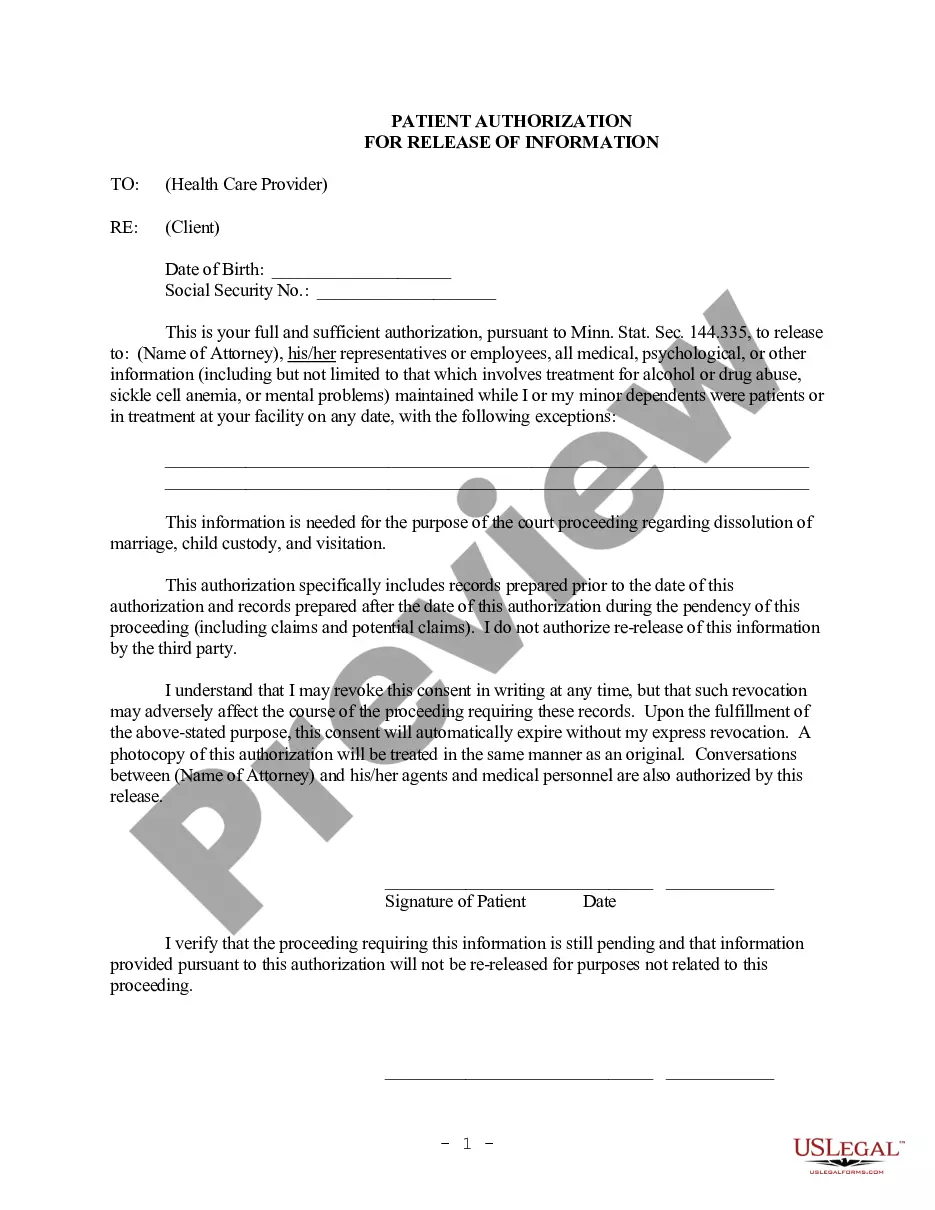

In this form, the trustor is amending the trust, pursuant to the power and authority he/she retained in the original trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Mexico Amendment of Trust Agreement and Revocation of Particular Provision

Description

How to fill out Amendment Of Trust Agreement And Revocation Of Particular Provision?

In the event that you require to completely download or print authorized document templates, make use of US Legal Forms, the premier collection of legal forms accessible online. Leverage the site’s straightforward and efficient search feature to find the documents you need. A variety of templates for commercial and personal purposes are categorized by categories, states, or keywords.

Utilize US Legal Forms to acquire the New Mexico Amendment of Trust Agreement and Revocation of Specific Provision with just a few clicks.

