New Mexico Salesperson Contract - Percentage Contract - Asset Purchase Transaction

Description

How to fill out Salesperson Contract - Percentage Contract - Asset Purchase Transaction?

Are you currently in a situation where you require documents for either business or personal purposes every single day.

There are many legal document templates accessible online, but finding templates you can trust is challenging.

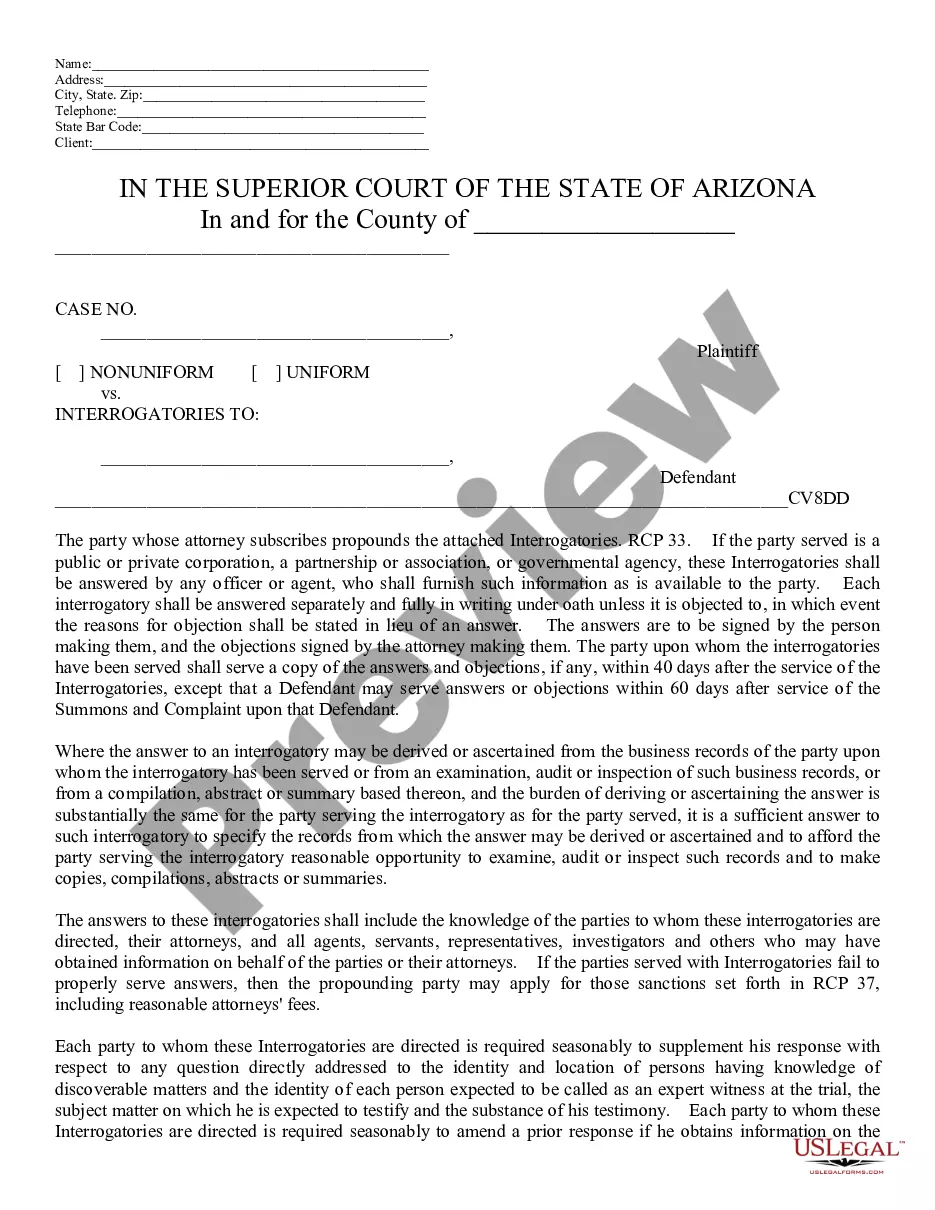

US Legal Forms provides a plethora of form templates, including the New Mexico Salesperson Contract - Percentage Contract - Asset Purchase Transaction, that are designed to comply with federal and state regulations.

Once you find the appropriate form, click Purchase now.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the New Mexico Salesperson Contract - Percentage Contract - Asset Purchase Transaction template.

- If you do not have an account and wish to start using US Legal Forms, follow these procedures.

- Locate the form you need and verify it is for the correct city/state.

- Use the Preview button to examine the form.

- Review the description to ensure you have chosen the right form.

- If the form is not what you require, utilize the Search field to find the form that meets your needs.

Form popularity

FAQ

Yes, the federal government maintains tax-exempt status in New Mexico regarding certain transactions. This exemption can impact real estate deals, including asset purchases, that involve federal entities. Understanding these nuances can help streamline transactions for buyers and sellers alike. Consider consulting USLegalForms for comprehensive guidance in such scenarios.

