New Jersey Partnership Formation Questionnaire

Description

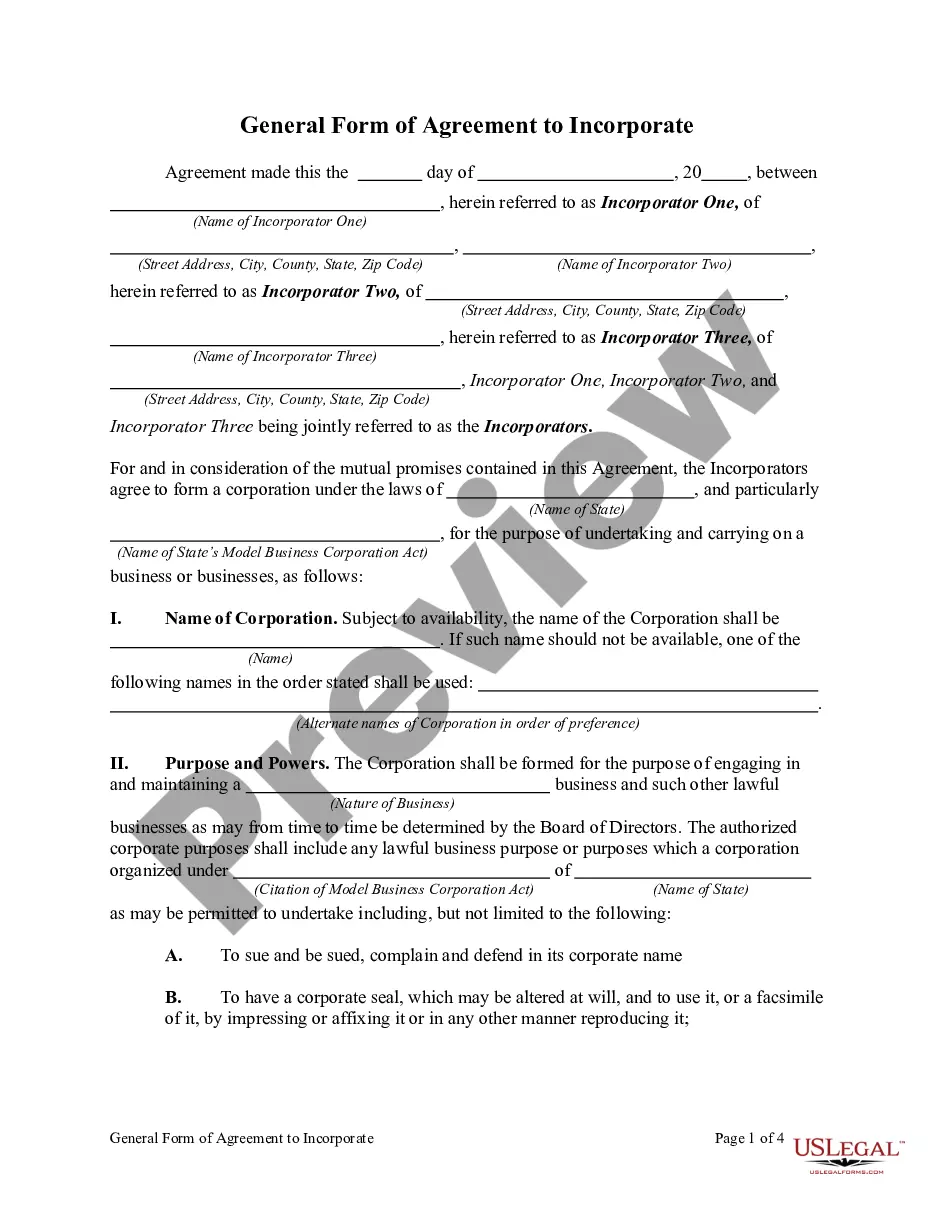

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

How to fill out Partnership Formation Questionnaire?

You have the capability to utilize the Internet searching for the official document template that meets the federal and state standards you require.

US Legal Forms offers a multitude of official forms that have been evaluated by experts.

