New Mexico Expense Report

Description

How to fill out Expense Report?

Selecting the optimal legitimate document format can be a struggle.

Of course, there are countless templates available on the internet, but how will you find the right kind you need.

Utilize the US Legal Forms website. The platform provides a vast array of templates, including the New Mexico Expense Report, which can be used for both business and personal purposes.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are currently registered, Log In to your account and click the Download button to obtain the New Mexico Expense Report.

- Use your account to browse through the legitimate documents you have previously purchased.

- Visit the My documents section of your account to access another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions you should follow.

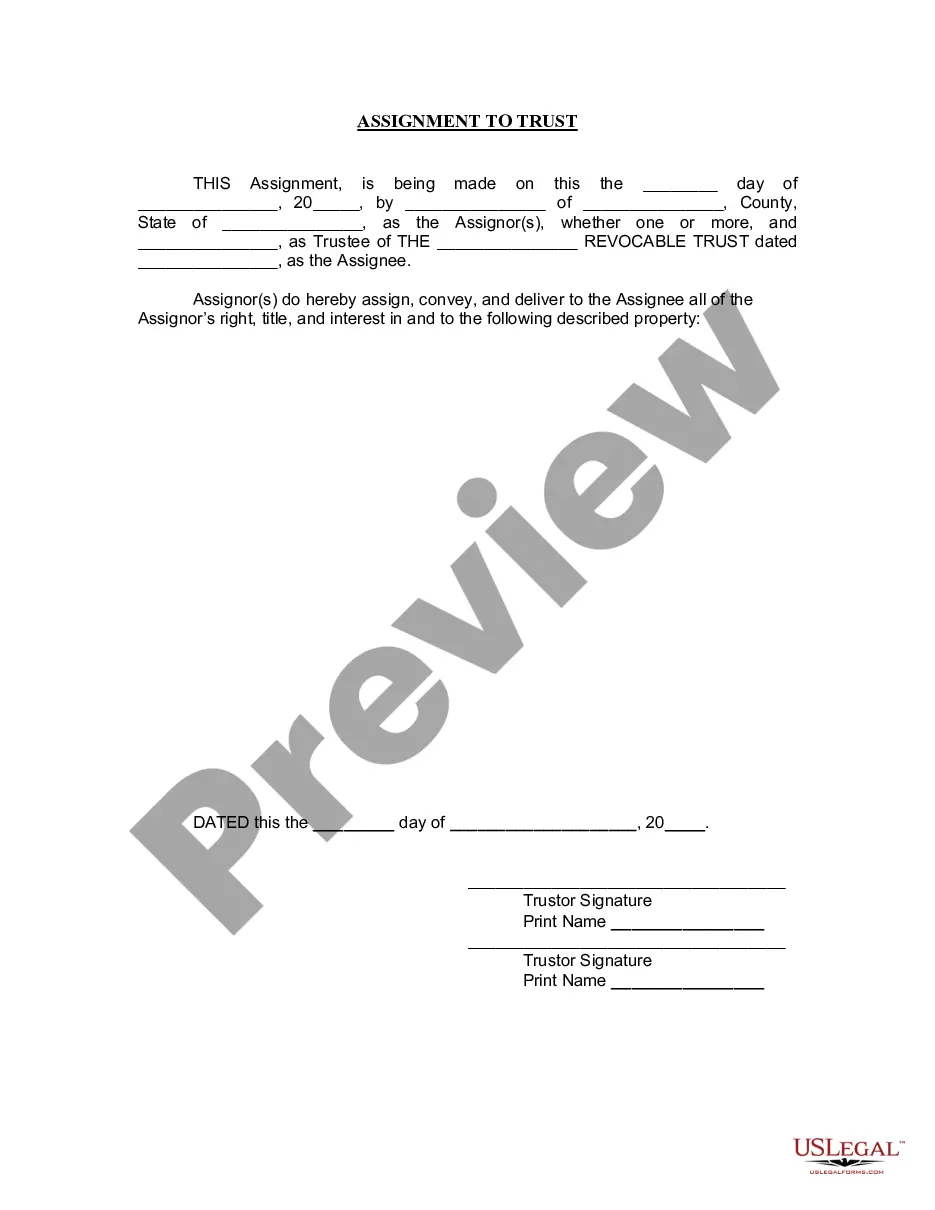

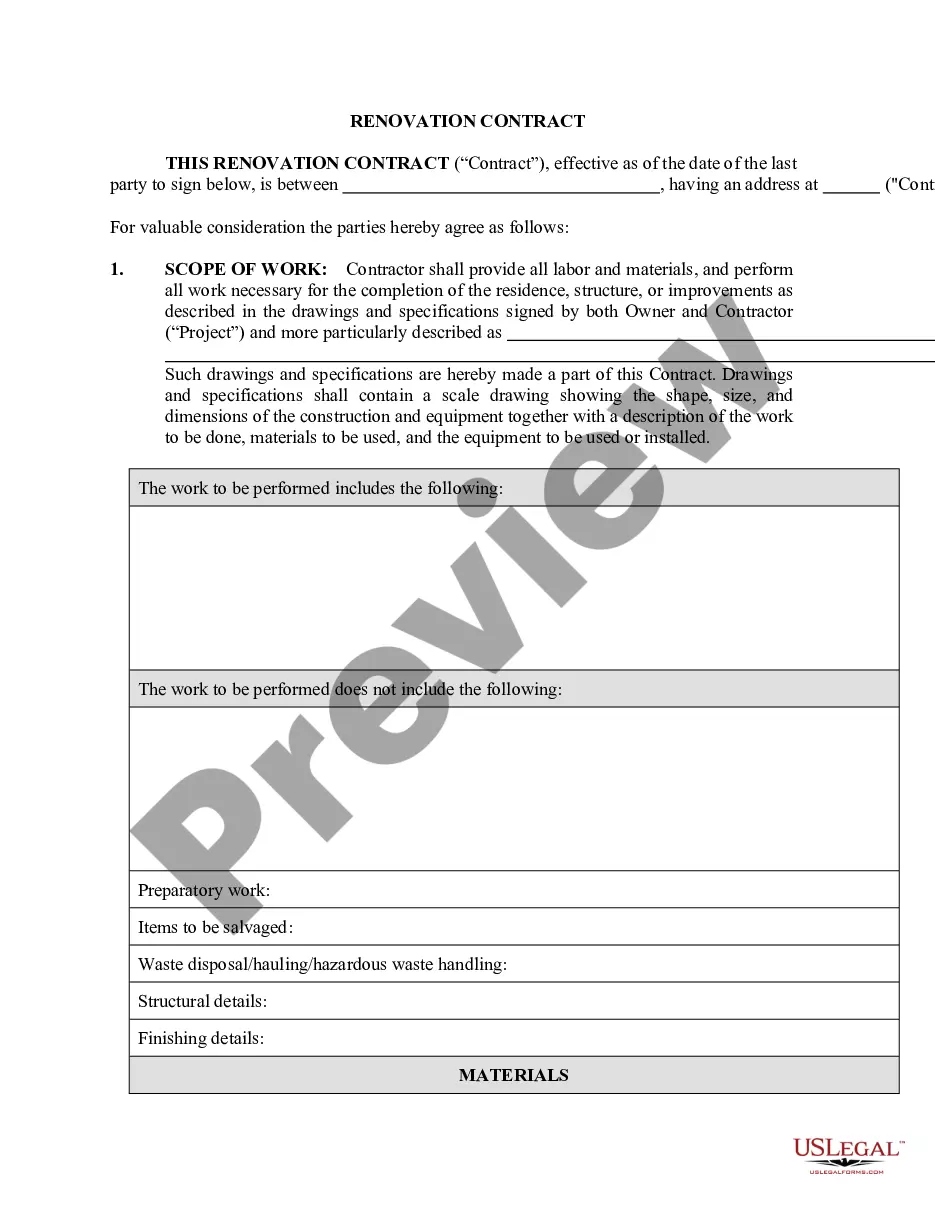

