An assistant pastor helps a senior pastor at a church lead others into a growing relationship with Jesus Christ. This typically includes taking on important responsibilities within the church, such as overseeing key leaders and leading a ministry. However, some denominations may put you in this role solely to prepare you to become a senior pastor. Further ordinances regarding who can be a pastor, such as women or individuals without a formal education, are typically determined by the traditions and affiliations of your church.

New Mexico Employment Agreement with Assistant Pastor

Description

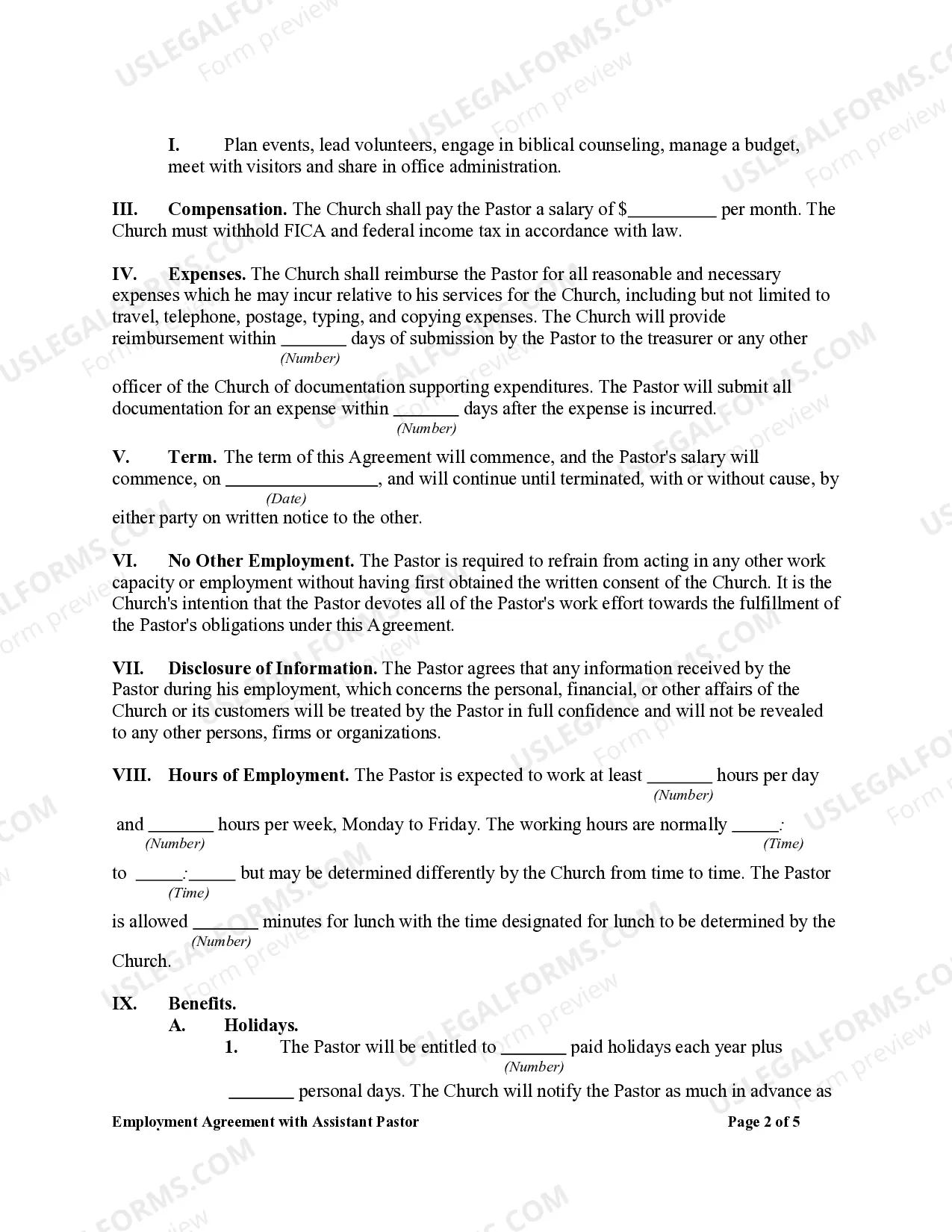

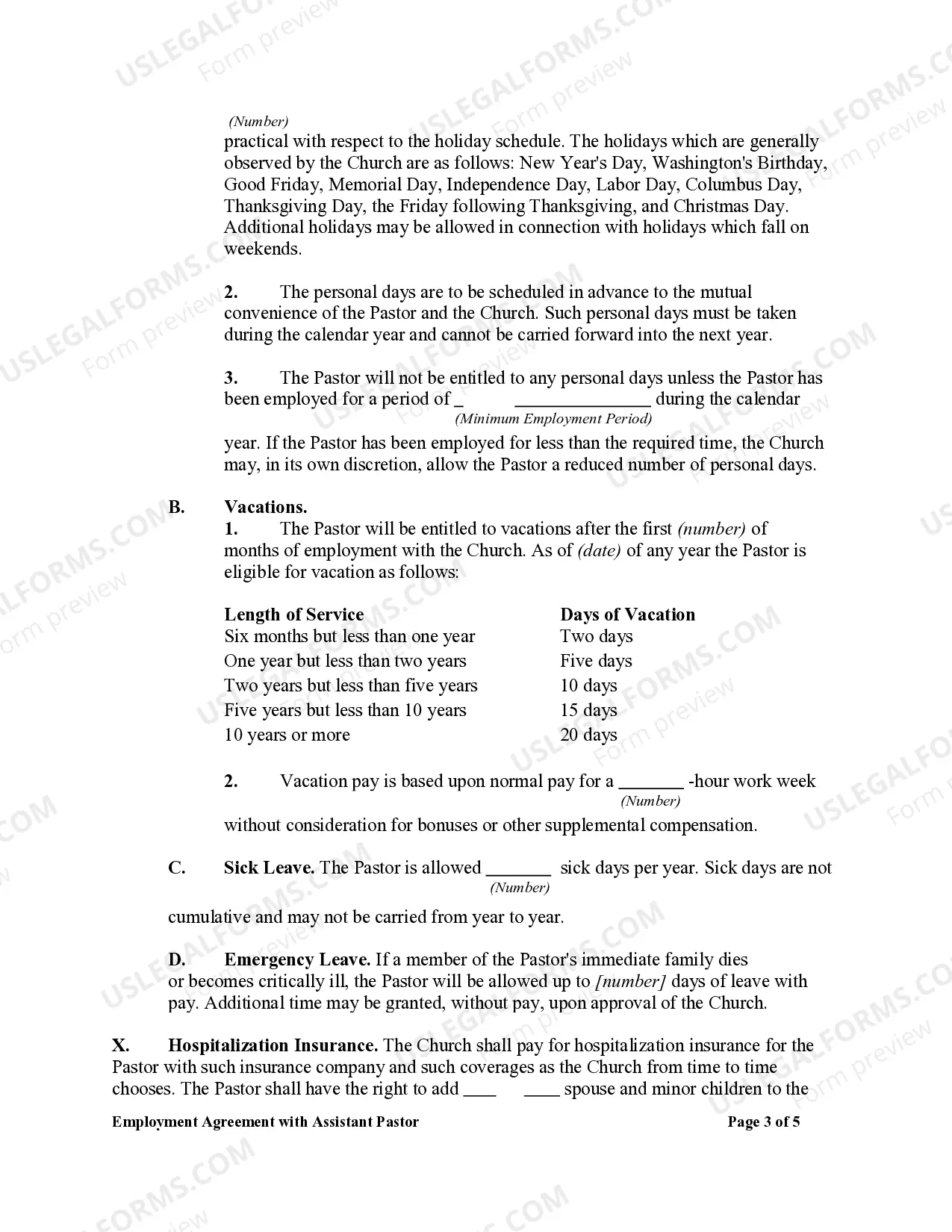

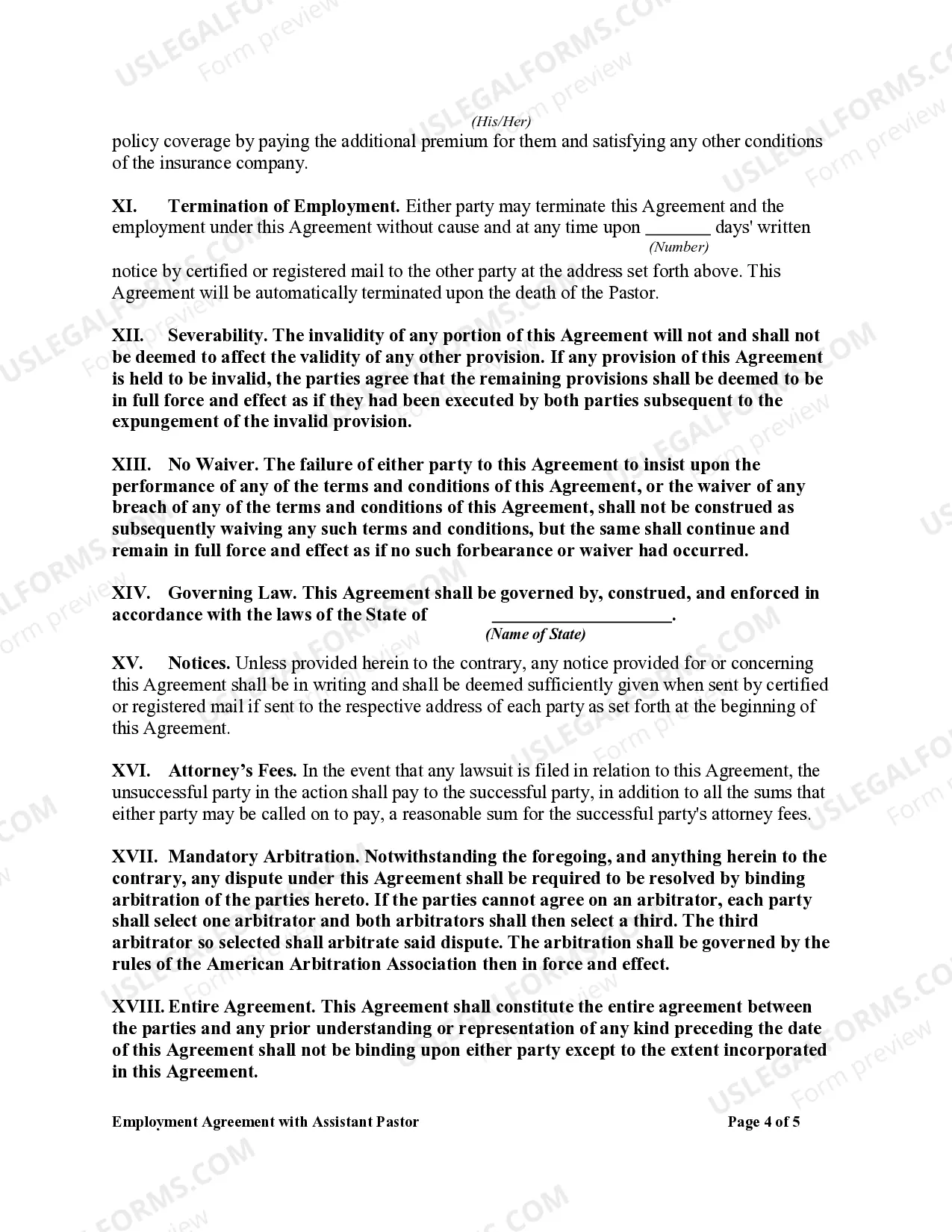

How to fill out Employment Agreement With Assistant Pastor?

Have you ever found yourself in a situation where you require documents for various business or personal reasons almost daily.

There are numerous legal document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms offers a vast array of template forms, including the New Mexico Employment Agreement with Assistant Pastor, designed to comply with both federal and state regulations.

Once you have found the correct form, click Purchase now.

Select your preferred pricing plan, enter the necessary information to create your account, and complete the purchase using PayPal or a credit card. Choose a suitable format and download your copy. You can access all