You can conveniently download or print the New Jersey Partnership Formation Questionnaire from your support.

If available, utilize the Review option to view the document template as well. If you wish to find another version of the form, use the Research section to locate the template that fits your needs and requirements. After identifying the template you want, click Get now to proceed. Select the pricing plan you prefer, enter your information, and create your account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the official template. Choose the format of the document and download it to your device. Make adjustments to your document if necessary. You can complete, edit, sign, and print the New Jersey Partnership Formation Questionnaire. Access and print thousands of document templates using the US Legal Forms website, which provides the largest collection of official forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can sign in and then select the Obtain option.

- Once done, you can complete, modify, print, or sign the New Jersey Partnership Formation Questionnaire.

- Each official document template you acquire is yours indefinitely.

- To obtain an additional copy of a purchased form, navigate to the My documents section and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have chosen the correct document template for the county/city that you select.

- Review the form description to confirm you have selected the right type.

Form popularity

FAQ

An LLC typically files Form 1065 if it has multiple members, reflecting its partnership taxation status. However, if the LLC elects to be taxed as an S Corporation, it will file Form 1120S. Choosing the correct form is vital for tax compliance and can impact your overall tax strategy. By utilizing the New Jersey Partnership Formation Questionnaire, you can determine the best filing approach for your LLC.

Form 1042 is used to report income that is subject to withholding for foreign persons in the United States. This form helps ensure compliance with U.S. tax laws when making payments to non-resident aliens. If your partnership involves international transactions, understanding this form is essential. The New Jersey Partnership Formation Questionnaire can guide you through the necessary steps to handle such tax reporting accurately.

Form 1065 is the U.S. Return of Partnership Income, which partnerships must file to report income, deductions, and other financial information. On the other hand, Schedule K-1 is a form that partnerships provide to each partner, detailing their share of the partnership's income, deductions, and credits. Understanding the differences between these forms is crucial for accurate tax reporting. Utilizing the New Jersey Partnership Formation Questionnaire can help clarify your obligations regarding these forms.