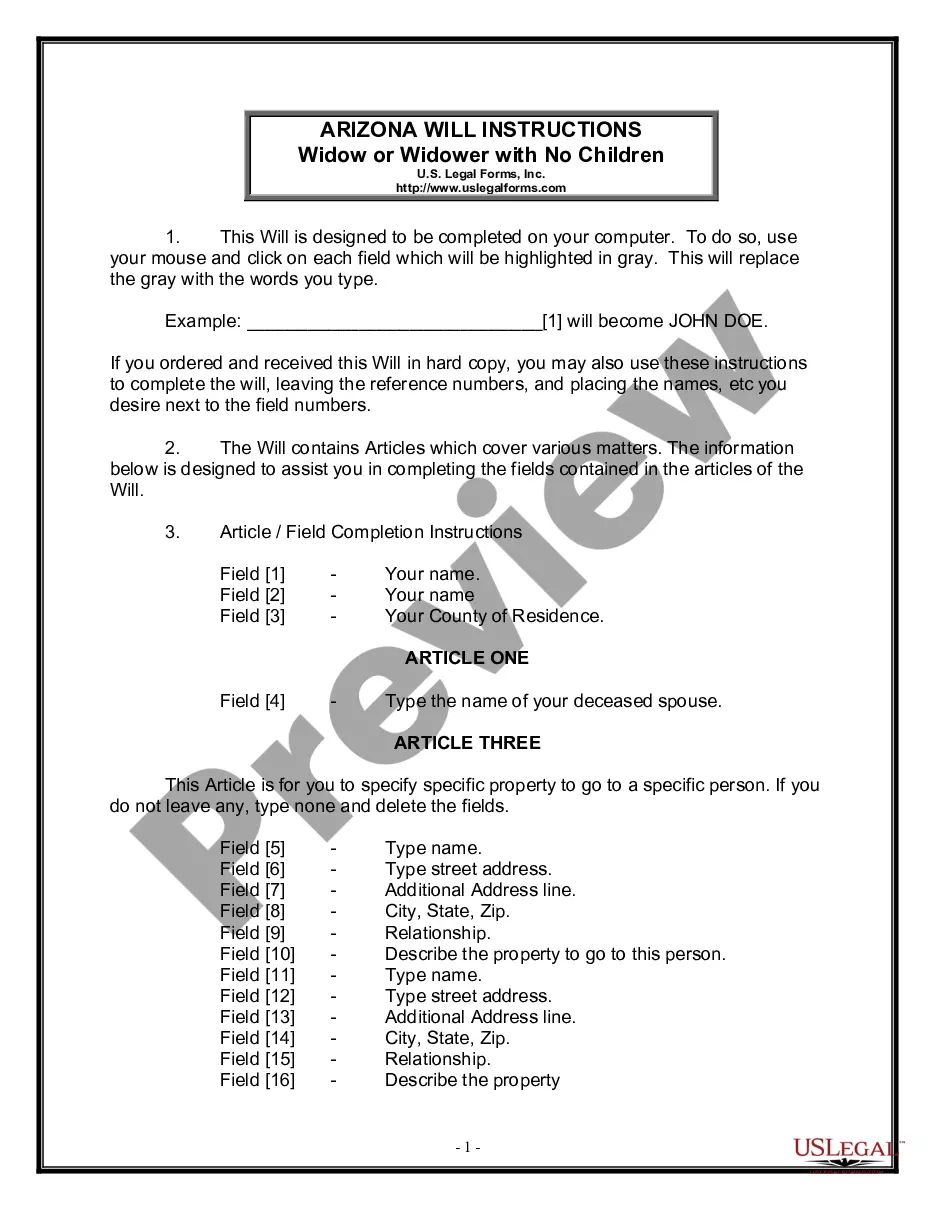

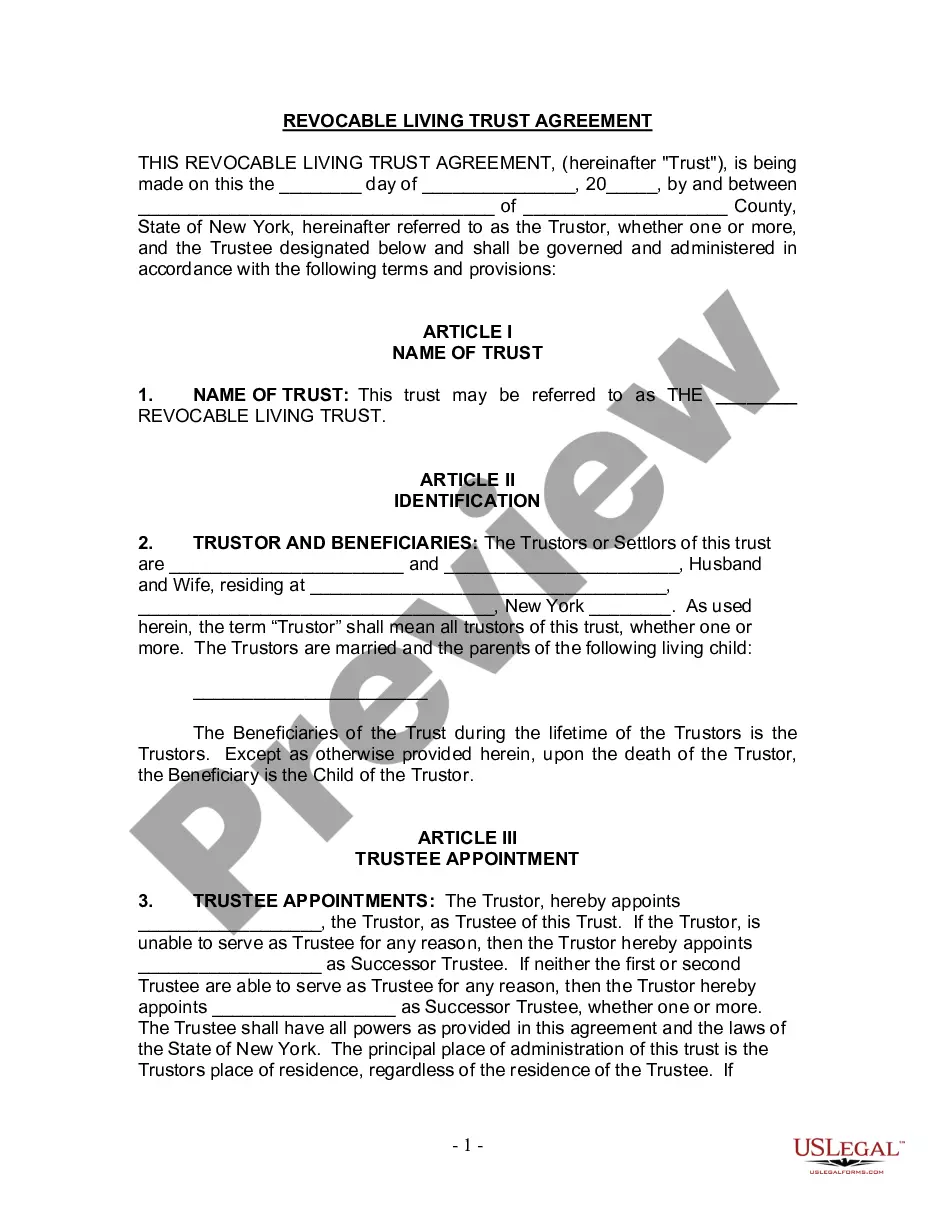

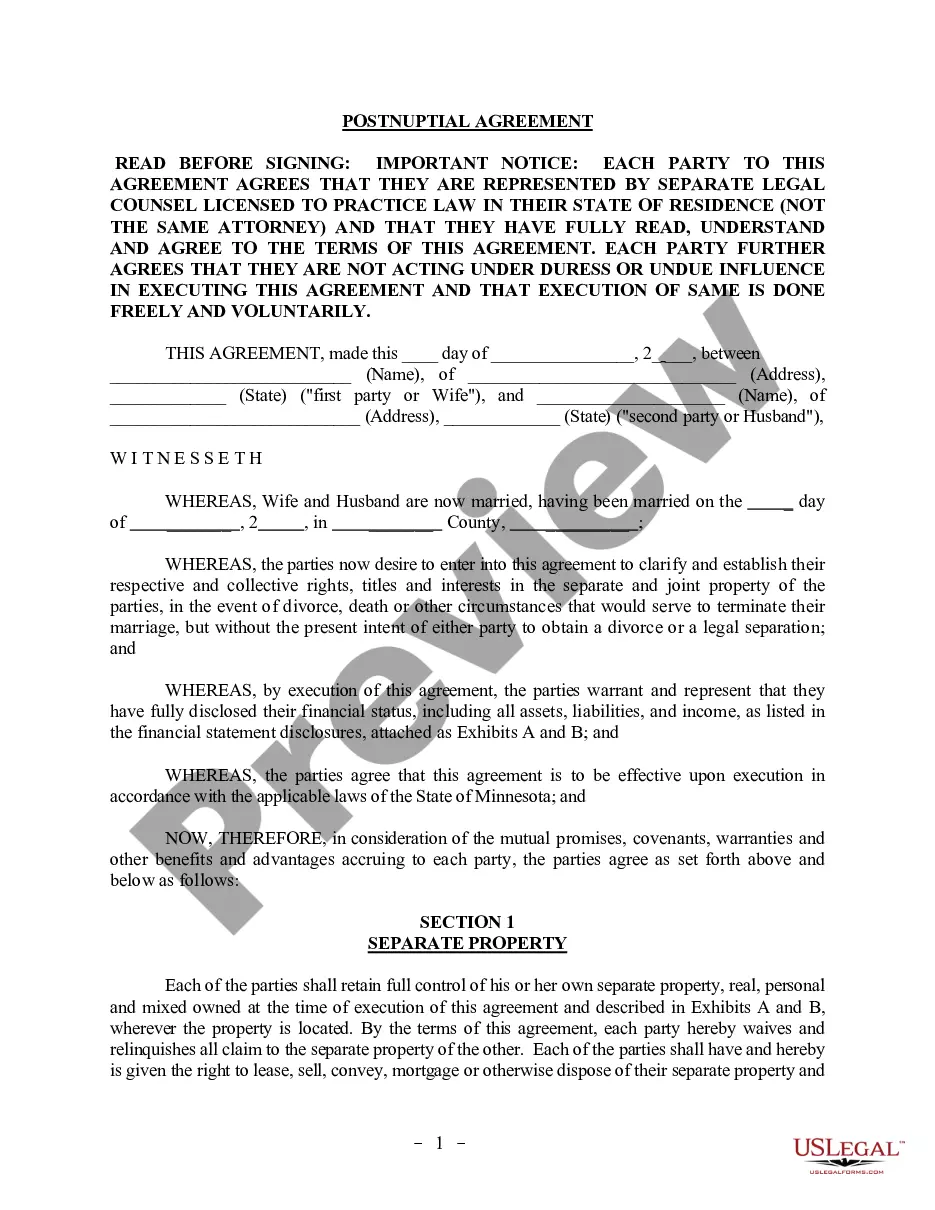

- First, ensure you have selected the correct form for your locality/county. You can review the document using the Preview button and check the document description to confirm it is the right one for you.

Form popularity

FAQ

New Mexico does require businesses to file an annual report, ensuring compliance with state regulations. Accurate record-keeping through your New Mexico Expense Report simplifies this process. The report allows you to maintain transparency and avoid potential penalties. For personalized help, consider using tools like uslegalforms, which can guide you in preparing the necessary filings.

As of now, discussions around another stimulus check in New Mexico are ongoing, and it often depends on state budget decisions. Keep an eye on official announcements regarding future distributions. Submitting