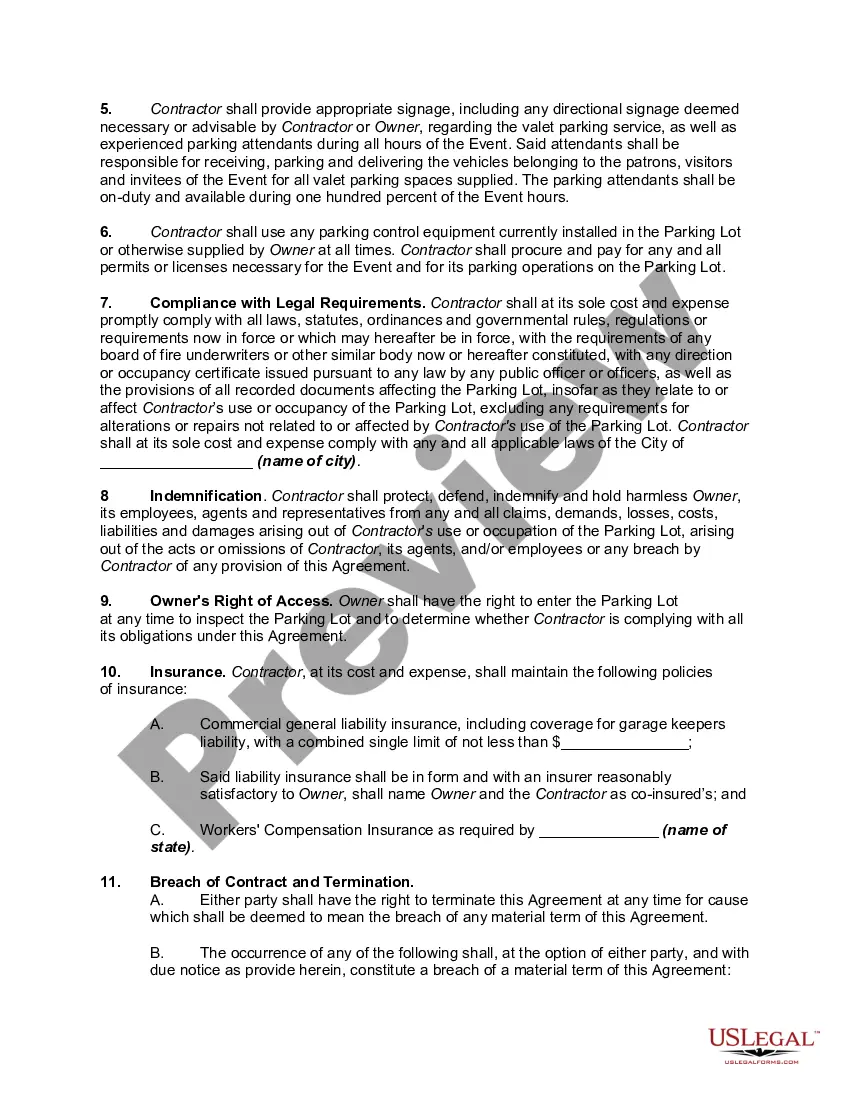

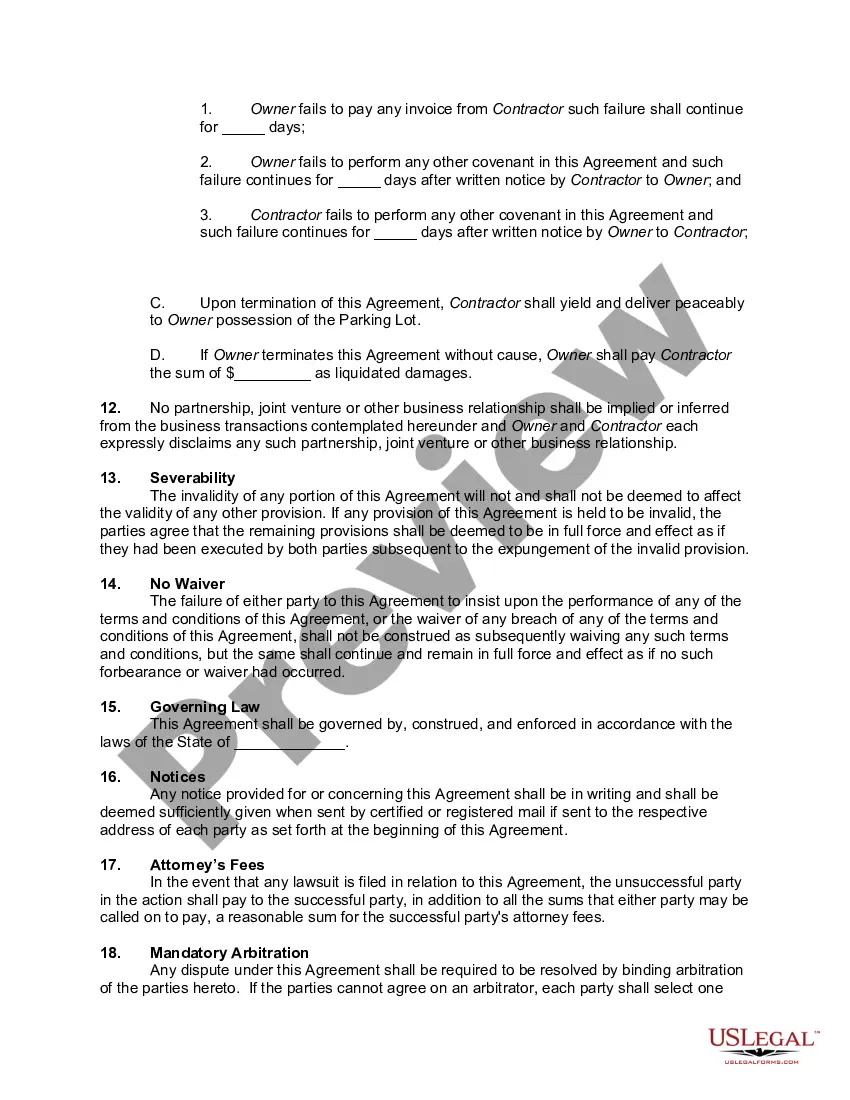

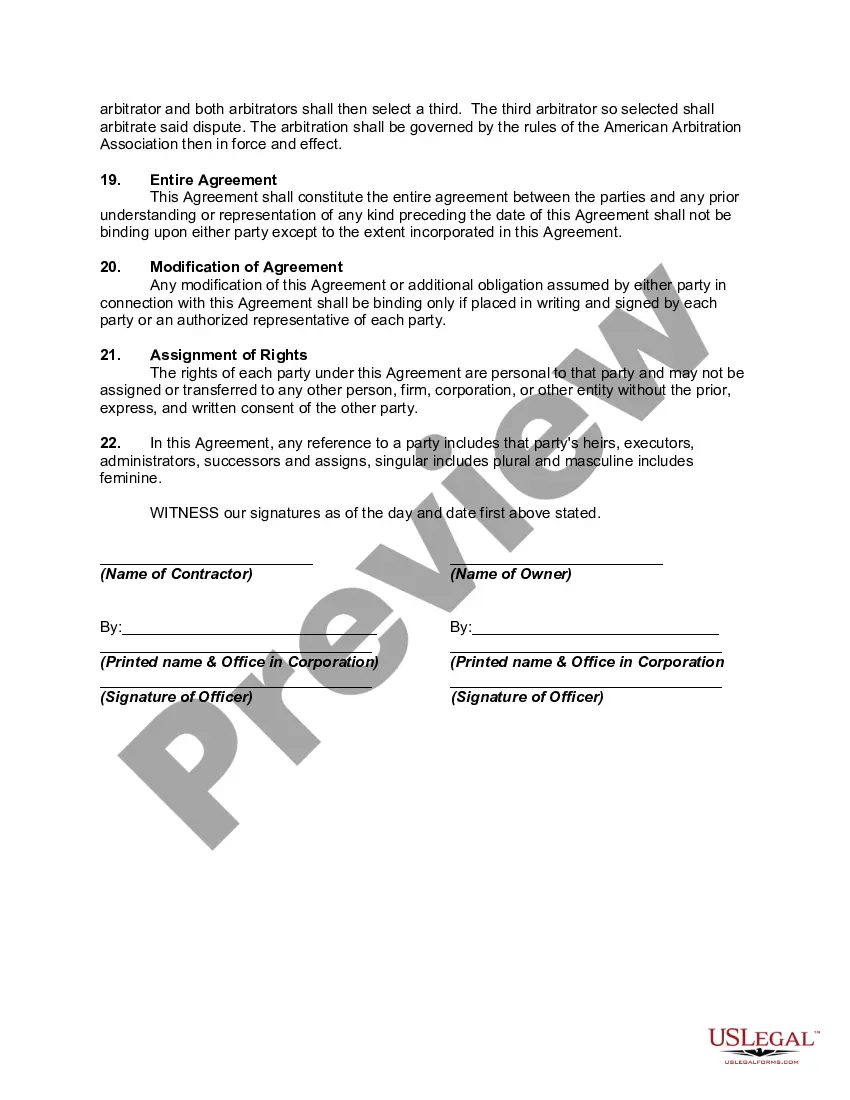

New Mexico Valet Parking Agreement

Description

How to fill out Valet Parking Agreement?

Are you in a position where you require documents for potential business or specific activities nearly every day.

There are numerous official document templates available online, but discovering reliable ones isn’t easy.

US Legal Forms provides thousands of form templates, including the New Mexico Valet Parking Agreement, which are designed to comply with federal and state regulations.

Once you locate the correct form, simply click Acquire now.

Choose the payment plan you prefer, fill in the required information to create your account, and complete your order with your PayPal or credit card.

- If you are currently familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the New Mexico Valet Parking Agreement template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your specific city/region.

- Utilize the Review button to verify the form.

- Check the description to confirm you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to find the document that meets your needs.

Form popularity

FAQ

To make a New Mexico PTE election, file the appropriate forms with the New Mexico Taxation and Revenue Department by the established deadline. Ensure you review eligibility criteria and gather necessary documents. This process is essential for compliance and can affect your overall business operations related to your New Mexico Valet Parking Agreement.

