New Mexico Sales Order Form

Description

How to fill out Sales Order Form?

It is feasible to dedicate time on the web searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms provides a vast selection of legal forms that are assessed by experts.

You can easily obtain or print the New Mexico Sales Order Form from our service.

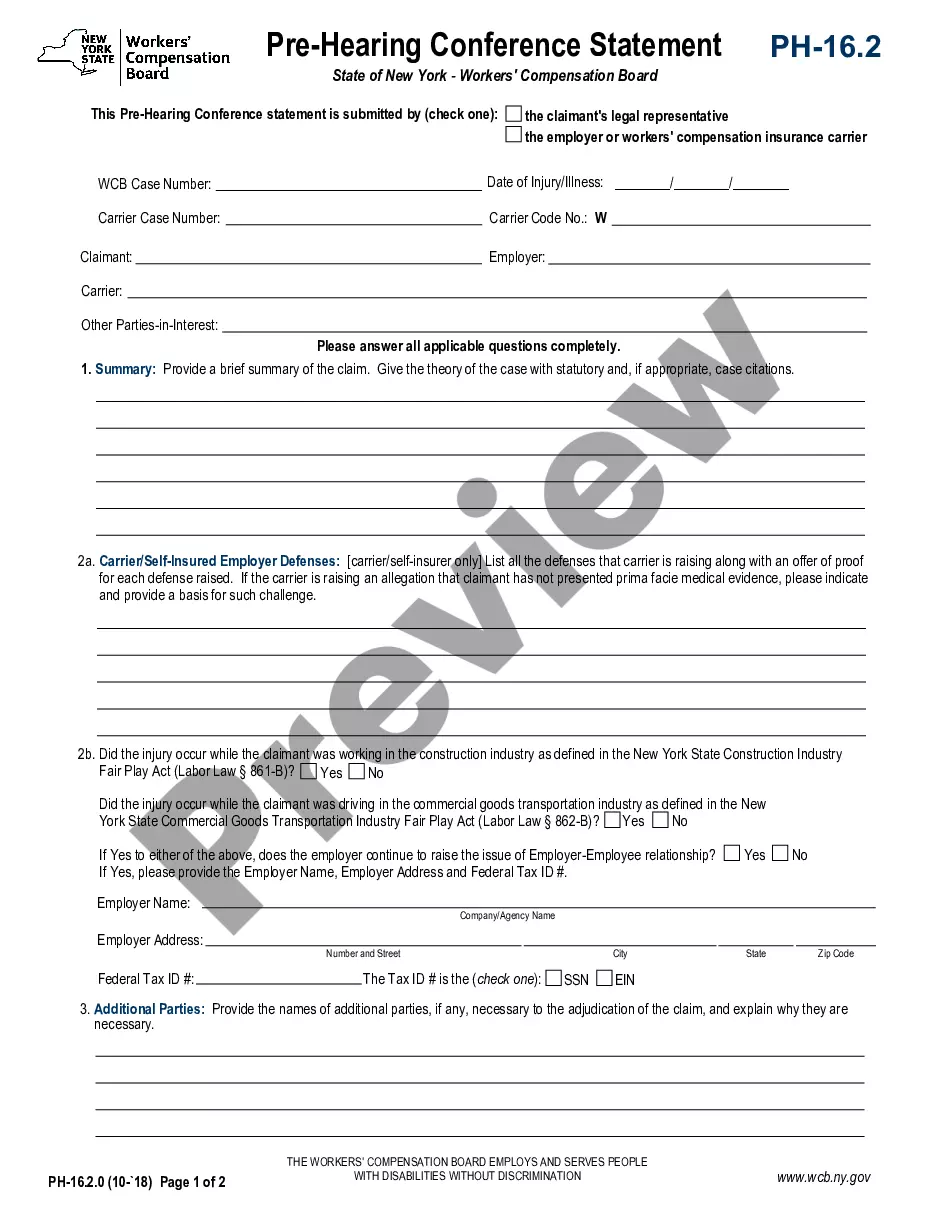

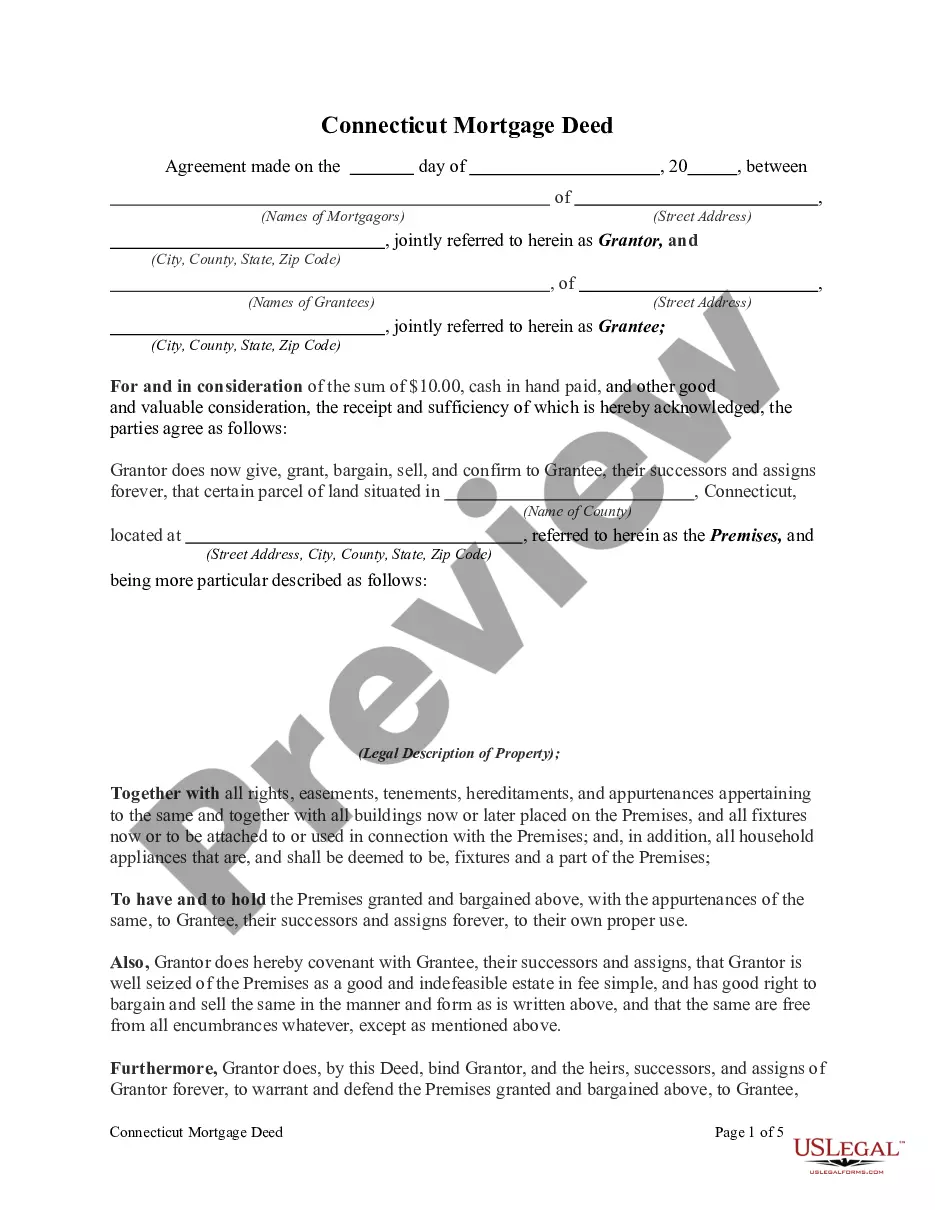

Check the form description to make sure you have chosen the right form. If available, use the Preview option to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and subsequently click the Obtain option.

- Then, you can fill out, modify, print, or sign the New Mexico Sales Order Form.

- Each legal document template you purchase is yours indefinitely.

- To get an additional copy of a purchased form, navigate to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

Form popularity

FAQ

To obtain a New Mexico NTTC, first complete the necessary application forms. You will need to provide the required business information and submit it to the New Mexico Taxation and Revenue Department. Once your application is approved, you can utilize the New Mexico Sales Order Form for your transactions, ensuring compliance with local regulations. For efficient processing, consider using platforms like USLegalForms that streamline this workflow.

A New Mexico bill of sale can be written in plain English, without legal jargon or archaic terms.

As the seller of a vehicle in NM, you need to: Assign the vehicle's title over to the buyer using the Assignment of Title section on the vehicle's title certificate (If an Assignment of Title section is not available, you need to provide a bill of sale (Form MVD 10009) Sign the vehicle's title.

