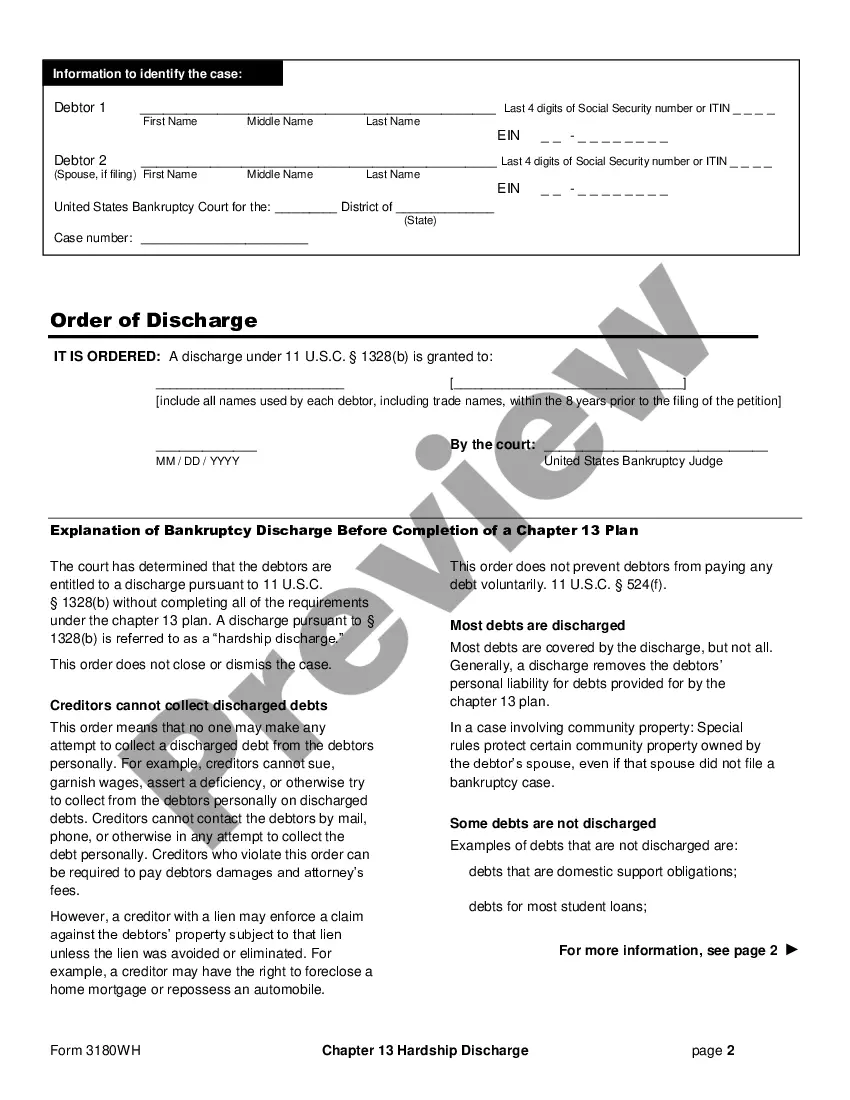

New Mexico Chapter 13 Plan

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Mexico Chapter 13 Plan?

US Legal Forms is really a special platform where you can find any legal or tax form for completing, including New Mexico Chapter 13 Plan. If you’re tired of wasting time seeking appropriate examples and spending money on document preparation/legal professional fees, then US Legal Forms is exactly what you’re trying to find.

To experience all of the service’s benefits, you don't have to install any application but simply select a subscription plan and create an account. If you have one, just log in and look for the right sample, save it, and fill it out. Downloaded documents are all kept in the My Forms folder.

