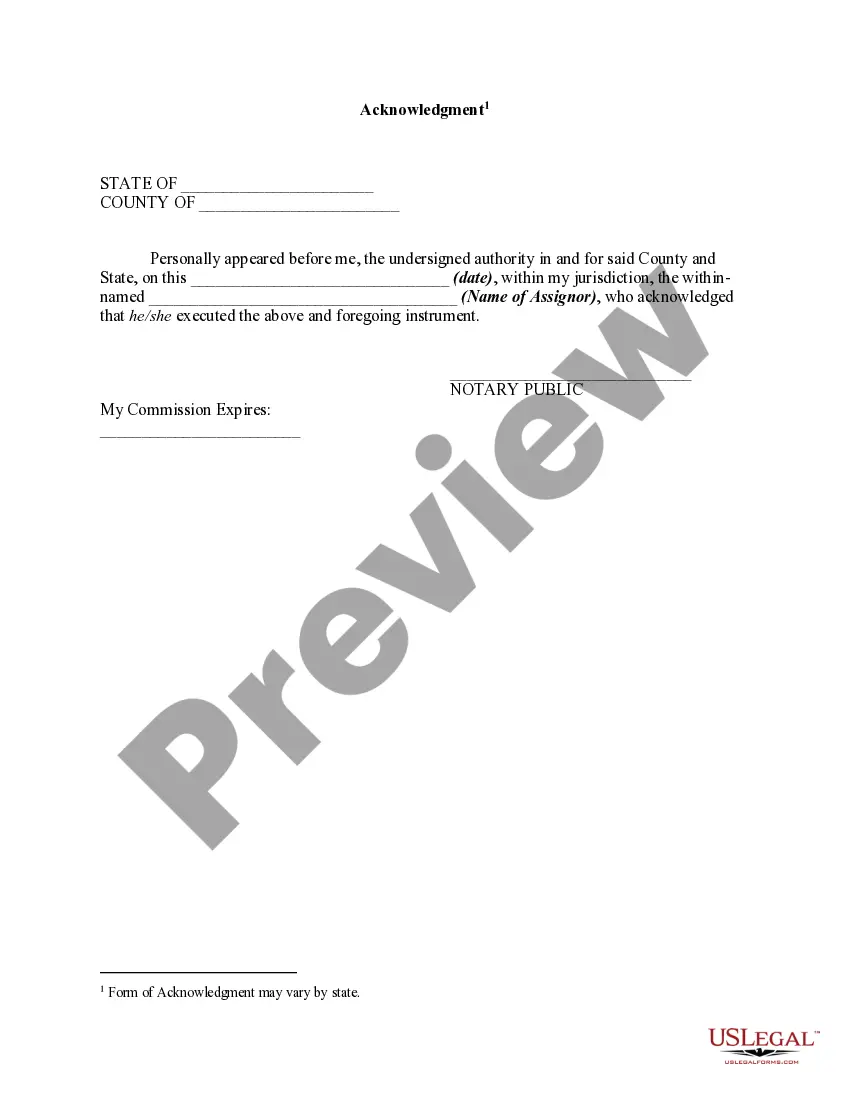

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Mexico Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of Portion For Specific Amount Of Money Of Interest In Estate In Order To Pay Indebtedness?

US Legal Forms - one of the biggest libraries of authorized forms in America - delivers a wide range of authorized document templates you may download or produce. While using internet site, you can get a huge number of forms for company and specific purposes, sorted by categories, says, or search phrases.You can get the most up-to-date models of forms like the New Mexico Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness in seconds.

If you have a registration, log in and download New Mexico Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness from your US Legal Forms catalogue. The Download switch can look on every single form you perspective. You have access to all previously acquired forms in the My Forms tab of the accounts.

If you want to use US Legal Forms the very first time, listed here are straightforward guidelines to get you started:

- Be sure to have chosen the right form for the city/region. Select the Preview switch to check the form`s content. Read the form outline to ensure that you have chosen the appropriate form.

- When the form does not satisfy your demands, make use of the Look for area near the top of the display to discover the the one that does.

- When you are satisfied with the form, verify your decision by clicking on the Purchase now switch. Then, select the rates plan you favor and supply your accreditations to register for the accounts.

- Approach the deal. Utilize your Visa or Mastercard or PayPal accounts to complete the deal.

- Find the file format and download the form on your own system.

- Make modifications. Fill up, change and produce and signal the acquired New Mexico Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness.

Each and every template you included with your money lacks an expiration particular date which is the one you have permanently. So, in order to download or produce another version, just check out the My Forms section and click in the form you require.

Gain access to the New Mexico Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness with US Legal Forms, by far the most comprehensive catalogue of authorized document templates. Use a huge number of specialist and state-distinct templates that meet your company or specific requirements and demands.

Form popularity

FAQ

Next of kin under New Mexico intestate inheritance law include: Surviving spouse. Children. Parents.

Family Allowance Probate Laws The family allowance provides up to $30,000 of the decedent's estate (NM Statutes §45-2-402) to the surviving spouse. If there is no surviving spouse, then the $30,000 will be divided evenly amongst any minor, dependent children.

In New Mexico in the absence of a will, a surviving spouse inherits the entire estate unless the decedent and the spouse share descendants, in which case the spouse inherits all of the decedent's community property and a quarter of the separate property; the descendants inherit the rest.

When there is no will, New Mexico distributes a decedent's property based on heirship: Surviving spouse and children ? In this situation, the spouse receives all communal property and a quarter of the decedent's separate property. The remaining separate property is split among surviving children.

When is it required for my Will to be probated through Court? In New Mexico, if the total value of the estate exceeds $50,000 the will must go through the Court to be probate. An estate worth less than $50,000 is considered a small estate.

If the property is in New Mexico and the owner dies without leaving a will, one-fourth of the property passes to the surviving spouse and three-fourths to the children.

Descendants, spouses, ascendants, collateral relatives to the 4th degree and common-law spouses have the right to inherit through intestate successions. If none of the relatives described above exist, the assets of the deceased must be distributed to public charity. In-law kinship does not grant the right to inherit.

Who Gets What in New Mexico? If you die with:here's what happens:children but no spousechildren inherit everythingspouse but no childrenspouse inherits everythingparents but no children or spouseparents inherit everythingsiblings but no children, spouse, or parentssiblings inherit everything1 more row