An independent contractor is a person or business who performs services for another person under an express or implied agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The person who hires an independent contractor is not liable to others for the acts or omissions of the independent contractor. An independent contractor is distinguished from an employee, who works regularly for an employer. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays their own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

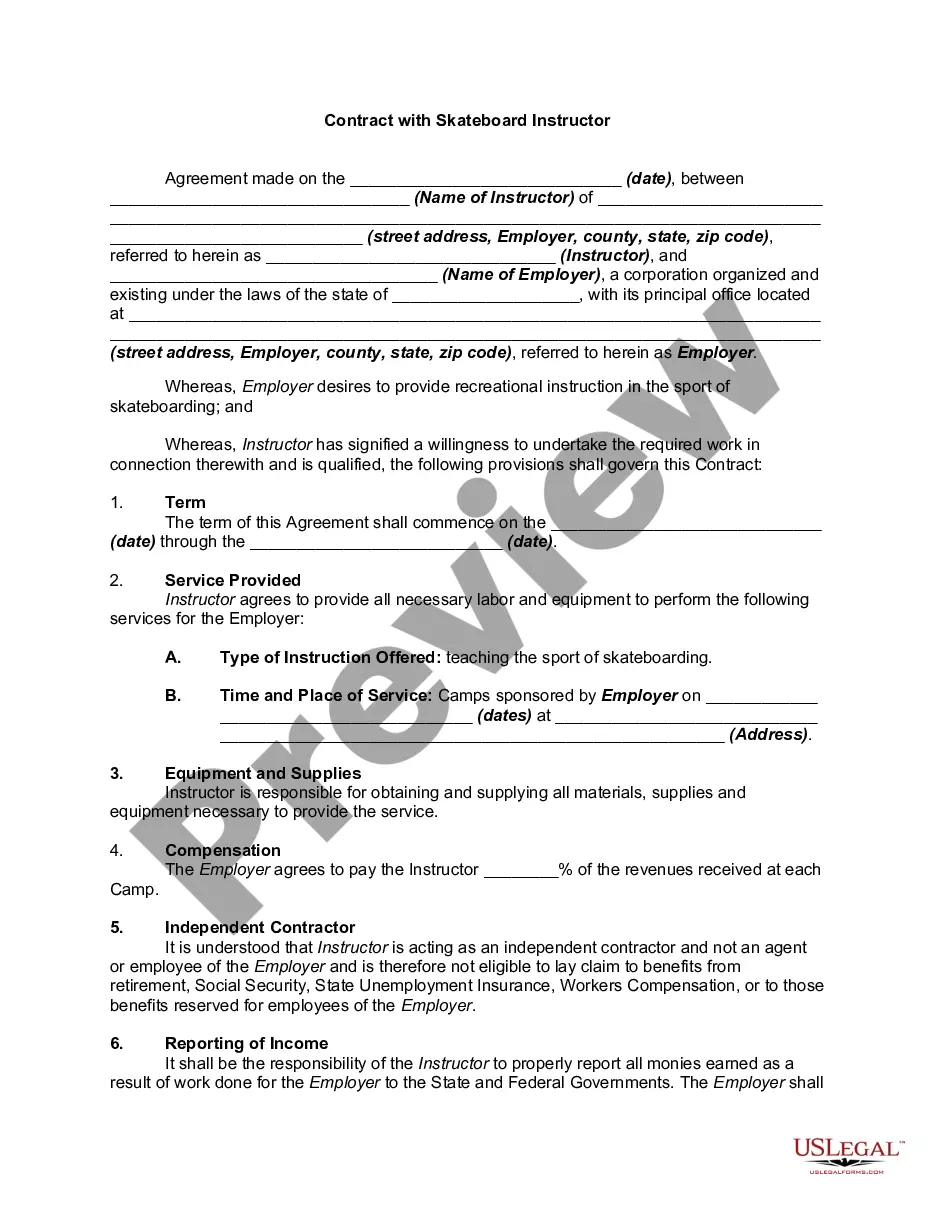

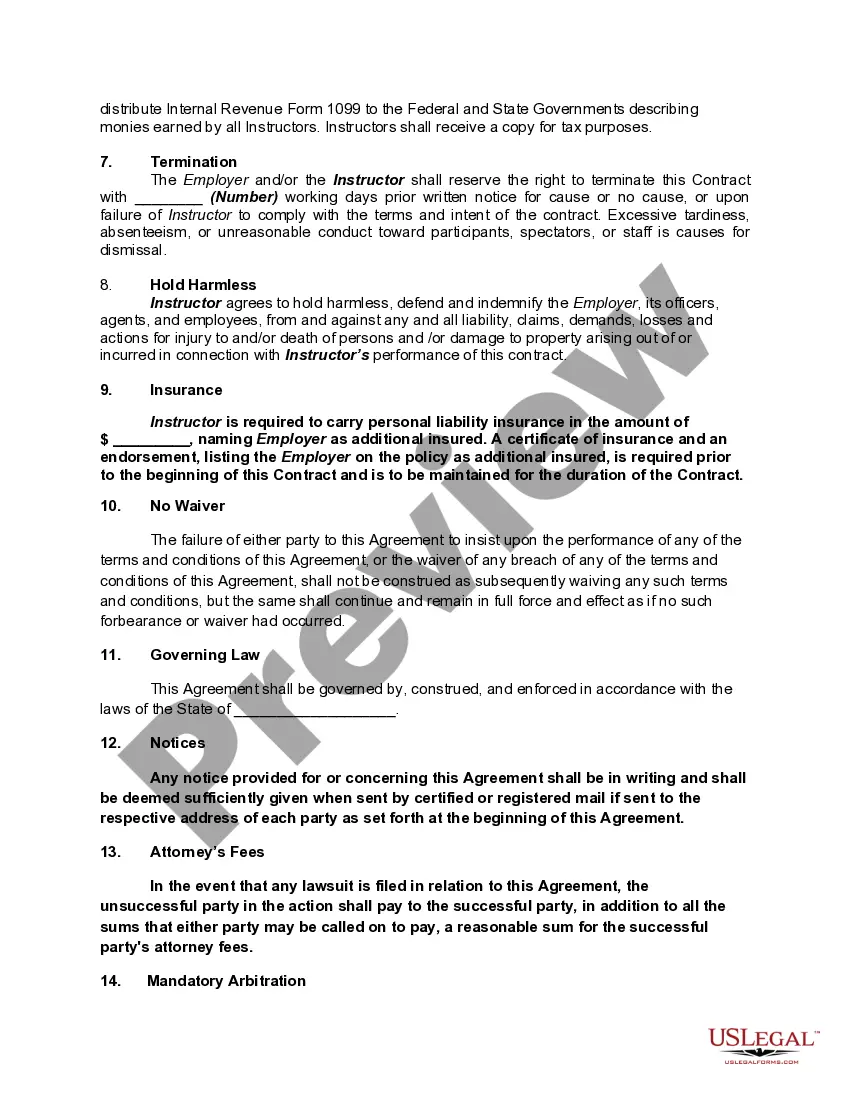

New Mexico Contract with Skateboard Instructor as a Self-Employed Independent Contractor

Description

How to fill out Contract With Skateboard Instructor As A Self-Employed Independent Contractor?

Are you presently in a situation where you need documents for either business or specific objectives nearly every workday.

There are numerous authorized document templates accessible online, but finding ones you can rely on is challenging.

US Legal Forms provides a vast selection of form templates, including the New Mexico Contract with Skateboard Instructor as a Self-Employed Independent Contractor, designed to meet state and federal requirements.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Mexico Contract with Skateboard Instructor as a Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your appropriate city/region.