Most real estate agent contracts in New Mexico typically last for six months, though duration can vary. These agreements define the representation period during which the agent assists with property sales. It’s essential to understand these timeframes, especially in a New Mexico Salesperson Contract - Percentage Contract where commitment levels matter. Knowing the specifics helps managing expectations.

In New Mexico, a contract requires an offer, acceptance, and consideration. It must involve a lawful subject and comply with public policy. These elements are vital, especially in a New Mexico Salesperson Contract - Percentage Contract, as they define enforceability. Making informed decisions with the help of USLegalForms can streamline this process.

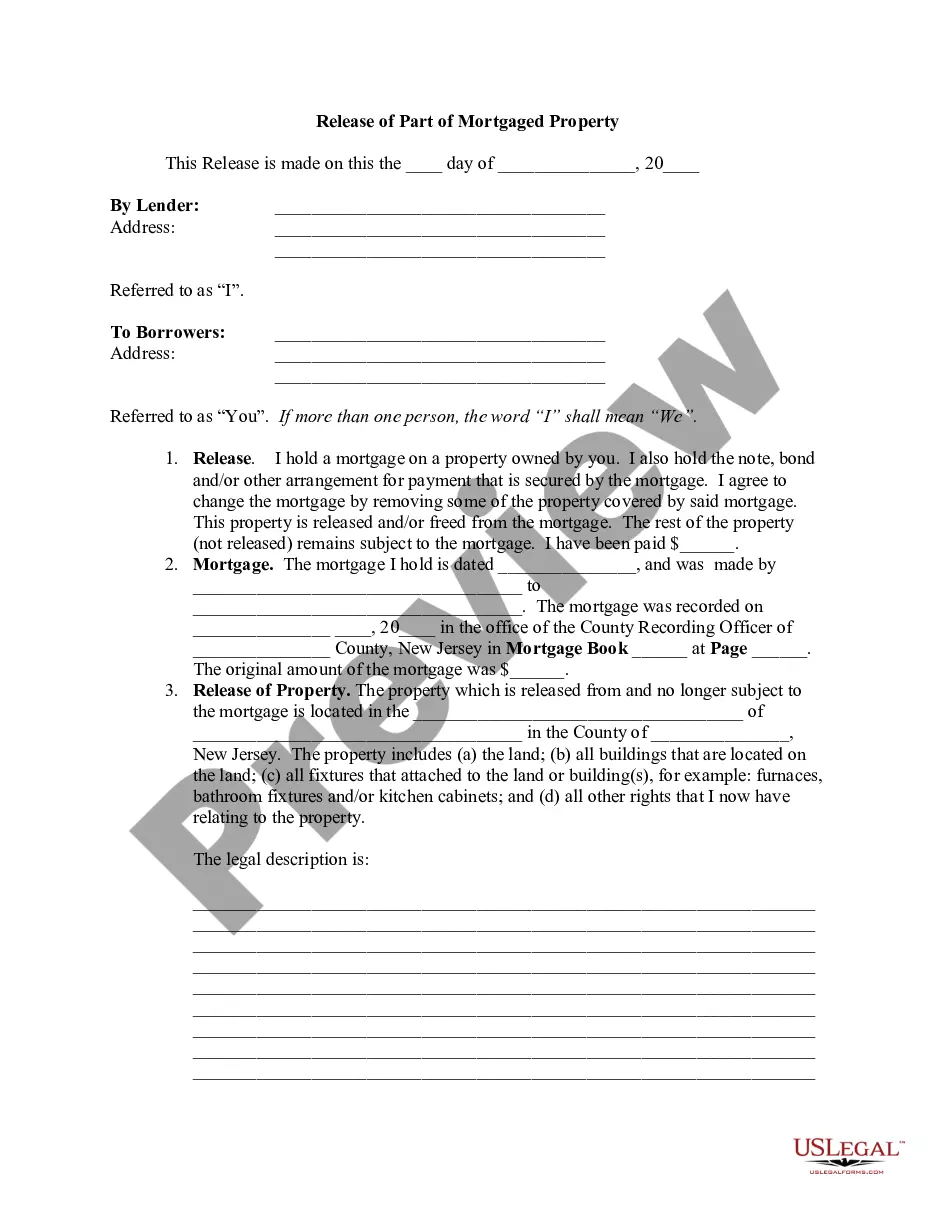

A purchase agreement is a type of contract that outlines terms and conditions related to the sale of goods. As a legally binding contract between buyer and seller, the agreements typically relate to buying and selling goods rather than services.

In an asset sale the target's contracts are transferred to the buyer by means of assigning the contracts to the buyer. The default rule is generally that a party to a contract has the right to assign the agreement to a third party (although the assigning party remains liable to the counter-party under the agreement).

In real estate, the acronym PID stands for a Public Improvement District. Properties can come together to petition a city to create a PID, a Public Improvement District. When a PID is created, a city can provide additional services to the district including police services, street cleaning, and promotion.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.