New Mexico Sales Receipt

Description

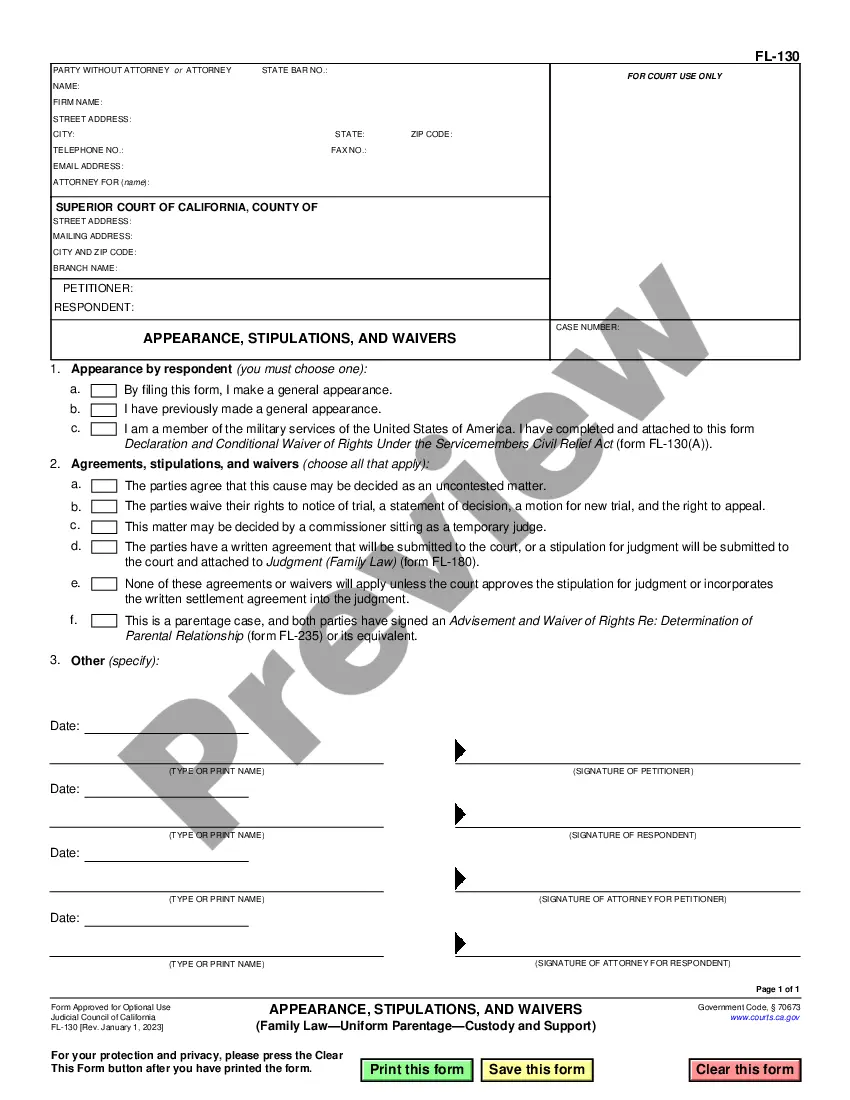

How to fill out Sales Receipt?

If you require complete, download, or printing legal document templates, utilize US Legal Forms, the premier collection of legal forms, accessible online.

Take advantage of the site's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and claims, or keywords.

Each legal document template you purchase is yours indefinitely. You have access to every form you acquired within your account. Click the My documents section and select a form to print or download again.

Stay competitive and download and print the New Mexico Sales Receipt with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to acquire the New Mexico Sales Receipt within just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to obtain the New Mexico Sales Receipt.

- You can also access forms you previously obtained from the My documents tab in your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's content. Remember to check the summary.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other templates in the legal form category.

- Step 4. After locating the form you desire, click the Get now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the New Mexico Sales Receipt.

Form popularity

FAQ

In New Mexico, certain services are exempt from sales tax, including those that relate to manufacturing, tangible personal property, and some professional services. For instance, services like medical and educational services typically do not require a New Mexico Sales Receipt. Additionally, services performed by certain nonprofits can also qualify for exemption. Understanding these exemptions can help businesses avoid unnecessary tax burdens while ensuring compliance with local regulations.

New Mexico is a destination-based sales tax state. This means that the sales tax rate applied to a transaction is based on the delivery location of the goods or services sold. Therefore, when calculating sales tax for your New Mexico Sales Receipt, it is important to know the local tax rates at the destination. This ensures transparent and satisfactory transactions for your customers.

To obtain a sales tax permit in New Mexico, you must apply through the New Mexico Taxation and Revenue Department. You typically can do this online or by submitting a paper application. As part of the process, you will need to provide information about your business, including your CRS number. Once approved, you'll be empowered to issue New Mexico Sales Receipts that comply with state laws.

No, a sales tax permit and an Employer Identification Number (EIN) are not the same. A sales tax permit allows you to collect taxes from customers, while an EIN is used for federal tax identification purposes, such as hiring employees. If you plan to operate in New Mexico, you will need both for comprehensive and compliant business operations. Issuing a New Mexico Sales Receipt often requires both identifiers for thorough record-keeping.

In New Mexico, businesses must collect gross receipts tax on most sales of goods and services. It's essential to register for a CRS number and obtain a sales tax permit before transacting. Additionally, you need to file periodic tax returns reporting your receipts and tax collected. Providing a clear New Mexico Sales Receipt to your customers will help simplify this process and ensure compliance.

A New Mexico CRS number is a unique tax identification number assigned to businesses for the purpose of reporting and paying gross receipts taxes. This number is crucial for businesses operating in New Mexico as it helps in compliance with state tax laws. If you're issuing a New Mexico Sales Receipt, you'll often need to include this number for proper documentation. You can obtain your CRS number through the New Mexico Taxation and Revenue Department.

To calculate sales tax in New Mexico, you first need to know the combined state and local sales tax rates applicable to your location. Generally, the state sales tax rate is 5.125%, but local municipalities may add additional taxes. Multiply the total sales amount by the combined rate to find your total tax due. When you generate a New Mexico Sales Receipt, the sales tax will be clearly itemized for better record-keeping.

CRS numbers are unique identifiers assigned to businesses in New Mexico for tax purposes. It stands for Combined Reporting System and is used for state tax identification, including sales and gross receipts tax. Understanding your CRS number is crucial, particularly when issuing New Mexico Sales Receipts for your business.

You can find New Mexico's CRS number on your business's tax forms or by checking your original applications with the New Mexico Taxation and Revenue Department. If you cannot locate this information, consider reaching out to their office for guidance. This number is essential when managing sales transactions, especially for issuing New Mexico Sales Receipts.

To claim a New Mexico sales tax refund, you must complete a refund application available from the New Mexico Taxation and Revenue Department. Be sure to include all necessary documentation, such as original New Mexico Sales Receipts that support your claim. Following the proper steps will help expedite your refund process.