New Mexico Assumption Agreement of Loan Payments

Description

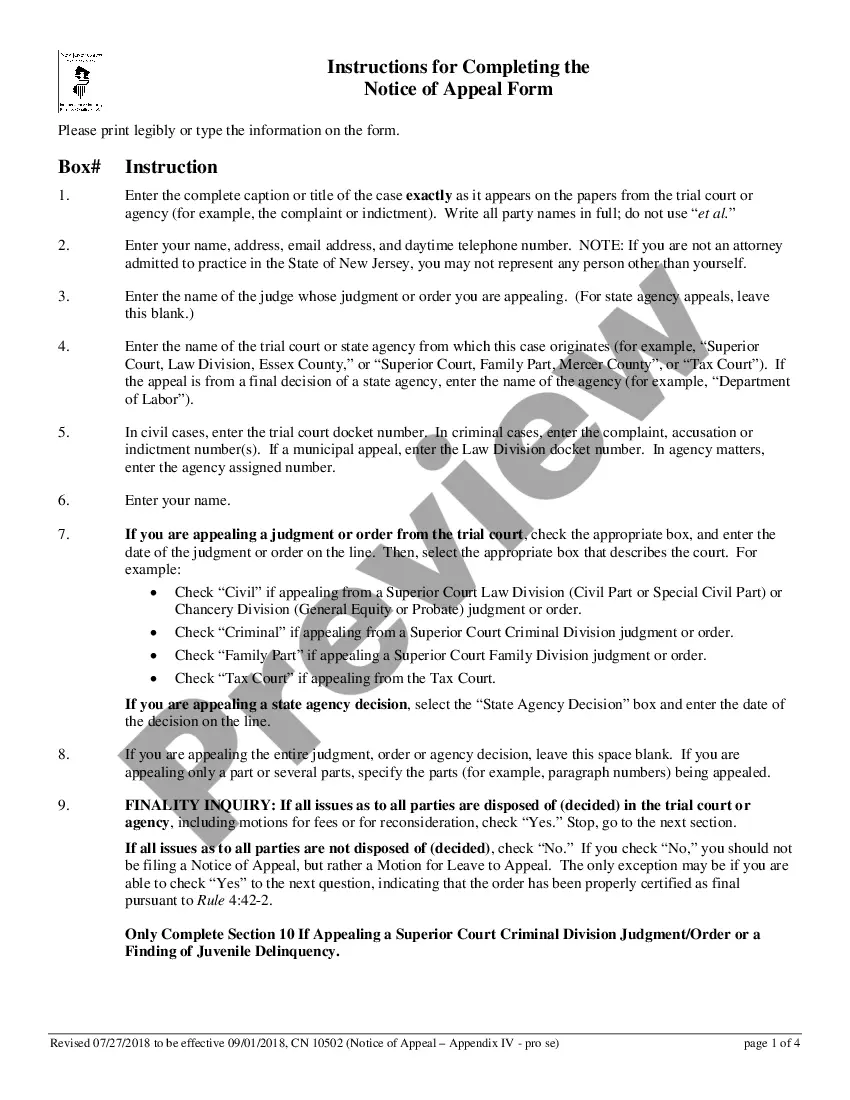

How to fill out Assumption Agreement Of Loan Payments?

Choosing the best legitimate file template could be a have difficulties. Of course, there are plenty of themes available on the net, but how can you find the legitimate develop you require? Utilize the US Legal Forms site. The support gives thousands of themes, including the New Mexico Assumption Agreement of Loan Payments, which can be used for enterprise and private requires. All of the varieties are checked out by pros and satisfy state and federal specifications.

Should you be presently signed up, log in to the profile and then click the Down load key to have the New Mexico Assumption Agreement of Loan Payments. Make use of profile to look from the legitimate varieties you have purchased previously. Go to the My Forms tab of your profile and get yet another duplicate from the file you require.

Should you be a fresh end user of US Legal Forms, listed below are simple recommendations so that you can comply with:

- Initial, make sure you have selected the right develop for your area/region. It is possible to look over the shape using the Review key and study the shape outline to make sure it is the right one for you.

- In the event the develop is not going to satisfy your expectations, make use of the Seach field to find the right develop.

- Once you are sure that the shape is proper, go through the Get now key to have the develop.

- Opt for the costs plan you would like and enter the needed information. Create your profile and buy the order making use of your PayPal profile or credit card.

- Choose the file file format and acquire the legitimate file template to the device.

- Comprehensive, modify and printing and sign the received New Mexico Assumption Agreement of Loan Payments.

US Legal Forms is definitely the most significant library of legitimate varieties for which you can find different file themes. Utilize the service to acquire expertly-created documents that comply with condition specifications.

Form popularity

FAQ

An assumable mortgage works much the same as a traditional home loan, except the buyer is limited to financing through the seller's lender. Lenders must typically approve an assumable mortgage. If done without approval, sellers run the risk of having to pay the full remaining balance upfront.

Updated March 7, 2022. In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

Most conventional mortgages are not assumable, but many government-backed loans (FHA, VA, USDA) are. The lender must approve you assuming the mortgage, and at the closing, you must compensate the old borrower for the amount they've paid off.

Cons On An Assumable Mortgage If you don't have that much cash, you'll have to take a second mortgage at current rate to cover the shortfall. You'll have to assume mortgage insurance payments: Most FHA and all USDA loans will include a monthly mortgage insurance payment in addition to the mortgage payment itself.

Since mortgage rates have recently skyrocketed, assumption offers a rare chance to access lower rates as a buyer ? or, if you're the seller, significantly boost buyer interest in your house. Lower closing costs. You'll likely have lower closing costs, as certain costs on assumed mortgages are capped. No appraisal.

To assume a loan, the buyer must qualify with the lender. If the price of the house exceeds the remaining mortgage, the buyer must remit a down payment that is the difference between the sale price and the mortgage. If the difference is substantial, the buyer may need to secure a second mortgage.

Calculation. The mortgage assumption value can be calculated as the net present value of the sum of the future monthly payment savings due to the assumable loan rate being lower than the prevailing new loan interest rate.

In some situations, a buyer may be able to assume the seller's existing mortgage. The buyer takes over the seller's mortgage payments, and the seller receives the value of their equity in the home.