your New Mexico Expense Report can make you eligible for current and future assistance programs. Staying informed will ensure you do not miss any available benefits.

Qualifying for the New Mexico rebate involves being a resident and filing a proper state tax return. Your New Mexico Expense Report helps define your eligibility by clearly outlining your income and tax situation. Remember to review your financial details carefully to ensure you're claiming everything you're entitled to. If eligible, you can benefit from a welcome rebate that supports your finances.

Eligibility for the New Mexico economic relief payment generally includes residents who meet certain income thresholds. These payments aim to support those in need, so filing a current New Mexico Expense Report can streamline your application. Always check the latest guidelines to confirm your eligibility. Information can often be found on government websites or through local offices.

If you're wondering about your New Mexico refund, you can track its status online. Usually, the New Mexico Expense Report helps you to pinpoint any delays or issues. Make sure your information is correct to avoid complications. If problems arise, consider reaching out to the New Mexico Taxation and Revenue Department for assistance.

If you have taxable income from New Mexico sources, you must file a state tax return. This includes income from self-employment or investments within the state. A New Mexico Expense Report can facilitate the organization of your expenses, making the filing process less daunting.

Some states, like Nevada and Wyoming, do not require 1099 filing for certain types of income. However, it is essential to familiarize yourself with local regulations. Regardless of your location, documenting expenses in a New Mexico Expense Report can prepare you for tax season and any potential audit.

New Mexico does not require LLCs to file annual reports, which can be a relief for business owners. However, maintaining a New Mexico Expense Report can help ensure that you stay organized and compliant with any tax obligations that may arise. Regular updates to your report will simplify your tax filing.

Yes, a 1099 needs to be filed when you have made payments that meet specific thresholds to non-corporate entities. This requirement aims to keep track of income for those individuals. A New Mexico Expense Report will assist you in documenting these payments, ensuring compliance with filing requirements.

To file your Combined Reporting System (CRS) in New Mexico, you need to gather all relevant income and deduction data. This information can be organized in a New Mexico Expense Report, making it easier to compile your filings. Filing can be done online through the New Mexico Taxation and Revenue Department's website.