New Mexico Corporate Guaranty - General

Description

How to fill out Corporate Guaranty - General?

Are you presently in a location that necessitates documents for occasional organizational tasks or particular applications on a daily basis? There are numerous legal document templates accessible online, yet locating reliable ones can be challenging. US Legal Forms offers thousands of template options, including the New Mexico Corporate Guaranty - General, which can be tailored to fulfill both federal and state requirements.

If you are already acquainted with the US Legal Forms website and have your account, simply Log In. You can then download the New Mexico Corporate Guaranty - General template.

If you do not have an account and wish to start using US Legal Forms, follow these steps.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the New Mexico Corporate Guaranty - General at any time, if desired. Just click on the required template to download or print the document format.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides well-prepared legal document templates that you can use for various applications. Create your account on US Legal Forms and start making your life a bit easier.

- Obtain the template you need and confirm it is for the correct city/state.

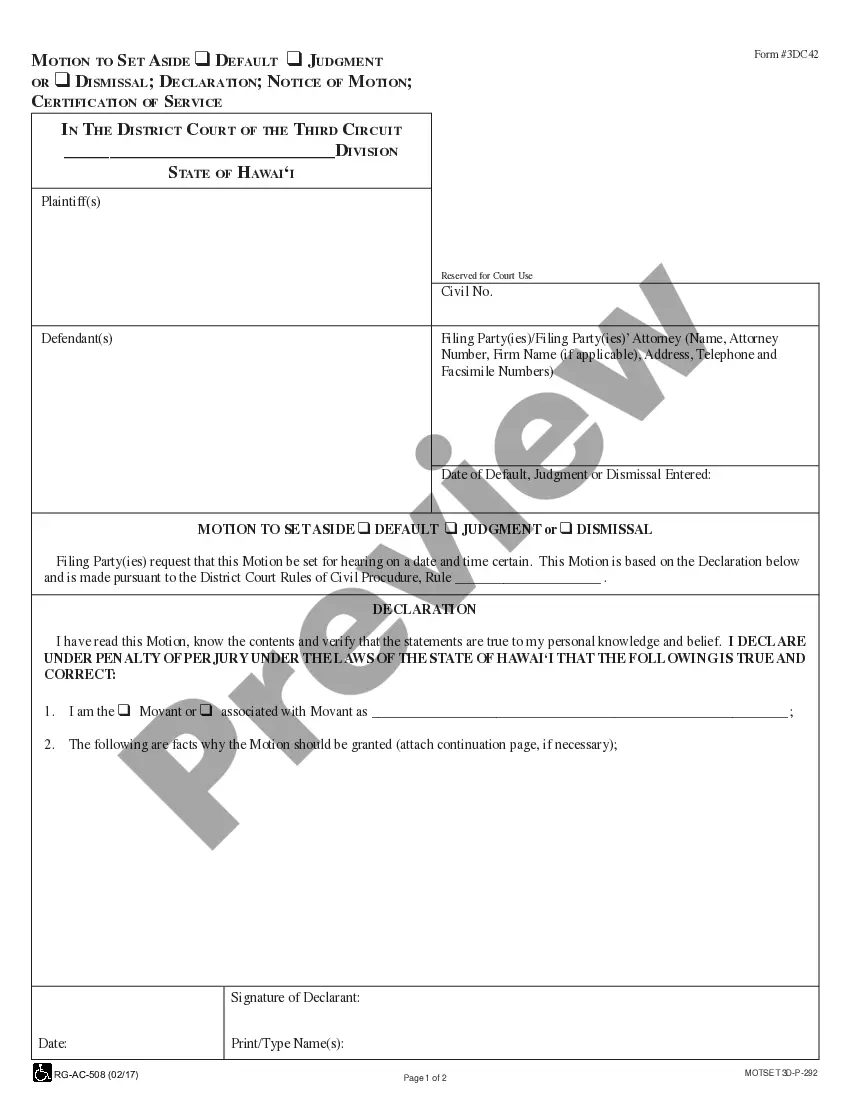

- Utilize the Preview button to examine the form.

- Check the description to ensure you have selected the correct template.

- If the template isn’t what you’re looking for, use the Search field to find the one that suits your needs and criteria.

- When you locate the correct template, click Buy now.

- Choose the pricing plan you wish, complete the necessary details to create your account, and process your order using PayPal or a credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Income from an LLC in New Mexico is typically taxed at the individual owner's rate since it is a pass-through entity. Owners report their share of profits on their personal tax returns, and this income is subject to state and federal tax rates. Understanding how these taxes apply to your specific situation is important for accurate planning. USLegalForms offers tools that can help you navigate the complexities related to New Mexico Corporate Guaranty - General, ensuring compliance and optimal tax strategy.

The Pass-Through Entity (PTE) rate in New Mexico is designed to benefit entities like LLCs and partnerships. This rate allows owners to more effectively manage their tax liabilities. Typically, the PTE tax is set at a flat rate on income, making it simpler for business owners to forecast expenses and profits. For guidance on the New Mexico Corporate Guaranty - General and specific tax strategies, accessing resources from USLegalForms can be quite helpful.

The New Mexico Life and Health Insurance Guaranty Association serves to protect policyholders by providing coverage when life and health insurance companies become insolvent. This organization works under the New Mexico Corporate Guaranty - General framework, offering crucial financial security and peace of mind. Their mission focuses on ensuring that consumers are not left vulnerable in the face of insurer failure. For more information on how this association functions, visit the uslegalforms platform for insights.

The maximum payment on the guaranty fund under the New Mexico Corporate Guaranty - General is subject to specific limits defined by state regulations. Typically, this limit ensures policyholders receive financial protection in the event their insurer fails. It's crucial to understand these limits to make informed decisions about your coverage. For detailed guidance, you can explore resources available through uslegalforms.

In New Mexico, seniors do not automatically stop paying property taxes at a certain age. However, they may qualify for property tax exemptions or credits based on their income and age. Exploring these options under the New Mexico Corporate Guaranty - General can help seniors save significantly on their property taxes.

RPD 41359 is a tax form used in New Mexico related to specific tax credits and adjustments. It is essential for businesses to file this form correctly to maintain compliance with state tax regulations. If you're navigating your responsibilities under the New Mexico Corporate Guaranty - General, using RPD 41359 properly can help ensure you maximize available credits.

A composite return allows multiple non-resident partners to file one tax return collectively, simplifying their tax obligations. In contrast, withholding involves individual tax payments deducted from employee wages by employers. Understanding these differences is crucial for businesses under the New Mexico Corporate Guaranty - General, as it affects tax compliance strategies.

Yes, New Mexico requires 1099 filing for independent contractors and certain payments. This includes payments made to individuals not classified as employees. Complying with these requirements is part of the New Mexico Corporate Guaranty - General, and our platform can assist you with the necessary forms and guidance.

In New Mexico, anyone who earns income above a certain threshold must file a state tax return. This includes individuals, couples, and corporations operating within the state. Understanding your obligations under the New Mexico Corporate Guaranty - General ensures that you can navigate your tax situation confidently and avoid penalties.

The RPD 41359 form is a specific document used for reporting certain tax obligations in New Mexico. It is vital for individuals and businesses to understand this form as it relates to compliance with state tax laws. When dealing with the New Mexico Corporate Guaranty - General, using forms correctly helps in maintaining your legal standing and ensures timely filing with the state.