New Jersey Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest

Description

How to fill out Assignment Of Oil And Gas Leases Of All Interest, Reserving An Overriding Royalty Interest?

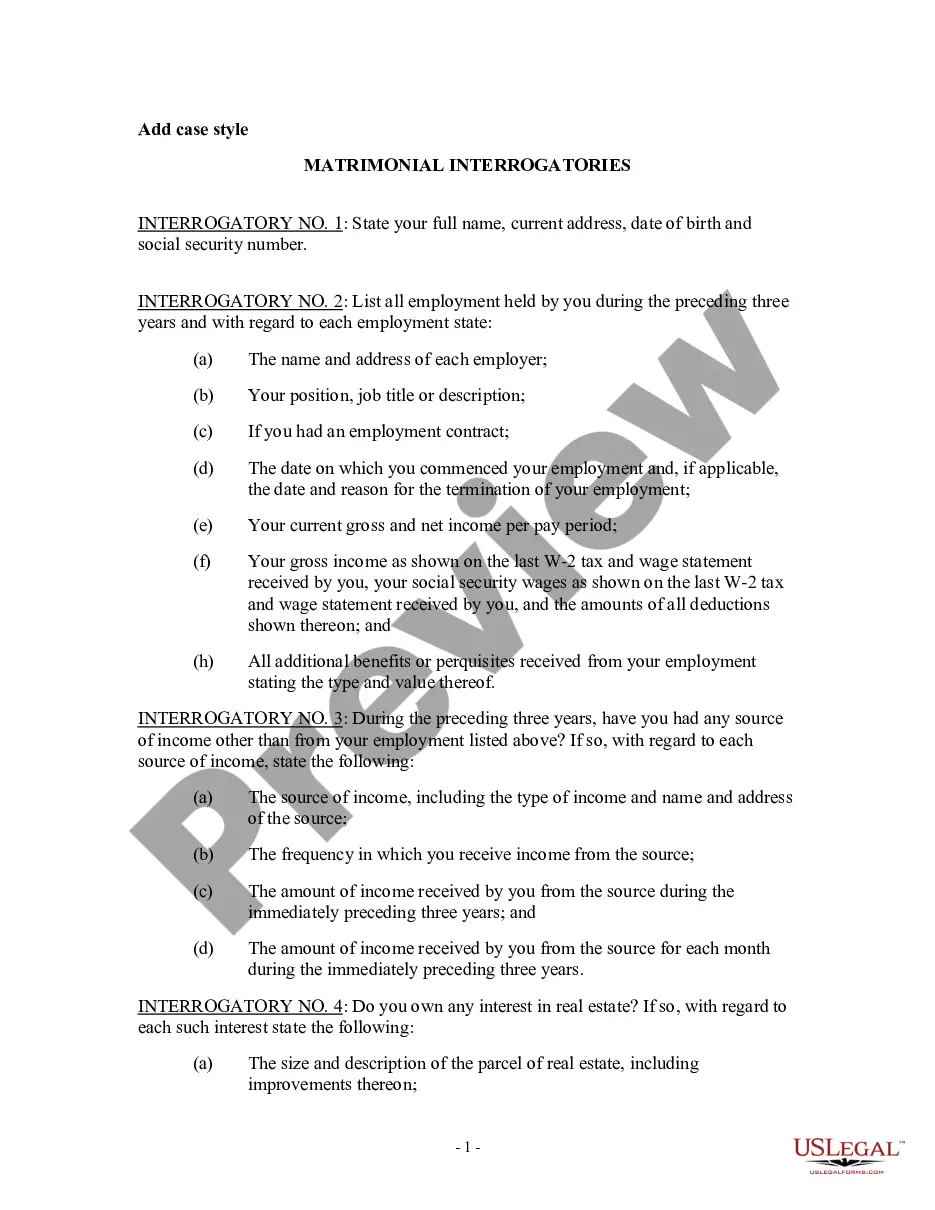

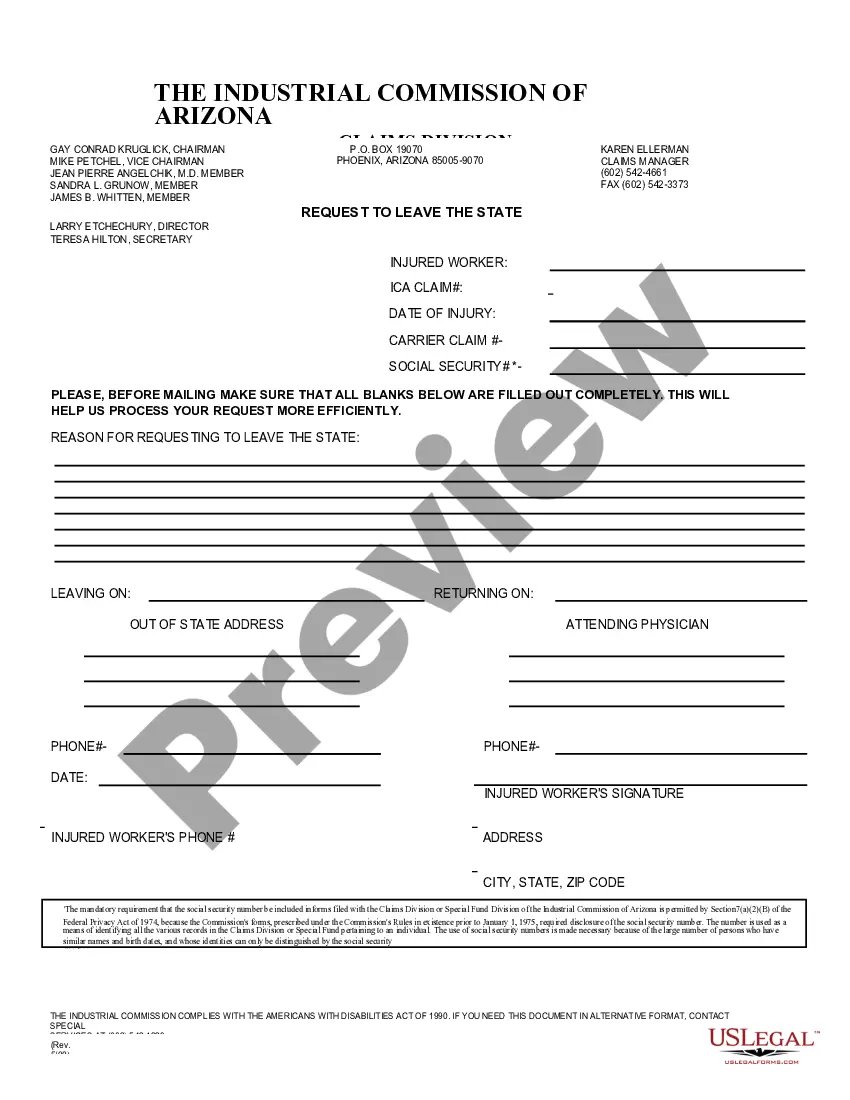

Are you inside a situation that you will need paperwork for possibly company or specific uses virtually every day? There are tons of legitimate file layouts available on the Internet, but locating kinds you can trust is not simple. US Legal Forms offers a huge number of form layouts, such as the New Jersey Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest, which are created to fulfill federal and state needs.

When you are presently acquainted with US Legal Forms web site and get your account, simply log in. Following that, it is possible to obtain the New Jersey Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest web template.

Unless you have an bank account and need to begin to use US Legal Forms, follow these steps:

- Obtain the form you require and ensure it is to the right town/county.

- Utilize the Preview key to examine the form.

- Look at the information to ensure that you have chosen the proper form.

- If the form is not what you are trying to find, make use of the Search industry to obtain the form that fits your needs and needs.

- Once you get the right form, click on Buy now.

- Opt for the costs strategy you need, fill in the necessary information and facts to create your money, and buy the transaction making use of your PayPal or charge card.

- Select a convenient paper structure and obtain your version.

Locate all the file layouts you possess purchased in the My Forms menu. You can obtain a extra version of New Jersey Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest anytime, if necessary. Just click on the essential form to obtain or print the file web template.

Use US Legal Forms, the most comprehensive selection of legitimate types, to save time as well as stay away from blunders. The support offers skillfully manufactured legitimate file layouts which can be used for a selection of uses. Create your account on US Legal Forms and start producing your lifestyle easier.

Form popularity

FAQ

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties. Non-Participating Royalty Interest (NPRI) Endeavor Energy Resources, LP ? 2019/07 Endeavor Energy Resources, LP ? 2019/07 PDF

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to. How to Calculate Oil and Gas Royalty Payments? - Pheasant Energy pheasantenergy.com ? how-to-calculate-oil-... pheasantenergy.com ? how-to-calculate-oil-...

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12. Information and Procedures for Transferring Overriding Royalty ... blm.gov ? article ? Information-and-Procedu... blm.gov ? article ? Information-and-Procedu...

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres. Net Royalty Acres Defined - Oil and Gas Lawyer Blog oilandgaslawyerblog.com ? net-royalty-acre... oilandgaslawyerblog.com ? net-royalty-acre...

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.