If you are already a US Legal Forms customer, Log In to your profile and click the Download button to access the New Mexico Amendment of Trust Agreement and Revocation of Specific Provision. You can also retrieve forms you previously obtained in the My documents section of your account.

Every legal document template you download is yours permanently. You have access to each form you have purchased within your account. Navigate to the My documents section and select a form to print or download again.

Be proactive and download, and print the New Mexico Amendment of Trust Agreement and Revocation of Specific Provision with US Legal Forms. There are numerous professional and state-specific templates available for your business or personal requirements.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to review the content of the form. Do not forget to read the summary.

- Step 3. If you aren't happy with the form, use the Search field at the top of the screen to find other templates of your legal form type.

- Step 4. Once you have located the necessary form, click the Buy now button. Choose your preferred pricing plan and provide your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal to finalize the payment.

- Step 6. Select the format of your legal form and download it onto your device.

- Step 7. Fill out, amend, and print or sign the New Mexico Amendment of Trust Agreement and Revocation of Specific Provision.

Form popularity

FAQ

An amendment to the trust agreement is a legal change made to modify the terms of an existing trust. This may involve adding, removing, or altering specific provisions within the trust, including the 'New Mexico Amendment of Trust Agreement and Revocation of Particular Provision' feature. Such amendments allow the trust to adapt to changing circumstances or desires of the grantor. Understanding how to properly amend your trust can help you maintain control over your assets and intentions.

To obtain a trust amendment form, you can visit the US Legal Forms platform, which offers easy access to various legal documents. Searching for 'New Mexico Amendment of Trust Agreement and Revocation of Particular Provision' will provide you with the necessary templates. Simply choose the form that suits your needs, download it, and fill it out according to your specifications. This streamlined process ensures you have the correct documents for your trust amendment.

To add an amendment to a revocable trust, you must create a written document that clearly outlines the changes you intend to make. This document should identify the original trust, state your intentions for the amendment, and be signed in accordance with New Mexico law. You can also specify any particular provisions you wish to revoke through this process. For comprehensive support, consider using US Legal Forms to ensure your New Mexico Amendment of Trust Agreement and Revocation of Particular Provision is legally sound.

To revoke a trust, the trust creator must follow specific legal guidelines, particularly if it is a revocable trust. This usually involves creating a formal document that clearly states the revocation, often referred to as a revocation of trust agreement. If you need assistance navigating this process, the New Mexico Amendment of Trust Agreement and Revocation of Particular Provision can provide essential insights and clarify the necessary steps.

Yes, a trust can be amended, particularly when it is a revocable trust. The New Mexico Amendment of Trust Agreement and Revocation of Particular Provision outlines the procedures for making necessary changes. However, it is crucial to follow legal protocols, ensuring that amendments reflect your updated wishes and intentions accurately.

Contesting a trust in New Mexico is indeed possible under certain circumstances. If you believe the trust creator lacked the capacity or was unduly influenced at the time of its creation, you can initiate a challenge. The process requires demonstrating valid legal grounds, and it is advisable to consult an expert familiar with the New Mexico Amendment of Trust Agreement and Revocation of Particular Provision for guidance.

A irrevocable trust is a specific type of trust that cannot be changed or modified once established. In contrast, a revocable trust allows for flexible management and can be altered through the New Mexico Amendment of Trust Agreement and Revocation of Particular Provision. If you seek stability and a fixed estate plan without the worry of modifications, an irrevocable trust may be the right choice for you.

When considering the New Mexico Amendment of Trust Agreement and Revocation of Particular Provision, it is essential to remember that some assets should typically remain outside of your revocable trust. For instance, retirement accounts, such as IRAs, usually have designated beneficiaries, making them unsuitable for inclusion. Additionally, life insurance policies, personal property with specific named beneficiaries, and assets with existing joint ownership should not be part of the trust to avoid complications.

Yes, a trust can be altered, amended, or revoked, allowing the trust creator to adapt to changing circumstances. This flexibility is crucial for ensuring that the trust aligns with current wishes and needs. Utilizing the New Mexico Amendment of Trust Agreement and Revocation of Particular Provision facilitates these changes effectively.

An example of a revocation of a trust occurs when the trust grantor creates a formal document stating their decision to revoke the trust. This document should outline the trust's details and affirm the grantor's intent within the framework of the New Mexico Amendment of Trust Agreement and Revocation of Particular Provision.