To make a tax election, you generally need to file specific forms with the tax authority during the designated election period. It's crucial to ensure that you meet all conditions set by the New Mexico Taxation and Revenue Department. Documentation is important for your New Mexico Valet Parking Agreement, so keep records of your election submission.

The Pass-Through Entity (PTE) rate in New Mexico is currently set at a specific percentage that varies based on the entity's income. This rate is essential for understanding your tax obligations and ensuring that your business remains in compliance. Be sure to account for this rate when managing your New Mexico Valet Parking Agreement.

The RPD 41359 form is used in New Mexico for the Personal Income Tax Non-Resident Application. This form allows non-resident taxpayers to address tax obligations relevant to New Mexico activities. Completing this form correctly ensures that your New Mexico Valet Parking Agreement stays compliant with tax regulations.

Yes, it is possible to make a late PTE election under specific conditions. To qualify, you must meet certain eligibility criteria and submit the required forms to the New Mexico Taxation and Revenue Department. Remember that a timely submission is important for compliance with your New Mexico Valet Parking Agreement.

To apply for a New Mexico CRS number, visit the New Mexico Taxation and Revenue Department's website. You can complete the online application form. Once you submit your application, allow for processing time, and you will receive your CRS number in your issued documents. This number is crucial for your New Mexico Valet Parking Agreement.

To organize your valet parking effectively, start by assessing the space available and estimating the number of vehicles you expect. Develop a clear plan that includes staff assignments, traffic flow management, and signage. Implement a New Mexico Valet Parking Agreement to outline responsibilities and ensure a smooth operation, enhancing your guests' experience.

Yes, you can sue a valet parking company if they are negligent or cause damage to your vehicle. Common issues include loss of property or vehicle damage while in their care. A New Mexico Valet Parking Agreement provides guidelines for liability, which can be crucial if disputes arise and may help you navigate the legal process.

A valet parking attendant is responsible for parking and retrieving vehicles for guests. They greet patrons, provide excellent customer service, and handle vehicles with care. Knowledge of the New Mexico Valet Parking Agreement ensures compliance with local regulations, which can enhance the overall guest experience.

To write a letter requesting a parking space, start with a clear subject line that indicates your purpose. State who you are, mention your intended use of the parking space, and provide any relevant details such as dates and location. Be polite and specific about your request, and consider mentioning a New Mexico Valet Parking Agreement to show you're serious about the arrangement.