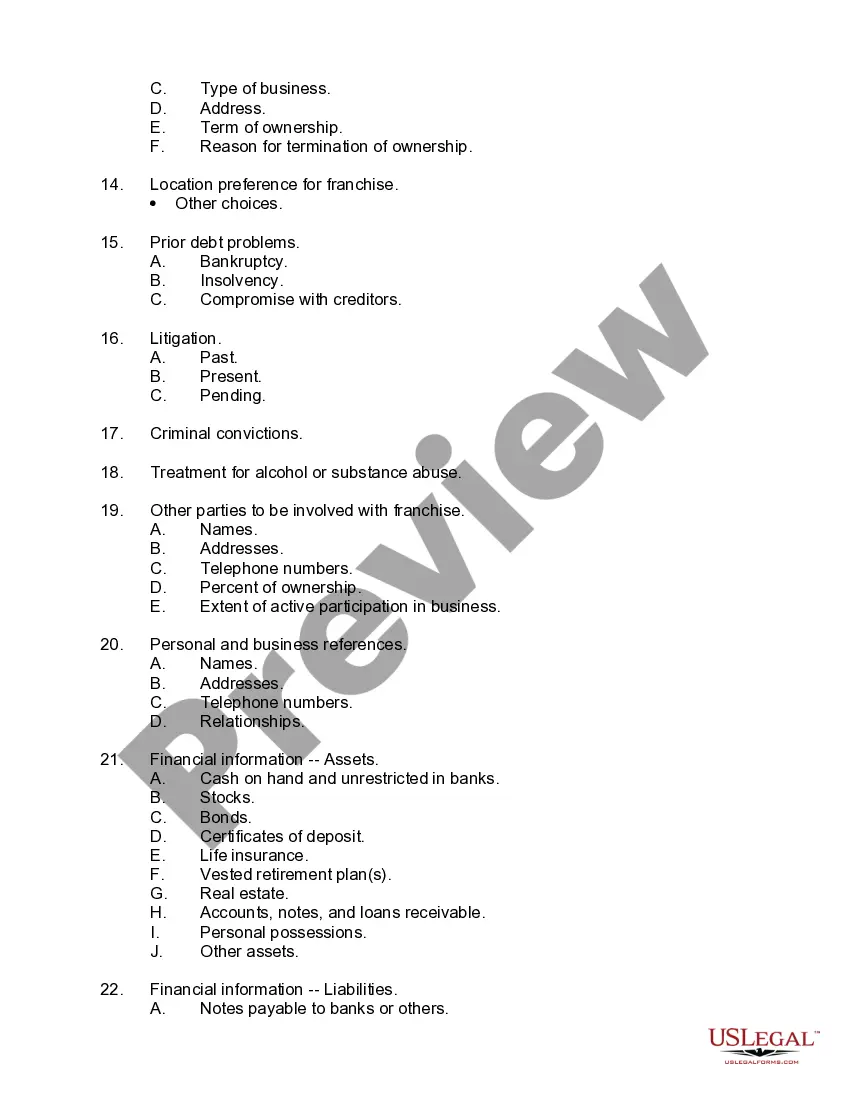

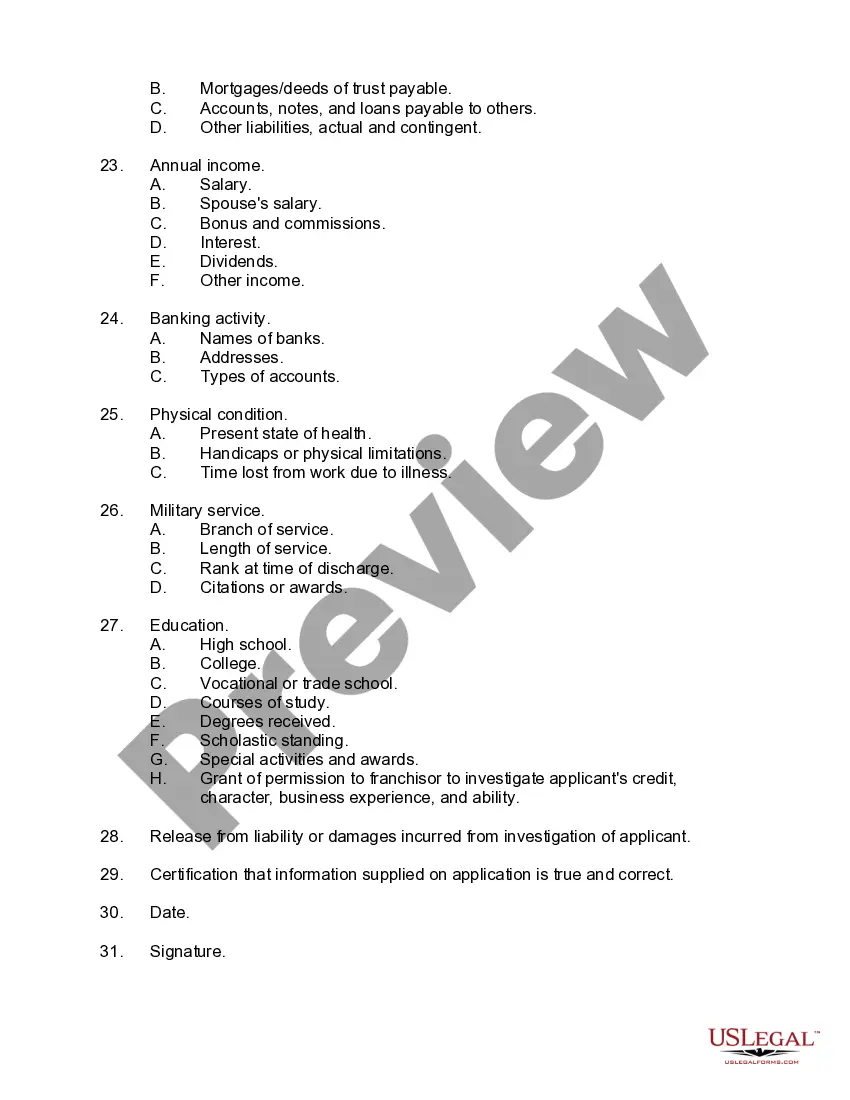

New Mexico Checklist for Drafting a Franchise Application

Description

How to fill out Checklist For Drafting A Franchise Application?

Are you currently in a situation where you require documents for either business or personal use on a daily basis? There are numerous legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms offers thousands of forms, including the New Mexico Checklist for Drafting a Franchise Application, which are designed to meet state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the New Mexico Checklist for Drafting a Franchise Application template.

- Obtain the form you need and ensure it is for the correct area/county.

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Lookup field to find the form that meets your needs and requirements.

- Once you find the appropriate form, click Purchase now.

- Select your desired pricing plan, fill out the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

To start a franchise, you need several important documents. Typically, these include a completed franchise application, a franchise disclosure document (FDD), and legal agreements that outline the terms of your relationship with the franchisor. Completing the New Mexico Checklist for Drafting a Franchise Application will help ensure you gather all necessary paperwork, minimizing potential setbacks during the process.

Yes, if you earn income in New Mexico, you will need to file a New Mexico income tax return. Understanding your filing obligations is critical for maintaining compliance. The New Mexico Checklist for Drafting a Franchise Application can support you in ensuring that you meet all necessary requirements without missing important details.

No, New Mexico does not require LLCs to file annual reports. However, it's important to remain aware of other obligations and regulations. The New Mexico Checklist for Drafting a Franchise Application can assist in outlining all necessary compliance steps for your business.

