New Mexico Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate

Description

How to fill out Sample Letter For Discharge Of Debtor And Order Approving Trustee's Report Of No Distribution And Closing Estate?

Choosing the right authorized record template could be a battle. Obviously, there are tons of themes available online, but how can you obtain the authorized kind you require? Make use of the US Legal Forms site. The services provides thousands of themes, like the New Mexico Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate, which you can use for business and personal requirements. All the kinds are inspected by experts and satisfy state and federal requirements.

Should you be presently listed, log in to your profile and click on the Acquire key to obtain the New Mexico Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate. Make use of your profile to search throughout the authorized kinds you possess purchased formerly. Check out the My Forms tab of your own profile and have yet another version of your record you require.

Should you be a whole new customer of US Legal Forms, here are simple directions that you should comply with:

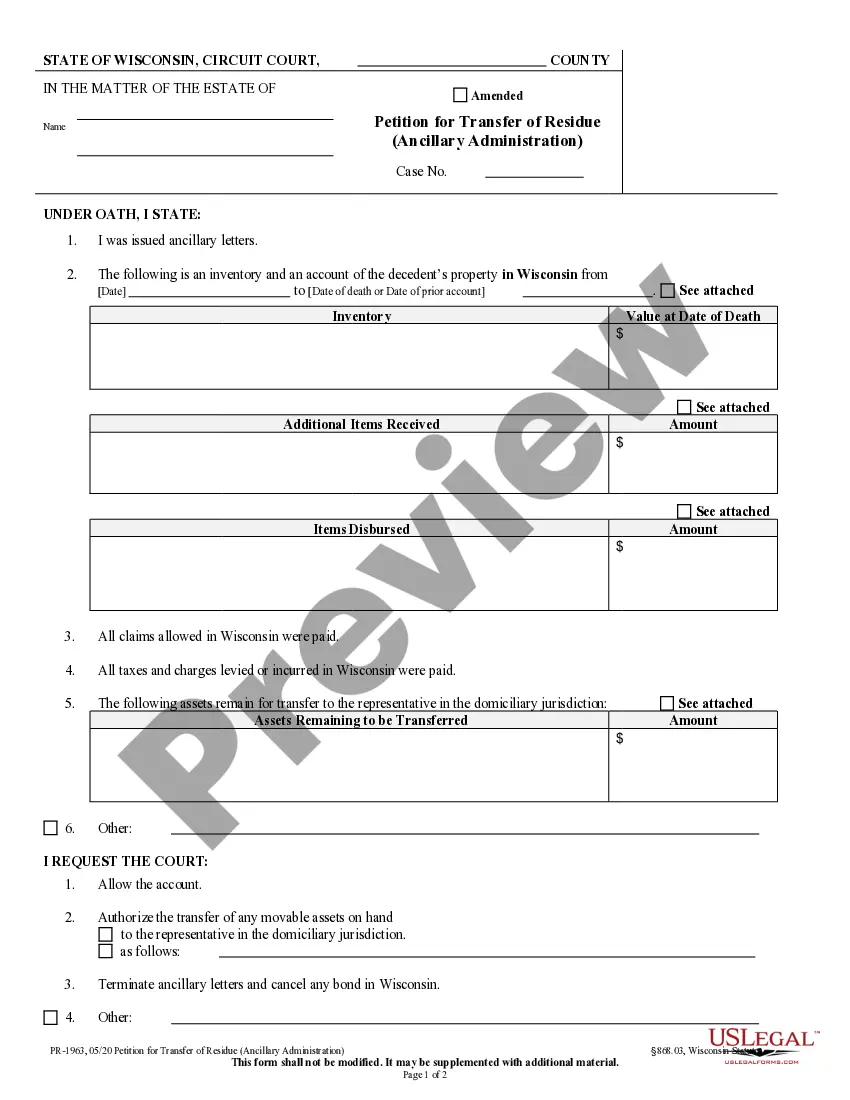

- First, make certain you have selected the proper kind for your personal town/county. It is possible to look over the shape while using Review key and look at the shape description to make sure this is the best for you.

- In case the kind fails to satisfy your requirements, take advantage of the Seach industry to obtain the right kind.

- When you are certain the shape is suitable, click on the Buy now key to obtain the kind.

- Pick the prices strategy you desire and enter in the needed information. Create your profile and purchase your order utilizing your PayPal profile or bank card.

- Pick the file file format and obtain the authorized record template to your gadget.

- Complete, edit and print and sign the received New Mexico Sample Letter for Discharge of Debtor and Order Approving Trustee's Report of No Distribution and Closing Estate.

US Legal Forms is definitely the most significant library of authorized kinds where you can discover various record themes. Make use of the service to obtain skillfully-produced paperwork that comply with condition requirements.

Form popularity

FAQ

Can a Bankruptcy Trustee Take Your Tax Refund After a Discharge? There are two types of bankruptcy for individuals, Chapter 7 and Chapter 13. The bankruptcy trustee can keep your tax refund in both, though with Chapter 7 it will happen only once. With Chapter 13, it can happen every year of your repayment plan.

Whether the trustee can take money you receive after filing your case depends on whether you were entitled to the money at the time your case was filed and how it was listed on your forms, if at all.

This order means that no one may make any attempt to collect a discharged debt from the debtors personally. For example, creditors cannot sue, garnish wages, assert a deficiency, or otherwise try to collect from the debtors personally on discharged debts.

When Lotto Winnings Aren't Exempt. Any winnings above your allowed exemption amounts go to the bankruptcy trustee to the extent necessary to pay your debts. However, if there is money left after all of your debts and the costs of the bankruptcy are paid, the excess will be returned to you.

The Trustee's Report of No Distribution, or NDR, lets the court and all interested parties know that no money will be paid to creditors. If a NDR is filed, the court will close the bankruptcy case shortly after the discharge has been entered. Unfortunately, you can only find the NDR by reviewing your case docket.

Closed Without a Discharge Cases are closed without discharge when the debtor does not complete the required debtor education required as a condition of discharge. The court may also close your case without discharge if you failed the last step for getting rid of debt. Your filing may not have been filed timely.

Closing a Chapter 7 Bankruptcy After Discharge A Chapter 7 case will remain open after the discharge if the Chapter 7 trustee appointed to the matter needs additional time to sell assets or if the case involves litigation.

Summary. Your trustee may exercise their legal function to review your finances including your bank accounts. However, they are not permitted to touch any of your funds. Unless, of course, you have stipulated that in your repayment plan.