New Mexico Purchase Order Log

Description

How to fill out Purchase Order Log?

You can spend hours online searching for the legal document template that satisfies the state and federal regulations you require.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

It is easy to download or print the New Mexico Purchase Order Log from our service.

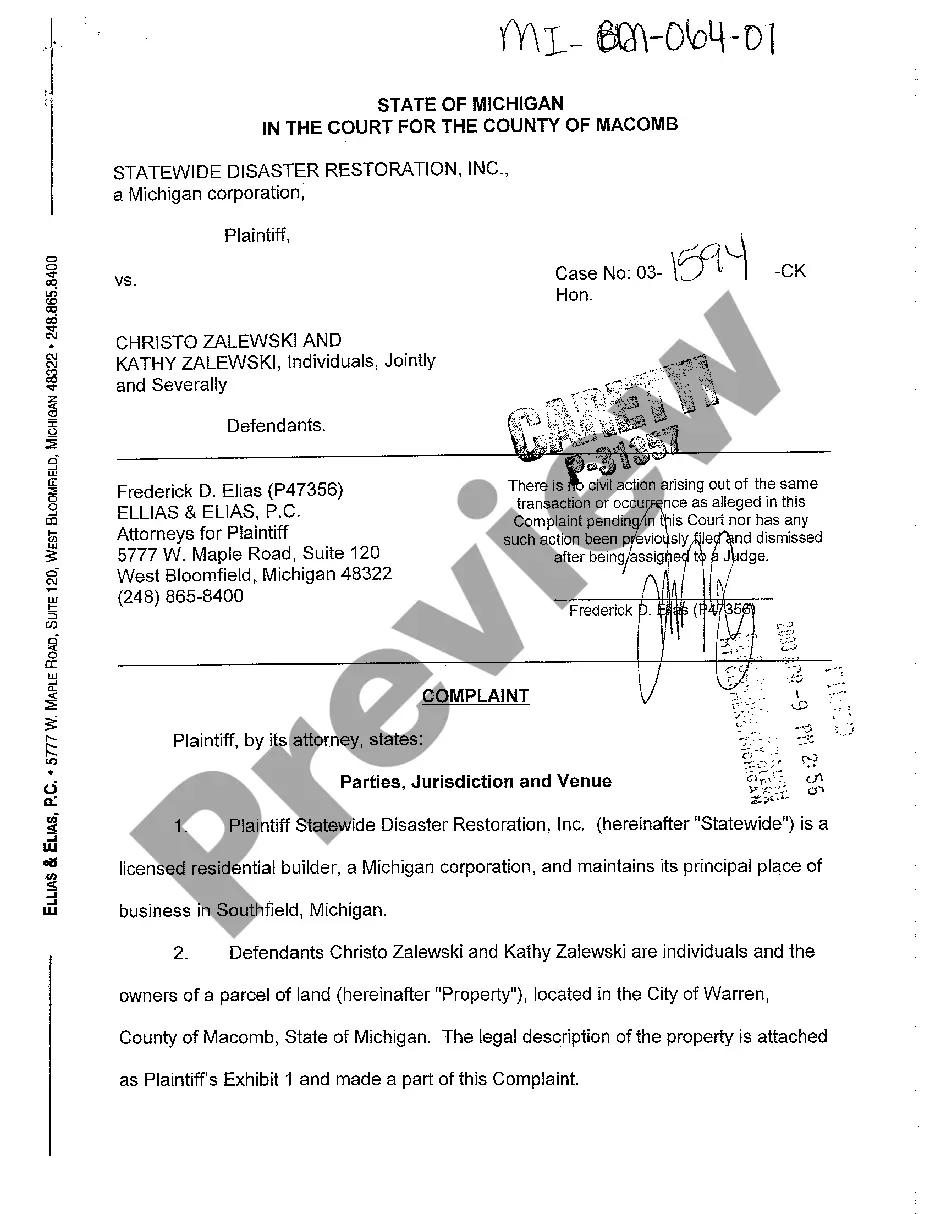

If available, utilize the Review button to preview the document template as well.

- If you already possess a US Legal Forms account, you may Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the New Mexico Purchase Order Log.

- Every legal document template you purchase is yours indefinitely.

- To obtain an additional copy of any purchased form, go to the My documents tab and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/area that you choose.

- Review the form description to make certain you have chosen the appropriate type.

Form popularity

FAQ

To apply for a New Mexico CRS number, visit the New Mexico Taxation and Revenue Department's website and complete the application online. It’s necessary for businesses to collect and remit taxes like GRT. Once you have your New Mexico Purchase Order Log set up, this will help you track sales and ensure compliance with the CRS requirements.

You can file your New Mexico state taxes online through the New Mexico Taxation and Revenue Department's website. They offer an electronic filing system that simplifies the process. Using your New Mexico Purchase Order Log can assist in accurately reporting your income and expenses during the filing.

Gross Receipts Tax (GRT) is a tax on the total gross revenue of businesses in New Mexico. It is imposed on the business for sales of goods and services, not just on the profit. Understanding GRT is vital, especially when maintaining your New Mexico Purchase Order Log, as it directly affects your business finances.

Filing a New Mexico tax return is typically required if your income meets certain thresholds. If you’re engaged in business or receive income from the state, it’s essential to file. Additionally, reviewing your New Mexico Purchase Order Log can help you determine your income and filing requirements effectively.

Yes, you generally need to file a New Mexico state tax return if you earn income in New Mexico. Even if you don’t owe tax, filing a return can be beneficial for various credits and refunds. Make sure to keep accurate records, including your New Mexico Purchase Order Log, to simplify the filing process.

A Purchase Order, or PO, serves as a document that outlines a buyer's intent to purchase goods or services from a seller. For instance, if a school in New Mexico orders 100 laptops from a supplier, the documentation generated will be a PO, specifying the details of the purchase, including quantities, prices, and delivery timelines. Utilizing a New Mexico Purchase Order Log ensures that all transactions are recorded properly, helping businesses track expense and inventory efficiently. By employing this log, organizations can streamline their purchasing process and enhance overall operational effectiveness.