The RPD 41359 form is a New Mexico tax document used for reporting certain income types. When drafting a franchise application, you may find this form relevant. Utilizing the New Mexico Checklist for Drafting a Franchise Application will help ensure that all required forms, including the RPD 41359, are completed accurately.

New Mexico does not impose a franchise tax but may have other fees and requirements for businesses. Understanding these costs is critical, so it's beneficial to reference the New Mexico Checklist for Drafting a Franchise Application. This checklist can guide you through the process and clarify any potential expenses related to your franchise.

Yes, New Mexico does require the filing of 1099 forms. Ensuring that you follow the New Mexico Checklist for Drafting a Franchise Application can make this process easier. Filing the necessary forms helps maintain transparency and compliance with state law.

Several states do not require 1099 filing, including Delaware, Nevada, and South Dakota. Each state has its own regulations, so it’s wise to consult the New Mexico Checklist for Drafting a Franchise Application. This will help you better understand what is necessary for franchises operating across state lines.

Yes, 1099 income is generally reported to the state tax authorities in New Mexico. To ensure compliance, it’s essential to review the New Mexico Checklist for Drafting a Franchise Application. By accurately reporting this income, you can avoid penalties and maintain a good standing with state authorities.

The 14-day rule in franchising mandates that prospective franchisees must receive the Franchise Disclosure Document (FDD) at least 14 days before making any financial commitment. This rule protects franchisees by giving them time to understand the terms of the agreement. To navigate this rule effectively, refer to a New Mexico Checklist for Drafting a Franchise Application to ensure all legal requirements are satisfied.

Backing out of a franchise agreement can be difficult and often requires valid legal grounds. Typically, once both parties sign the contract, you are legally bound to its terms. However, reviewing the New Mexico Checklist for Drafting a Franchise Application may help you understand your rights and any potential exit strategies before signing.