A motion to release property is a pleading asking a judge to issue a ruling that will result in the release of property or a person from custody. When property is held in custody, a motion to release must be filed in order to get it back. There are a number of situations where this may become necessary. These can include cases where property is confiscated and the cause of the confiscation is later deemed spurious, as well as situations where people deposit money with a court as surety in a case or in response to a court order. For example, someone brought to small claims court and sued for back rent might write a check to the court for the amount owed, and the landlord would need to file a motion to release for the court to give him the money.

New Mexico Motion to Release Property from Levy upon Filing Bond

Description

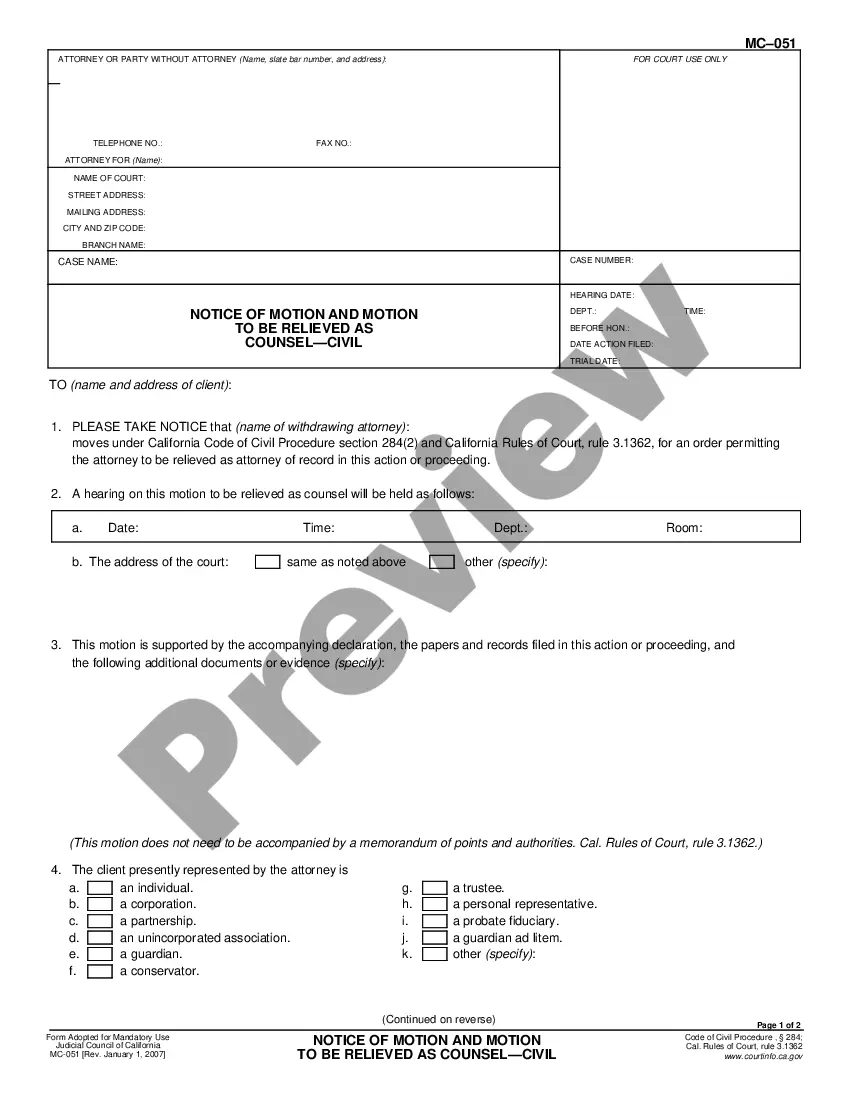

How to fill out Motion To Release Property From Levy Upon Filing Bond?

If you wish to total, obtain, or print out legitimate document themes, use US Legal Forms, the biggest variety of legitimate types, that can be found online. Utilize the site`s easy and hassle-free look for to find the documents you will need. Different themes for enterprise and specific functions are categorized by types and claims, or search phrases. Use US Legal Forms to find the New Mexico Motion to Release Property from Levy upon Filing Bond with a few click throughs.

If you are currently a US Legal Forms consumer, log in for your profile and click the Acquire option to get the New Mexico Motion to Release Property from Levy upon Filing Bond. You can even access types you formerly delivered electronically from the My Forms tab of your profile.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape to the proper town/region.

- Step 2. Make use of the Preview choice to look through the form`s content material. Do not forget about to read through the information.

- Step 3. If you are unsatisfied with all the type, take advantage of the Research industry towards the top of the display to locate other models of the legitimate type format.

- Step 4. Upon having identified the shape you will need, click on the Buy now option. Choose the pricing plan you favor and add your accreditations to register for an profile.

- Step 5. Procedure the deal. You should use your bank card or PayPal profile to accomplish the deal.

- Step 6. Find the format of the legitimate type and obtain it in your gadget.

- Step 7. Full, edit and print out or indication the New Mexico Motion to Release Property from Levy upon Filing Bond.

Each legitimate document format you buy is your own property forever. You may have acces to each and every type you delivered electronically within your acccount. Go through the My Forms segment and pick a type to print out or obtain once again.

Be competitive and obtain, and print out the New Mexico Motion to Release Property from Levy upon Filing Bond with US Legal Forms. There are thousands of specialist and state-specific types you can use for the enterprise or specific requires.

Form popularity

FAQ

Unless the judgment has been stayed, the clerk of the court shall issue a writ of execution for seizure of property to satisfy a judgment on an underlying dispute: (1) if the judgment debtor is not a natural person, at any time after the filing of the judgment; or (2) if the judgment debtor is a natural person: (a) ...

One way to collect upon a judgment in New Mexico is to obtain a judgment lien A judgment lien gives the creditor the right to be paid a certain amount of money from proceeds from the sale of the debtor's property. The judgment creditor will need to identify where the defendant (now the judgment debtor) has property.

One way to collect upon a judgment in New Mexico is to obtain a judgment lien A judgment lien gives the creditor the right to be paid a certain amount of money from proceeds from the sale of the debtor's property. The judgment creditor will need to identify where the defendant (now the judgment debtor) has property.

? The personal representative of an estate has a continuing fiduciary duty to protect the assets of the estate and to properly account therefor until his appointment is terminated by court order or his death.

If the property is in New Mexico and the owner dies without leaving a will, one-fourth of the property passes to the surviving spouse and three-fourths to the children.

? Mandamus is a proper action to contest the validity of the secretary of state's action in failing to certify a party's nominees. State ex rel. Chavez v. Evans, 1968-NMSC-167, 79 N.M. 578, 446 P.

Any person having a right to the immediate possession of any goods or chattels, wrongfully taken or wrongfully detained, may bring an action of replevin for the recovery thereof and for damages sustained by reason of the unjust caption or detention thereof. History: C.L. 1897, § 2685 (228), added by Laws 1907, ch.

A writ of execution issued upon a judgment for the possession of personal property or its value must command the sheriff or constable to levy and collect the personal property, or in case possession cannot be obtained, to levy and collect the specified value for which the judgment was recovered out of any property of ...