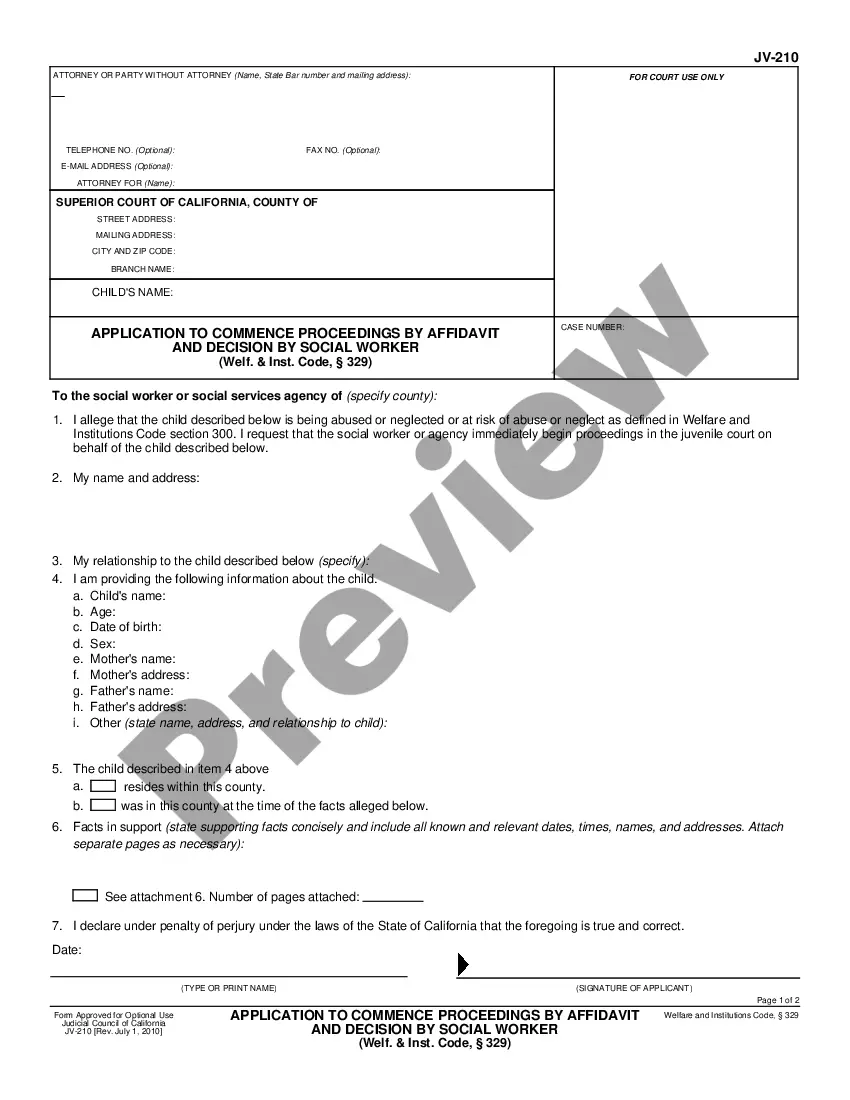

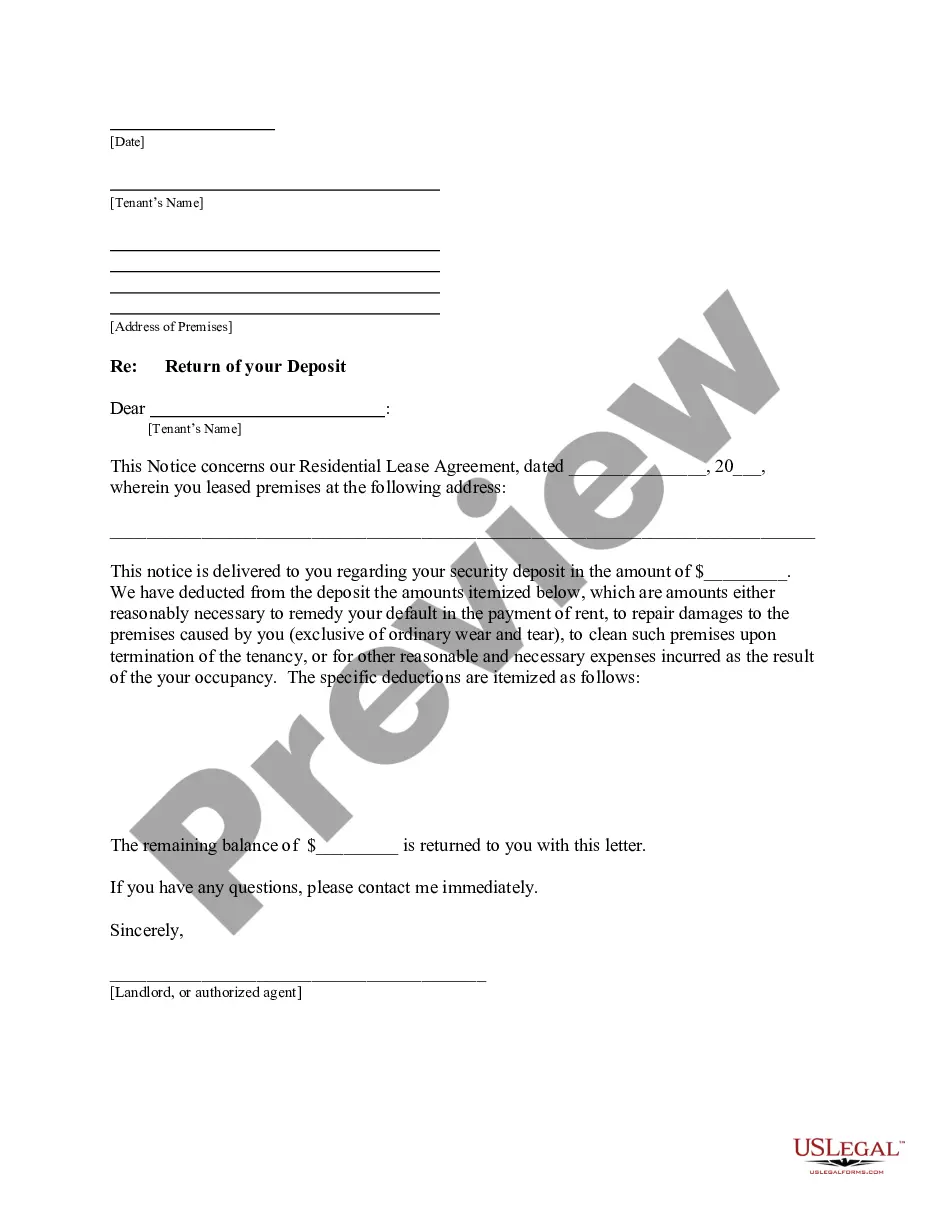

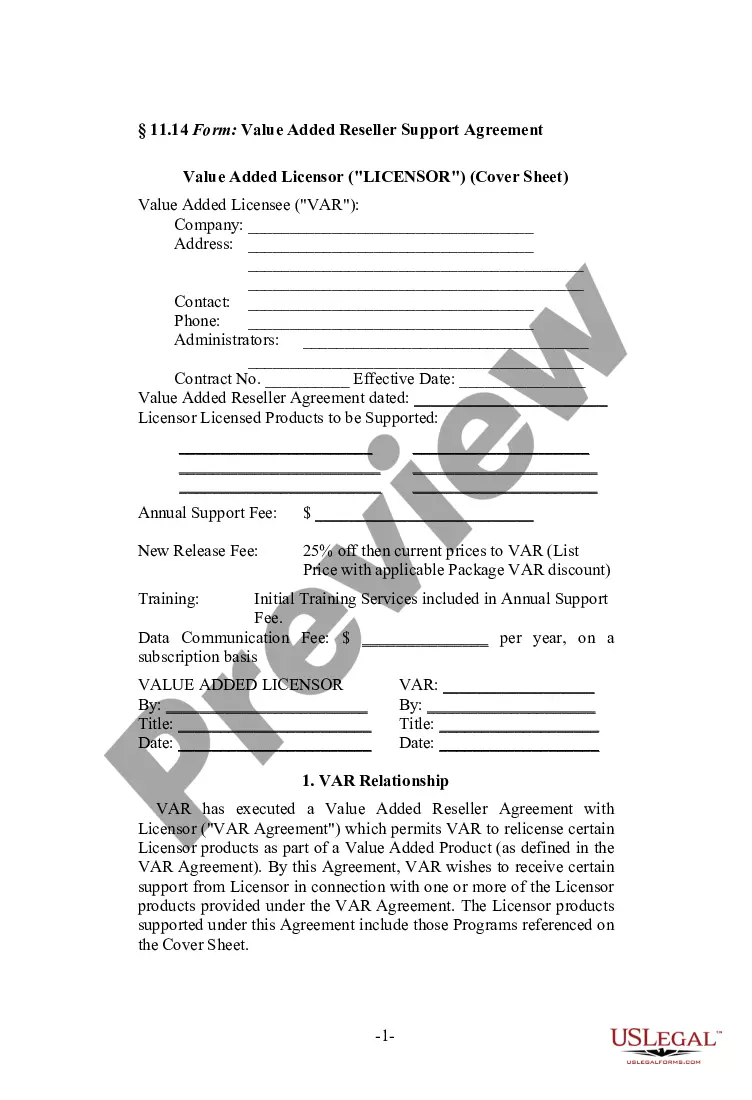

- Use the Review button to verify the form.

- Check the description to make sure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your requirements.

- Once you find the right form, click on Acquire now.

- Choose the payment plan you want, fill in the required information to set up your account, and pay for your order using PayPal or a credit card.

- Select a convenient file format and download your version.

- Access all the document templates you have purchased from the My documents menu. You can obtain another copy of the New Mexico Contract with Skateboard Instructor as a Self-Employed Independent Contractor anytime; just select the needed form to download or print the document template.

Form popularity

FAQ

As a self-employed individual, you must file taxes if your net earnings exceed $400. This means that even if you earn less than $5,000, your tax responsibility kicks in at this threshold. Utilizing resources from uslegalforms allows you to clarify your tax obligations under a New Mexico Contract with Skateboard Instructor as a Self-Employed Independent Contractor.

