New Mexico Renunciation of Legacy to give Effect to Intent of Testator

Description

How to fill out Renunciation Of Legacy To Give Effect To Intent Of Testator?

Are you in a place where you require files for either organization or personal uses virtually every working day? There are tons of authorized record themes available on the Internet, but finding versions you can rely on is not effortless. US Legal Forms delivers a huge number of kind themes, like the New Mexico Renunciation of Legacy to give Effect to Intent of Testator, which can be composed in order to meet state and federal requirements.

In case you are presently informed about US Legal Forms site and also have an account, just log in. Afterward, you are able to obtain the New Mexico Renunciation of Legacy to give Effect to Intent of Testator template.

If you do not provide an profile and wish to begin using US Legal Forms, abide by these steps:

- Discover the kind you require and make sure it is for that right metropolis/area.

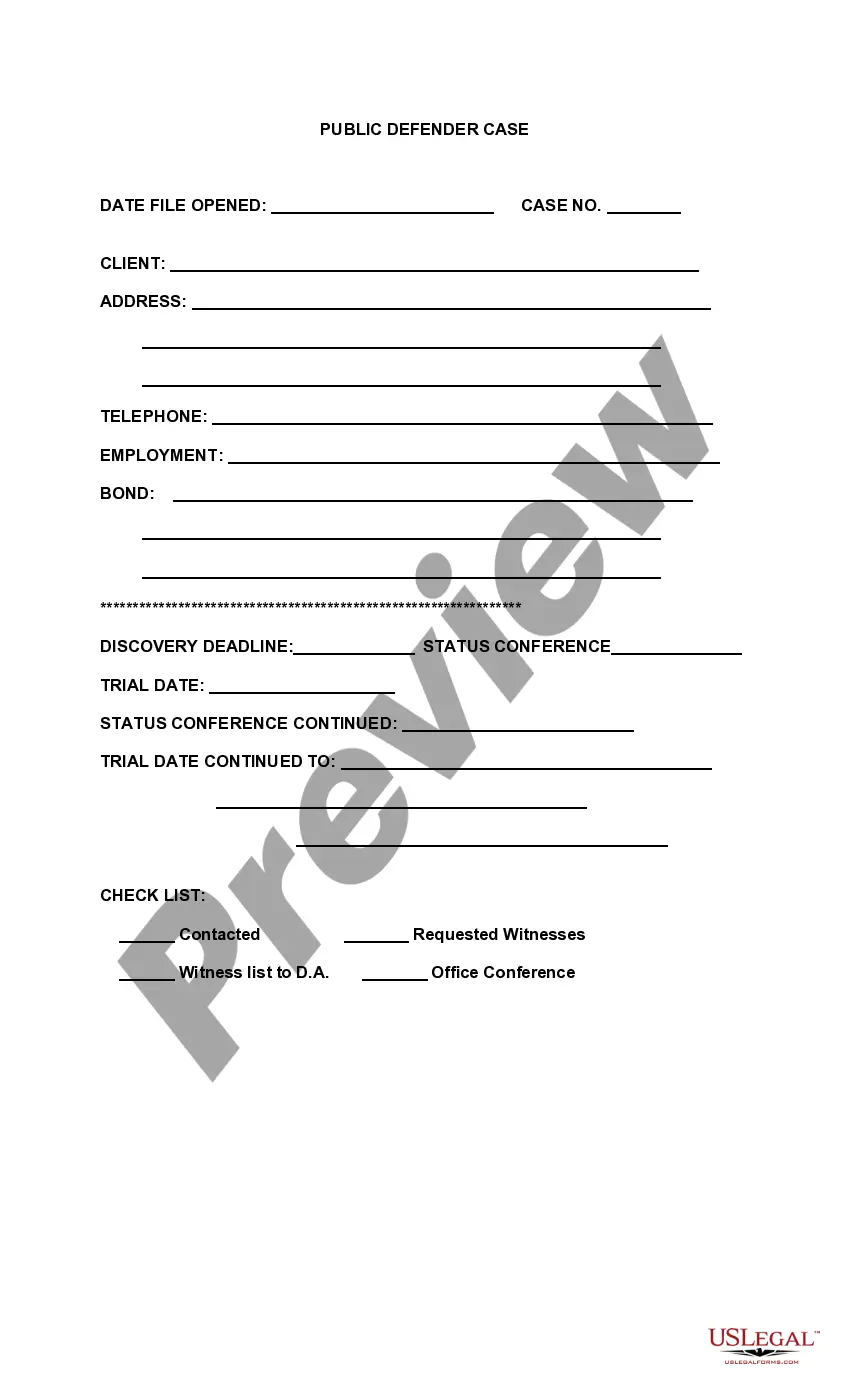

- Utilize the Review key to analyze the form.

- Browse the information to actually have selected the appropriate kind.

- In case the kind is not what you`re seeking, utilize the Research area to discover the kind that meets your requirements and requirements.

- If you discover the right kind, click Acquire now.

- Select the pricing prepare you would like, submit the specified details to create your account, and purchase your order using your PayPal or credit card.

- Choose a handy data file formatting and obtain your backup.

Get each of the record themes you may have purchased in the My Forms food list. You can get a more backup of New Mexico Renunciation of Legacy to give Effect to Intent of Testator at any time, if possible. Just click the needed kind to obtain or print out the record template.

Use US Legal Forms, by far the most extensive collection of authorized varieties, to save time and prevent mistakes. The service delivers professionally produced authorized record themes that can be used for an array of uses. Make an account on US Legal Forms and begin generating your daily life a little easier.

Form popularity

FAQ

When is it required for my Will to be probated through Court? In New Mexico, if the total value of the estate exceeds $50,000 the will must go through the Court to be probate. An estate worth less than $50,000 is considered a small estate.

Child can be disinherited without being mentioned in a will, unless it appears that the omission to mention such child occurred because of mistake or inadvertence. In re Estate of McMillen, 1903-NMSC-012, 12 N.M. 31, 71 P. 1083 (decided under former law).

When the first spouse dies, half of the total community property passes to the surviving spouse. The tax basis of all the community property is stepped up to its fair market value at the time of the first spouse's death, which can be a significant tax advantage. Joint Tenancy with the Right of Survivorship.

If a decedent had no children and no Will, the surviving spouse receives all of the decedent's separate property. If the decedent had children and no Will, the decedent's children (or their heirs) receive 75% of the separate property, and the surviving spouse receives 25%.

Yes. The TODD is for any real estate located in New Mexico. Any existing leases would continue in effect after the owner's death. Before you exe- cute a TODD for business or investment proper- ty, you should consult with an attorney as there may be tax consequences you need to consider.

If the property is in New Mexico and the owner dies without leaving a will, one-fourth of the property passes to the surviving spouse and three-fourths to the children.

Requirements for a Valid Will in New Mexico In order for a will to be finalized, it must be signed by the testator in front of two witnesses of sound mind, with the capacity to understand that they are witnessing the signing of a will.

Under the right of survivorship, each tenant possesses an undivided interest in the whole estate. When one tenant dies, the tenant's interest disappears and the others tenants' shares increase proportionally and obtain the rights to the entire estate.