If you don't have a subscription but need to have New Mexico Chapter 13 Plan, have a look at the guidelines listed below:

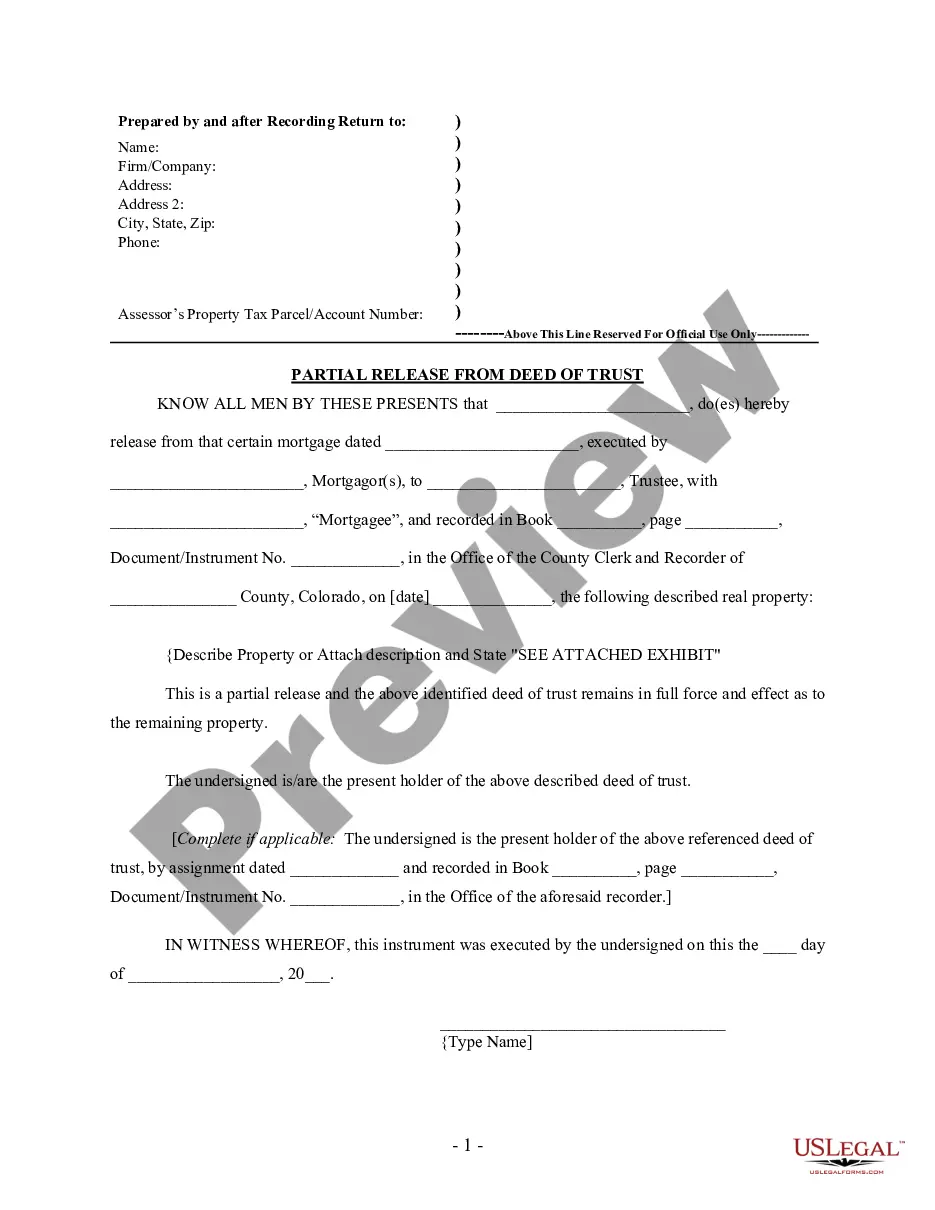

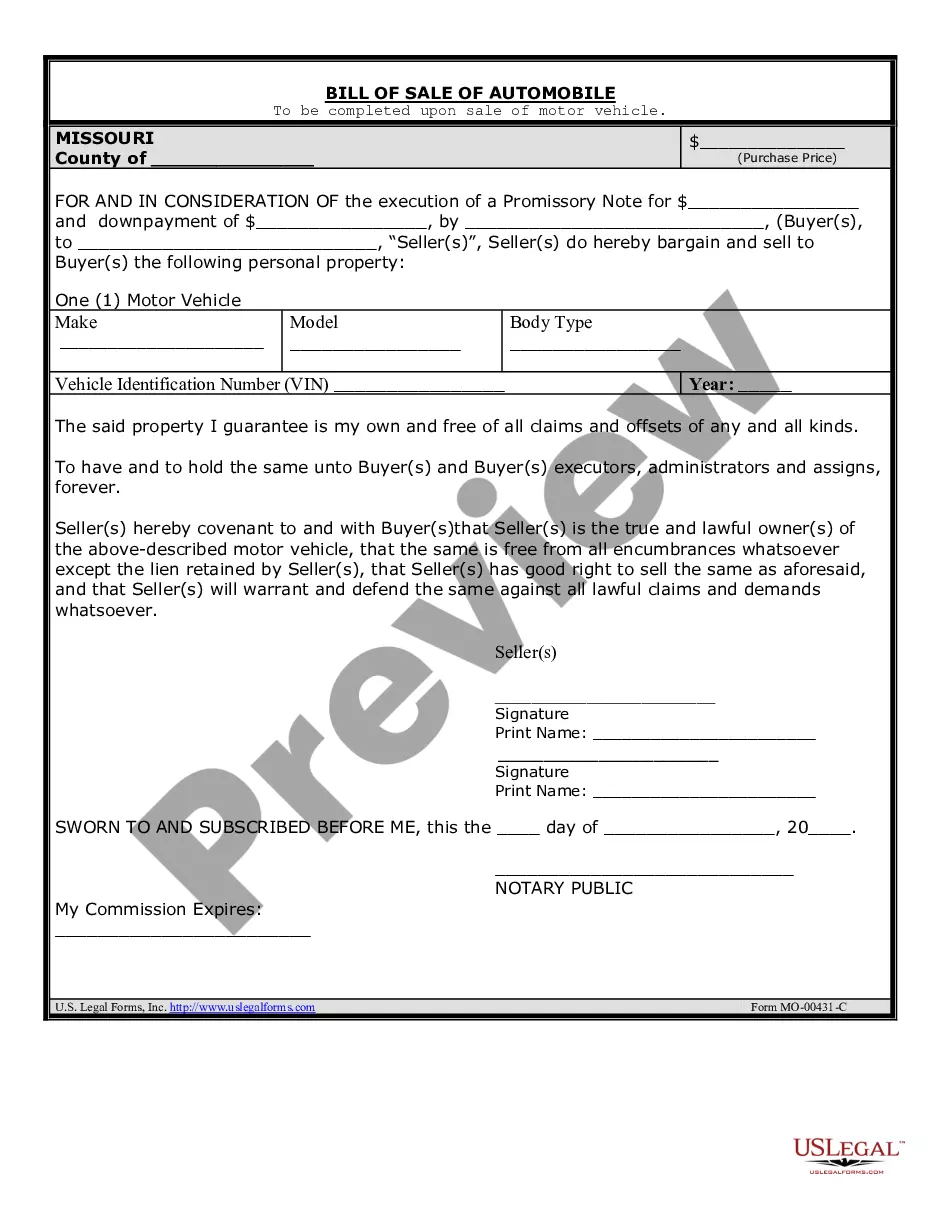

- Double-check that the form you’re considering applies in the state you need it in.

- Preview the example and look at its description.

- Click Buy Now to reach the sign up webpage.

- Choose a pricing plan and carry on signing up by providing some info.

- Select a payment method to complete the registration.

- Download the file by selecting your preferred file format (.docx or .pdf)

Now, fill out the document online or print out it. If you feel unsure regarding your New Mexico Chapter 13 Plan template, speak to a lawyer to check it before you send out or file it. Begin without hassles!