Whether board members are classified as independent contractors depends on their relationship with the organization and the nature of their compensation. Typically, board members serve as independent contractors if they receive payment for their services, but the specifics can vary. Understanding the legal nuances within your New Mexico Contract with Skateboard Instructor as a Self-Employed Independent Contractor can highlight your obligations and rights in similar situations.

To avoid paying taxes, an independent contractor's net earnings must remain below $400. This threshold means that if your earnings are at or below this amount, you do not have to file a tax return. However, always consider documenting your income, benefits, and expenses for future reference, especially when working under a New Mexico Contract with Skateboard Instructor as a Self-Employed Independent Contractor.

If you receive a 1099 form, you need to report all income on your tax return, regardless of the amount. However, you are only required to file taxes if your net earnings exceed $400. Thus, having a clear understanding of the New Mexico Contract with Skateboard Instructor as a Self-Employed Independent Contractor can aid in proper record-keeping and tax filing.

Even if your earnings are less than $5,000, you must file taxes as an independent contractor if your net income is $400 or more. This requirement applies regardless of your total income level. You can benefit from using platforms like uslegalforms to ensure compliance and manage your self-employment tax obligations.

As an independent contractor operating under a New Mexico Contract with Skateboard Instructor as a Self-Employed Independent Contractor, you must file taxes if you earn $400 or more in net income. This threshold applies to self-employment income specifically. It’s important to maintain accurate records of your earnings and expenses to determine your taxable income.

You can indeed require training for independent contractors. This training helps ensure that they meet the standards you expect, especially in a specialized area like skateboarding instruction. When creating a New Mexico Contract with Skateboard Instructor as a Self-Employed Independent Contractor, it’s prudent to specify any required training programs, enhancing both safety and skill levels.