In the state of New Mexico a Bill of Sale form is not required for most vehicle transactions but a Bill of Sale (Form MVD 10009) is required when a certificate of title is not available. The first time you register a used vehicle in your name, you must come into a MVD Field Office.

Does a bill of sale have to be notarized in New Mexico? No. A bill of sale for a private party vehicle transfer does not need to be notarized in New Mexico.

A New Mexico bill of sale is written using the following components:The printed legal name of the buyer and the seller.The date the bill of sale was created.The amount of money the item was sold for.Descriptive information about the item sold.The signature of both the buyer and the seller.

You will need a notarized New Mexico Powers of Attorney (MVD-10037; or notarized generic POA) signed by all owners listed on the title. If you have a lien on the vehicle you will need a lien release. You will need to fill out the Application for Duplicate Certificate of Title form which can be found at your MVD.

New Mexico CRS Identification Number and Filing Frequency If you are already registered with the New Mexico Taxation and Revenue Department,, you can find your CRS Identification Number and filing frequency online or on correspondence from the New Mexico Taxation and Revenue Department.

A Bill of Sale typically includes:The full names and contact information of the buyer and seller.A statement that transfers ownership of the item from the seller to the buyer.A complete description of the item being purchased.A clause indicating the item is sold "as-is"The item's price (including sales tax)More items...

In the state of New Mexico a Bill of Sale form is not required for most vehicle transactions but a Bill of Sale (Form MVD 10009) is required when a certificate of title is not available. The first time you register a used vehicle in your name, you must come into a MVD Field Office.