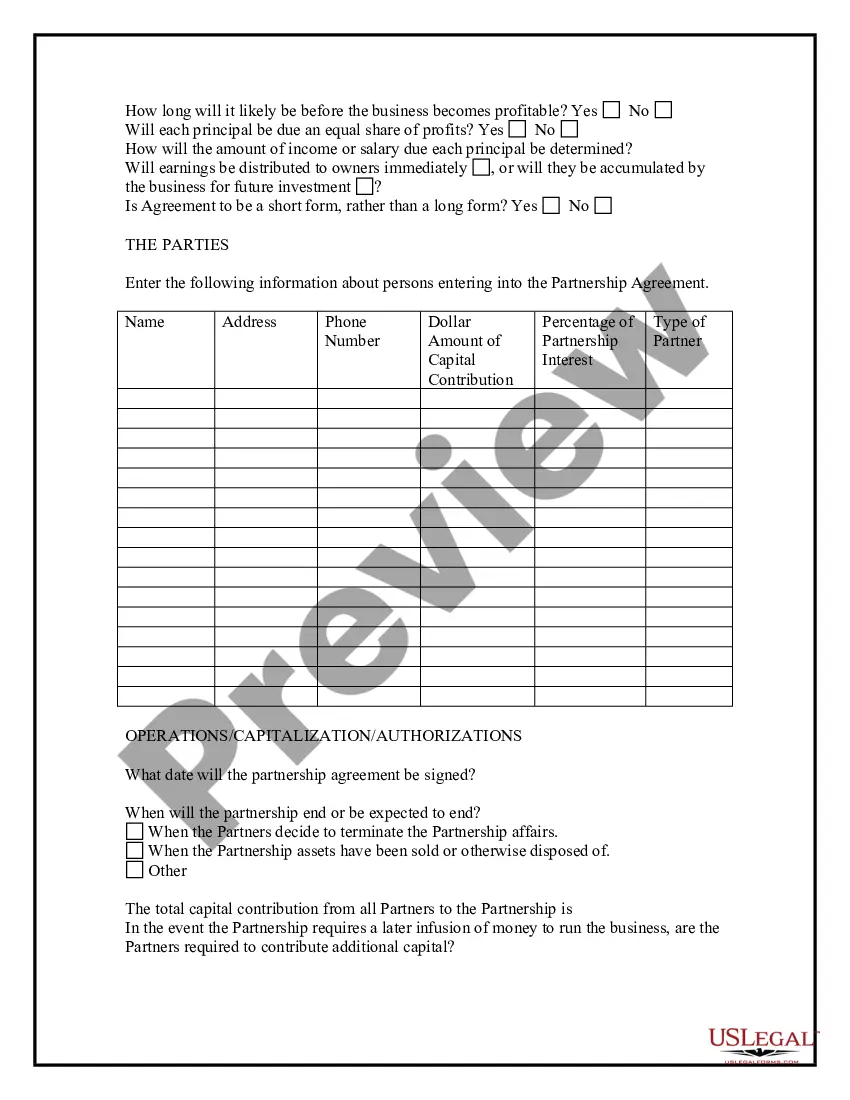

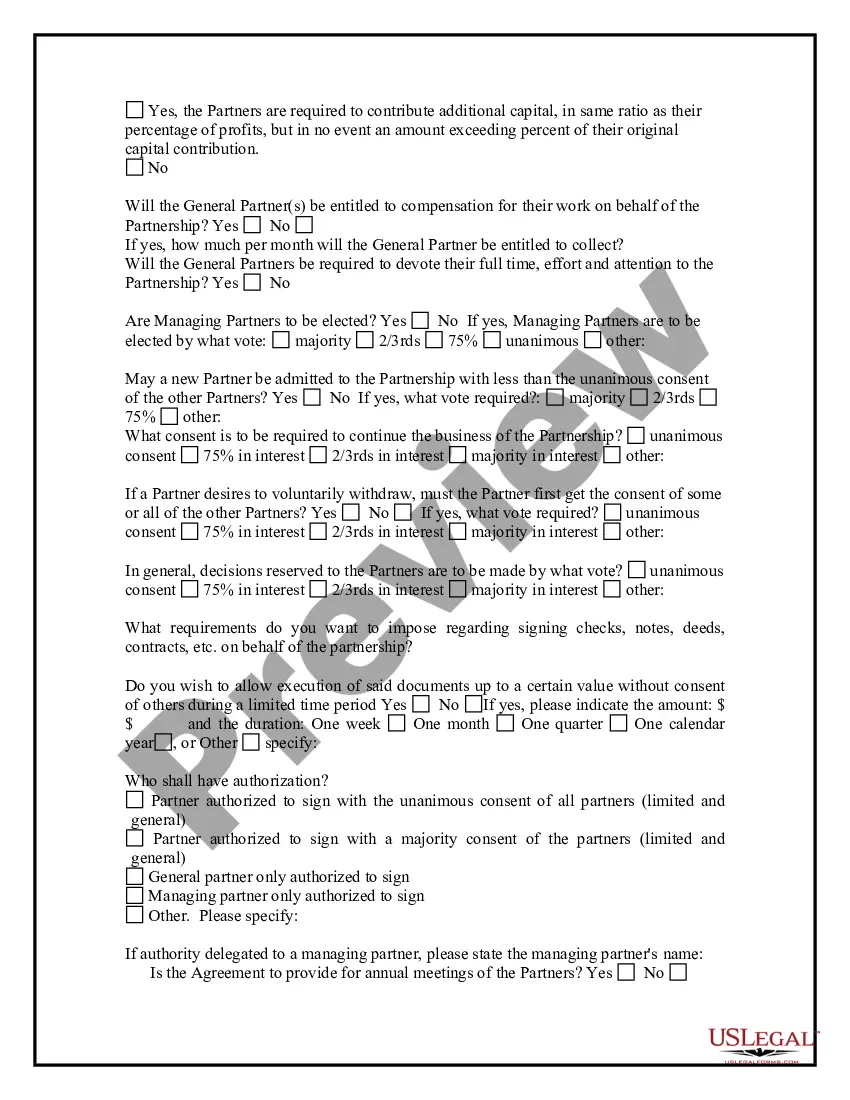

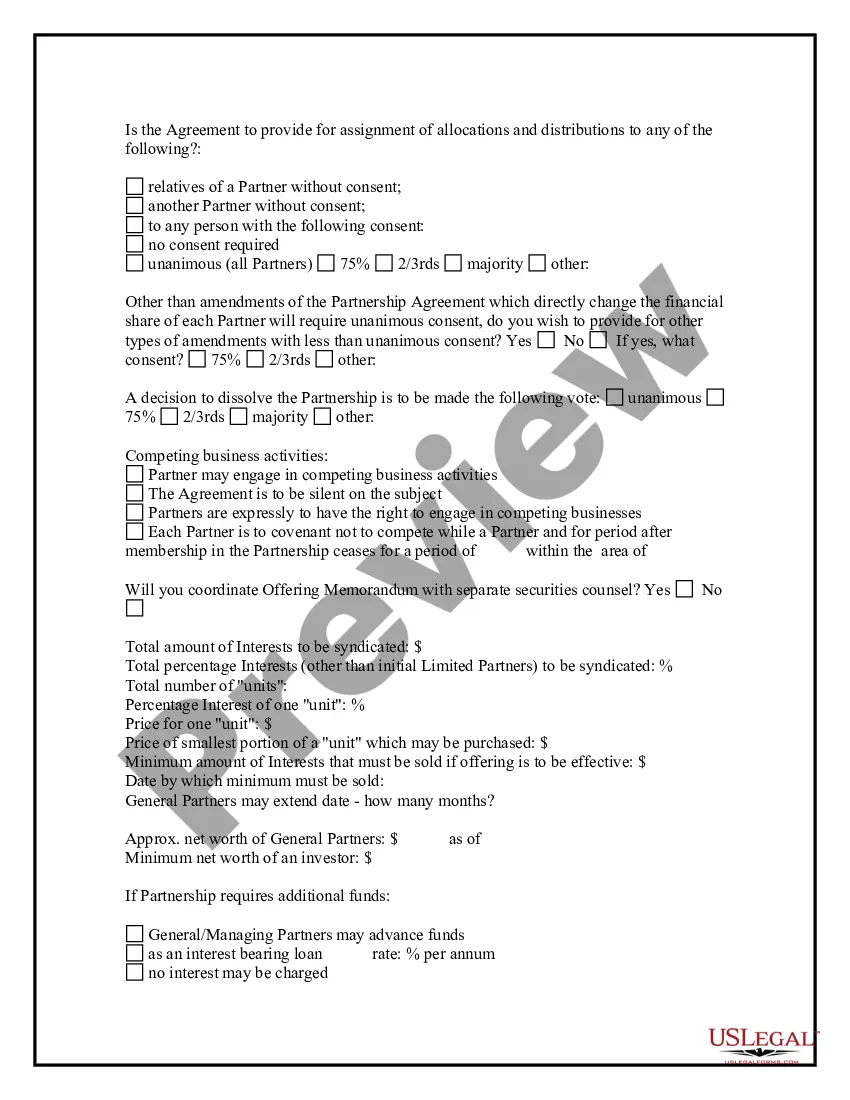

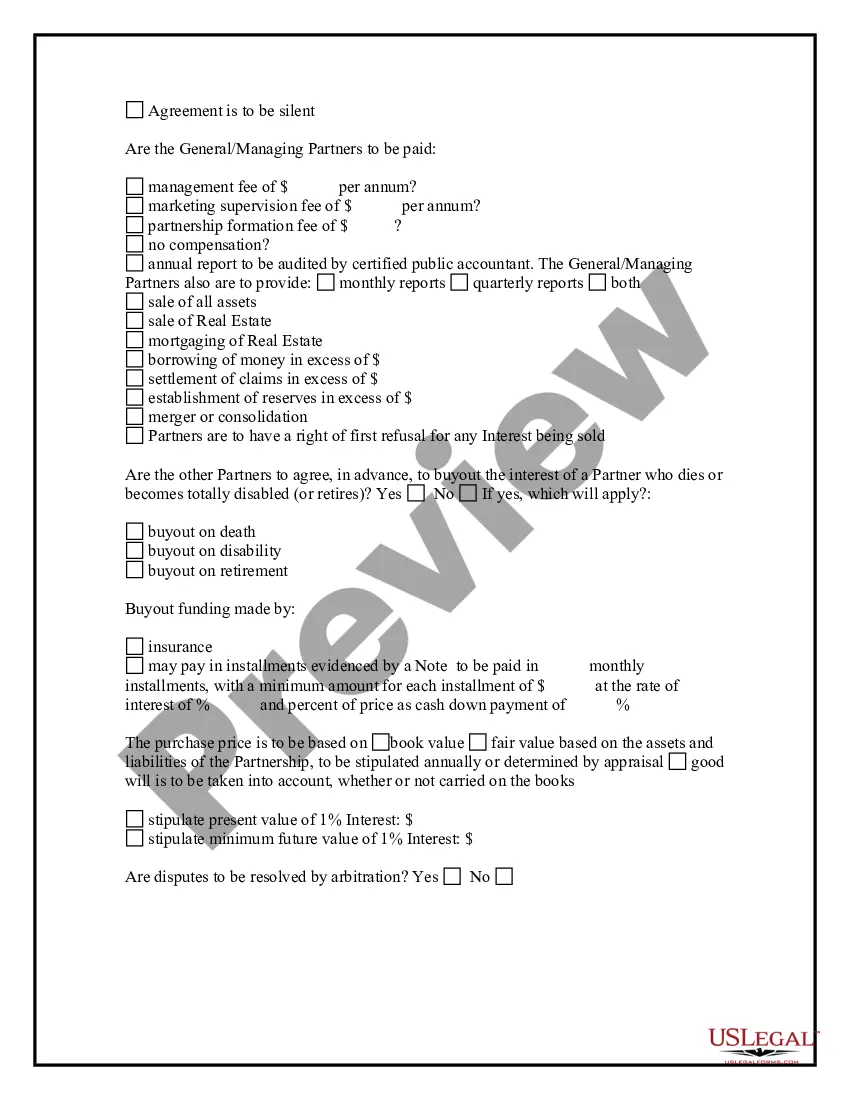

Partnerships in New Jersey typically need to complete the New Jersey Partnership Formation Questionnaire to establish their legal status. This form includes essential details about the partnership, such as names, addresses, and the nature of the business. By filling out this questionnaire accurately, you can ensure your partnership is recognized by the state. If you need assistance, our platform offers resources to help you complete this form correctly.

To prove a Domestic Partnership in New Jersey, you need to provide a valid Domestic Partnership Certificate issued by the state. This certificate demonstrates your partnership status and is essential for various legal and financial