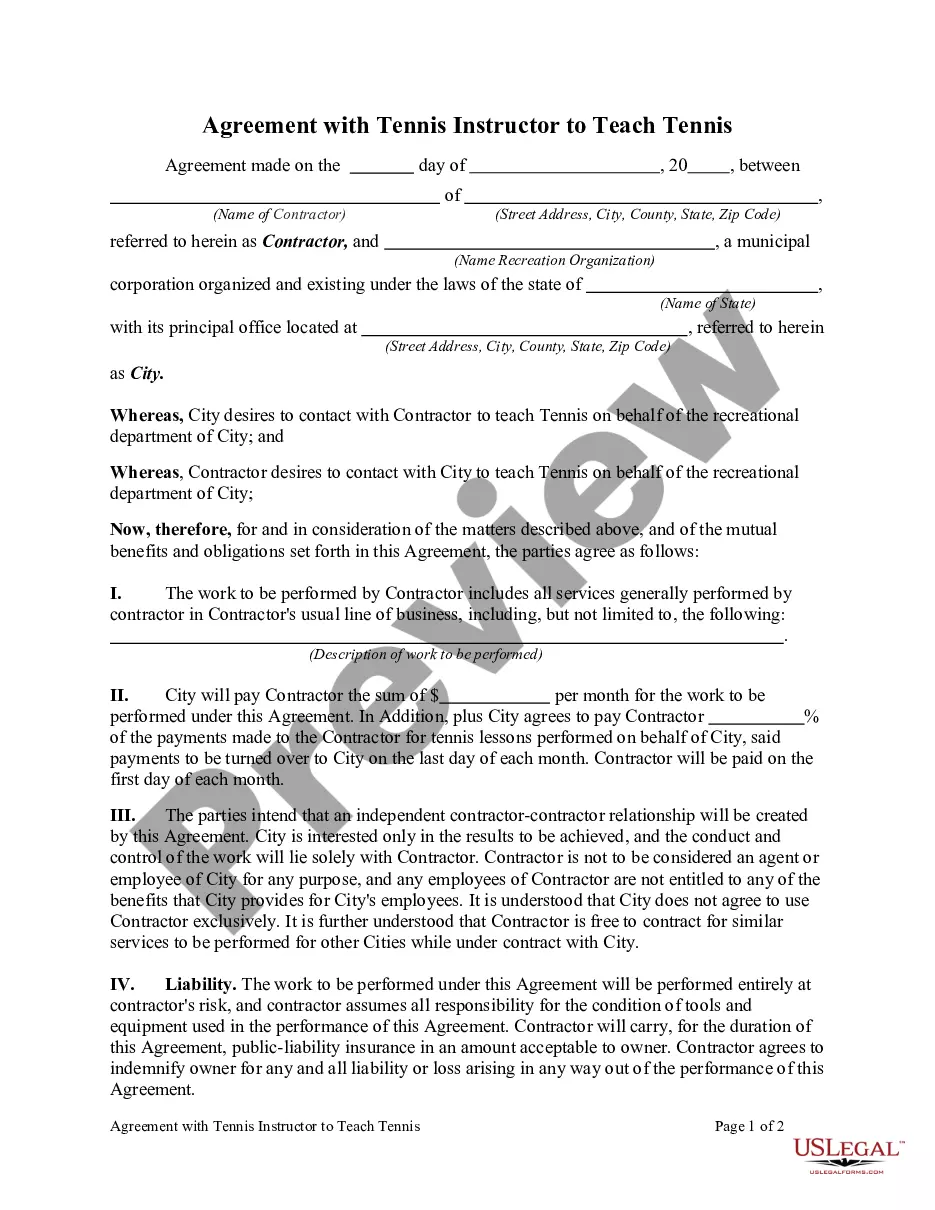

Yes, a coach can operate as an independent contractor. This arrangement allows coaches to teach skills without the constraints of employer-employee relationships. When forming a New Mexico Contract with Skateboard Instructor as a Self-Employed Independent Contractor, it’s essential to outline specific terms, such as payment and services provided, to ensure compliance with local laws.

Yes, you can provide training to an independent contractor, especially under a New Mexico Contract with Skateboard Instructor as a Self-Employed Independent Contractor. Ensure that this training aligns with their independence and promotes skill development without establishing control. The right approach supports their growth while they remain self-employed.

Independent contractors in New Mexico may need a business license depending on their specific activities and local regulations. If your work as a skateboard instructor falls under registered services, a license may be necessary. It’s essential to consult local guidelines to ensure compliance when operating under a New Mexico Contract with Skateboard Instructor as a Self-Employed Independent Contractor.