New Mexico Guaranty without Pledged Collateral

Description

How to fill out Guaranty Without Pledged Collateral?

Have you ever been in a circumstance where you consistently require documents for both business or personal purposes.

There are numerous legal document templates available online, but finding ones you can depend on is not easy.

US Legal Forms offers thousands of form templates, such as the New Mexico Guaranty without Pledged Collateral, designed to fulfill federal and state requirements.

Once you find the correct form, click Purchase now.

Choose a suitable document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Mexico Guaranty without Pledged Collateral template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct state/region.

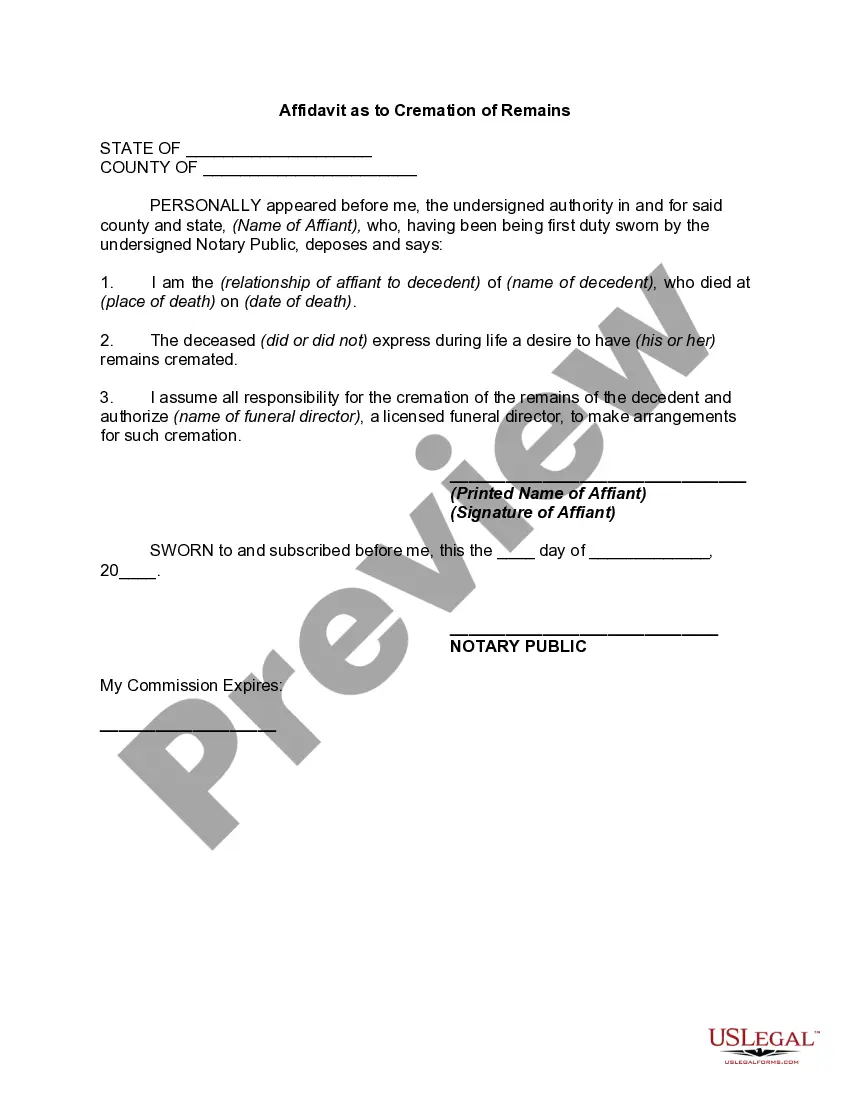

- Use the Preview button to view the form.

- Check the description to confirm you have selected the right form.

- If the form isn’t what you expected, use the Search field to locate the form that suits your requirements.

Form popularity

FAQ

Mortgages and car loans are two types of collateralized loans. Other personal assets, such as a savings or investment account, can be used to secure a collateralized personal loan.

As nouns the difference between pledge and guaranty is that pledge is a solemn promise to do something while guaranty is (legal) an undertaking to answer for the payment of some debt, or the performance of some contract or duty, of another, in case of the failure of such other to pay or perform; a warranty; a security.

Types of CollateralReal estate.Cash secured loan.Inventory financing.Invoice collateral.Blanket liens.

An advance payment guarantee acts as collateral for reimbursing advance payment from the buyer if the seller does not supply the specified goods per the contract. A credit security bond serves as collateral for repaying a loan. A rental guarantee serves as collateral for rental agreement payments.

A guaranteed loan is used by borrowers with poor credit or little in the way of financial resources; it enables financially unattractive candidates to qualify for a loan and assures that the lender won't lose money. Guaranteed mortgages, federal student loans, and payday loans are all examples of guaranteed loans.

Types of Collateral When you take out a mortgage, your home becomes the collateral. If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include carsonly if they are paid off in fullbank savings deposits, and investment accounts.

A suretyship is an undertaking that the debt shall be paid; a guaranty, an undertaking that the debtor shall pay.

An unsecured loan is a loan that doesn't require any type of collateral. Instead of relying on a borrower's assets as security, lenders approve unsecured loans based on a borrower's creditworthiness. Examples of unsecured loans include personal loans, student loans, and credit cards.

A secured personal loan is backed by collateral. If the borrower defaults, the lender can collect the collateral. For this reason, secured loans tend to offer better rates than unsecured loans.

Understanding Financial Guarantees Guarantees may take on the form of a security deposit. Common in the banking and lending industries, this is a form of collateral provided by the debtor that can be liquidated if the debtor defaults.