matters. If you are unsure how to obtain this certificate, consider using the New Jersey Partnership Formation Questionnaire to guide you through the process. This resource can help ensure you meet all required criteria.

Receiving a letter from the NJ Division of Taxation could indicate various issues, such as missing forms, tax assessments, or requests for additional information. It is essential to review the letter carefully to understand the specific reason. If you have recently completed the New Jersey Partnership Formation Questionnaire, ensure that all information has been submitted correctly to avoid any misunderstandings.

NJPortal serves as the online gateway for various tax-related services in New Jersey. It allows businesses to file taxes, submit forms, and manage their tax accounts efficiently. If you are working on your New Jersey Partnership Formation Questionnaire, NJPortal can be a valuable resource for submitting your partnership registration and accessing necessary forms.

To obtain the NJ 01 form, you can visit the New Jersey Division of Taxation's website. They provide downloadable forms and instructions to help you complete your filing accurately. Additionally, using the New Jersey Partnership Formation Questionnaire can simplify your understanding of the required documents and streamline your filing process.

In New Jersey, partnerships that generate income must file the NJ CBT 1065 form. This requirement applies to partnerships doing business in New Jersey, regardless of where the partners reside. If you are forming a partnership, completing the New Jersey Partnership Formation Questionnaire can guide you through the necessary steps, ensuring compliance with state regulations.