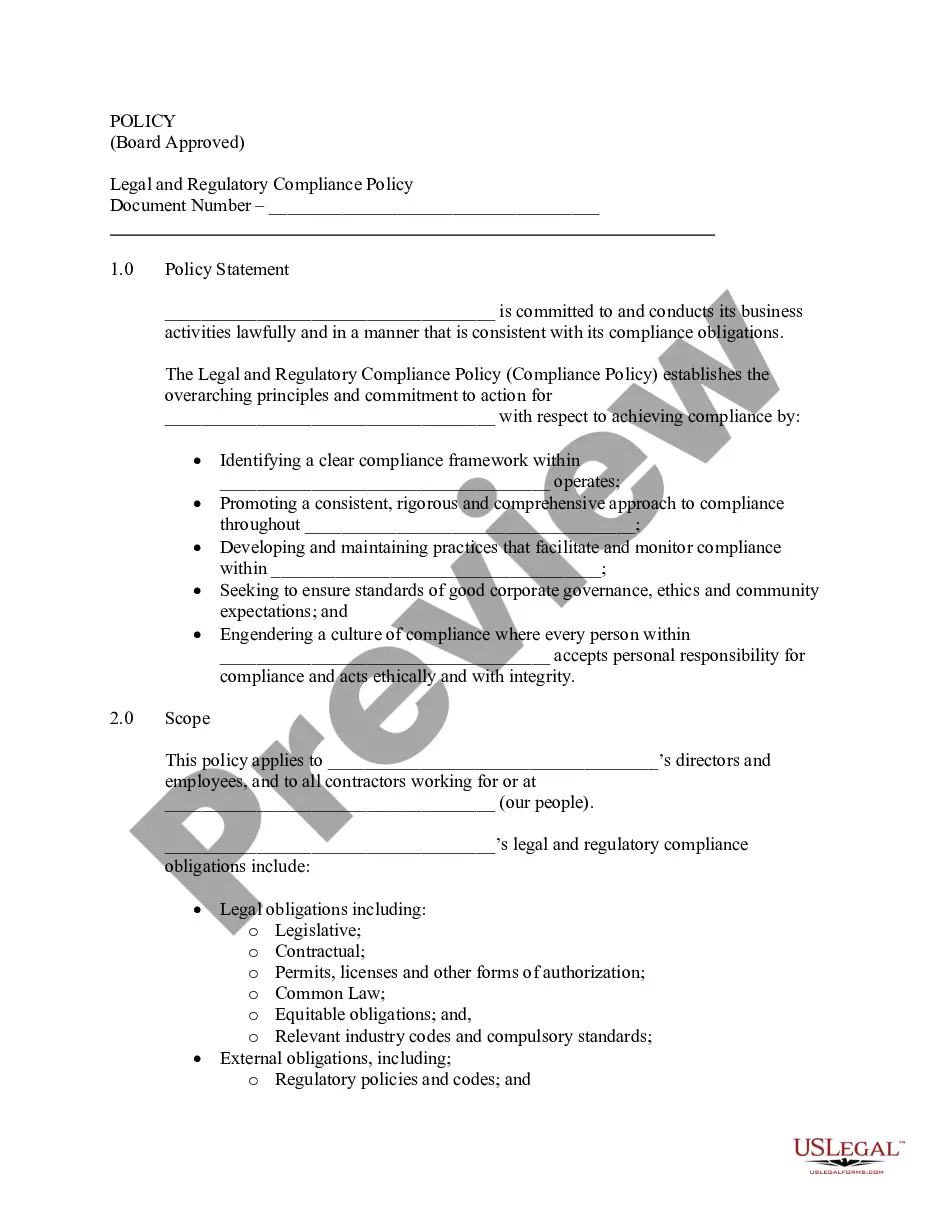

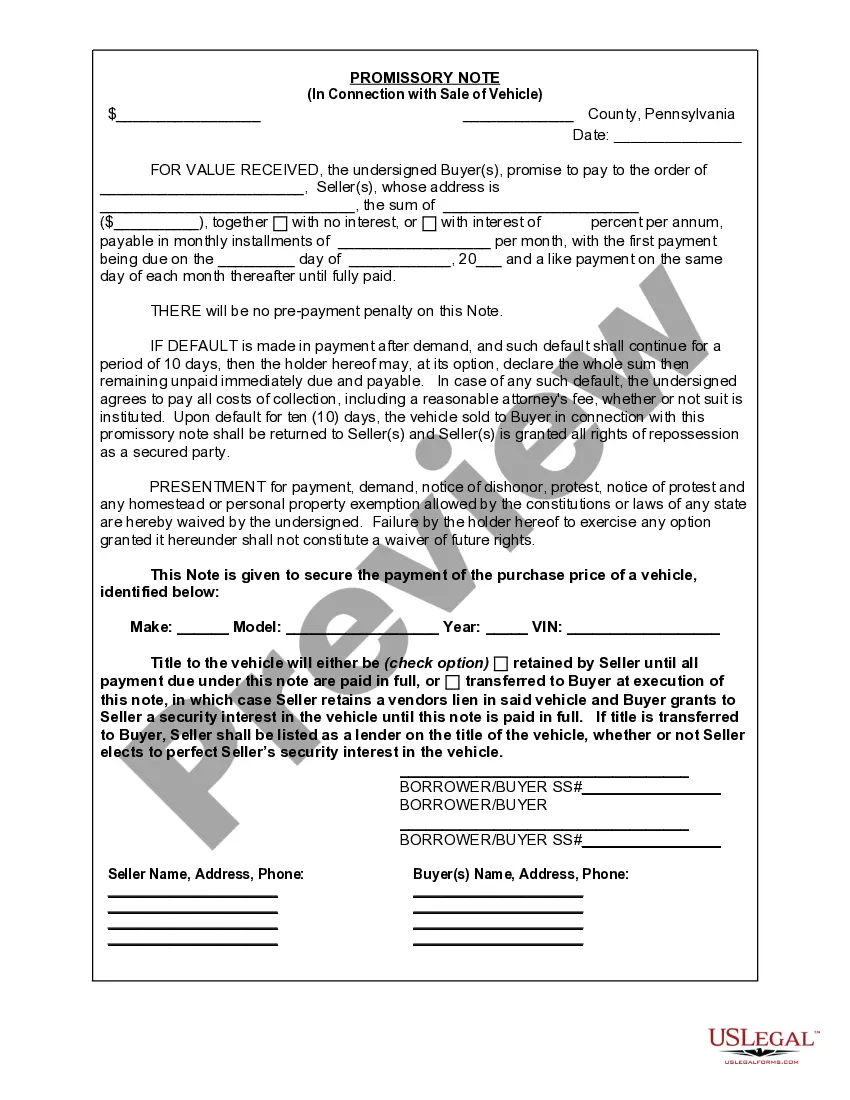

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Mexico Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage

Description

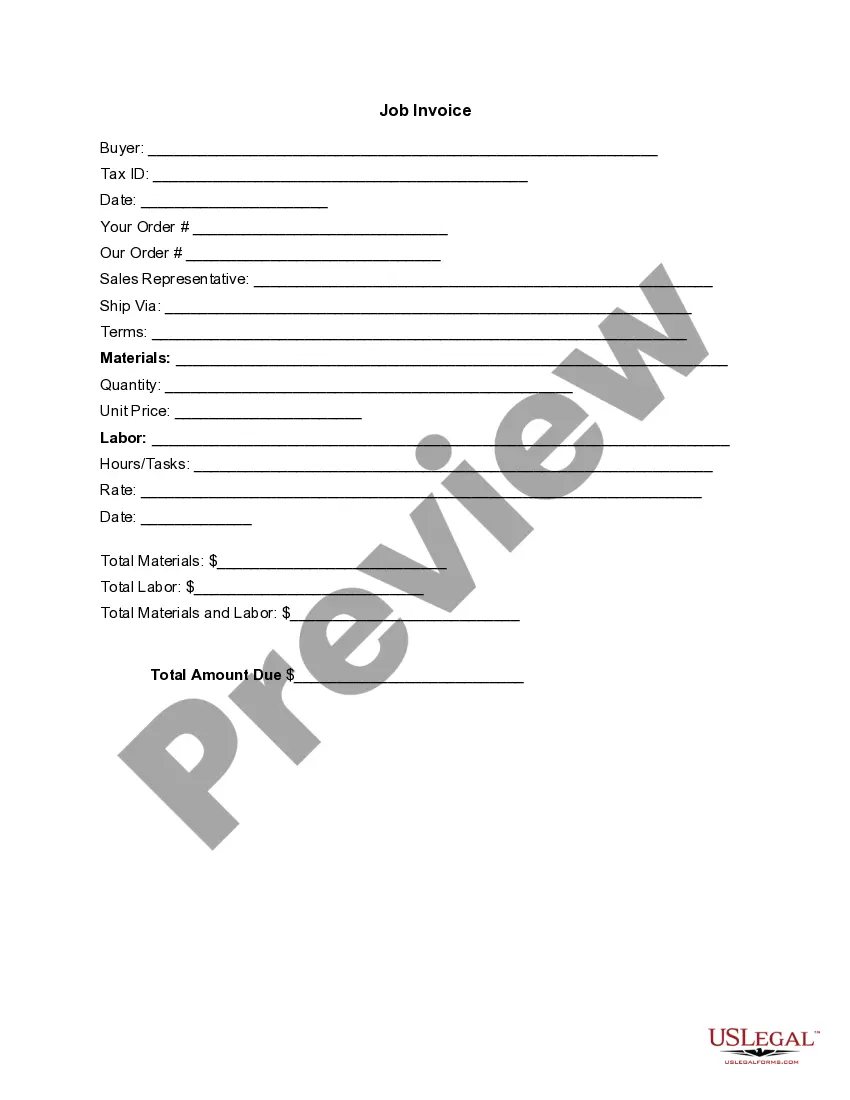

How to fill out Agreement To Modify Interest Rate, Maturity Date, And Payment Schedule Of Promissory Note Secured By A Mortgage?

US Legal Forms - one of the most prominent collections of legal templates in the United States - offers an extensive variety of legal document formats that you can download or print. By using the website, you can access thousands of forms for business and personal needs, categorized by types, states, or keywords.

You can find the latest versions of forms such as the New Mexico Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage in just minutes. If you already have an account, Log In and download the New Mexico Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage from the US Legal Forms library. The Download option will be available on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

To utilize US Legal Forms for the first time, here are some basic tips to get started: Ensure you have selected the correct form for your city/state. Click the Preview button to review the form's details. Check the form summary to confirm you have chosen the right one. If the form does not meet your needs, use the Search field at the top of the page to find one that does. Once you are satisfied with the form, confirm your choice by clicking on the Buy now button. Then, select your payment plan and provide your information to register for an account. Complete the payment. Use your credit card or PayPal account to finalize the transaction. Choose the file format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded New Mexico Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage. Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another version, simply go to the My documents section and click on the form you need.

- Access the New Mexico Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage with US Legal Forms, the most extensive library of legal document formats.

- Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

To extend the loan maturity and perfect the lender's lien on a matured loan, you must refinance the loan with a new loan account number and a new set of full loan documents. Be aware that renewing a loan after maturity may cause issues with title insurance.

If you need extra time to make your final payment, one option is a short-term extension. Extensions are common for lines of credit and construction loans. Often a lender will write an automatic extension into the note if the construction project falls behind schedule to prevent maturity problems.

A seller financing addendum defines the terms for how a seller finances a buyer's real estate purchase. It is added to the original purchase agreement to establish details such as the type of financing (e.g., balloon mortgage, adjustable rate mortgage, amortized loan), interest rate, and other relevant terms.

Loan maturity date refers to the date on which a borrower's final loan payment is due. Once that payment is made and all repayment terms have been met, the promissory note that is a record of the original debt is retired.

Changing a loan's maturity date is possible in more than one way. Some lenders offer borrowers the option to modify their loan terms. In this case, a borrower could adjust their repayment term and in so doing change the date.

If payment is not made by the agreed-upon maturity date, both parties may be held liable and legal actions could follow which would include any property (office building) that had been put up as collateral for repayment of debt or else even garnishment of wages etc.

Maturity date refers to a date at which the principal amount becomes due to the lender. It can be stated in two ways; first one is on demand, where lender can demand the money to be repaid. Other one is on specific date, on which the principal amount becomes due.

You end up with a collections notice on your credit report or, worse, your car may be repossessed. Because repossessions are costly and complicated, banks try to avoid them if possible. However, if you don't make an arrangement to repay your loan, you could end up with fees that drive your balance higher.

A maturity date on a loan is the date it's scheduled to be paid in full. The loan and any accrued interest should ideally be paid off in full if you've made regular and timely payments. If you do have a remaining balance past your maturity date, you'll have to work with the lender to figure out how to pay it off.

The maturity date of the note is the date the loan is due and payment must be received. It depends on the wording of the promissory note as to how the maturity date is calculated. If it states that the term of the note is in months, then the maturity date is simply counted on months.