New Mexico Purchase Order for Non Inventory Items

Description

How to fill out Purchase Order For Non Inventory Items?

Are you currently in a location where you need documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers thousands of form templates, such as the New Mexico Purchase Order for Non-Inventory Items, that are crafted to meet state and federal requirements.

Once you acquire the correct form, click Purchase now.

Select the pricing plan you prefer, fill in the necessary details to create your account, and complete your order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, just Log In.

- After that, you can download the New Mexico Purchase Order for Non-Inventory Items template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/state.

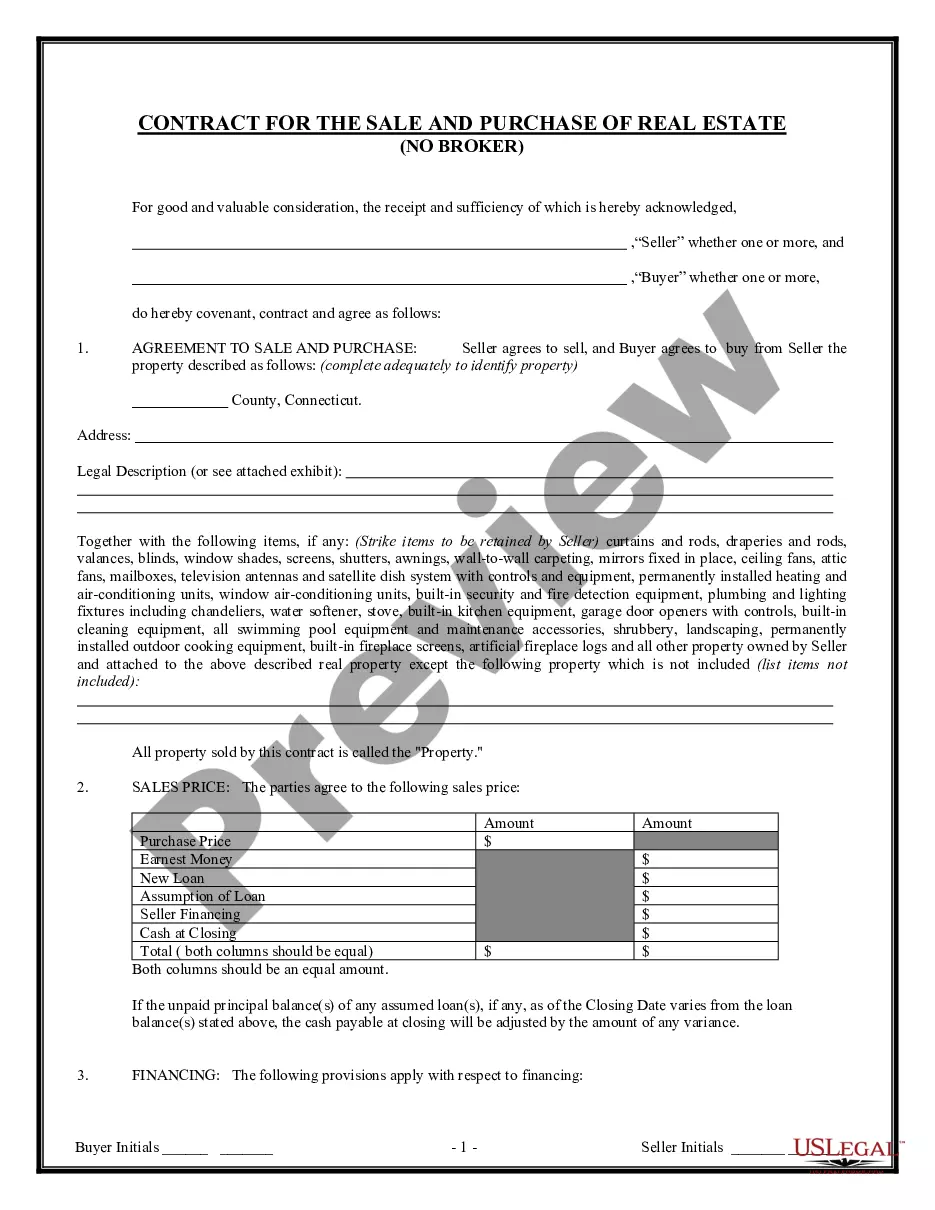

- Use the Review button to inspect the form.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that fulfills your needs.

Form popularity

FAQ

An example of a non-inventory item is office supplies such as printer paper, cleaning services, or software licenses. These items are not tracked in inventory systems because they do not have a lasting value like physical products. When you utilize a New Mexico Purchase Order for Non Inventory Items, you can efficiently manage and allocate your budget for these essential purchases.

The primary difference between inventory and non-inventory items lies in how they are tracked. Inventory items are goods you buy to resell or use in production, while non-inventory items are purchases that are consumed or utilized immediately. Using a New Mexico Purchase Order for Non Inventory Items allows businesses to manage these types of expenditures efficiently without complicating inventory management.

inventory purchase order (PO) is a document used to buy goods or services that do not require tracking in inventory. This type of order helps streamline purchasing for items like services, maintenance, or office supplies. When you create a New Mexico Purchase Order for Non Inventory Items, you simplify your purchasing process and ensure accurate tracking of expenses.

The four types of purchasing include direct purchasing, indirect purchasing, capital purchasing, and service purchasing. Direct purchasing relates to materials and products used in production, while indirect purchasing encompasses office supplies and services. Capital purchasing pertains to long-term investments like machinery, and service purchasing involves contracts for services such as maintenance. Understanding these categories can optimize your New Mexico Purchase Order for Non Inventory Items and enhance overall procurement efficiency.

A Purchase Order (PO) is a formal document issued by a buyer to a seller, request a purchase of goods or services. A Local Purchase Order (LPO), specifically used within certain regions or for local vendors, often simplifies the purchasing process for smaller transactions. Utilizing a New Mexico Purchase Order for Non Inventory Items enables you to navigate these differences effectively while ensuring compliance with local purchasing regulations.

Non stock procurement includes items that organizations do not regularly keep in inventory, such as special equipment, custom products, or one-time services. For a New Mexico Purchase Order for Non Inventory Items, you may find services such as consulting or construction also fall under this category. Understanding what qualifies can help streamline your purchasing process and ensure you meet your operational needs.

Justifying single source procurement involves demonstrating that only one supplier can fulfill your needs. For New Mexico Purchase Order for Non Inventory Items, you should provide reasons such as unique capabilities of the supplier, specific product requirements, or time-sensitive projects. Thorough documentation and a clear rationale can strengthen your case, ensuring compliance with procurement regulations and transparency.

To become a vendor in New Mexico, start by registering your business with the New Mexico Secretary of State. After that, you need to apply for a New Mexico Purchase Order for Non Inventory Items, which allows you to provide goods and services to state agencies. Additionally, familiarize yourself with the specific requirements and regulations that apply to state contracts. You can find valuable resources on the uslegalforms platform, which simplifies the process of becoming a vendor and ensures you meet all necessary criteria.