Form popularity

FAQ

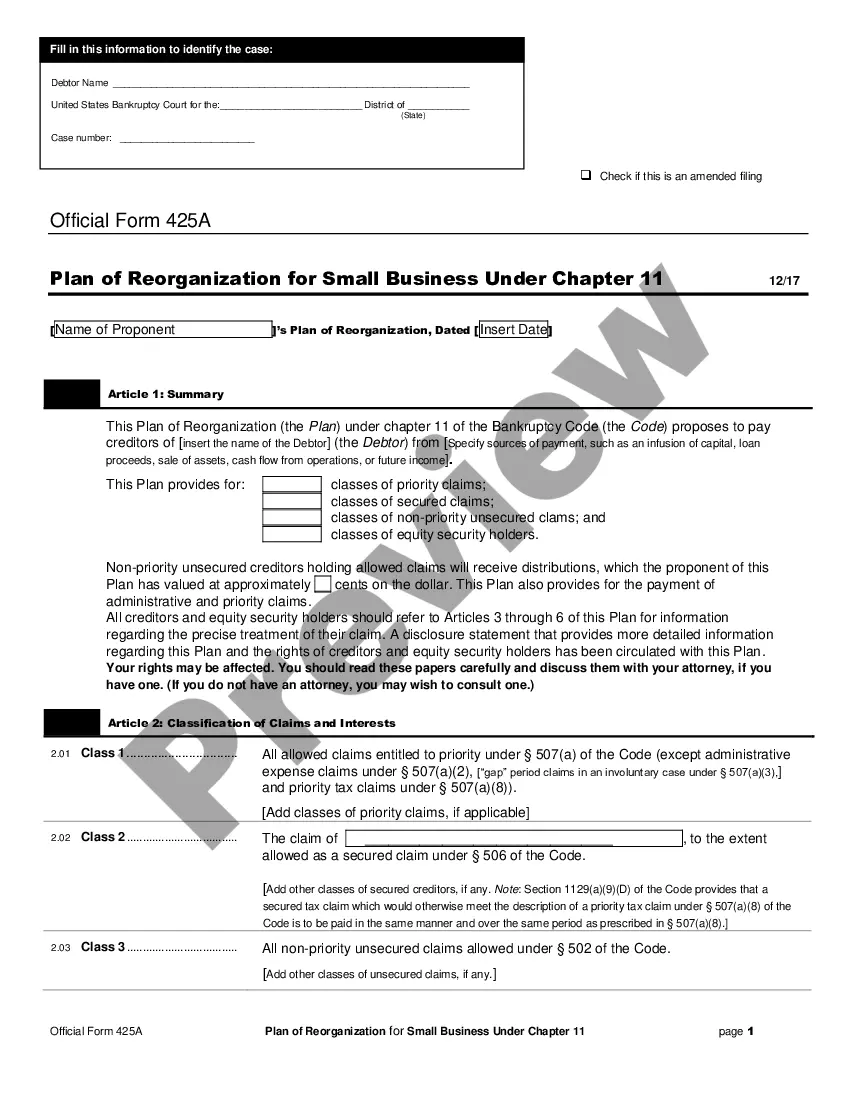

In Chapter 13 bankruptcy, you pay your unsecured creditors an amount between 0 and 100% of what you owe them. The exact amount is depends on these rules: (1) The minimum amount you must pay is equal to the amount your unsecured creditors would have received had you filed for Chapter 7 bankruptcy.

In the majority of cases where the court denies a chapter 13 plan, it is because a debtor did not comply with requirements outlined by your attorney or the court. In order for your chapter 13 plan to be confirmed, you must:2) Have made your first chapter 13 payment within 30 days of filing your case.

The Chapter 13 process The Chapter 13 filing process generally takes 95 days from the filing of the petition to the approval of the repayment plan. But the bankruptcy won't actually be discharged until the three- to five-year plan is completed.

The difference between your income on Schedule I and your expenses on Schedule J will be your Chapter 13 plan payment. Your unsecured creditors will receive a percentage of the disposable income that remains after secured and priority creditors receive payment.

In Chapter 13 bankruptcy, you pay your unsecured creditors an amount between 0 and 100% of what you owe them. The exact amount is depends on these rules: (1) The minimum amount you must pay is equal to the amount your unsecured creditors would have received had you filed for Chapter 7 bankruptcy.

After you file for Chapter 13 bankruptcy, the court will schedule a confirmation hearing to determine whether or not your plan should be approved. If the trustee or your creditors don't object to your proposed plan, the court will confirm your plan at the hearing.

The answer to this question is "yes," your Chapter 13 Plan payment can be increased after the Plan is confirmed. When you file a Chapter 13 bankruptcy case, your wages and all other income are under the jurisdiction of the United States Bankruptcy Court.

The Overall Chapter 13 Average Payment. The average payment for a Chapter 13 case overall is probably about $500 to $600 per month. This information, however, may not be very helpful for your particular situation.

Before the court confirms (approves) your Chapter 13 repayment plan, you must show that it represents your "best efforts" to pay back creditors. It's also called the disposable income test because you must pay all of your disposable income at a minimum.