New Mexico Service Bureau Form

Description

How to fill out Service Bureau Form?

If you need to finalize, acquire, or print legal document templates, utilize US Legal Forms, the premier assortment of legal forms, which is accessible online.

Employ the website's straightforward and convenient search feature to locate the documents you require.

Various templates for commercial and personal purposes are categorized by types and regions, or keywords.

Every legal document template you acquire belongs to you indefinitely. You have access to each form you downloaded within your account.

Act proactively to obtain and print the New Mexico Service Bureau Form with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to find the New Mexico Service Bureau Form in just a few clicks.

- If you are already a US Legal Forms member, Log Into your account and click the Download button to obtain the New Mexico Service Bureau Form.

- You can also access forms you previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your appropriate city/state.

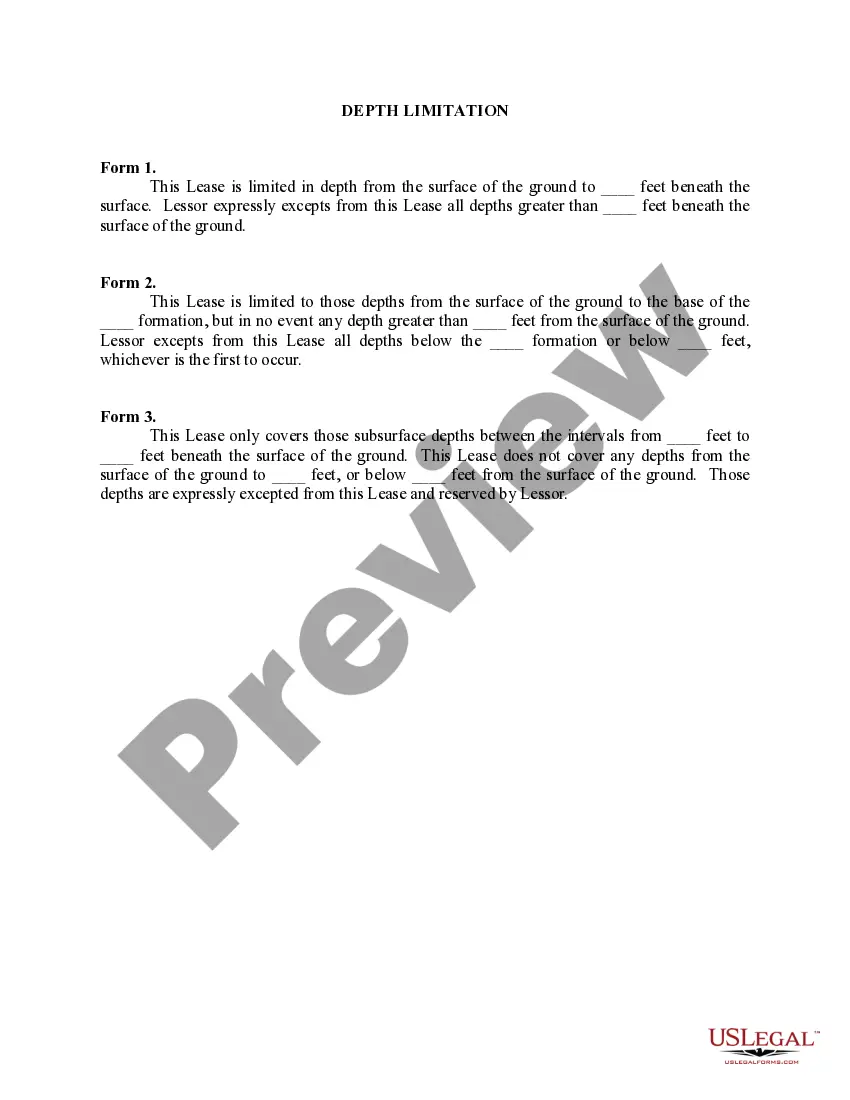

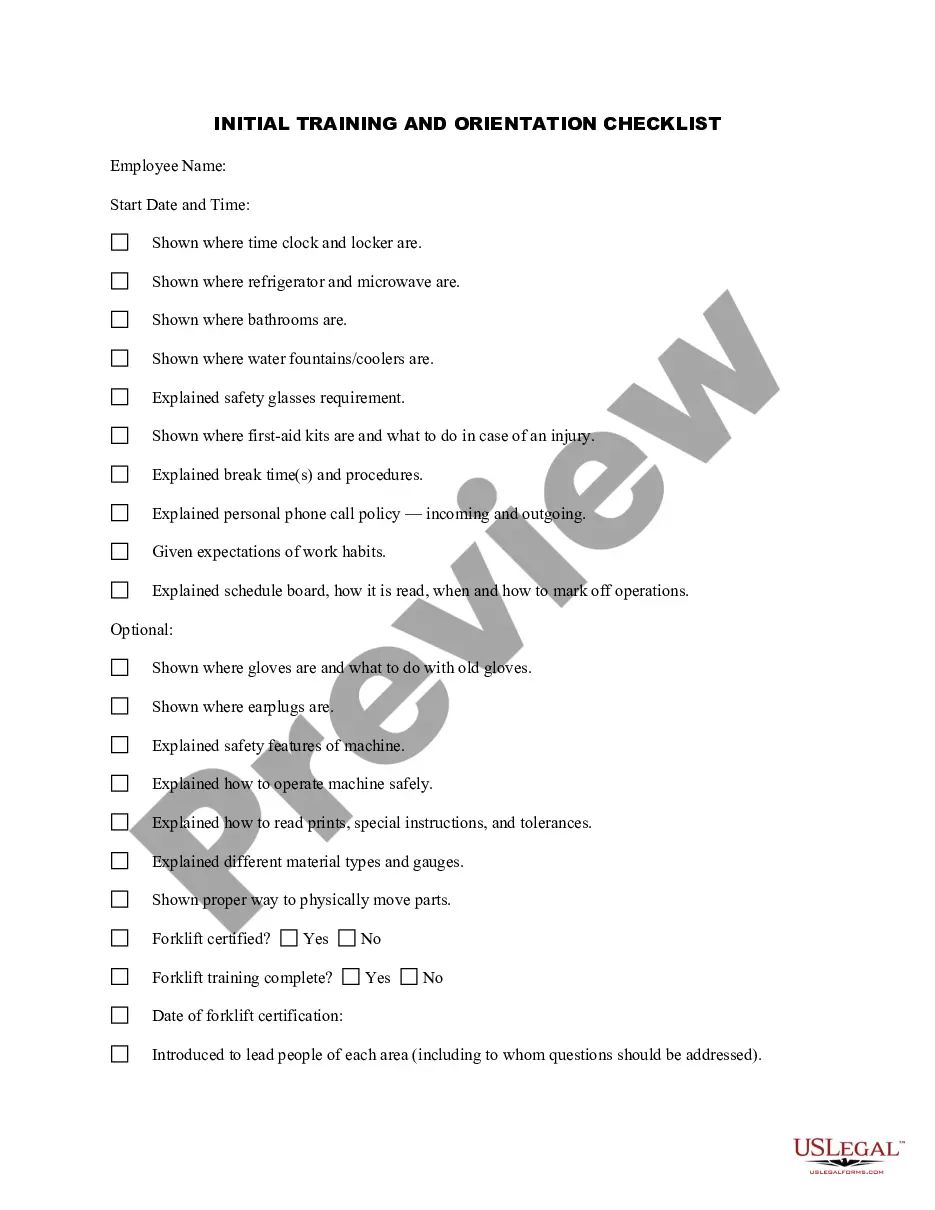

- Step 2. Use the Preview feature to review the form's contents. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternative types of your legal form template.

- Step 4. Once you have located the desired form, select the Download now button. Choose the pricing plan you prefer and provide your details to register for the account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the New Mexico Service Bureau Form.

Form popularity

FAQ

Rule 1 006 in New Mexico outlines the requirements for serving legal documents. It specifies how to properly notify individuals involved in a legal matter, ensuring that due process is followed. By utilizing the New Mexico Service Bureau Form, you can simplify the process of serving these documents. Understanding this rule is crucial for compliance and successful legal proceedings.

New Mexico Tax Account Numbers If you are already registered with the New Mexico Taxation and Revenue Department,, you can find your CRS Identification Number and filing frequency online or on correspondence from the New Mexico Taxation and Revenue Department.

