New Mexico Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

How to fill out Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

Have you ever been in a situation where you require documents for either business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers a vast array of form templates, including the New Mexico Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, designed to comply with federal and state regulations.

When you identify the correct form, click on Get now.

Select your desired pricing plan, fill in the necessary information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the New Mexico Liquidation of Partnership with Sale of Assets and Assumption of Liabilities template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

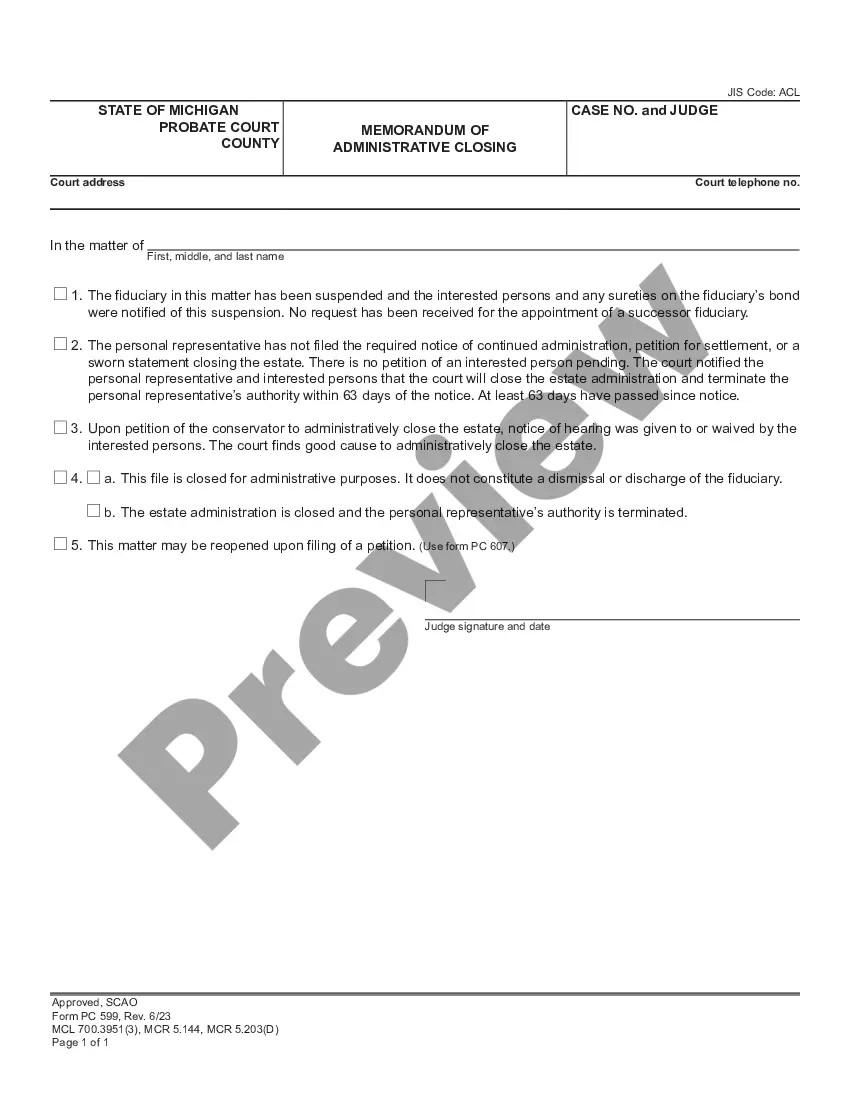

- Utilize the Preview option to review the form.

- Examine the description to confirm that you have selected the appropriate form.

- If the form is not what you seek, use the Search field to locate the form that fits your needs.

Form popularity

FAQ

During the liquidation, noncash assets are usually evaluated and sold at fair market value. After all liabilities and debts are cleared, the remaining value of these assets is divided among the partners based on their respective ownership shares. It's important for each partner to understand their rights during this extensive process in a New Mexico liquidation of partnership with sale of assets and assumption of liabilities. Consider using the US Legal Forms platform for guidance and documentation support.

This means the ownership interest a partner has in a partnership is treated as a separate asset that can be purchased and sold. The general rule is the selling partner treats the gain or loss on the sale of the partnership interest as the sale of a capital asset (see IRC 741).

2012 Review Schedule D, Form 8949 and Form 4797 to determine the amount of gain or loss the partner reported on the sale of the partnership interest. After determining a partner sold its interest in the partnership, establish other relevant facts that can impact the tax treatment of this transaction.

Upon liquidation of a partnership, the Internal Revenue Service views the distributions as a sale of a partnership interest; as a result, gains are generally taxed as long-term capital gains to partners.

Solution. If an asset is taken over by partner from firm his capital account will be debited. Explanation: When an asset is taken over by a partner, then the Realisation A/c is credited and the Concerned Partner's Capital A/c is debited with the agreed price at which the asset is taken over by him.

The sale of a partnership interest is generally treated as a sale of a capital asset, resulting in capital gain or loss for the selling partner.

How to sell your share of a partnership?Step 1: Review the partnership agreement which outlines how partners would address certain business situations, such as selling.Step 2: Meet with your partner(s) in order to take a vote on how to dissolve the partnership and sell your assets.More items...

In an asset purchase from a partnership, the tax consequences to the buyer are the same as for an asset purchase from a corporation. In such an asset sale, the partnership is selling the various assets of the partnership separately and the aggregate purchase price is allocated among each asset acquired.

In an asset purchase from a partnership, the tax consequences to the buyer are the same as for an asset purchase from a corporation. In such an asset sale, the partnership is selling the various assets of the partnership separately and the aggregate purchase price is allocated among each asset acquired.

A liquidating distribution terminates a partner's entire interest in the partnership. A current distribution reduces a partner's capital accounts and basis in his interest in the partnership (outside basis) but does not terminate the interest.