the document templates you’ve bought from the My documents section. You can download or print the New Mexico Employment Agreement with Assistant Pastor anytime you need it by simply clicking on the desired form. Utilize US Legal Forms, the most extensive collection of legal documents, to save time and prevent errors. The service provides professionally created legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Mexico Employment Agreement with Assistant Pastor template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Read the summary to confirm that you have selected the right form.

- If the form does not meet your requirements, utilize the Research section to find the form that suits your needs and criteria.

Form popularity

FAQ

Clergy: known as rabbis, ministers, priests, imams, and other titles, conduct religious worship and provide spiritual and moral guidance to members of a congregation. They maintain the practices and beliefs of a particular religious faith or denomination.

A pastor has a unique dual tax status. While they can be considered an employee of a church, for federal income tax purposes a pastor is considered self-employed by the IRS. Some pastors are considered independent contractors if they aren't affiliated with one specific church, like traveling evangelists.

The IRS considers any money pastors directly receive from congregation members for services such as weddings or baptisms as self-employment earnings. This makes them independent contractors.

1 To determine usual requirements. Review contracts for other pastors in your denomination to determine usual requirements.2 Specify basic employment elements : start date.3 Delineate the church-specific goals and responsibilities.4 Identify additional items.5 Review the contract.29-Sept-2017

These ministers receive Form W-2 and report their taxable gross income as employees. However, the minister's status as self-employed for Social Security tax purposes comes into play here. Since they are considered self-employed, ministers are exempt from federal income tax withholding.

Even though a minister receives Form 1099-NEC or MISC, he or she may be an employee who should also receive Form W-2. A minister's earned income is net self-employment income from Schedule SE minus one-half of self-employment tax plus any nonministerial wages.

What Is an Associate Pastor? An associate pastor works with a senior pastor at their church to serve their congregation. As an associate pastor, you assist with worship services and lead other religious activities for various ministry groups.

Other duties include attending inter-church programs, leading and coordinating mission trips. The ultimate responsibility is to preach and spread the word of God. A good public speaker, a youth development lover, a passion for community outreach, and confidence are all essential skills for an associate pastor.