2) All owners of New Mexico businesses registered as a Partnership, Limited Liability Company or CORPORATION must obtain a New Mexico CRS Tax ID number.

Everyone who is required to file a New Mexico personal income tax return must complete and file a form PIT-1, New Mexico Personal Income Tax Return. Depending upon your residency status and your own personal situation, you may need other forms and schedules.

You may fill out and submit the Application for Business Tax Identification Number (ACD-31015) to any local tax office. There is no fee to register or obtain a CRS identification number. If you return your application in person to any district tax office, you will receive your CRS identification number immediately.

Everyone who is required to file a New Mexico personal income tax return must complete and file a form PIT-1, New Mexico Personal Income Tax Return. Depending upon your residency status and your own personal situation, you may need other forms and schedules.

During registration, each business will be provided with a State Tax ID number, also known as a Combined Reporting System (CRS) ID Number. This registration it is used to report and pay tax collected on gross receipts from business conducted in New Mexico.

REGISTRATION WITH THE DEPARTMENT With few exceptions a business must hold a New Mexico Business Tax Identification Number (NMBTIN). The NMBTIN is your state tax identification number, and is used when filing gross receipts tax (GRT), compensating tax, wage withholding, and a few other business-related tax programs.

You may expect your CRS identification within one to two weeks when you return the application by mail. You may also obtain an application at many city, village, and town halls around the state. These offices can assign your CRS identification number immediately when you apply in person.

A gross receipts tax permit can be obtained by registering for a CRS Identification Number online or submitting the paper form ACD-31015. After registering, the business will be issued a Combined Reporting System (CRS) Number, sometimes known as a New Mexico Tax Identification Number.