigation under FCRA § 1681s-2(b) requires the furnisher to examine sufficient evidence to determine whether the disputed information is accurate.

Upon making a determination that a dispute is frivolous or irrelevant, the furnisher must notify the consumer of the determination not later than five business days after making the determination, by mail or, if authorized by the consumer for that purpose, by any other means available to the furnisher.

The applicant or employee must agree in writing to the release of the report to the employer. This written permission may be given on the notice itself.

The FCRA requires any prospective user of a consumer report, for example, a lender, insurer, landlord, or employer, among others, to have a legally permissible purpose to obtain a report. Legally Permissible Purposes.

Get written permission from the applicant or employee. This can be part of the document you use to notify the person that you will get a consumer report. If you want the authorization to allow you to get consumer reports throughout the person's employment, make sure you say so clearly and conspicuously.

A consumer report is a report expected to be used or collected in whole or part for the purpose of serving as a factor used in establishing the consumers eligibility for credit or insurance used primarily for personal, family, household, or employment purposes.

After sending negative information: If a debt collection agency or creditor reports something negative about your account, they must notify you of that action within 30 days.

Credit Report Adverse Action Letter A post-decision form sent by entities to consumers after deciding to deny/reject them due to their credit score and/or other information found in a consumer credit report.