New Mexico Sample Letter for Tax Clearance Letters

Description

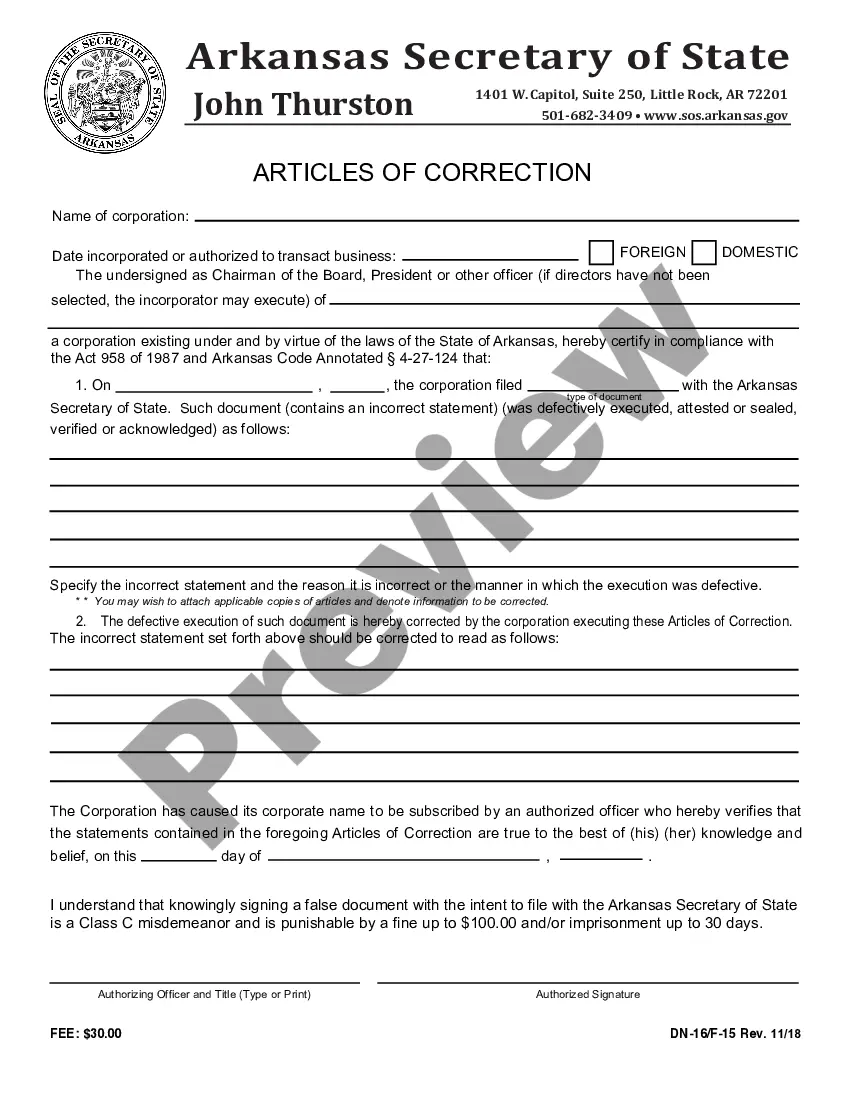

How to fill out Sample Letter For Tax Clearance Letters?

Have you been within a placement that you will need paperwork for sometimes company or personal functions almost every day time? There are plenty of legitimate document web templates available on the Internet, but locating ones you can rely on is not simple. US Legal Forms delivers thousands of type web templates, just like the New Mexico Sample Letter for Tax Clearance Letters, which are written to meet state and federal demands.

In case you are already familiar with US Legal Forms internet site and get an account, basically log in. Next, you can obtain the New Mexico Sample Letter for Tax Clearance Letters design.

If you do not come with an accounts and would like to start using US Legal Forms, adopt these measures:

- Get the type you will need and ensure it is for that appropriate metropolis/area.

- Utilize the Review key to examine the shape.

- See the outline to actually have chosen the correct type.

- When the type is not what you are seeking, use the Lookup area to find the type that suits you and demands.

- Whenever you get the appropriate type, just click Purchase now.

- Select the rates plan you want, fill in the specified information to make your bank account, and buy your order using your PayPal or bank card.

- Decide on a practical file format and obtain your backup.

Get each of the document web templates you might have bought in the My Forms food list. You can obtain a further backup of New Mexico Sample Letter for Tax Clearance Letters anytime, if required. Just go through the required type to obtain or produce the document design.

Use US Legal Forms, probably the most extensive variety of legitimate varieties, to save lots of some time and stay away from blunders. The assistance delivers professionally made legitimate document web templates which you can use for a range of functions. Generate an account on US Legal Forms and commence generating your life easier.

Form popularity

FAQ

A clearance certificate confirms that all tax liabilities of an individual or entity have been paid. The certificate is applicable upon the sale of a business, transfer of ownership, or the death of an individual.

A Tax Compliance Certificate is a document issued by a Secretary of State or State Department of Revenue. The Tax Compliance Certificate is evidence that a Corporation, LLC or Non Profit is in Good Standing with respect to any tax returns due and taxes payable to the state.

If you are a new business, register online with the New Mexico Taxation and Revenue Department to retrieve your CRS Identification Number and filing frequency. Your filing frequency refers to the frequency at which you need to make withholding tax payments to the agency.

You may also close your account by completing and submitting form ACD-31015 BusinessTax Registration. Instructions are included with the form. Be sure all your taxes are paid by the due dates associated with your tax account.

After registering with Taxation and Revenue and receiving a Business Tax Identification Number, you may obtain an NTTC online through the Taxpayer Access Point (TAP). Please note that resale certificates issued by other states are not valid in New Mexico.

The Taxation and Revenue Department serves the State of New Mexico by providing fair and efficient tax and motor vehicle services. The Department administers more than 35 tax programs and distributes revenue to the State and to local and tribal governments throughout New Mexico.

In New Mexico a Tax Status Compliance Certificate is called a Tax Compliance Certificate and is issued by the New Mexico Department of Taxation and Revenue for a Company (Corporation or LLC) or Sole Proprietor which has met all of its New Mexico tax obligations.